Published on June 15, 2020 by Madhav Garg

Twin shocks – A ‘black swan’ event and the oil price war

This year commenced with twin shocks – the unexpected “black swan” event of a global pandemic and the oil price war started by the rivalry between Saudi Arabia and Russia. Both events disrupted the US and the world economy and, as a result, central banks, including the US Federal Reserve (Fed), the European Central Bank (ECB) and the Bank of England, have taken measures to boost economic activity in their respective countries.

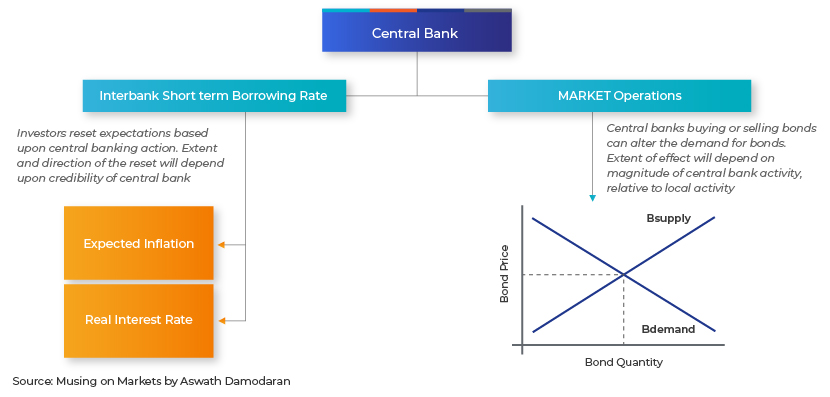

How central banks influence rates – Interest rate basics

The economics of negative interest rates

In a negative interest rate scenario, lenders pay additional money to borrowers, instead of receiving interest from them. Therefore, when the Federal funds rate turns negative, the US government gets paid by investors, including banks and mutual funds.

Ideally, interest rate reduction is used as an expansionary monetary policy; this reduces the cost of borrowing and increases spending. Low or negative interest rates make companies borrow more, build up their cash reserves and incur capital expenditure. Demand for goods increases and economic activity gets a boost.

However, negative interest rates send a negative signal to investors and savers about the health of the economy. Bond prices crash due to low demand because of low return on them.

A negative interest rate environment adversely affects banks, as it has asymmetrical effects both on their assets and liabilities sides. On the assets side, borrowers from the bank get lower interest rates on their loans. However, on the liabilities side, it is not possible for banks to pass on the effect of negative interest rates to their depositors; if they do, people will start withdrawing their money. Thus, the cost of funds for banks becomes very high, squeezing their profit margins and even destabilising them.

US President Donald Trump has publicly stated many times that he wants the US to have negative interest rates. One of his main reasons is to weaken the US currency. A weaker USD would give the country’s exports a competitive advantage. It would also boost inflation by pushing up import costs. However, Fed Chair Jerome Powell is of a different opinion and does not seem to be interested in negative interest rates.

Negative interest rates adopted by different economies

Many economies, including Europe, Switzerland, Denmark, Sweden and Japan, have adopted negative interest rates in the past. The main reason for their central banks adopting low or negative interest rates is to boost the economy, increase inflation and grow exports.

The ECB introduced negative interest rates in June 2014 by lowering its deposit facility rate to -0.1% to stimulate the economy. At its April 2020 meeting, it held its rate at -0.5%.

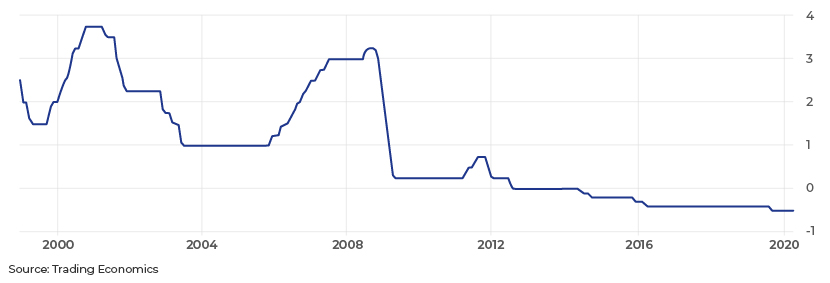

Eurozone deposit facility rate

However, these negative interest rates have not measurably improved the performance of the Eurozone economy. Bank margins dropped sharply after 2014. Lower margins and lower loan growth led to lower profitability for banks, eroding their capital and further limiting credit growth.

Japan introduced negative interest rates in 2016. However, its economy was not measurably revived either. Negative interest rates usually send a negative signal to investors and savers about the economic health of the economy and the helplessness of their central banks. Japanese banks, including MUFG, Mizuhu, Resona, Sumitomo and JPB, have seen a decline in profitability and margins since then.

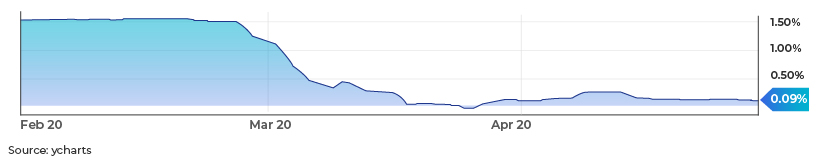

JPY LIBOR three-month rate

The Bank of England (BoE) also lowered its official bank rate to 0.1% recently, opening up the possibility of negative interest rates. On 20 May 2020, the UK sold its first-ever negative interest rate bonds. The country auctioned GBP3.75bn (USD4.66bn) worth of three-year notes at a yield of -0.003%. BoE Governor Andrew Bailey has also recently been discussing the possibility of negative interest rates, after denying the possibilities of doing so.

Fed policy inching towards negative rates

The Fed announced various measures, including reducing the interest rate from 0.25% to 0%, on 15 March 2020, and launched a number of programmes to help borrowers and businesses. The US government has also announced a USD2tn stimulus package to boost the economy.

Yields on short-term US Treasury bills, i.e., bills with maturities of one and three months, turned negative after these announcements as investors continued to prefer short-term debt that acts like cash and is easier to trade than longer-term debt.

Three-month Treasury bill rate

As the chart above shows, yields of the 3-month US Treasury bill turned negative, reaching -0.04% on 25 March 2020 and -0.05% on 26 March 2020. However, yields turned positive subsequently and have been above 0% since. The fall in short-term Treasury yields was due to the panic created by the COVID-19 pandemic, with investors moving out of riskier investments such as assets and into less risky investments, including US Treasuries. As investors started amassing these securities, demand for them rose, increasing their price and reducing their yields, as price and yield are negatively related.

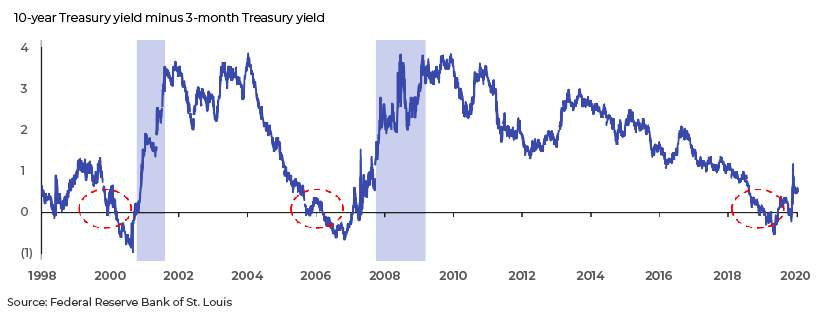

First indications of a recession – US inverted yield curve

The yield spread between the 10-year Treasury note interest rate and the short-term borrowing rate (in this case, the 3-month Treasury note) indicates the possibility of either a recession or a recovery in the coming year. The yield-spread diagram above shows that when the yield spread turned negative in late 2000 and late 2006, it was followed by recessions – in 2001-02 and 2008-09, respectively.

Yield spread turned negative again in mid-2019 and remained negative for a few months. Negative spread is due to higher short-term interest rates, stimulated by the Fed, and lower long-term rates, due to a slow economy and investors seeing fewer investment opportunities in the bond market.

Yield spread bounced back to positive territory by end-2019 and further in March 2020 and has remained positive since. This is due to market volatility caused by COVID-19-related fears and supply-chain disruption, leading to investment in risk-free US Treasuries and taking the 10-year Treasury note to historic lows. The Fed has been dropping the Federal funds rate since then, and the 3-month Treasury rate has now dropped to near zero.

Likely effect of the Fed’s zero and negative rates on banks (as of December 2019)

The following charts shows US banks’ net interest margin (NIM) and return on equity (RoE) over the years. In a negative or low rate environment, we expect US banks’ NIM and RoE to decline in 2020 and 2021 due to stress on their profitability caused by the near-zero rate.

Impact of negative interest rates on asset classes

-

Equities: If a company’s cost of borrowing is lower than the dividend yield, it could re-gear its balance sheet by issuing debt and buying back shares

-

Bonds: Investors can boost return potential by diversifying a fixed income portfolio across segments of the bond market that offer higher yields than government bonds, including corporate bonds, mortgage-backed securities and emerging markets

-

Gold: Gold is negatively correlated with interest rates; negative rates would be bullish for the price of gold. However, current levels of negative interest rates are too small to make a difference

-

Bitcoins: More negative rates, if passed on to consumers, could increase the popularity of cryptocurrencies. Bitcoin supply cannot be manipulated with a strictly limited hard cap and predictable daily output. It cannot be devalued by central banks and more of it cannot be printed

-

Other commodities: Commodity prices have been range-bound for over a decade, i.e., since the global financial crisis depressed demand, suppressed inflation and strengthened the USD. A negative interest rate could influence the exchange rate negatively, bumping up commodity prices

Outlook

The COVID-19 pandemic has put economies in very bad shape, and they are likely to remain so for a long time. Many countries and regions, including Japan, Germany, the Eurozone, Denmark, Switzerland and Sweden, have had negative-yielding government debt for some time. However, we cannot say for certain that negative interest rates have been successful in boosting their economies.

The Fed plans to maintain the Federal funds rate at 0-0.25% and not cut it to below 0%. However, if the economic situation does not improve in the next couple of years and we see lengthy periods of deflation and an increase in the unemployment rate, the Fed may opt for negative interest rates. The case is the same with the BoE. However, it may take a few months to see the implications of these actions. It also cannot be established whether the negative rates will be measurably able to revive economic activity and boost exports.

Acuity Knowledge Partners has rich experience in supporting investment banks in the US and Europe. We offer M&A-, debt- and equity-related solutions to onshore bankers. We have dedicated debt and loan syndication teams to help clients with issuance and re-issuance related to bonds and other debt. This helps them focus on pitching and negotiation, while we take care of research and analysis.

Sources:

https://ycharts.com/indicators/3_month_t_bill

https://www.axios.com/us-bond-markets-negative-coronavirus-05c21eb0-6436-4141-9ea3-f989d268d8e2.html

https://www.ccn.com/the-fed-shouldnt-even-discuss-negative-interest-rates-next-week/

https://www.bankrate.com/banking/federal-reserve/how-negative-interest-rates-work/

https://www.bloombergquint.com/gadfly/coronavirus-economy-the-fed-should-go-negative-next-week

https://fred.stlouisfed.org/series/T10Y3M

https://journal.firsttuesday.us/using-the-yield-spread-to-forecast-recessions-and-recoveries/2933/

https://fred.stlouisfed.org/series/USROE

https://fred.stlouisfed.org/series/USNIM

https://tradingeconomics.com/euro-area/deposit-interest-rate

https://tradingeconomics.com/japan/interbank-rate

https://www.bloombergquint.com/gadfly/britain-s-alarming-flirtation-with-negative-interest-rates

https://mail.google.com/mail/u/0/#inbox/QgrcJHsTnPbXRpCJXjDZspGmsDMtVjxvMmV

What's your view?

About the Author

Madhav Garg has over 5 years of experience working across various roles in the Investment Banking team. Currently, he supports in the debt capital markets team for a U.S. based investment bank, with a focus on issuance and re-issuance of high-yield debt across various sectors. He is CFA Level 2 cleared and holds a Master’s degree in Business Administration in Finance.

Comments

17-Jun-2020 05:59:44 am

Very well explained

Like the way we think?

Next time we post something new, we'll send it to your inbox