Published on April 9, 2020 by Madhav Garg

Twin shocks – A ‘black swan’ event and an oil price war

This year started with twin shocks – a surprise or “black swan” event in terms of a global pandemic and Saudi Arabia initiating an oil price war with Russia. The coronavirus outbreak created a demand-side shock, with China having to shut down, followed by the major economies of Europe, the US and Asia, blocking domestic and foreign consumption and investment. The fall in oil prices due to the price war created a global supply-side shock.

With social distancing and lockdowns being the only solutions available at present to contain the spread of COVID-19, global economic activity has been affected, increasing the chances of a global recession in 1H 2020. Demand- and supply-side constraints are likely to have a contagion effect on the financial services sector, leading to stressed assets and poor asset quality.

Impact on the US bond market

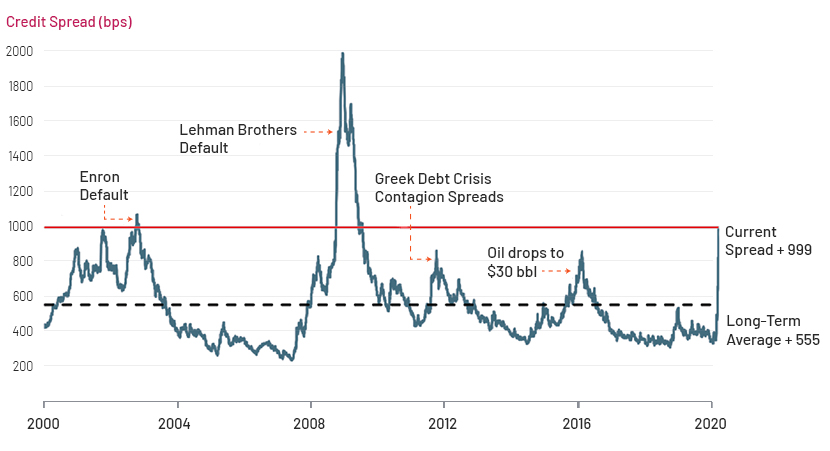

The US bond market has been severely impacted by the outbreak, with corporate bond and high-yield bond spreads widening significantly in recent weeks. The Morningstar Corporate Bond Index’s average credit spread has widened by 299bps to +396bps, and the Morningstar High-Yield Bond Index’s by 643bps to +999bps.

Source: Morningstar

High-yield credit spreads have reached levels last seen in 2001-02, when many companies defaulted as the tech bubble burst. However, at current levels, high-yield or junk bonds are still trading well inside their 2008-09 crisis levels. Note that in 2008-09, the credit spread widened to c.2,000bps over four to six months; since the COVID-19 outbreak, however, credit spreads have widened sharply within just a couple of months. Due to such widening, average high-yield bond prices have dropped 20 points to about 80 cents on the dollar.

Source: Sifma, KPMG

High-yield bond issuance declined a sharp 83% to USD4.2bn in March 2020 compared with March 2019. Total bond issuance increased by 5.7% to USD70.8bn in 1Q 2020 compared with USD67.0bn in 1Q 2019. This shows that most of the high-yield bond issuance activity in 1Q 2020 occurred in the first two months.

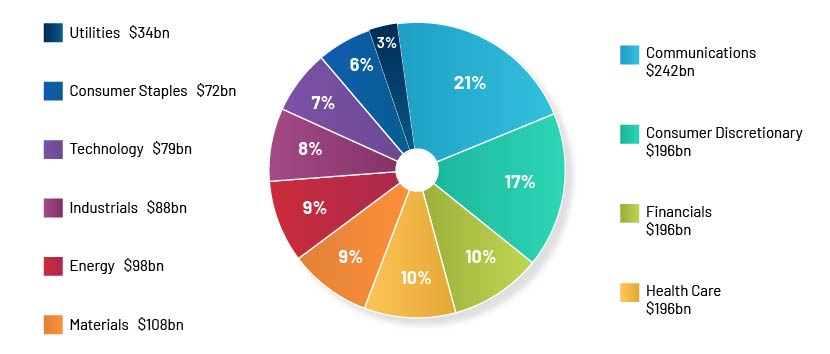

US high-yield corporate bond exposure by sector

Total US high-yield corporate bond exposure amounted to c.USD1.2tn as of 18 March 2020. S&P expects the trailing 12-month (TTM) default rate for US junk corporate bonds to rise to 10% in December 2020 from 3.1% in December 2019.

Source: KPMG Economics

The risk of default across sectors is high due to the following reasons:

-

A drop in demand due to lockdowns and consumers cutting purchases because of layoffs and job uncertainty

-

The sharp fall in oil prices to below USD30 per barrel

-

Disruptions in supply chains

-

The partial or complete closure of manufacturing facilities

Consumer discretionary and energy companies are at high risk of default, followed by industrial and materials companies.

Fed buying corporate bonds

The Fed announced on 23 March 2020 that it will launch two credit facilities to support the corporate or high-grade credit market. One would be a Primary Market Corporate Credit Facility under which the Fed will purchase corporate bonds directly from companies and provide loans to them. The Secondary Market Corporate Credit Facility will provide liquidity for outstanding corporate bonds. Under this facility, the Fed will buy corporate bonds in the secondary market at fair market value and only up to 10% of a single company’s outstanding bonds. These measures will focus on debt issued by investment-grade companies in the US and US-listed exchange-traded funds that provide US investment-grade corporate bonds with exposure to the market.

Issuance of new corporate debt has risen significantly after this announcement, with benchmark interest rates at their lowest ever (0-0.25%) and as Fed support has reduced investor uncertainty. Investment-grade bonds have rebounded by 7.1%, according to ICE BofA Indices. The Fed’s move is, therefore, expected to stabilise the corporate bond market. US corporations issued a record high USD253.5bn worth of investment-grade corporate bonds in March 2020, 153% more than in March 2019.

Furthermore, the Fed expanded its corporate bond-buying programme to include debt from companies rated investment-grade (i.e., BBB-/Baa3 or higher) as of 22 March 2020; however, this was later downgraded to one of three high-yield speculative-grade ratings: BB+/Ba1, BB/Ba2 or BB-/Ba3. The Fed also announced buying ETFs, focusing on investment-grade and high-yield debt.After this announcement, the iShares iBoxx High Yield Corporate Bond ETF increased by 7.5%.

Source: ycharts

There has been no new issuance in the high-yield bond market for junk-rated debt since 4 March 2020. However, this market is also seeing steady improvement in investor sentiment, with Yum! Brands raising USD500m on 30 March 2020. Issuance activity in the high-yield bond market has increased since then, with many companies coming to the market with new issuances and investor sentiment improving slightly. High-yield credit spreads have tightened by c.200bps and the average yield has dropped by 200bps.

Near-term outlook

The US government and the Fed have taken a number of measures to boost economic activity, such as liquidity injection, and introducing monetary easing policies and stimulus packages, resulting in investors returning to the corporate and high-yield bond market. High-yield debt issuance has shown positive signs in the past few days, after a dismal month in March 2020. Additionally, the high-yield credit spread has narrowed somewhat after widening to 999bps.

However, it is too early to think the worst is over, as the number of coronavirus infections in the US is increasing rapidly. Nevertheless, estimating that the number of infections reaches its peak by end-Aprilor May 2020, we could see a return to normalcy by July 2020. In such a scenario, high-yield debt issuance could remain low and credit spreads volatile in 2Q 2020.

Average high-yield bonds across sectors are trading at price levels that are close to corporate recovery values in the event of bankruptcy. Normally, these levels are a floor for bond prices and should limit downside price risk.

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Investment Banks will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020.

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. We have experience in supporting investment banks in the US and Europe. We offer M&A, and debt- and equity-related solutions to onshore bankers. We have dedicated debt and loan syndication teams to help clients with research and analysis in terms of issuance and re-issuance related to bonds and other debt, so that they could focus on pitching to clients and negotiations.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices.

Sources

1. https://www.kpmg.us/content/dam/kpmg/pdf/2020/covid-19-impact.pdf

3. https://seekingalpha.com/article/4331120-u-s-high-yield-faces-double-whammy

5. https://insight.factset.com/covid-19-risk-analysis

7. https://www.thestreet.com/investing/us-companies-race-to-issue-debt-as-fed-buys-corporate-bonds

What's your view?

About the Author

Madhav Garg has over 5 years of experience working across various roles in the Investment Banking team. Currently, he supports in the debt capital markets team for a U.S. based investment bank, with a focus on issuance and re-issuance of high-yield debt across various sectors. He is CFA Level 2 cleared and holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox