Published on July 31, 2025 by Parushi Kalra

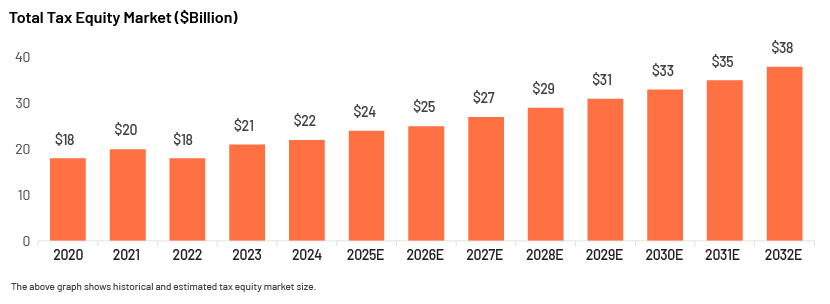

The tax equity market is experiencing rapid growth, driven by conventional investments and innovative tax credit transferability. The Inflation Reduction Act (IRA) of 2022 has significantly transformed the landscape, enabling clean energy developers to sell tax credits directly to investors. By 2024, the market for transferable tax credits expanded to $25 billion, with solar projects contributing substantially. Traditional tax equity investments reached $20-21 billion in 2023, and projections indicate demand could surpass $50 billion annually soon. These developments highlight a dynamic shift in tax equity financing, fostering increased investment and innovation in renewable energy.

What is tax equity?

Investors, usually financial institutions and corporations with large tax liabilities, can take advantage of tax credits available to developers and operators of clean energy projects to offset their tax liabilities. The Inflation Reduction Act (IRA) provides incentives for developing clean energy projects via tax credits. Developers typically do not generate high taxable income to fully utilize the benefits from the tax credits, so they collaborate with investors with high tax liabilities to invest in the projects. This collaboration allows them to start the projects without needing to raise debt.

Tax equity is applicable to projects involving federal tax incentives, such as renewable energy (solar, wind, hydro, etc.). There are two types of credits available for investors:

-

Investment Tax Credits: These credits are calculated as a percentage of the project's total cost and are available in a single payment in the first year of operations.

-

Production Tax Credits: These credits are calculated based on energy production (adjusted for inflation) and the cost of depreciation. They are paid out over a period of 10 years from the start of operations.

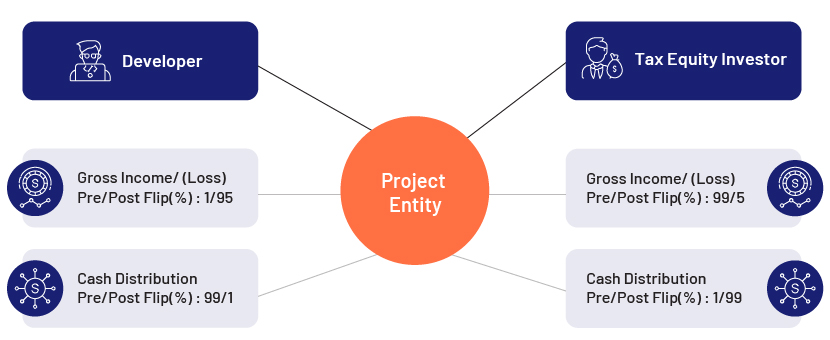

Partnership Flip Structure

Both parties enter a flip structure, where the Tax Equity Investor receives most (usually 99%) of the tax benefits during the initial years (known as pre-flip years). After this period, the Sponsor receives the majority of the benefits (usually, but not always, 95%).

The flip date is a term used in tax equity to achieve a target after-tax yield, usually 5-9 years after the system is placed in service. Conversely, the majority (99%) of the cash is distributed to the developer before the flip date, and after that, the investor receives most of the cash. The investor's contribution to the project is determined based on the future tax benefit they would receive by entering the project.

Market Overview

In 2023, tax equity investments amounted to approximately $21 billion annually. The US capital market showed robust activity in 2024, with an estimated $22 billion in the tax equity market. Debt markets were also significant, with strong involvement in construction financing, tax equity bridge loans, and term debt. Additionally, a decline in interest rates in the latter half of 2024 further boosted market activity.

According to the ACORE survey, 99% of investor respondents invest $100 million or more annually in the U.S. renewable energy sector. Also, almost half of the developer respondents are operating business with a minimum revenue of $100 million in the U.S. renewable energy market.

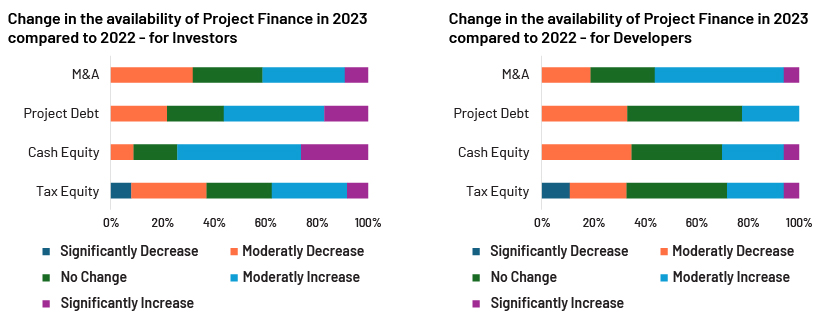

As per the above graph, more than one-third of investors and developers anticipate a decrease in tax equity accessibility this year, while others foresee an increase. ACORE surveyed investors about the market's availability of project financing sources and developers about their experiences attracting these sources. Among investors focused on tax equity, 36% report a decrease in tax equity compared to 2022, while 45% observe an increase.

Recent developments

-

New IRA Provisions: The Inflation Reduction Act (IRA) has introduced a new provision that allows owners of assets generating clean energy tax credits to sell these credits directly to third parties for cash. The transferability rules are expected to significantly broaden the tax equity market and enhance liquidity in the renewable energy sector.

-

Hybrid Transactions (T-Flips): Recently, the tax equity market has seen several sizable hybrid transactions, known as t-flips. These transactions involve projects monetizing tax credits through typical tax equity structures, with tax equity partners selling their shares under the new transferability rules.

-

Market Expansion: The IRA is anticipated to spur a ramp-up in the renewable energy tax equity market. This expansion is expected to contribute to the growth of green energy sources as new participants enter the market and additional energy sources benefit from tax equity.

-

Political Context: Despite potential policy changes with the election of Donald Trump, renewable energy tax credits are expected to remain due to their benefits and historical support. The IRA's provisions are anticipated to significantly broaden the tax equity market and enhance liquidity in the renewable energy sector.

Outlook

-

Expansion to New Technologies: Traditionally focused on solar and wind projects, tax equity investments are now seeing growing interest in other renewable technologies like energy storage, geothermal, and hydrogen. As these technologies advance, tax equity investors may find new opportunities to diversify their portfolios.

-

Increased Investor Participation: With the rising demand for renewable energy projects, more investors may enter the tax equity market. Simplifying the tax equity investment process and broadening access to a wider range of investors could help address the limited investor pool and provide more capital for renewable energy projects.

-

Legislative Changes: Government policies will continue to play a crucial role in the future of tax equity investments. Extending or expanding tax credits for renewable energy could boost tax equity investments, while changes or reductions in these incentives could dampen the market. Investors and developers must stay agile and responsive to shifts in the legislative landscape.

Risks and Challenges for Tax Equity

-

Limited Supply of Tax Equity: The tax equity market is dominated by a few major investors, such as JP Morgan and Bank of America. This limited supply can hinder the rapid deployment of clean energy projects, as developers struggle to find sufficient tax equity investment.

-

Economic Downturns: Economic downturns, like the one caused by the COVID-19 pandemic, can reduce corporate profits and, consequently, the need for tax management strategies. This can lead to a decrease in tax equity investments, affecting project financing.

-

Passive Activity Loss Rules: These rules prevent individuals from using tax credits and losses from businesses they are not materially involved in against active income. This makes it challenging for individuals to claim energy tax credits, limiting the pool of potential tax equity investors.

-

At-Risk Rules: These rules bar individuals from deducting interest on nonrecourse loans and claiming depreciation deductions funded with nonrecourse debt. This further complicates the ability of individuals to invest in renewable energy projects.

-

Market Volatility: The tax equity market can be volatile, with fluctuations in pricing and demand. This can make it difficult for developers to secure stable financing and plan long-term projects.

-

Legislative Changes: Changes in government policies and tax incentives can significantly impact the tax equity market. Investors and developers must stay agile and responsive to shifts in the legislative landscape.

How can Acuity Knowledge Partners (Acuity) help?

Our tax equity support encompasses a wide range of end-to-end tax equity project financing assistance, including:

Clean Energy Financial Modelling and Audits

Benchmarking Studies

Portfolio and Document Reviews

Tax Equity Modelling

-

Sensitivity Analysis

Other renewable energy project finance support offered:

Sources:

-

Renewable Energy Tax Credit Finance: Insights Into 2024 Tax Equity Financing Trends | Novogradac

-

U.S. Renewable Energy M&A: Review of 2024 Outlook 2025 | FTI

-

Impact of the Inflation Reduction Act on Tax Equity Financing

-

Understanding Tax Equity Investments: Fueling Renewable Energy Growth - Inframox

-

https://www.pfie.com/story/3655914/ira-changing-the-tax-equity-game-fp9ydbsvqb

-

https://22608340.fs1.hubspotusercontent-na1.net/hubfs/22608340/Reunion

-

https://www.askramerlaw.com/publications/energy-tax-credits-for-a-new-world-part-ix

-

https://www.cruxclimate.com/insights/trends-in-transferable-tax-credit-investment-structures

-

https://www.jpmorgan.com/insights/banking/investment-banking/orsted

What's your view?

About the Author

Parushi joined Acuity in September’22 and has over 7 years of experience in reviewing, validating, and developing project finance models. She has hands-on experience in independently structuring models in discussion with onshore clients across diverse sectors such as power generation, renewable energy, and infrastructure sectors. Parushi is a Chartered Accountant from ICAI and Bachelor of Commerce from Rajasthan University.

Like the way we think?

Next time we post something new, we'll send it to your inbox