Published on April 30, 2025 by Shakun Singh

Introduction

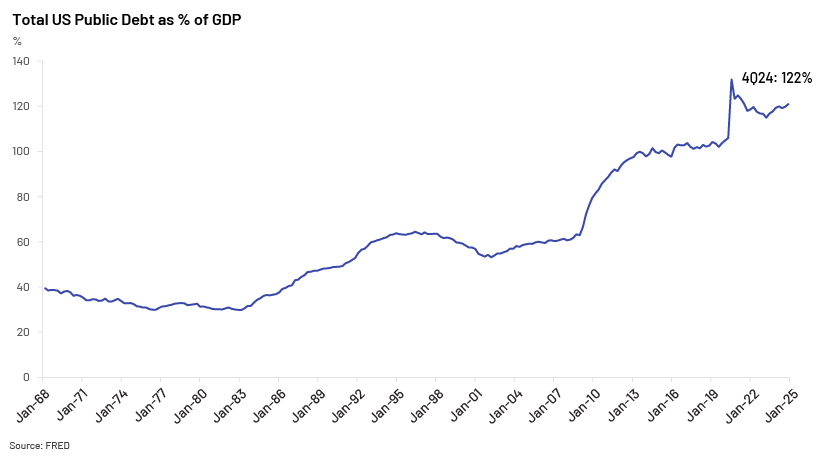

The lithium market has experienced significant price volatility in the recent past because of fluctuations in supply and demand. The price of lithium carbonate, used primarily in energy-storage systems and lithium-ion batteries, peaked at approximately USD77,041 per ton at end-2022.1 However, by the end of 2024, the price of lithium carbonate – 99% grade (the China spot price) – experienced a rapid decline, falling to around USD9,655 per ton1, an 87% decline from its 2022 high.

This price decline was driven primarily by a combination of factors:

-

Oversupply of lithium: Lithium production has increased significantly in China, accounting for around 64% of total production of lithium chemicals. The International Energy Agency (IEA) expects production to increase at a CAGR of around 10% until 2030.

-

Slower-than-expected demand: Global sales of electric vehicles (EVs) rose by 20% in the first half of 2024, according to Reuters, more slowly than expected. Examples indicating a slowdown:

-

Toyota: Announced plans to produce 1m EVs by 2026, revising its earlier sales target (as of 6 September 2024) of 1.5m EVs

-

Volvo: The Swedish automaker has scrapped its target (as of 4 September 2024) to go all-electric by 2030

-

Ford: Reduced its planned annual capital spending on pure EVs to approximately 30% from 40% in August 2024

-

-

Inventory buildup: An overestimation of lithium demand has led to excess stock

Despite the price volatility of lithium, the metal is expected to have strong growth potential in the long term, driven by the global transition from fossil fuels to clean energy and the electrification of a number of sectors, aimed at reducing carbon emissions. IEA data projects demand for lithium to surpass supply in the coming years. This imbalance is expected to drive a recovery in lithium prices. Lithium is expected to play a crucial role in the transition to clean energy solutions, supporting the expansion of EVs and energy-storage systems.

Lithium supply constraints: why prices are set to rise

1. Cautious supply response

-

The decline in lithium prices since late 2022 has led producers to adopt a cautious approach, with several major lithium producers scaling back their expansion plans or shutting down certain operations. This has raised concerns about supply availability, particularly as demand is projected to rise in the coming years.

-

For instance, Australia and China, home to some of the world’s largest lithium producers, have adjusted their output strategies due to prolonged price declines. Australia’s Greenbushes mine, one of the largest hard-rock lithium operations globally, has moderated expansion, while China’s battery giant CATL has slowed investment in lithium refining. These developments indicate that while the market is in oversupply, supply restrictions could contribute to a price rebound in the future.

2. Short-term oversupply, long-term deficit

-

The IEA reported a temporary oversupply of 11 kilotons (Kt) of lithium in 2023, largely due to an aggressive expansion cycle in prior years. However, this temporary surplus is expected to be short-lived as demand outpaces supply growth.

-

Despite short-term oversupply, the lithium market outlook indicates a widening deficit. By 2030, the supply of lithium (lithium carbonate and lithium hydroxide) is projected to reach 373Kt, while demand is expected to hit 472Kt (with 81% of this demand driven by EVs and grid battery storage), creating a shortfall of 97Kt of lithium. By 2040, this shortfall is anticipated to expand to 621Kt.

-

As the deficit continues to grow, a lithium price recovery is anticipated, driven by the widening supply-demand gap.

Surge in lithium demand: the driving forces

1. EVs: the primary growth engine

-

EV adoption is skyrocketing, making up more than 50% of lithium demand in 2024. The IEA expects this proportion to increase to approximately 75% of total demand by 2030.

-

Global EV sales grew from 3m units in 2020 to almost 17m units in 2024.

-

The EV sales CAGR from 2020 to 2024 was nearly 50%, underscoring the sustained momentum in the sector.

-

As the world shifts towards greener alternatives, lithium demand is expected to rise significantly, driven by the increasing popularity of EVs and supportive government policies.

2. Energy-storage solutions

-

Lithium-ion batteries are also becoming crucial for grid-storage solutions, enabling efficient energy management of renewable sources such as solar and wind.

-

Bloomberg NEF forecasts that global energy-storage installations will reach a cumulative 411 gigawatts (GW) [or 1,194 gigawatt-hours (GWh)] by the end of 2030, representing a 15x increase from the 27GW (56GWh) of storage that was online at the end of 2021.

-

This anticipated increase in energy storage is driven by significant policies such as the US Inflation Reduction Act, a landmark piece of legislation providing over USD369bn in funding for clean technologies, and the European Union’s REPowerEU plan, which establishes ambitious targets to reduce reliance on gas from Russia.

-

An estimated 387GW (1,143GWh) of new energy-storage capacity will be added globally from 2022 to 2030, with China and the US remaining the two largest markets with more than half of global storage installations.

-

Consequently, lithium demand is expected to rise significantly, further intensifying the competition for this valuable resource.

The lithium outlook: a price rebound

Due to anticipated supply shortages, According to the lithium price forecast, the lithium market is expected to rebound in the coming years. Reduced EV sales, oversupply and inventory buildups have led to a decline in prices so far, but the outlook remains strong, indicating strong demand from clean energy technologies.

As EV adoption and energy-storage installations increase, global demand for lithium is expected to surpass supply, setting the stage for a price recovery. A shortfall of 97Kt is projected by 2030, increasing to 621Kt by 2040. Lithium will remain indispensable for EVs and energy-storage systems. As the world moves towards clean energy, lithium demand will likely continue to outpace supply growth, reinforcing expectations of a price recovery in the coming years.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners offer a wide range of services to support stakeholders in the critical minerals market, including investors, producers and end users. We collaborate closely with clients, leveraging our expertise and developing customised strategies that enable them to capitalise on emerging trends and expand their market presence. Our comprehensive range of services includes market research and forecasting, market entry and due diligence support, opportunity evaluation, market access solutions, pipeline analysis, benchmarking and competitive intelligence.

By offering tailored research assistance and strategic guidance, we empower our clients to gain a competitive edge. Our dedicated team excels in providing valuable insights and tracking global sectors, enabling data-driven decision-making and ensuring optimal outcomes for our clients.

1Exchange rate: CNY1 = USD0.13696

Sources:

-

Introduction:

-

Lithium supply constraints:

-

Lithium demand:

-

Surge in lithium demand: the driving forces:

Tags:

What's your view?

About the Author

Shakun is an associate with nearly three years of experience in research and consulting, specializing in metals, mining, and critical minerals. At Acuity Knowledge Partners, he supports clients with a variety of strategic research initiatives. He holds a PGPM degree with a specialization in finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox