Published on February 16, 2021 by Mathew Joseph and Bijaya Das

ESG investing is gaining popularity in the investment world. But what is ESG investing? How does it work, and why is it picking up steam?

COVID-19 induced instability in the financial markets and increased environmental degradation have been a wake-up call for many investors, prompting them to invest their time, energy and money towards taking care of the environment and protecting the planet. Such investors now intend to adopt a more sustainable investing approach – ESG investing.

What is ESG?

ESG stands for environmental, social and governance – the three main factors that measure the sustainability and societal impact of a company or business.

In detail:

A company that satisfies the basic requirements is labelled ESG-compliant. An investment based solely on these criteria is referred as an ESG investment. Mutual fund schemes that invest in companies adhering to these regulations are known as ESG funds.

What makes ESG investing so appealing?

The main objective of ESG investing is to seek both financial and social returns. Investors seem to trust companies with a reputation for being socially responsible and environmentally sound. Around 88% of investors still believe in the possibility of balancing financial gains with reasonable investing, and about 86% believe in the possibility of higher profits via ESG investing in the long run, according to a survey conducted by the Morgan Stanley Institute for Sustainable Investing1 .

In addition, the number of companies listed as ESG-compliant is limited at present. This may translate into the stock prices of slow-growing companies performing well in the long term.

Global performance and perception of ESG investing

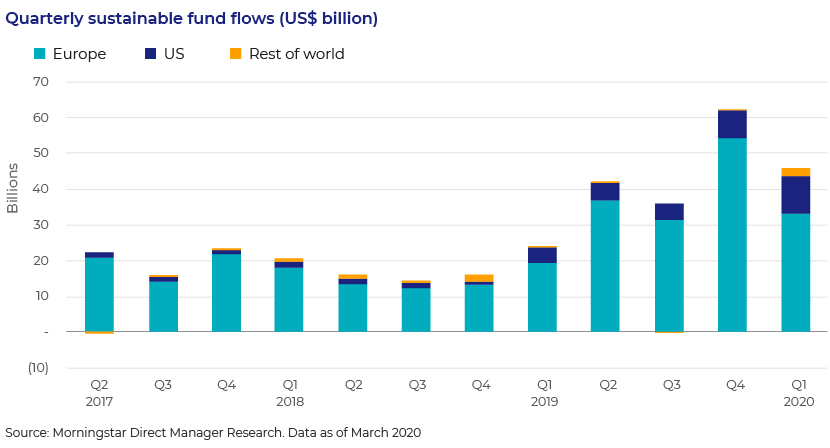

Investment in sustainable options amounted to USD45.6bn2 in the first quarter of 2020, despite the pandemic.

However, as the chart above shows, Europe continues to lead in terms of ESG investing. With increased demand for green and ethical investing options, European funds that invested in ESG companies surged to USD132bn3 in 2019.

We list below the three- and five-year total returns of selected European funds. They show a better performance by ESG-focused funds than non-ESG funds by end-March 2020.

While it may seem to be the world’s largest market of investors, the US, lags in terms of ESG investing, reports indicate it is gaining momentum. The US SIF Foundation's 2020 biennial Report on US Sustainable and Impact Investing Trends5 records an increase in sustainable investing assets in the US from USD12tn at the start of 2018 to USD17.1tn in 2020, a 42% increase, accounting for 33% of total US assets under management (AUM).

The future of ESG investing

Europe: PwC6 expects ESG fund AUM in the European market to account for over 50% of their total mutual fund assets by 2025.

The US: President Joe Biden has taken a stand to fight climate change full-time by naming former US Secretary of State John Kerry as Special Presidential Envoy for Climate. Under Biden’s presidency, the US is expected to provide the environmentally and socially conscious investors with a wide range of investment options that meet the ESG criteria.

Asia: Demand for ESG investing in Asia is increasing, and regulators are determined to drive sustainable business practices to encourage foreign investment.

-

The capital markets of Singapore, one of the first countries to adopt ESG practices, have already shown significant development7 and are expected to continue doing so in the coming years.

-

In 2017, China’s Ministry of Ecology and Environment mandated ESG disclosure by listed companies and bond issuers to increase transparency8 . It is now encouraging fund managers to increase their focus on sustainable investments.

-

Hong Kong has begun mandatory ESG disclosure9 and is soon to join the rest of the world.

-

Company awareness of ESG-related reforms has increased in Japan10 , with increasing demand for government reforms & local pension funds, and the need to attract foreign investors.

While each country seems to have a different approach to ESG practices and investing, we expect an overall positive outcome for companies and investors. Besides, with increased transparency, it may turn out to be a win-win situation for all in the long run.

ESG compliance and measurement:

With increased demand for ESG investing, fund managers are ensuring compliance with firm-and account-level ESG policies and guidelines. They identify, address and disclose ESG compliance failures in a timely manner, and use exclusionary or inclusionary screens to filter out investments not in line with an account’s ESG strategies and polices11 .

However, challenges may arise when measuring compliance, as ESG positions are more qualitative than quantitative in nature. A number of ratings systems have been designed to rank a company’s sustainability performance, using a numeric score based on investment analytics and ESG risk exposure12 .

With the growth of socially responsible investing, measuring ESG compliance may become easier since the best practices and benchmarks would be set in place.

Acuity Knowledge Partners’ solution:

Acuity Knowledge Partners has been providing its clients with a wide range of solutions, including analytics on ESG indicators and themes, policies and frameworks, and ESG scoring, rating and benchmarking.

Our subject-matter experts, with their extensive knowledge of standardised ESG disclosure frameworks, can help you implement and monitor ESG policies and guidelines through trade surveillance, and investment, corporate, forensic and financial crime compliance.

Sources

2 https://investmentnews.co.nz/wp-content/uploads/MESG.pdf

3 https://www.morningstar.co.uk/uk/news/199190/record-shattering-year-for-sustainable-investments.aspx

5 https://www.ussif.org/files/Trends%20Report%202020%20Executive%20Summary.pdf

7 https://www2.deloitte.com/us/en/insights/industry/financial-services/esg-investing-performance.html

8 https://equalocean.com/analysis/2020041913900

9 https://www.kroll.com/en-ca/insights/publications/compliance-risk/why-esg-is-on-the-rise-in-asia

10 https://esgclarity.com/japanese-refinements-show-a-commitment-to-esg/

12 https://www.alva-group.com/blog/how-to-measure-esg-performance/

Tags:

What's your view?

About the Authors

Mathew is an investment compliance specialist with 5+ years of experience primarily in post trade monitoring and performance reporting. At Acuity Knowledge Partners he is part of post trade compliance services. He hold Masters of Business Administration Degree.

Bijaya is an investment compliance specialist with 7 years of experience primarily in post trade monitoring and performance reporting. She has worked for various firms including State Street, Northern Trust and Ernst & Young. At Acuity Knowledge Partners she is working as a supervisor supporting post trade compliance services. She has done her PGDBM in Finance from Jain University, Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox