Published on March 25, 2021 by Livingston Samraj

Investopedia defines financial technology (fintech) as “new tech that seeks to improve and automate the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.” Fintech facilities such as money transfer and payment are used by three out of four consumers, according to the EY 2019 Fintech Adoption Index.

Global fintech industry market size

The global fintech market reached nearly USD111.2bn in 2019 and is expected to reach USD325.3bn in 2030 on increased use of digital payments, significant opportunity and increasing investment in blockchain technology, exponential growth of e-commerce and the impact of the pandemic.

Trends/opportunities (drivers) in the fintech sector:

-

Authorities across the globe are encouraging the use of digital payments in response to the pandemic

-

An increase in work-from-home (WFH) arrangements, adoption of telemedicine, teleconferencing, online education and telebanking are further accelerating the push for e-commerce

-

Increased use and adoption of e-learning and web-based learning also provides an opportunity, as most transactions such as fee payments are conducted online

-

Revenue for those firms that were not ready to adopt such digital services dropped amid the lockdowns, while cashless-transaction firms such as PayPal, Square and Braintree benefitted from the shift

-

Recent developments include the following:

-

High use of online digital models and online products and service channels

-

Retailers diversifying their payment offerings after going digital

-

Payment using QR codes

-

Voice-activated payment

-

Contactless payment

-

-

Autonomous finance – customers can delegate recurring tasks such as paying utility bills and making other regular payments to fintech solutions. This works through artificial intelligence (AI) and machine learning (ML)p>

-

Open banking – according to Investopedia, it provides third-party financial service providers open access to consumer banking, transaction and other financial data from banks and non-bank financial institutions through the use of application programming interfaces (APIs)

-

New-generation financial institutions are increasingly leveraging fintech solutions to offer convenient digital-only banking services that require no physical contact

-

Other trends include advancing financial inclusion programs globally, crowdfunding, insuretech, biometric security systems, regtech in financial services, using one platform for multiple services, blockchain and big data

-

-

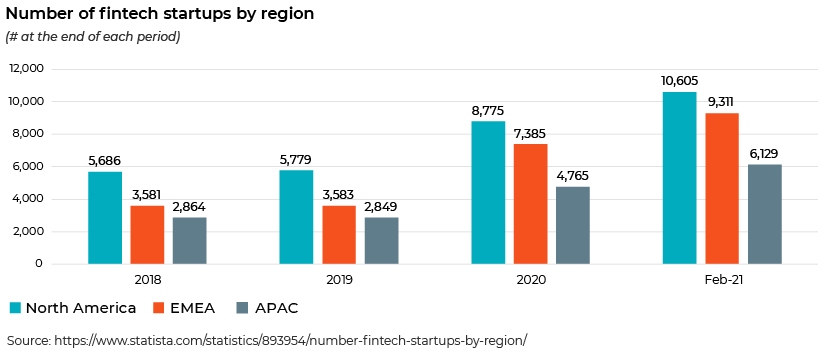

Many fintech startups have emerged due to these trends driving the sector

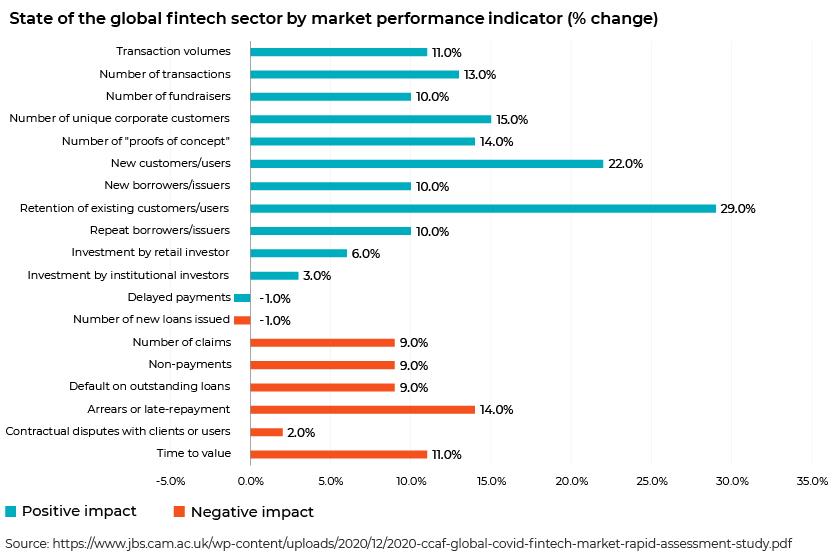

A recent World Bank assessment shows the fintech sector is booming, as measured by a number of performance indicators.

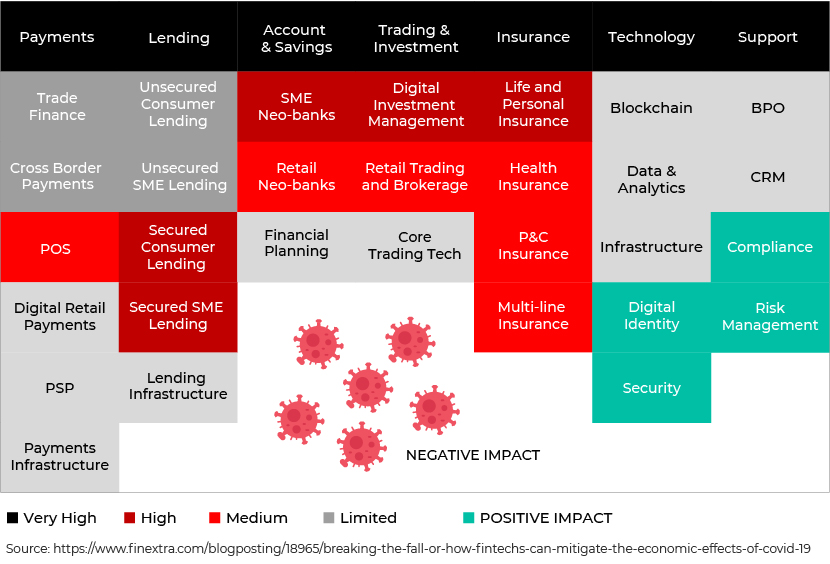

Likely impact of the pandemic on fintech providers

The future of fintech firms may depend on the type of solutions they offer. We consider some of the major segments and the likely impact of the pandemic below.

-

Payments. Negative impact on point-of-sale (POS) payments due to the slow recovery in spending globally. Peer-to-peer (P2P) digital payments are steady and strong. Ecommerce payments are witnessing a secular shift as consumers move away from using cash and cards to digital alternatives such as online payment and internet banking.

-

Lending. Consumers and businesses will likely miss regular payments, resulting in a short-term impact, but this segment should strengthen in the long term. Companies in the lending business could minimise losses through using advanced credit-risk algorithms to serve small businesses and consumers. We could see a slowdown in online lending, leading to industry consolidation.

-

Investment services. Market volatility is significant, and fintech firms in the retail brokerage business should continue to benefit from this. Consumers will likely look for hybrid robo-advisors and deeply integrated platforms.

-

Technology providers. Saas-based tech providers to B2C and traditional financial institutions are gaining momentum as traditional financial institutions focus on cost reduction. Offerings from these tech providers include KYC through video conferencing, chatbots, credit-scoring platforms and loan-origination platforms; this segment should continue to see improvement.

The following table illustrates the different levels of impact on each segment in the fintech sector.

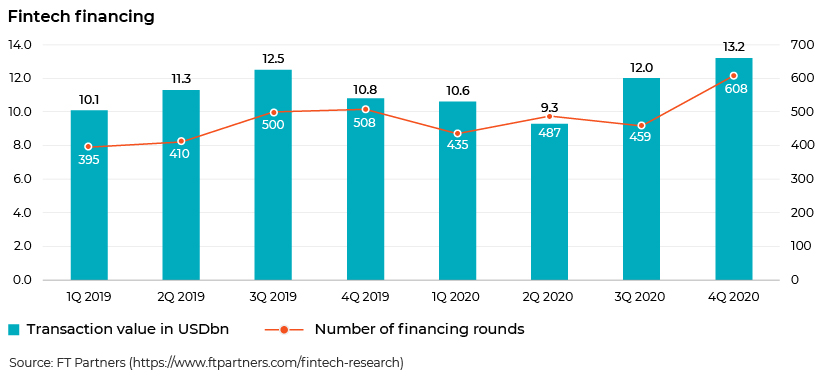

The fintech sector has been booming in recent years, with record funding levels and rising valuations. A number of companies in the sector are competing for market share and have prioritised growth and customer acquisition over profitability. The pandemic’s impact on fintech funding is almost negligible. Fintech funding amounted to USD13.2bn in 4Q 2020, the largest quarterly volume ever. The banking, lending and real estate tech subsectors remain the most active. Fifteen venture capital firms made 18 new/follow-on offerings in this sector in 2020.

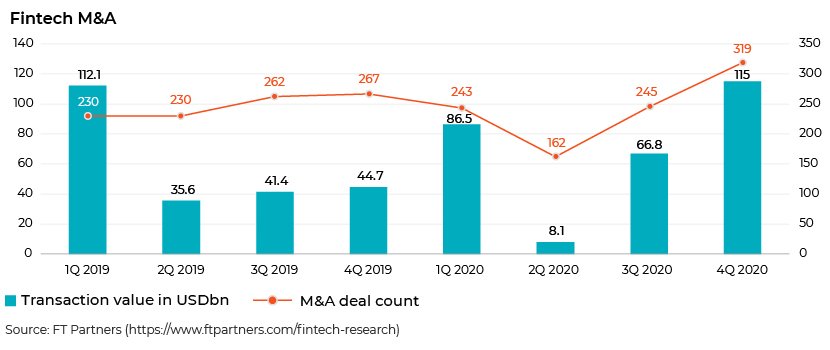

The pandemic has had a greater impact on M&A activity than on financing activity. According to FT Partners, 32% of M&A last year were cross-border, and North American companies accounted for 63% of this. Notable transactions in 2020 included S&P Global’s acquisition of IHS for USD44bn, Aon’s acquisition of Willis Towers Watson for USD36bn and Morgan Stanley’s acquisition of E*TRADE for USD36bn. Moreover, Chinese tech players Alibaba and Ant Group are keenly looking to expand overseas through joint ventures and partnerships. Total M&A transaction value and volume bounced back to their pre-pandemic highs in the fourth quarter of 2020, indicating an optimistic outlook for M&A in this sector; cash-rich companies are likely to add new categories of firms to their portfolios going forward.

Fintech-focused SPACs

During 2020, there were 15 SPAC deals in the fintech space compared to two during all of 2019 and one in 2018. The target companies are mostly mortgage companies and brokerage firms. Notable deals include mortgage analytics firm Black Knight’s acquisition of Optimal Blue for USD1.8bn and ICE’s acquisition of Ellie Mae for USD11bn.

Conclusion

Although the fintech sector faces challenges amid the pandemic, a number of opportunities are available in the long term even if another pandemic were to strike. These opportunities include supporting government relief initiatives. Most traditional financial businesses have started shifting to digital technologies and services, and we could also see a transformation in business models and competitive dynamics in this field. Other interesting trends such as autonomous finance, digital-only banks, open banking, crowdfunding and insuretech are likely to help the sector grow. We believe the consistent upward trend in M&A and financing bodes well for the space.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) provides thematic research for investment banks and financial research services. We assist them in the different stages of investment and with M&A opportunities. Our strong team of subject-matter experts supports a number of bulge-bracket investment banks and boutique investment banking advisory firms across the world. Our Investment Banking team has considerable experience in providing M&A, equity capital market, debt capital market and analytics solutions to our clients.

Sources:

https://a16z.com/2020/03/31/stimulus-depends-on-fintech/

https://www.cbinsights.com/research/fintech-covid-outlook/

https://thefinancialbrand.com/96254/covid-19-impact-future-fintech-banking/

https://www.ftpartners.com/fintech-research

https://www.entrepreneur.com/article/362981

https://www.investopedia.com/terms/f/fintech.asp

https://www.investopedia.com/terms/o/open-banking.asp

https://vilmate.com/blog/fintech-industry-trends/

https://www.ey.com/en_in/ey-global-fintech-adoption-index

Tags:

What's your view?

About the Author

Livingston Samraj is a Delivery Lead at Acuity Knowledge Partners’ Investment Banking division. He brings over 13 years of work experience as a researcher. He is currently part of the research team for a US-based mid-size investment bank, providing support on library services and complex data requirements across sectors. He also plays an active role in training and mentoring team members. He holds a master’s degree in Business Administration (Finance and International Business) from Karunya University, India.

Comments

28-Apr-2021 01:55:44 am

Great stuff! I also think that more software firms should follow finance trends in 2021 It\'s extremely useful and beneficial!

Like the way we think?

Next time we post something new, we'll send it to your inbox