Published on July 22, 2025 by Gauri Atree

The hospitality sector has undergone a dramatic transformation in recent years, with the pandemic reshaping how businesses operate and how guests experience travel and service. Hotels, restaurants and other service-based segments in the US have had to swiftly adapt to new health protocols, changing consumer preferences and a surge in digital innovations. In this blog, we explore how hospitality trends have evolved before and after the pandemic, discussing shifts in consumer behaviour, safety standards and technology.

Pre-pandemic hospitality trends

International and domestic travel in the US was booming in the years before the pandemic, driven by rising consumer confidence and disposable income. Hotel bookings were bolstered by a desire to explore popular and off-the-beaten-path destinations. In addition to this, the rise of digital platforms, such as Airbnb and Booking.com, offered personalised and diverse short-term rental options.

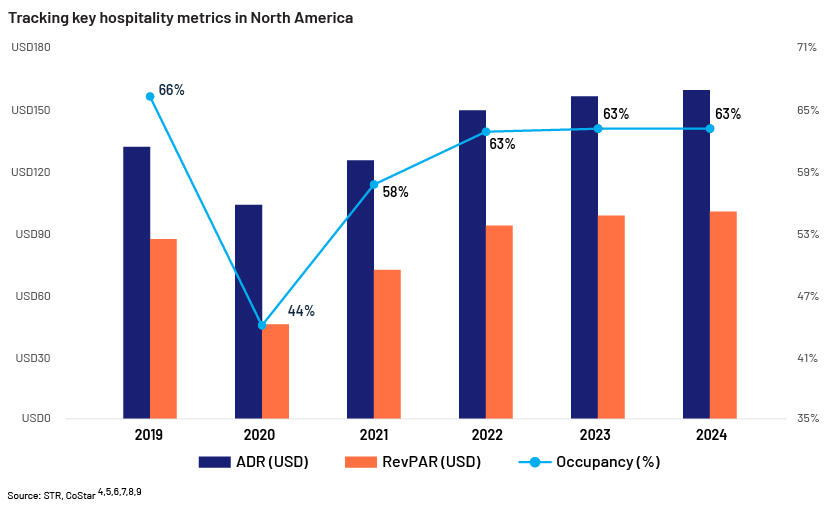

A decade after the economic recession, the US travel sector reached a significant milestone in 2019, marking its emergence from the downturn. More companies relied on business travel, meetings, events and incentive travel so they could connect and grow, generating economic output of USD2.6tn.1 Gross travel bookings grew by c.60% to USD185bn from 2009 to 2017.2 Domestic individual trips increased to 2.3bn in 2019 from 2bn in 2010.3 Meanwhile, the number of international inbound visitors to the US increased to 79m in 2019 from 60m in 2010.3 With increasing consumer interest in unique experiences and convenience, the travel sector was flourishing, setting the stage for an even more expansive future.

How the pandemic crippled the hospitality sector

A hotel-sector downturn is often triggered by an external catalyst. The previous downcycle began with the financial collapse in 2008, and the one prior to that was sparked by economic recession and exacerbated by the 11 September terror attacks. The pandemic had a devastating impact on the US hospitality sector, with lockdowns, travel restrictions and health concerns causing a sharp decline in demand. Hotels faced widespread closures, mass layoffs and severe financial losses as travel ground to a halt. The sector saw record-low occupancy rates, and several businesses struggled to adapt to the sudden shift in consumer behaviour, including the need for enhanced safety protocol.

The pandemic forced a rapid rethink of operations, accelerating trends such as digital services and contactless technology to survive the crisis. Business travel declined significantly, with companies prioritising sustainability. Travel budgets plummeted by c.90% in 2020, and major corporations such as Zurich Insurance Group, Bain & Company and S&P Global planned further cuts to reduce emissions, impacting the leisure and hospitality sector 10.

Recovery in leisure travel after the pandemic

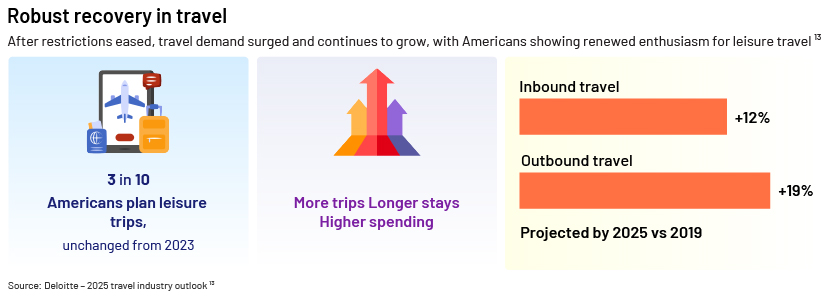

After prolonged restrictions, leisure demand carried the hotel sector’s recovery from the pandemic as business travel declined sharply. Consumers’ pent-up demand resulted in them allocating discretionary spending towards leisure and experiential travel. Moreover, the rise of flexible booking policies and remote working enabled travellers to extend their vacations or work while traveling, fuelling a new wave of “bleisure” trips. This spike in demand and consumer confidence led to an increase in hotel bookings and higher occupancy rates.

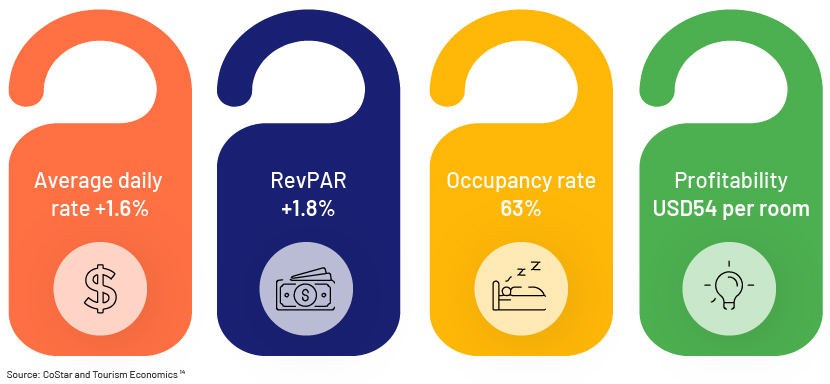

The travel sector has seen three years of growth, largely attributed to post-pandemic enthusiasm for experiential travel. The Americas recovered 97% of pre-pandemic arrivals as of 2024, 3% below pre-pandemic levels.12 The economic impact was profound, as increased volumes of leisure travel helped offset losses, stimulating the local economy and driving job growth in the sector. Air passenger volumes and hotel revenue per available room (RevPAR) have largely met or surpassed their 2019 benchmarks. The rebound reflected a shift in consumer behaviour, prioritising personal fulfilment and spending as part of broader economic recovery efforts.

The way forward

The US hotel sector is poised for modest growth, with upscale hotels expected to perform better. The outlook is cautiously optimistic, influenced by macroeconomic conditions and potential policy changes. However, rising tariffs, construction and operating costs may pose financial challenges. Notwithstanding these hurdles, the outlook remains promising, with the CBRE forecasting annual RevPAR growth of 1.5-3.5%15 over the next few years, supported by major events such as the 2026 FIFA World Cup and the 2028 Los Angeles Olympics.

To thrive post-pandemic, hotels should adapt by offering shared workspaces and flexible room setups for business travellers, encouraging longer stays that blend work and leisure. Wellness services and transforming common areas into vibrant spaces with retail pop-ups and art exhibits can enhance guest experiences and attract non-guests. The rise of generative AI tools is reshaping travel planning. AI-powered chatbots and virtual assistants help personalise itineraries and streamline bookings. Hotels integrating these tools can offer seamless, tech-savvy experiences. Despite obstacles and the need to upgrade existing hotel facilities, the US hospitality market is expected to expand to USD313.87bn by 2030, growing at a CAGR of c.5% over 2025-30.16

How Acuity Knowledge Partners can help

We are a leading provider of specialised research and analytics services relating to the real estate investment sector. Our team of experts have deep domain knowledge, able to provide market analysis, financial modelling, due diligence and technology integration support to hospitality developers/operators and investors. This expertise helps clients enhance their operational capabilities and focus on strategic, value-added activities and critical decision-making processes. Our comprehensive and customised suite of services span the entire investment lifecycle and all asset types such as hospitality, office/retail, multifamily, industrial and warehousing developments.

References:

-

S. hotel industry posts record levels in 2019, but lowest growth since recession | STR

-

STR: 2020 Worst Year on Record for U.S. Hotels | Business Travel News

-

STR: U.S. hotel ADR and RevPAR reached record highs in 2022 | STR

-

S. Hotels Hit Record ADR, RevPAR in 2024, Growth Slows – Asian Hospitality

-

Why Business Travel's Demise Could Have Big Consequences | TIME

Tags:

What's your view?

About the Author

Gauri has over 4 years of experience in the commercial real estate industry, specializing in originations, preliminary underwriting, financial due diligence, portfolio monitoring and asset management reports. Currently, at Acuity, she is supporting a leading alternative investment manager with investment/market research, investor reporting and acquisition strategies. Her previous experience includes a role at MCube Financial, LLC, where she was actively involved in detailed CRE deal sizing and underwriting of CMBS and bridge loans, appraisal analysis, research, etc. Gauri holds a Bachelor of Science (Honours) degree in Economics.

Like the way we think?

Next time we post something new, we'll send it to your inbox