Published on October 8, 2018 by Rohit Agarwal

There is a lot of speculation around the current private equity market due to higher valuation of companies. Currently, the average purchase multiple is hovering over 11.0x EBITDA and the average debt is around 6.0x EBITDA.

One of the main factors that has skyrocketed valuations is the abundance of private equity (PE) capital. Investors are feeding over $500bn of new commitments per year in PE, in addition to the enormous pile of dry powder of $1.7 trillion as of December 2017. Moreover, lower-cost debt has further enhanced the accessibility of easy capital, which in turn is fueling market competition and thus company valuations.

The rationale behind investors bequeathing more and more money into PE has been explained by a recent survey, which confirms the fact that investors have strong faith in PE’s ability to outperform the public market in the long term. The survey results showed 49% of investors expect PE to outperform the public market by at least 4% per annum; another 45% believe that PE will outperform the public market by 2-4%; only 6% think both private and public returns will be comparable.

Some of the key impacts of higher valuation on the PE market and its challenges are discussed below:

Impacts and Challenges:

-

Generating Good Returns: This is one big challenge for PE funds. After investing at 11.0x EBITDA, funds would look to exit at much higher multiples to generate good returns, which seems very difficult. Alternatively, they would have to generate value by making quick operational turnarounds within the average holding period of four to five years.

-

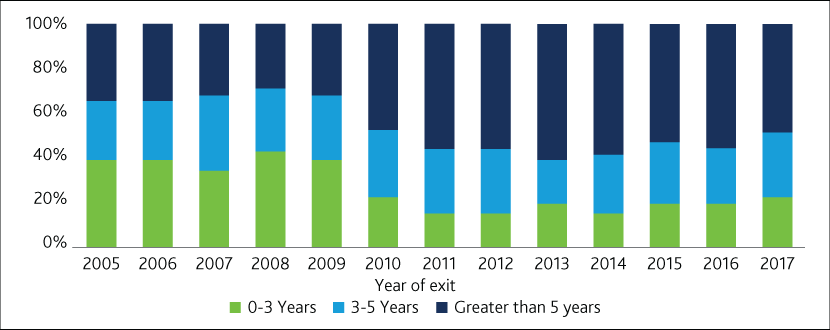

Increasing Holding Period and Operational Expenses: In 2017, the total number of buyout deals exited stood at 1,063, valuing $366 billion, as compared to 1032 deals worth $337 billion in 2016. Hence, the overall exit market is doing well, but the median holding period for portfolio investments of PE funds has increased since 2009. The new normal average holding period is five years in comparison to the previous "less than four years”.

Moreover, previously, 40% of deals used to achieve realization within the three-year period, compared to the present 20%. PE funds are stretching the holding period (as shown in the chart below) to make the required value enhancement to generate good returns. However, the stretched holding period may impact the performance IRRs and lead to an increase in operational and administrative expenses.

In near future, the holding period is not expected to return to earlier levels owing to a new US tax law. According to the law, the carry generated from an investment held for more than three years will attract lesser capital gain tax as compared to higher standard tax rate for investments held for less than three years.

-

Reduced Management Fee/Carried Interest: Investors are highly cautious here and would not accept reduced returns from their PE investments. Hence, investors look to offset any probable fall in returns by paying lesser management fee and carried interest to the PE firms. They are bargaining really hard with their fund managers, which ultimately lead to reduced fee revenue of PE firms.

-

Increased Deal Sourcing Competition: The shortage of cheaper deals has tremendously increased competition in the deal sourcing market. There are over 7,500 active PE firms competing for deal sourcing. This supply-demand mismatch is also contributing to higher company valuations.

-

Enlarged Competition from Corporate Buyers: In the recent past, corporates have also shown increased interest in acquiring VC companies/deals, which has further increased deal sourcing competition in the middle market buyout segment.

Road Ahead

General Partners need to stringently look for deals that can generate competitive returns. In addition, investors need to be smarter and alert to prevent themselves from falling for cheaper but poor fund investments.

Acuity Knowledge Partners is a leading service provider to private equity, venture capital, and PE fund-of-funds across deal screening, due diligence, portfolio monitoring, periodic reporting and business development.

Source: Preqin, Bain 2018 Private Equity Report, Web search

What's your view?

About the Author

Rohit has around 10 years of experience across asset management and private equity (PE). His current role involves providing support to alternative asset management teams on salesforce and e-front maintenance, financial reporting, and investment due diligence. Rohit has extensive experience across a broad range of analyses, including financial reporting, industry reports, due diligence memorandum, fund cash flow modeling, track record creation, fund revaluation models, client pitch presentations, quarterly market overview reports, and newsletters.

Prior to joining Acuity Knowledge Partners, Rohit has worked with Kotak Asset Management Company based in Delhi. He holds a Master of Business Administration (Finance) from Institute of Chartered Financial Analysts of..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox