Published on May 12, 2025 by Shitij Mathur

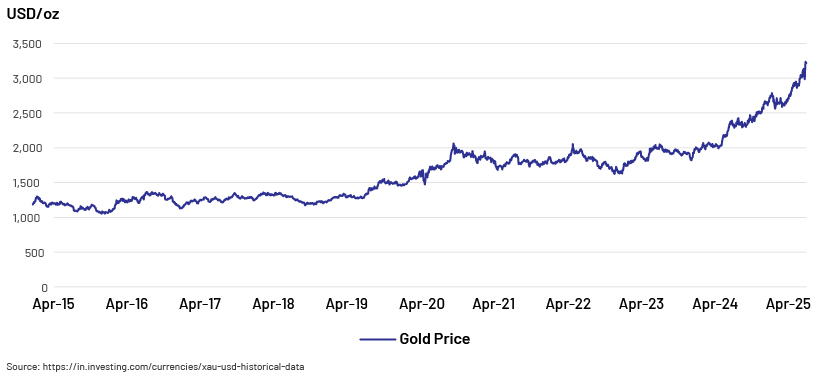

Gold prices have surged to a record high in April and surpassed USD3,200 per ounce (up c.22% YTD, as of 14 April 2025). The metal has experienced a strong rally since late 2023, posting a c.56% gain and consistently reaching new all-time highs. It has appreciated at an annual rate of about 10.4% over the past decade, having provided attractive long-term returns historically. At the time of writing, gold has narrowly outperformed the S&P 500, ranking as one of the best-performing assets.

The uncertainty associated with President Trump's tariff threats has led investors to turn increasingly to safe-haven assets such as gold. His inconsistent announcements, delays and the fluctuating nature of trade disputes with major trading partners over the past two months have eroded confidence in the market. Notably, traditional safe-haven assets such as the USD and Treasuries are losing appeal, amid declining global confidence driven by rising debt levels and protectionist tariff policies.

Long-term investors should consider adding gold to their diversified portfolios, as it functions as a stable store of wealth over time, offers a short-term safeguard against risks and, most significantly, enhances a portfolio's risk diversification.

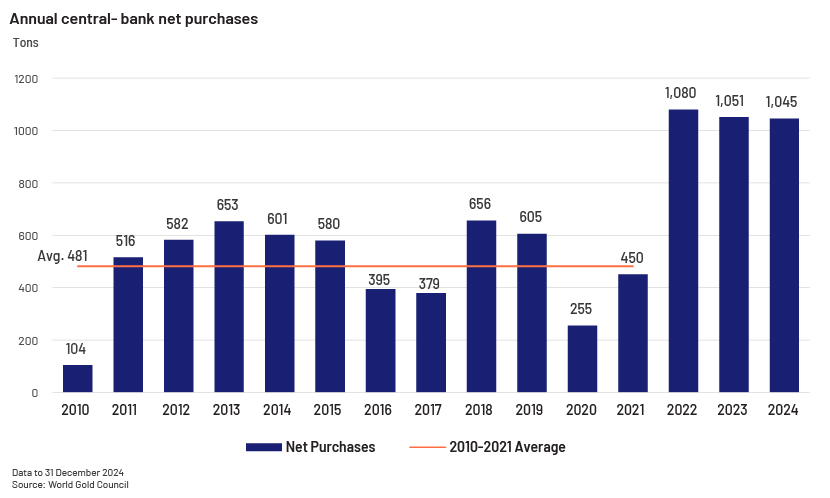

Central-bank purchases have risen notably in recent years

Robust central-bank demand for the metal has been one of the primary drivers of its performance, together with increased geopolitical risk, USD weakness, uncertainty, inflation concerns and a drop in interest rates.

Gold has now come to represent about 20% of the foreign exchange reserves held by central banks globally over the past two decades. Net purchases by central banks reached an unprecedented 1,082 tons in 2022, according to the World Gold Council, more than double the average annual purchases of the past 10 years. This trend of strong buying continued into 2023 and 2024, with a notable 1,037 and 1,045 tons purchased, respectively. Consequently, the buying streak has extended to 15 years. 2024 marks the third consecutive year where demand has exceeded 1,000 tons, far surpassing the annual average of 473 tons from 2010 to 2021, and playing a significant role in gold's annual performance.

Central banks have been net buyers for 15 consecutive years

Consistent with the previous 14 years, activity in 2024 was driven largely by a broad spectrum of banks in emerging markets.

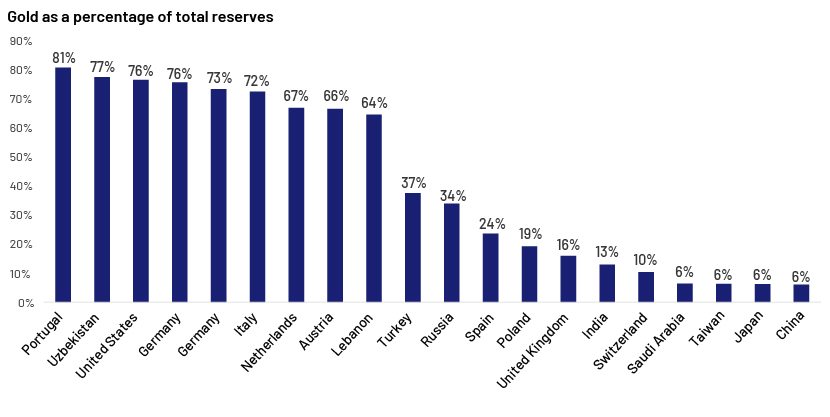

The National Bank of Poland (NBP) was the top gold purchaser in 2024, increasing its reserves by 90 tons. Adam Glapiński, the bank's president, has been a prominent supporter of gold, having mentioned plans to raise the NBP's gold allocation to 20% of its total reserves. As a result of last year's purchases, the bank's gold reserves stood at 448 tons at the end of the year, making up 17% of its total international reserves. The People's Bank of China purchased 44 tons of gold in 2024, bringing its total holdings to 2,280 tons, equivalent to 5% of its total international reserves. The Czech National Bank also continued its steady accumulation, increasing its gold reserves by 20 tons during the year, slightly more than in 2023, taking its total holdings to over 50 tons, more than triple the level at the end of 2022. Elsewhere in Central and Eastern Europe, the National Bank of Serbia added 81 tons, while the National Bank of Georgia boosted its reserves by 7 tons, both standing out as notable gold buyers.

Such central-bank accumulation also reflects a broader de-dollarisation trend among emerging markets seeking to reduce reliance on the USD.

Key drivers of gold price movement

The gold rate is influenced by many factors, ranging from economic indicators to geopolitical events. Key factors affecting gold prices include the following:

-

Interest rates:As an asset that does not yield returns, gold competes with interest-bearing options such as bonds and savings accounts. Shifts in interest rates can change the opportunity cost of holding gold, impacting the level of investor demand.

-

Dollar Index:Since gold is priced in USD, variations in the value of key currencies compared to the USD can affect gold prices. A decline in USD strength usually leads to an increase in gold prices, making it cheaper for investors using other currencies.

-

Geopolitical tensions:Demand for gold can surge due to political instability, conflict and geopolitical tension. In times of global market uncertainty, investors often seek gold as a reliable store of value.

-

Supply and demand:Gold prices are subject to the same supply and demand dynamics as other commodities. Variations in mining yields, recycling efforts and industrial consumption can significantly alter the amount of gold accessible in the marketplace.

-

Inflation and deflation:Gold is perceived as a defence against inflation, as its value often escalates during times of currency devaluation. However, in deflationary environments, it may become less appealing to investors who favour assets with more predictable returns.

-

Market sentiment and speculation:Short-term fluctuations in gold prices can be heavily influenced by investor sentiment and speculative trading. Events in the news, rumours circulating in the market and changes in how investors perceive risk assets can all lead to such price changes.

-

Technological advances: Gold serves multiple industrial purposes, particularly within the electronics and technology fields. When technological advancements reduce demand for gold in certain areas, it can affect pricing, although demand from industry is usually overshadowed by demand as an investment and for jewellery.

Outlook

The near-term outlook for the metal remains bullish. Gold prices are likely to increase even more in 2025 due to peaked real yields, ongoing geopolitical tensions, strong demand from central banks and the expectation of more retail investors getting involved. On a larger scale, if a universal tariff remains implemented, it could significantly amplify the overall impact on the price of precious metals. Concerns about economic growth and rising inflation could keep driving strong interest in gold among investors.

Who will be the main buyers of gold in 2025?

Central banks are not done with gold yet, and heightened political uncertainty is likely to drive a revival that may last until 2025

Given a tough macroeconomic situation marked by higher tariffs, trade disputes, increased inflation and an expanding US budget deficit, central-bank purchases, particularly by China, could lead to greater demand in 2025. Prospects for central-bank purchases look promising, according to a recent survey by the World Gold Council, as over 80% of global monetary authorities are keen to increase their gold holdings.

With cash rates on the decline, retail investors are likely to boost their investments in gold exchange traded funds (ETFs) over the next year, resulting in higher holdings as the appeal of money-market funds diminishes

Gold ETFs have attracted more retail investors since they started in 2004, peaking in 2020, when the pandemic led to lockdowns worldwide. Amounts held in these ETFs have been gradually falling since then and are only now back to where it was before the pandemic. Gold still accounts for just 2% of investor financial assets, and notional real ETF holdings remain around 6% lower than in 2020. If macroeconomic conditions remain volatile in 2025 and attention shifts to the Federal Reserve's potential interest rate cuts, increased investment in gold ETFs is likely to materialise as the attractiveness of money-market funds fades. ETF holdings have traditionally been driven by interest rate changes, with lower rates making gold a more appealing risk-free asset.

Major investment banks have updated their gold price forecasts in response to current economic conditions and market dynamics:

Goldman Sachs raises year-end gold price forecasts to USD3700 per ounce amid trade-war tensions

Goldman Sachs announced on 14 April 2025, that it has raised its forecast for the gold price at the end of the year to USD3,700 per ounce, up from the previous USD3,300. This adjustment is linked to stronger inflows to gold-backed ETFs and continued demand from central banks.

Morgan Stanley: Central-bank buying will drive gold to all-time highs

Goldman Sachs announced on 14 April 2025, that it has raised its forecast for the gold price at the end of the year to USD3,700 per ounce, up from the previous USD3,300. This adjustment is linked to stronger inflows to gold-backed ETFs and continued demand from central banks.

Bank of America predicts gold could reach USD3,500 per ounce in the next two years

On 26 March 2025, Bank of America raised its gold price forecasts and now expects it to trade at USD3,350 per ounce in 2026. This is an increase from its previous forecast of USD2,625 per ounce for 2026. It reiterated in a note that if investment demand increases by 10%, spot gold prices could climb to USD3,500 within the next two years.

Final thoughts

In an era marked by economic uncertainty, geopolitical unrest and shifting monetary dynamics, gold continues to shine as a resilient and reliable asset. Its dual role as a hedge against inflation and a safe haven during market volatility makes it an essential component of a balanced investment strategy.

Given the strong momentum from central-bank purchases, increasing interest from retail investors and the potential return of ETF inflows, gold is well positioned for continued strength in 2025 and beyond. Investors should consider recalibrating their portfolios to include a strategic allocation to gold – not only for its defensive qualities but also for its potential to deliver attractive returns over the long term.

How Acuity Knowledge Partners can help

We provide research on industry- and country-specific topics to global organisations and research houses and help them make sound decisions. We support our clients in a wide range of areas, including mergers and acquisitions, investment research, industry profiling, financial analysis, thematic research and macroeconomic and FX research. We also help clients build databases and provide regular sector coverage. Each output is customised based on the client’s requirement. By leveraging dedicated teams of experienced analysts at our offshore delivery centres, our clients benefit in terms of operational efficiency and cost optimisation.

Sources:

-

https://www.gold.org/goldhub/gold-focus/2025/04/central-banks-keep-gold-focus-february

-

https://www.gold.org/goldhub/research/gold-market-commentary-february-2025

-

https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/is-it-a-golden-era-for-gold

-

Why Gold Has Surged 20% This Year and Keeps Hitting Record Highs

-

https://www.reuters.com/markets/commodities/goldman-sachs-raises-end-2025-gold-price-forecast/

-

https://www.jpmorgan.com/insights/global-research/commodities/gold-prices

-

https://finance.yahoo.com/news/bofa-raises-gold-price-forecasts-134319258.html

What's your view?

About the Author

Shitij has been working with Acuity Knowledge Partners since 2014 as an Assistant Director. He has in total more than 18 years of experience in Capital markets, Investment / Financial research, Valuations and has worked with various investment banking, private equity and hedge funds teams worked across multiple sectors including DCM, RSG, FSG and Leverage Finance. He has extensive experience in handling end-to-end projects related to Capital markets including macroeconomic research, financial benchmarking, bond pricing, market updates, portfolio analysis and others. Shitij is a Chartered Accountant from the Institute of Chartered Accountants of India and also holds a Masters in Business Administration with specialization in Investments from ICFAI University..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox