Published on July 13, 2023 by Manvendra Jain

The global flexible workspace market – including co-working spaces, serviced offices, hot desking (desks on demand) and virtual offices – started as a niche market primarily for freelancers, small businesses and start-ups. It became a very attractive proposition primarily due to fluctuating economic scenarios and as rising inflation and interest rates led to increased costs.

-

A co-working space is an open-plan office concept where companies and individuals share the space

-

Serviced offices are fully furnished offices available for bigger companies to move in immediately, with an option of customising the space

-

Hot desking is a type of workspace arrangement with desks available on an on-demand basis

-

Virtual offices are offices without a physical location, relying completely on technologies such as videoconferencing, messaging apps and phone-answering services

Via flexible workspaces, companies can access cost-effective, fully equipped and serviced workplace options, networking and collaboration opportunities, with flexible contracting, providing an opportunity for out-of-station employees to work from closer to their homes and low-cost options for new businesses.

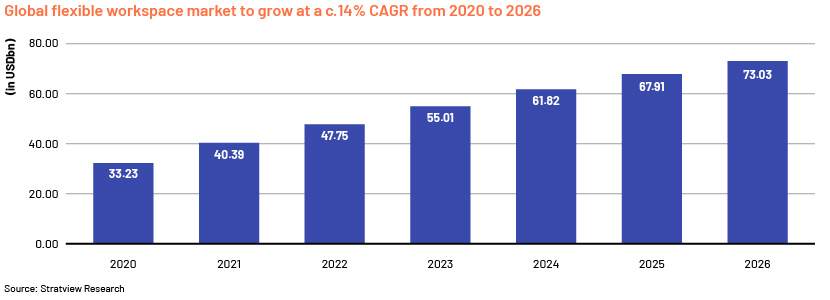

The global market is likely to see increased investment in the next two years

JLL’s Future of Work Survey of over 1,000 corporate real estate decision-makers found that 43% of the firms plan to increase investment in flexible workspaces through 2025. Around 17% of US occupiers reported that flexible workspaces accounted for a significant part of their portfolios as of October 2022, according to CBRE’s Occupier Sentiment Survey; this number is expected to grow to 59% by 2025.

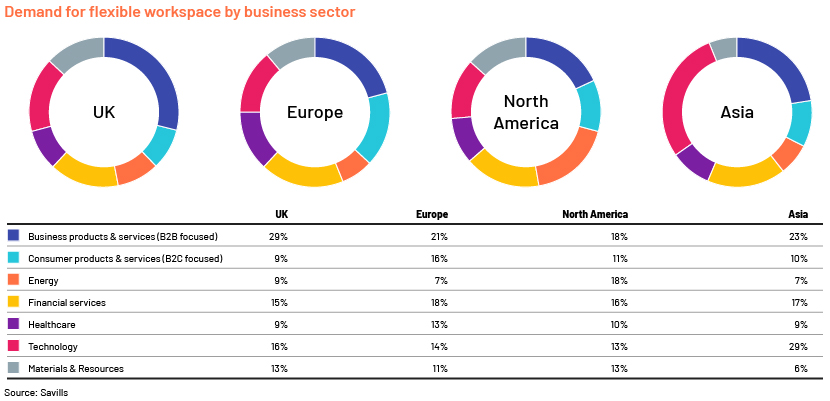

The top four sectors that drove demand for flexible workspaces in 2022 were business products and services (B2B focused), technology, financial services, and consumer products and services (B2C focused), according to Savills. Demand for flexible offices in Asia is still from technology companies, but this is expected to widen going forward.

Trends in the flexible workspace market:

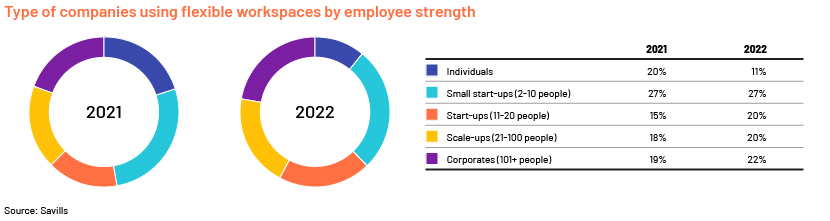

Start-ups are expected to be the primary customers of the flexible workspace market, followed by medium-size enterprises and corporates. Start-ups are expected to lease c.29m sq. ft. of global co-working space from 2022 to 2024; this is a 130% increase from 2019-21, according to a combined study by Colliers and CBRE Matrix.

Flexible workspaces support expansion for tech start-ups, as additional space requirements could be met easily, without moving to a different location.

Globally, 540 start-ups achieved unicorn status in 2021, up from 150 in 2020, signalling a continued increase in the number of start-ups, mainly in the technology sector, which is expected to drive demand for flexible workspaces.

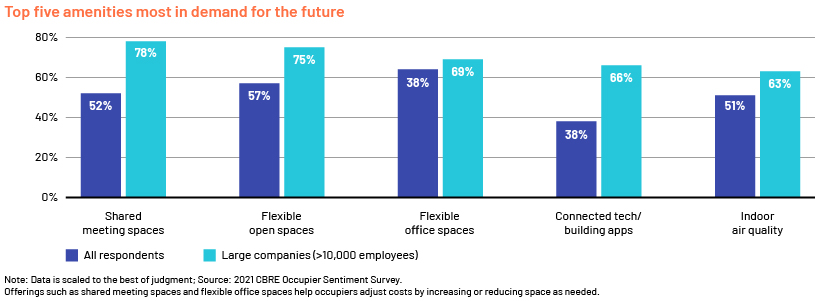

Amenities expected to drive preference for workspaces. The top three requirements are wellness, technology and flexibility, especially for large enterprises, with shared meeting spaces and flexible open space options being the most desired. Property owners comment that offering flexible spaces enable them to maintain flexible relationships and grow strategically.

Offerings such as shared meeting spaces and flexible office spaces help occupiers adjust costs by increasing or reducing space as needed.

Technological advancements to drive demand for flexible office space. Many companies are willing to pay more for flexible office space if state-of-the-art technologies, such as cloud computing and high-speed internet, are provided.

De-centralised centres likely to grow in popularity. The focus is shifting from central business districts to suburban cities as employees who live in the suburbs prefer to save on travel costs and time. The commute is expected to play a crucial role in shaping the future of the flexible workspace market, prompting service providers to look at decentralised locations as an alternative.

Mark Dixon, founder and CEO of International Workplace Group (IWG), predicts a rapid shift to new suburban locations to meet growing demand and reduce costs amid the stressful macroeconomic conditions, especially in Europe and the US.

The future of the flexible workspace market

Demand for flexible workspace solutions has grown consistently over the past decade, with the pandemic only accelerating it. However, flexible workspace providers expect to see the following changes in the market in the next five years.

-

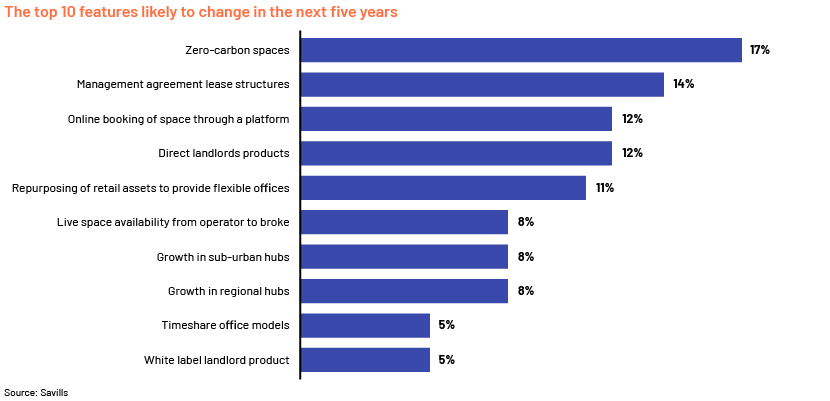

In the US and Asia, workspace providers expect the main change in management agreements, followed by booking space via online platforms (in the US) and growth in suburban hubs (in Asia).

-

In Europe, the main change is expected in booking space via online platforms, followed by management agreements.

-

In European cities, the main change is expected in relation to zero-carbon spaces. ESG factors did not feature among the top three changes expected in the US and Asia.

Savills conducted a survey of flexible workspace providers in 2022 to identify the most likely changes in the market. It found the following 10 features likely to change in the next five years.

Our Private Markets team helps private equity clients keep abreast of investment opportunities, developments in the flexible workspace market and related sector trends. This includes deep-dive analyses, thematic research, newsletters including changes in the sector, competitive landscape analyses and company coverage.

References:

-

https://www.workthere.com/media/zwfosyhv/workthere-flexmark-3-0-final.pdf

-

https://www.officeevolution.com/blog/who-rents-private-offices/

-

https://www.stratviewresearch.com/1680/flexible-workspace-market.html

-

https://www.bisnow.com/search/news?search=flexible%20office&sort=date&city=

-

https://coworkinginsights.com/tech-firms-leading-the-rush-in-demand-for-flexible-workspaces/

-

https://www.entrepreneurshipinabox.com/18668/the-rise-of-coworking-spaces-in-the-startup-economy/

-

https://www.officernd.com/blog/future-of-work/flex-office-space/

What's your view?

About the Author

I have a total experience of 13yrs and I have been at Acuity for past 4 years as Delivery Lead working for a Private Market client. I am a seasoned professional with all the exposure in Secondary Business Research.

Like the way we think?

Next time we post something new, we'll send it to your inbox