Published on June 2, 2025 by Ma. Daniela Barrantes

Introduction

In evaluating a promising investment, it would be invaluable to go beyond traditional financial metrics and consider location-based factors such as demographics, market trends and potential risks. This is where a geographic information system (GIS) proves its worth.

Staying ahead of market trends and making well-informed decisions in an increasingly complex environment demands innovative tools like GIS in financial decision-making. GIS has emerged as a powerful technology that integrates spatial data with financial analysis, offering unique insights that drive smarter investments. Whether assessing real estate opportunities, managing risks or optimising market strategies, GIS is reshaping how financial institutions and businesses operate.

This blog explores the importance of GIS in relation to finance, highlighting its current applications, challenges and potential solutions.

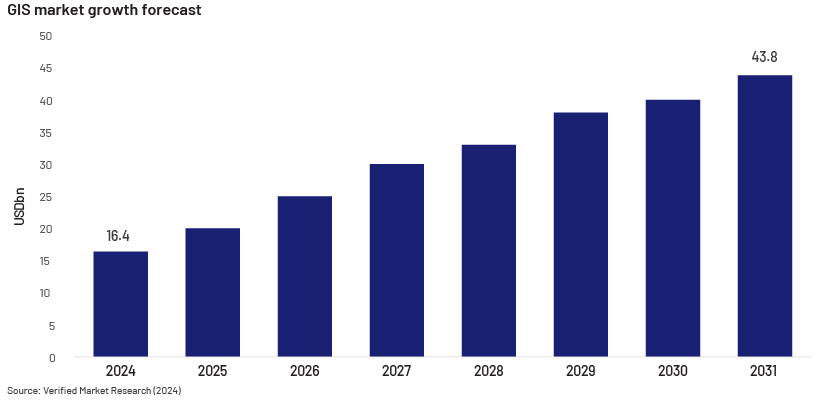

The global geographic information system market was valued at approximately USD16.4bn in 2024 and is projected to reach USD43.8bn by 2031, growing at a CAGR of 13.07%, according to Verified Market Research (2024). This strong growth potential highlights the expanding applications of GIS across sectors, including finance.

Importance of GIS

The lack of spatial insights could result in the following:

1. Missing investment opportunities

Ignoring geographical data could result in investors missing crucial regional trends that impact asset performance. Take real estate, for example: a property investor may assess market values based solely on average sale prices and rental yields without considering key location-driven factors such as infrastructure development, population shifts or climate-related risks.

Properties near new transit hubs experienced a 15-20% increase in value, according to a study by Mathur, S., & Ferrell, C. (2013). This substantial increase in home values suggests that transit facilities have a positive impact on home values; investors who base their decisions solely on financial data, however, may overlook these opportunities.

2. Risks of inadequate geospatial risk assessment

Financial institutions and insurance companies need to assess risk exposure to safeguard their assets and clients. Without GIS in finance, risk evaluations may be incomplete or inaccurate.

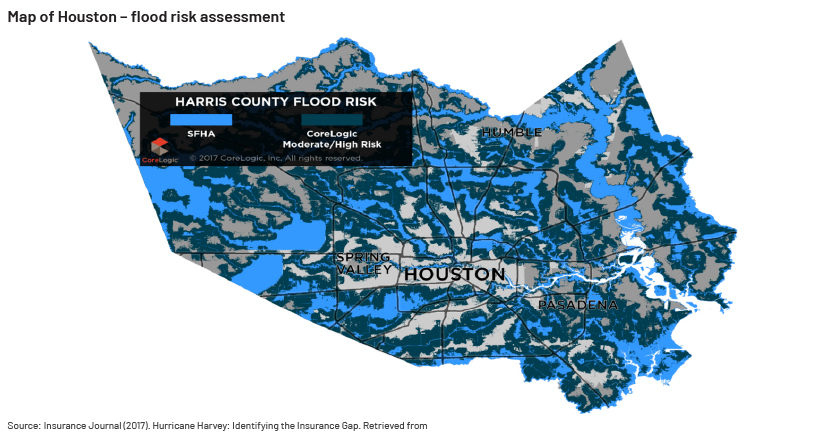

For example, in 2017, Hurricane Harvey caused USD125bn in damage across Texas. Analysis by CoreLogic estimated that about 70% of the flood damage was uninsured, underscoring a significant insurance gap. The report called for a comprehensive understanding of risk powered by data and analytics, including the adoption of catastrophe risk loss models to simulate large-scale events. (Larsen, T., 2017).

Understanding flood risks is essential for effective financial management, according to the Organisation for Economic Co-operation and Development ( ECD; 2016). Incorporating spatial data into financial strategies enhances risk assessment, supports informed decision-making and helps mitigate potential financial loss.

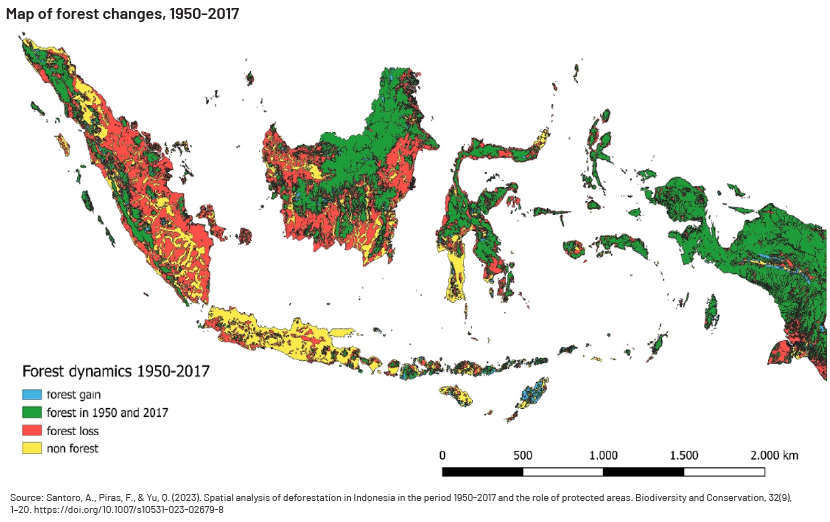

1. Urban expansion and forest loss

Incorporating spatial insights into land-use planning is essential for preventing deforestation and its associated risks. Without such insights, unchecked development can result in habitat destruction, biodiversity loss and environmental decline.

A study by Santoro et al. (2023) found that in Indonesia, the lack of comprehensive spatial planning has led to significant deforestation. The country’s forest cover decreased from 78.3% to 46.8% from 1950 to 2017, with an annual deforestation rate of approximately 985,200 hectares. Without spatial insights to guide land-use decisions, such activity has resulted in the loss of critical forest area, impacting biodiversity and contributing to environmental degradation.

1. Inefficient resource allocation in banking

Banks and financial institutions often struggle to determine the best locations for new branches and ATMs; this could result in limited customer accessibility and increased operational expenses.

Challenges in financial analysis

The financial sector is increasingly complex, with factors such as market volatility, demographic shifts and environmental risks influencing decision-making. As explained by Esri (2007), traditional financial analysis often lacks spatial dimension, making it difficult to identify regional economic trends and their impact on investments; assess risks associated with geographic variables, such as natural disasters or regional economic downturns; optimise the location of branches, ATMs, or other financial services; and much more.

A GIS-powered solution for finance

A comprehensive GIS solution for finance involves the following:

1. Real estate and property valuation:

GIS technology empowers real estate professionals to assess property values more accurately by analysing spatial data. It helps evaluate factors such as location, proximity to amenities and neighbourhood characteristics, offering advanced tools for more precise property and real estate valuation. (GIS Resources, 2024)

2. Branch and ATM placement:

Financial institutions use GIS to analyse demographic data, customer distribution and accessibility to determine optimal locations for branches and ATMs, ensuring convenience for customers and efficient resource allocation. (Ellipsis Drive, n.d.)

A study by Esri Indonesia (n.d.) found that bank Muamalat enhanced 64% of its ATMs' cost and acquired 10% more customers with 40% fewer branches after implementing GIS technology. By mapping population density, customer foot traffic and local income levels, institutions can strategically position financial services for maximum impact.

3. Risk assessment and management:

GIS helps assess risks by mapping regions vulnerable to natural disasters or economic downturns, enabling financial institutions to make well-informed decisions on investments and insurance underwriting. (GEO Business, 2024)

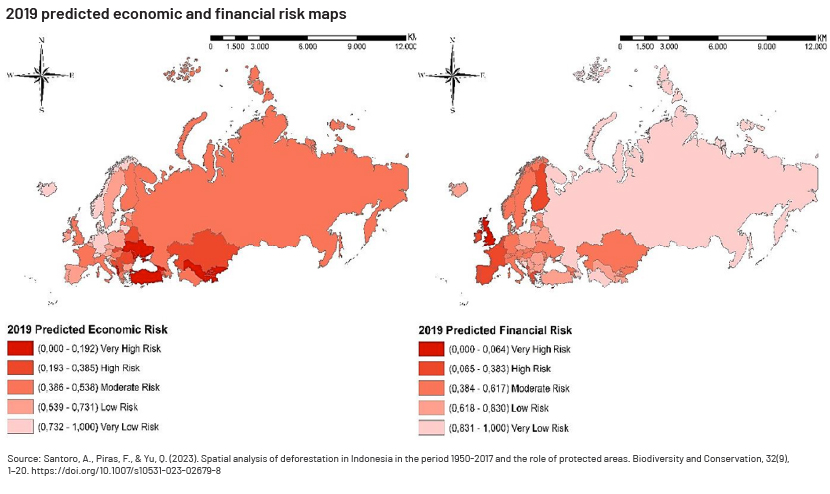

A case study by Kalkan & Çam (2023) found which countries had a very high financial risk. The study employed techniques such as geographical weighted regression (GWR) and Moran’s Index for spatial autocorrelation to create risk maps, highlighting spatial dependencies between countries.

Conclusion

GIS has evolved beyond a simple mapping tool into a useful and strategic asset for the financial sector. By incorporating spatial insights into financial analysis, organisations can improve decision-making, minimise risks and identify new opportunities.

As the financial sector becomes increasingly data-driven, embracing GIS would be crucial to stay competitive and achieve sustainable growth. Whether in terms of optimising investments, assessing risks or tailoring services, the power of "where" is redefining the future of finance.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners assist in GIS for finance by offering specialised tools and services that analyse spatial data to predict market trends, assess real estate values and identify investment opportunities. By integrating GIS into financial models, we help forecast economic developments and pinpoint high-growth areas, enabling more informed decision-making in property investment and urban development.

Bibliography:

-

Esri (2007). GIS for financial services. Retrieved 30 December 2024 from https://www.esri.com/content/dam/esrisites/sitecore-archive/Files/Pdfs/library/bestpractices/financial-services.pdf

-

Verified Market Research (2024). Global geographic information system (GIS) market size and forecast. Retrieved 30 December 2024 from https://www.verifiedmarketresearch.com/product/global-geographic-information-system-gis-market-size-and-forecast/

-

GIS Resources (2024). The role of GIS in real estate valuation and its impact on property taxes. Retrieved 30 December 2024 from https://gisresources.com/the-role-of-gis-in-real-estate-valuation-and-its-impact-on-property-taxes/

-

GEO Business (2024). The role of GIS in finance. Retrieved 5 January 2025 from https://www.geobusinessshow.com/the-role-of-gis-in-finance

-

Ellipsis Drive (n.d.). How is GIS used to make smarter financial decisions? Retrieved 5 January 2025 from https://ellipsis-drive.com/blog/how-is-gis-used-to-make-smarter-financial-decisions/

-

Mathur, S., & Ferrell, C. (2013). Measuring the impact of sub-urban transit-oriented developments on single-family home values. Transportation Research Part A: Policy and Practice, 47, 42-55

-

Larsen, T. (2017, 11 September). Hurricane Harvey: Identifying the insurance gap. Insurance Journal

-

Organisation for Economic Co-operation and Development. (2016). Financial management of flood risk. OECD Publishing. https://doi.org/10.1787/9789264257689-en

-

Santoro, A., Piras, F., & Yu, Q. (2023). Spatial analysis of deforestation in Indonesia in the period 1950-2017 and the role of protected areas. Biodiversity and Conservation, 32(9), 1-20. https://doi.org/10.1007/s10531-023-02679-8

-

Esri Indonesia (n.d.). Improving banking service with location analytics

-

Asian Banking & Finance (2019). How Bank Muamalat Indonesia used smart mapping technology to optimise its branch and ATM network

-

Kalkan, Y., & Çam, A. V. (2023). Geographic Information System Based Economic And Financial Risk Analysis: The Case Of Europe And Central Asia. Estudios de economía aplicada

What's your view?

About the Author

Daniela Barrantes holds the position of Senior Associate Data Analyst within the Specialized Solutions division. Her professional expertise encompasses investment research, marketing, and data analysis, reflecting her diverse skillset and background.

Like the way we think?

Next time we post something new, we'll send it to your inbox