Published on August 25, 2025 by Kunal Tolani

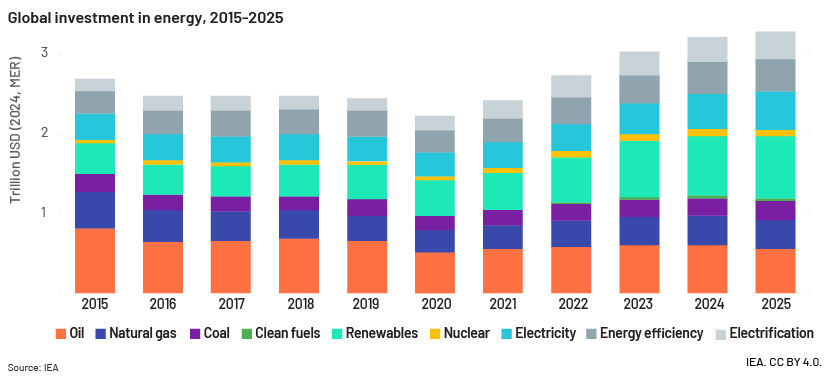

Global energy investment is set to hit a record USD3.3tn in 2025, growing 2% over last year. Clean energy is set to account for USD2.2tn of total investment, almost double the amount earmarked for fossil fuels. The global energy system is undergoing significant transformation with clean energy dominating new investments, driven by a shift in industrial policies towards low-emission power generation, cost competitiveness of electricity energy, security concerns and technological progress.

The chart above depicts a sharp fall in investment in 2020, prompted by the start of the pandemic that led to a global recession and collapse in energy demand. However, total investment has spiked since 2021. The overall investment stack has also become more diversified, with a smaller fossil-fuel base and increased allocation to emerging clean energy pillars. The most significant growth has been in investment in renewables, with their share of the investment stack expanding not just in absolute value but also relative to fossil fuels and other sectors.

Highlights of clean energy investments

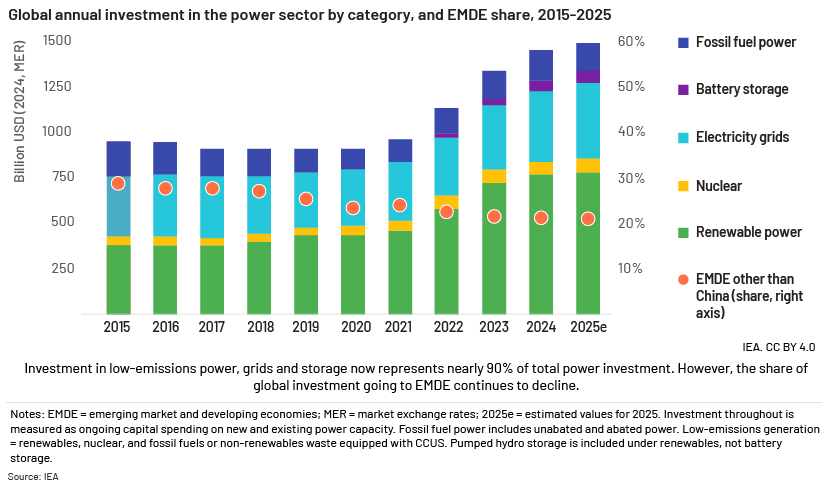

Clean energy investments comprise investments in renewables, nuclear power, electricity grids, storage, low-emission fuels, energy efficiency and electrification. These are expected to account for two-thirds of global energy investments in 2025, followed by fossil fuels, as depicted below. Investment in solar PV systems, including utility-scale and rooftop systems, is expected to reach USD450bn in 2025, earmarking it as the single largest investment within the clean energy category. Nuclear power and battery storage investments are also rising significantly, having surged above USD70bn and USD66bn, respectively, in 2025. Electricity demand is also underpinning investments in fossil fuels, largely in India and China.

Regional shifts and energy trends

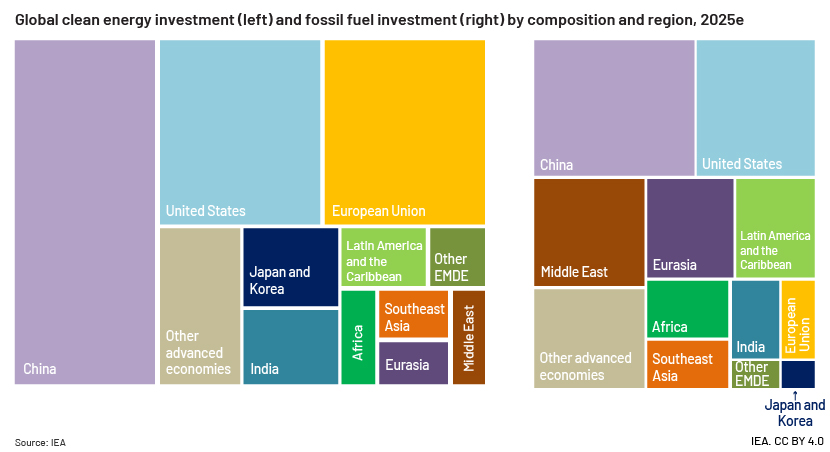

The chart above shows that China is expected to lead in clean energy investments and fossil fuel investments in 2025. While global trade plays a key role in balancing energy supply and demand, overdependence on a few countries for fuel or critical minerals poses serious risks. This was clear in 2022, when Europe’s reliance on Russian gas triggered a major energy crisis when the Russia-Ukraine conflict began. Ongoing trade tensions are also adding uncertainty, prompting many companies to delay new investments as they adopt a wait-and-see approach. The following is how these trends are playing out across regions:

US: The US government is rapidly expanding its cleantech sector, with investment rising to USD60bn in 2024 from USD2bn in 2018. However, the Trump administration rolling back clean energy incentives and regulations has created policy uncertainty. At the same time, US tariffs on key components such as solar panels and wind parts are raising costs and slowing project deployment. Although aiming to boost domestic manufacturing, current production falls short of demand, making utility-scale projects more expensive and less competitive globally.

Europe, the Middle East and Africa: Europe has significantly deepened its commitment to clean energy over the past decade, with investments projected to reach nearly USD390bn in 2025, in response to policy incentives, the cost-competitiveness of renewable technologies and the global energy crisis following Russia's invasion of Ukraine. In the Middle East, investment growth in low-emission power has nearly matched that of fossil fuel but remains short due to the substantial subsidies provided to fossil fuel projects; this has resulted in clean energy accounting for only 15% of total investments. Clean energy investment in Africa has accelerated since 2021, with investment in low-emission power making up about 40% of clean energy investment in 2024. Solar energy has become the lowest-cost power source in many countries in the continent, driving this growth in investment.

Asia Pacific: China is expected to account for almost 25% of global clean energy investment in 2025. Its clean energy investment surged to USD625bn in 2024, nearly doubling since 2015, driven largely by a strategic change in energy security priorities. India is also making substantial progress towards obtaining 50% of its electricity requirement from non-fossil sources, even ahead of its 2030 goal, mainly due to its significant investments in solar power. The Indian government has already announced programmes to encourage such investments in power generation. Japan and Korea are investing heavily to reduce reliance on imported fossil fuels and boost energy security. Almost 92% of energy investment in these two countries is skewed towards clean energy, far outpacing the global average of 66%. Renewables (solar PV and wind) are the main area of focus for new capacity, accounting for over half of all new energy investment.

Latin America and the Caribbean: The region’s clean electricity sector is growing fast, with 60% of its power requirement now coming from renewables, primarily hydropower. Clean energy investment has grown by nearly 25% over the past 10 years, with an estimated USD70bn in 2025, but growth remains lower than that globally.

Sustainable finance and policies

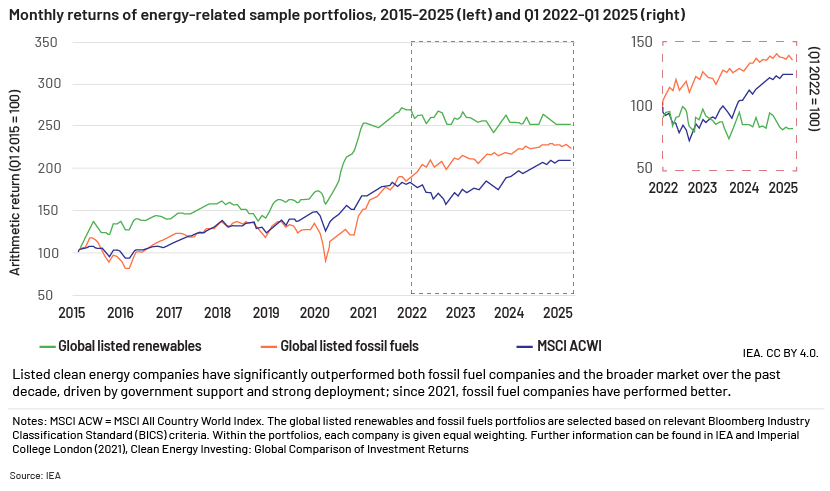

Sustainable finance has increased rapidly over the past decade, driven largely by new climate disclosure rules, such as those governing integration of environmental, social and governance (ESG) considerations and green taxonomies now adopted by over 58 countries, together with significant efforts on the part of the sector. These initiatives have pushed global financial institutions to announce and commit to their net-zero targets. However, interest rates have been increasing since 2021, driving up capital costs; supply chains have been disrupted since the pandemic; and there is regulatory uncertainty. These factors have dampened the performance of renewable energy companies (see chart below), resulting in questions relating to the underlying cost-benefit of ESG practices.

Global clean energy policies and regulations are now focusing on cutting emissions, improving energy security and expanding access. Governments worldwide use tools such as carbon pricing, clean energy targets and renewable energy mandates, supported by financial incentives such as tax credits, feed-in tariffs and auctions.

Developed countries are investing heavily through large-scale subsidies and innovation programmes, while developing regions rely more on public-private partnerships and international funding to boost renewable energy. Despite regional differences, solar and wind are driving strong growth in clean power, now making up nearly half of global electricity generation. In 2024, 80% of total investment in utility-scale solar and wind was met through debt financing, compared to 56% in 2015. However, challenges remain in financing, grid upgrades and ensuring fair access to clean energy.

Annual issuance of green debt, including private debt, rose nearly 20 times over the past decade – to USD800bn in 2024 from USD45bn in 2015. Banks and institutional investors play major but differing roles in energy finance. Since 2016, banks have provided about USD500bn in primary project finance to clean energy sectors, while institutional investors have provided just over USD100bn. The gap between these institutions has widened in recent years as the end of the low-rate environment led investors to allocate more capital to government bonds. The same trend can be seen in clean energy acquisition finance and refinancing. If cashflows and returns are predictable, clean energy finance from banks should continue to grow.

Conclusion

The energy landscape is undergoing profound transformation, with clean energy now firmly dominating global investments. Regionally, the US is emerging as a leader in cleantech manufacturing, with China continuing its dual expansion in clean energy and coal. Growth in global clean energy investment in 2025 is backed by solar PV, wind, nuclear, batteries and electrification, with the electricity sector’s spending surpassing spending on fossil fuels for the first time. Despite robust growth of sustainable finance, rising interest rates and regulatory uncertainty pose challenges, potentially slowing private clean energy spending, particularly in emerging markets burdened by debt, underscoring the complexities of global energy transition.

How Acuity Knowledge Partners can help

We provide customised energy research and consulting solutions to clean energy companies, with a strong focus on renewable energy, utility-scale projects, carbon neutrality, hydrogen, e-mobility and smart grid technologies. We also provide specialised commercial lending services for the energy and utilities sector, including for renewable energy projects, infrastructure financing, cleantech ventures and energy transition investments. This includes credit underwriting support for renewable energy developers and utilities, loan-monitoring services tailored to large-scale and cross-border energy investments and deal pipeline tracking and regulatory intelligence for energy-focused lending portfolios.

Sources

-

https://www.edfenergy.com/energywise/renewable-energy-sources

-

https://www.homaio.com/post/decrypting-trumps-impact-on-climate-part-1

-

https://www.latitudemedia.com/news/is-the-middle-east-missing-a-clean-energy-ai-opportunity/

What's your view?

About the Author

Kunal is an Investment Banking Associate at Acuity Knowledge Partners. He provides coverage to a global investment bank's Sustainable and Impact Banking team for the US region. Prior to joining Acuity, he worked at KPMG Global Services as a Business Associate in the Capability Hubs department for over three years. Kunal has a Bachelor's degree in Economics (Hons.) from Delhi University, and he is currently pursuing CFA Program Level 3 from the CFA Institute.

Like the way we think?

Next time we post something new, we'll send it to your inbox