Published on August 18, 2023 by Harsha Krishnakumar and Anurag Sikder

In 1956, a student of Benjamin Graham decided to create a first-of-a-kind document to market his funds. Subsequently, a British-American investor named Sir John Templeton wrote a monthly letter, called a fund commentary, to investors in his Templeton Growth Fund that contained insights on the global economy and his stock-market predictions (that would be reflected in his decisions for the fund). He had an optimistic approach to the letter and helped educate investors on the importance of investing strategies, fund performance and the benefits of long-term investing. The mutual fund industry followed suit, publishing commentaries for different funds and for a range of time periods. Commentaries have since become a critical component of any asset manager’s marketing arsenal. Investors use them to stay in tune with those handling their investments, to understand their approach and where they think there is opportunity to grow and to assess how their investments are performing.

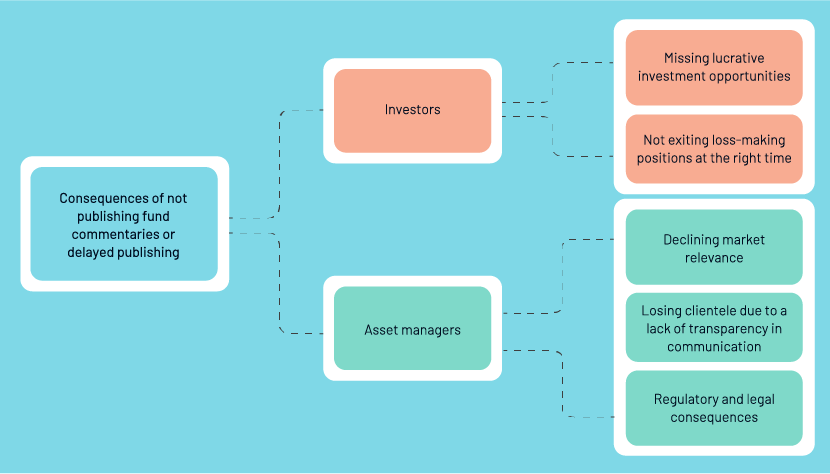

However, even the biggest asset managers may face challenges when producing commentaries regularly for all their funds. Writing fund commentaries, quarter after quarter, could put pressure on the portfolio manager, sometimes leading to focusing only on certain asset classes, delays or even cancelling the process altogether. The pressure to adhere to tight deadlines could be another burden, with marquee funds, for example, requiring commentaries to be produced in just five days after the end of a quarter. With the additional requirements of quality control and compliance, such stringent requirements could derail efforts. The lack of resources to execute all these tasks could also be a major reason for delayed publication, differences in publication dates or outdated fund commentaries remaining on websites for prolonged periods of time.

Acuity Knowledge Partners’ 1Q23 survey of fund commentaries

We conducted an in-depth survey of the patterns of publishing investment commentary by some of the world’s top asset managers. We identified active publishers, the fastest publisher, the average number of days after the end of the quarter the commentary was published and the preferred asset classes.

We chose asset managers based on overall assets under management (AuM; more than USD190bn) and the frequency of investment commentary publication (quarterly). Even though asset managers publish commentaries monthly, quarterly, semi-annually and annually, this survey was based on quarterly publication, as we deemed it to be an appropriate timeframe within which managers should produce commentaries for their clients. There is pressure associated with producing commentaries every month, but publishing frequencies of every six months or year may not necessarily mean the manager has an active commentary-writing team. The commentaries of the selected companies and their active publishing dates were profiled for the purposes of this survey.

The survey was conducted until 16 June 2023, considering commentaries published for the first quarter of 2023. The findings gave us insights on the priority the asset managers assign to their commentary-writing processes and how much time it takes to produce them.

Key findings

1. Only 40% of the asset managers published fund commentaries in 1Q23

However, for the purpose of practicality, we considered asset managers that had published at least one fund commentary during this period as active publishers of commentaries. 72% of the asset managers had at least one fund for which they had not published commentary. 22% of the asset managers had “stale” fund commentaries on their websites.

These figures are worrying, as they indicate that many of the world’s largest organisations due not treat the commentary-writing process with the seriousness it deserves. Reasons for this could range from resource availability to prioritising the process. We recommend that these organisations revisit this function and consider commentary as an important marketing document.

2. Minimum time to market for active publishers: seven business days after quarter-end

One asset manager published at least one commentary within seven business days of the end of the quarter. 16% of the asset managers published commentaries for at least one fund within 15 business days of quarter-end, while 20% published within 25 business days and 6% published as late as 60 calendar days (or later) after the end of the quarter. The more delayed the publication, the more likely the asset manager’s relevance would diminish. Commentaries are also a way to remain visible to potential investors.

3. The average time taken to publish is 30 days after quarter-end

The average time the 40% of asset managers that regularly publish their commentaries take to publish all their commentaries is 30 days after quarter-end. Some take much longer than 30 days to publish. 14% of the asset managers had a 50-day (or longer) gap between when they published the first commentary and when they published their last one. 6% of the asset managers prefer to publish all their commentaries on the same day, 8% publish them within 10 days of publishing their first commentary and 12% publish them within 20 days.

A significant gap such as 50 days or longer between publishing dates could give mixed signals to investors. Although these asset managers are well within the regulatory limits for staying competitive, it is best to plan to publish commentaries as soon as possible.

4. Equity commentaries are largely published first and most often

Equity funds account for 66% of the commentaries published within 60 calendar days of quarter-end. The other 34% comprises fixed income and alternative funds. When the sample is widened to include commentaries published after 60 days, the share of equity funds rises to 71%. Another interesting observation was that 8% of the asset managers’ published portfolios of commentaries had only equity funds (100%), while 4% contained mostly equity funds (90-95%). Other kinds of funds covered were fixed income, alternatives, multi-asset and real assets.

This preference for equity funds shows that either equity fund commentaries are easier to write or investors demand that equity fund commentaries be published first. In our experience, writing commentaries for fixed income funds requires a certain degree of specialised knowledge and attention of experienced managers. The busy schedules of managers at quarter-end make it even more difficult to write deeply analytical commentaries on fixed income funds. Whatever the reason, equity funds lead the way, an interesting fact for companies that do not publish commentaries to consider.

Making commentary writing easier with Acuity

Our in-depth experience in commentary writing is built on more than 15 years of supporting the processes of some of the largest asset managers in the word, covering all asset classes. We optimise the commentary process, leveraging proven writing practices and enhanced production and review processes and by maintaining strong relationships with stakeholders throughout the production process.

The difference in publication dates for different funds was common to most of the asset managers surveyed. We recommend that asset managers have a schedule for publishing commentaries, streamlining the production process further.

5. Depth of content determines when they are published

The findings confirm a link between depth of content of a commentary and the date of publication. Funds whose commentaries require the inclusion of charts, diagrams, performance data tables and ESG analysis have a publishing date of more than 15 days after quarter-end. This is to ensure all the critical information the asset manager wants to share with clients is available. Or it could be that they require time to produce commentary due to a lack of dedicated resources.

Conclusion

We infer from these results that to stay ahead of the industry in terms of time to market, asset managers must ensure certain abilities, resources and processes are in place:

1. Have a clear production and review process in place – This refers to an established writing and reviewing process for all marketing collateral, including commentaries. It requires investment in the right talent and establishing a standard for writing and reviewing on par with established market standards.

2. Just hiring the right talent may not be enough – In today’s competitive world, acquiring the right talent to write fund commentaries could be a challenge in itself. Ensuring they remain invested in the work for a sustained period of time could be another. We recommend that asset managers be patient in choosing the right team or engage a third party specialised in these services and that could ensure commentaries are produced for all funds.

3. Stay up to date with technology – Having the latest technology is essential for reducing the amount of time spent on coordinating writing and review. This could include collaborative tools, project management tools or the latest file-sharing systems to avoid latency in data availability.

4. Create a culture of collaboration – To write informed commentaries, asset managers need to have partnerships in place for obtaining market intelligence, outsourcing tasks or simply having the right tools to make the investment commentary writing process seamless.

While organisations could improve their commentary production processes, it really entails a shift in priorities if asset managers are to assign commentaries the level of importance required. It is not simply a question of putting together a team of writers and getting started. It requires gathering strong analysts and support staff who know the standards of reporting portfolio managers require, the standard of language investors require and the regulatory standards that need to be followed. Without such a team, there is likely to be more damage done than improvement.

How Acuity Knowledge Partners can help

We provide a service that combines process, people and technology. We help clients reduce manual intervention and increase efficiency in the fund commentary process, using the best tools. We help asset managers publish commentaries for all their funds and as fast as possible, integrating our domain and technology expertise to provide a holistic solution.

Sources

What's your view?

About the Authors

Harsha Krishnakumar has over 10 years of experience in RFP creation/writing and personal coaching. In his current role at Acuity Knowledge Partners, he provides support in business development and content strategy for fund marketing services. Prior to this, he was part of the Sales Enablement team at JPMorgan. He holds a Master of Business Administration from ICFAI Business School and a Bachelor of Engineering from Bangalore Institute of Technology.

Anurag Sikder has over 13 years of experience in producing content for a wide range of industries. At Acuity, Anurag leads a range of different teams providing qualitative insight for numerous sectors in the form of market reports, white papers, thought leadership pieces, and commentaries.

Like the way we think?

Next time we post something new, we'll send it to your inbox