Published on July 8, 2025 by Pravin Srinivasan

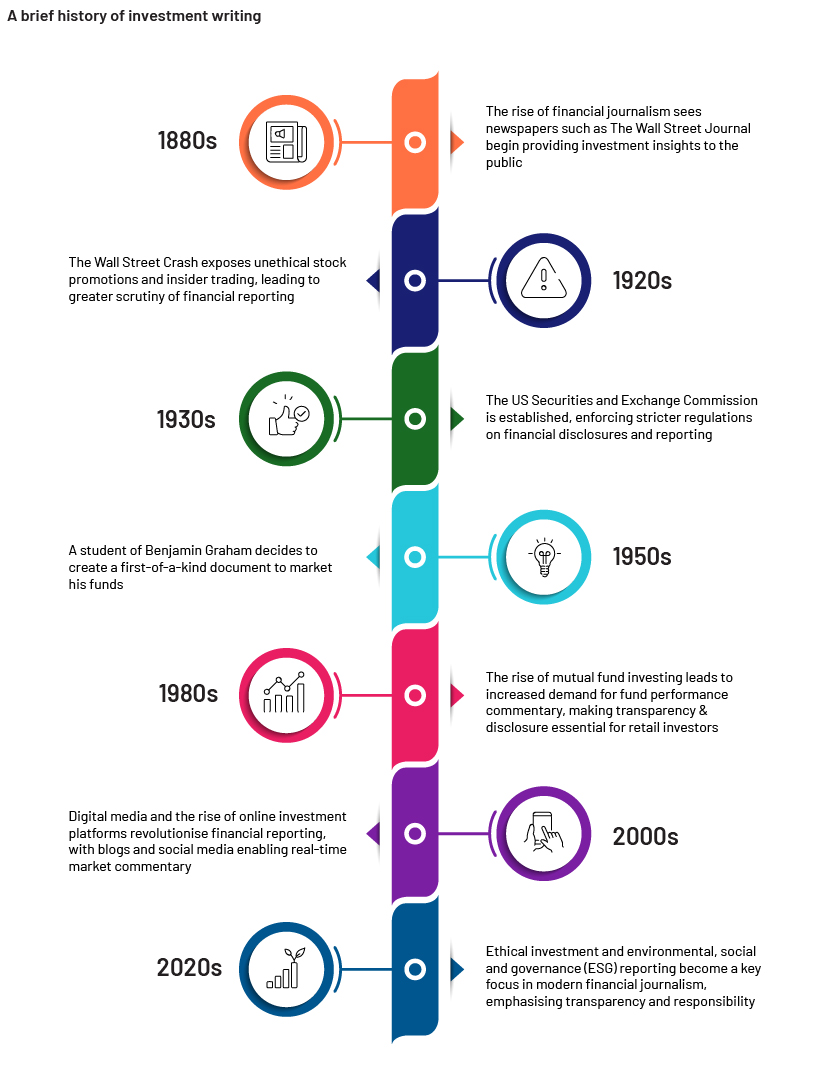

In the realm of finance, where decisions can wield substantial influence over markets and individuals’ financial wellbeing, the significance of ethics in investment reporting cannot be overstated. Throughout history, financial writing and commentary have played a role in shaping public perceptions, guiding investment decisions and maintaining market integrity. This kind of writing has evolved from a mere marketing tool to an art and science of communicating complex financial information to investors concisely. Trust between investors and financial institutions is built on accurate reporting that supports ethical investing and long-term financial wellbeing. The 2022 CFA Institute Investor Trust Study highlighted that 86% of institutional investors consider trust a critical factor when selecting investment firms.

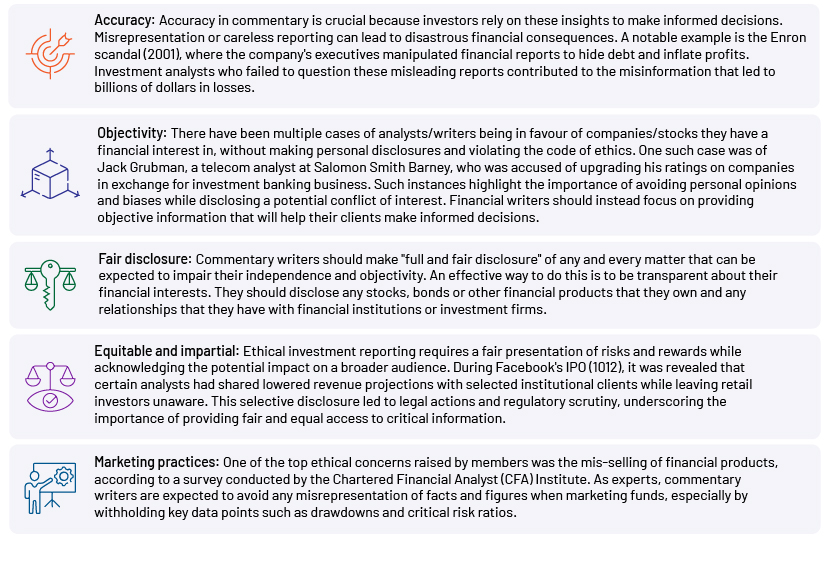

Financial scandals, such as the dot-com bubble and the 2008 financial crisis, reveal how a lack of moral obligations in commentary can erode public confidence and lead to sweeping regulatory reforms. The introduction of key legislation, such as the Sarbanes-Oxley Act (2002) and the Global Analyst Research Settlements (2003), underscores the legal and moral obligation to ensure that the investment content remains truthful, transparent and free from conflicts of interest. A 2024 survey by the Certified Financial Planner Board of Standards revealed that 92% of Americans expect financial professionals to act in their best interests, particularly regarding retirement investment advice.

Commentary writers wield much power, as they help simplify hard-to-understand technical jargon for investors to assist in their decision-making. With such power comes many responsibilities, especially moral ones, to ensure accurate information is published.

Ethical responsibility of financial writers to gain client trust

There are currently hundreds of professional fund writers who produce a wide range of content, including fund prospectuses, fact sheets, website copy and marketing material. Growth of the fund writing sector has also led to the development of several regulatory requirements. In the US, for example, the Securities and Exchange Commission (SEC) has strict rules governing the writing of fund prospectuses. These rules are designed to ensure that investors have access to accurate and unbiased information about mutual funds. Despite the regulatory requirements, investment writing remains a challenging profession, demanding both technical expertise and ethical clarity. Fund writers must be able to distil complex financial information into a form that is easy for investors to understand. Moreover, fund writers must uphold their moral duty to gain client trust.

The fundamental principles guiding financial writers' work were compiled to ensure that commentary remains ethically sound and investor-centric. In financial commentary, where information dissemination can significantly impact markets and investor decisions, the absence of ethics poses critical challenges. Without ethical considerations, investment commentary risks being skewed by biases, conflicts of interest and misleading information. All the stakeholders involved may be misled into making decisions that are not in their best interests, potentially leading to financial loss and an erosion of trust. It can undermine market integrity, triggering volatility and destroying confidence among market participants.

At the heart of responsible investment reporting lies a commitment to fairness, integrity and responsibility. As information directly influences decisions and market movements, those providing insights must uphold the highest standards to ensure trust and transparency. Responsible reporting, driven by financial reporting transparency, safeguards investors from misinformation and enhances the overall credibility of the financial sector. This requires a careful balance – offering honest analysis while safeguarding sensitive information and avoiding conflict. By adhering to these core values, investment commentators play a vital role in promoting informed decision-making. In the following sections, we explain the essential ethical foundations that guide responsible investment commentary.

Upholding these ethical responsibilities is essential for financial writers to maintain their credibility and integrity with their clients. Financial writers who are principled and reliable are more likely to be successful in their careers and attract clients who will value their services. While organisations could improve their commentary production processes, it entails a shift in priorities if asset managers are to assign commentaries the level of importance required. It is not simply a question of putting together a team of writers and getting started. It requires gathering strong analysts and support staff who know the standards of reporting portfolio managers require, the standard of language investors require and the regulatory standards that need to be followed. Without such a team, there is likely to be more damage done than improvement.

How Acuity Knowledge Partners can help

Our services combine process, people and technology. Acuity Knowledge Partners help clients reduce manual intervention and increase efficiency in the fund commentary process, using the best tools. We help asset managers publish commentaries for all their funds and as fast as possible, integrating our domain and technology expertise to provide a holistic solution.

Sources:

-

https://www.acuitykp.com/blog/five-findings-on-fund-commentaries-of-top-asset-managers/

-

https://www.businessinsider.com/facebook-ipo-disclosure-scandal-2012-5

Tags:

What's your view?

About the Author

Pravin Srinivasan, a BBA graduate and CFA Level 3 candidate, has over 8 years in the financial sector. His expertise encompasses a broad spectrum of financial services, including performance attribution, investment commentary, collectives and factsheet preparation, DDQs, and equity research. Pravin has a proven track record in both qualitative and quantitative fund analysis, and performance measurement, and has a robust understanding of capital markets and various financial instruments. As a Delivery Lead at Acuity Knowledge Partners, he has excelled in producing comprehensive fund reports and thought leadership content, earning the 'Rising Star Award' shortly after his tenure began.

Like the way we think?

Next time we post something new, we'll send it to your inbox