Published on February 7, 2020 by Avinash Saxena

With the financial services industry witnessing increasing competition from within and from new entrants such as fintech and bigtech/techfin firms (e.g., Apple, Amazon and Alibaba), the pressure on industry players to curtail costs, find new revenue streams, and enhance customer experience is growing. Addressing these challenges would require a multi-pronged approach spanning operations, business, and the overall ecosystem. Many of these areas would in turn require solutions that simplify processes by leveraging emerging technologies and would often involve collaboration with other industry stakeholders.

One such solution is digital identity.

In simple terms, a digital identity is the body of information about an individual, organisation, asset, or electronic device that exists online1. A digital identity could be used to authenticate and assess users (often at a lower cost than traditional physical channels), without human intervention 2.

How does it help consumers and organisations?

There are numerous instances when one’s identity needs to be proved. It could be for a big ticket purchase, such as, applying for a mortgage, or for day-to-day activities such as authenticating one’s age to enter a pub, online shopping, or managing a Netflix subscription – essentially, anything that would require an individual to prove that they are who they claim to be. This is generally done through a system of username and password authentication. However, the rapid increase in living our lives online or digitally has made it quite inconvenient and (sometimes) unsafe to manage these credentials. Similarly, businesses need to trust the parties they are doing business with. For example, in international trade, two companies with limited information on each other have to rely on the complex process of trade finance, which is not foolproof. A well-established identity framework could help a business build trust and minimize the involvement of third-parties.

Apart from resolving complexities, digital identity can also help boost an economy through financial inclusion. As of 2017, nearly 1.1bn, the majority being women, children, and refugees, were unable to prove their identity3. This severely limits their ability to access basic services and to contribute to the economy. Having digital identities also reduces the operational overheads associated with verification requirements, adding to economic value.

How do banks come into the picture?

The execution of digital identity initiatives may be fully government-driven or through government-endorsed identity providers or a fully decentralized open identity market with multiple players. While government-run initiatives will likely be trusted by its citizens, it may be a tall ask to expect all governments to come to a consensus and build a uniform database and system of digital identities. Also, not all countries are likely to have the technical expertise required to build and maintain such a database in a secure manner.

In such a scenario, banks would become an obvious choice. Generally, banks are the most trusted institutions – to hold money, life savings, and financial information. They are also likely to be trusted more than a retailer or social media application, for example, to capture digital identities. A survey by global management consulting firm A.T. Kearney found that 62% of customers trust banks the most to ensure the security of their personal information, as opposed to other organizations, such as Google, Amazon, PayPal or Apple4.

While email or social media logins are also types of digital identities and are used as authentication plugins on many online platforms, these are often not unique to a user and could be used by a criminal to misrepresent himself as another person. It is extremely easy to commit identity theft. Hence, we believe such logins should be used only in less critical areas such as online news subscriptions or food delivery. Critical and sensitive activities such as bank account opening and transactions, transferring government benefits, and international relocations would need identities that can be trusted and that have the actual individual or entity behind it. The numerous data privacy-related controversies surrounding the social media giants do not help their case either.

How is this an opportunity for banks?

Digital identity has the potential to create a positive impact on various fronts. Identification is crucial for banks as they directly deal with finances and are susceptible to fraud. In this regard, banks spend billions of dollars globally on KYC and AML compliance. So far, government-issued methods of identification such as passports, driving licences, voter cards, and company registration certificates have mostly been used to establish an identity. However, accepting these forms of identification at face value is far from optimal. Since there are no standard formats, at any given time there are more than 6,000 type of unique identification documents issued by more than 200 countries and states5. While validating such a diverse set of documents is in itself very difficult, their vulnerability to being counterfeited and subject to random unreported updates, such as updates to addresses and contact numbers, make it nearly impossible for banks to have a fully robust verification framework. A robust digital identity framework would help banks save these expenses.

In terms of business opportunity, banks can position themselves as trusted brokers. While it is nearly impossible to have a single solution to digital identity that is globally accepted, it is certainly possible to create a network that enables interoperability of various systems. Although there are many entities working towards the broad acceptance of digital identity through common standards and formats, their reach is regional at best. For example, a very successful digital identity initiative in Estonia (eID) is accepted only in the Baltic States. To solve the issue of interoperability, inspiration could be drawn from card network schemes. A card issued in one geography could be used in other geographies as the authorisation and transaction is routed through the service provider and the card network. Similarly, network schemes can be created for digital identities too, also enabling participating institutions to earn a fee – the modalities of which can be fine-tuned as the market matures.

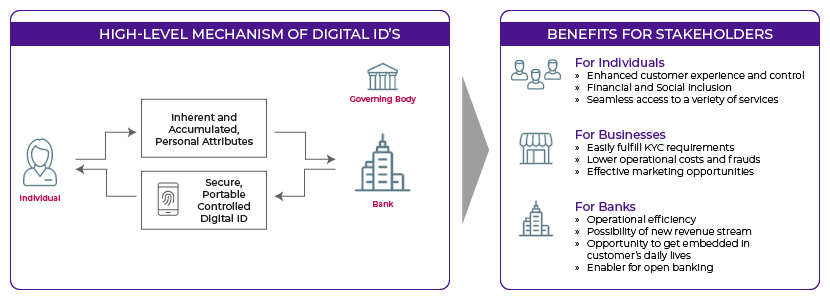

Digital identities and key benefits for stakeholders

Source: Acuity Knowledge Partners

A few banks have already made a head start in this area. Canada’s top five banks, in association with a digital identity network provider, launched a blockchain-based digital identity service in May 20196. In Sweden, several banks are issuing a digital identity termed BankID to individual customers. Similar examples can be seen in Belgium and Norway. These systems are expected to help banks to verify identities more accurately, reducing the possibility of fraud and hiccups in the process. They could also be used to avail oneself of government services. For example, in the UK, Barclays is certified by GOV.UK (the government’s digital service) to verify identities. When a user chooses Barclays as an option for verification, the user is routed to the Barclays Identity Service; after verification, the user is routed back to the government’s digital service7.

In December 2018, Microsoft and Mastercard announced a strategic collaboration to improve the management and use of digital identities. The primary aim was to make a globally interoperable digital identity service a reality8. The scheme could be used as a flexible verification tool for financial transactions, government interactions, or online services. They envision a platform where consumer identity would be set up through a bank (or other participating institution), but where the consumer would have full control of their identity information, as the information would be stored locally on their device, rather than in a centralised system9.

However, it is not a straight road from here. There are many questions still requiring answers, For example, will an individual have a universal digital identity? Should banks offer digital identity to everyone or only to their customers? What methods will be used in creating the identity system? How secure is sharing data with third-party providers? How much information is shared with third-parties? How do customers manage their identities and access rights given to other entities? In case of data breach, who will bear the responsibility? Despite all these uncertainties, the case for banks to become the custodians of authentication and identity management is pretty strong and offers substantial benefits. Banks would have to collaborate with other stakeholders to come up with a robust framework, while utilising their existing strengths of trust, infrastructure, customer data, and regulatory compliance10.

Sources:

1. https://whatis.techtarget.com/definition/digital-identity

2. https://en.wikipedia.org/wiki/Digital_identity

5. https://www.bankingtech.com/files/2019/02/A-guide-to-digital-indentity-verification.pdf

8. https://www.wired.com/story/mastercard-digital-id/

Finextra, The Role of Digital Identity in the Future of Banking

What's your view?

About the Author

Avinash Saxena has over nine years of work experience in consulting, market research, and project management. Before Acuity Knowledge Partners, he has worked with Capgemini, Infosys, and Persistent Systems. His expertise areas include business strategy, emerging technologies, innovation for the financial services sector - particularly banking, payments, and FinTechs. Currently, he is a strategic consultant for one of the leading global financial solutions provider firms. Avinash has done MBA from NMIMS Mumbai and B.Tech. from VNIT Nagpur.

Like the way we think?

Next time we post something new, we'll send it to your inbox