Published on September 4, 2025 by Isha Chauhan

Introduction

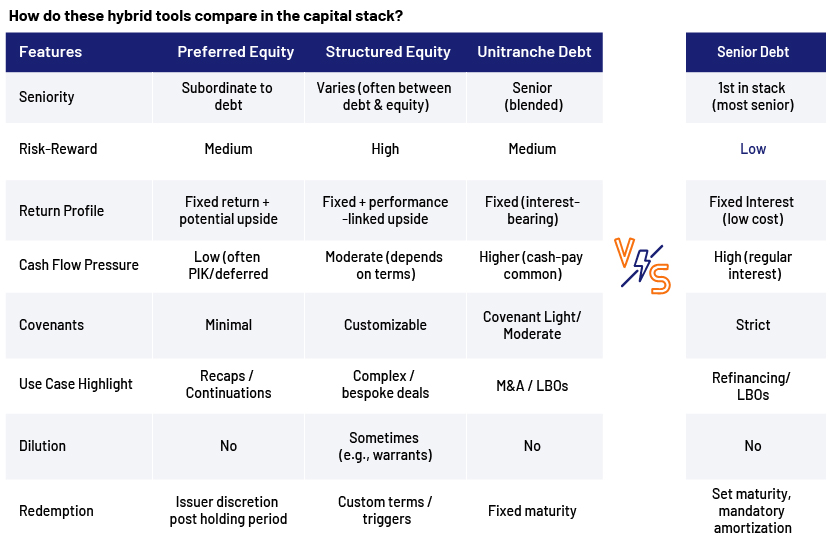

Conventionally, deals in private equity have long been underpinned by a mix of senior debt (secured debt stream with the lowest risk and cost), mezzanine debt (subordinated to senior debt with comparatively high interest and, thus, higher returns often with warrants) and common equity (high reward capital to offset high risk).

Having said this, as deal dynamics break free from rigid credit availability, delayed exits and increasing transaction complexity, traditional senior debt no longer constitutes a one-size-fits-all solution. In response, hybrid capital solutions, such as structured equity, preferred equity and unitranche debt, are gaining traction to become core strategies.

These flexible hybrid financing tools offer speed, adaptability and ingenuity, especially for deals where the conventional mould does not fit. They assist in funding growth, unlock liquidity and bridge the gap between senior debt and common equity without necessitating a full exit.

Why isn’t traditional senior debt always enough?

Cost-efficient and low-risk senior debt often comes with restricted flexibility, such as:

-

Strict covenants

-

Low/limited leverage tolerance (i.e., lenders do not allow high level of debt relative to equity/cash flow)

-

Strict amortisation schedules

-

Limited flexibility in cash flow use

-

Syndication challenges, especially in volatile markets.

Furthermore, macroeconomic pressures have amplified these limitations.

As is well known from the ‘law of demand’, cost and demand have an inverse relationship. Whenever cost moves up, demand will typically move down and vice versa.

In this scenario, too, the same law comes into play. Under pressure from prolonged inflation, interest rates have seen frequent and steep rate hikes by central banks, translating into higher cost of borrowing. Ergo, demand for senior debt declined for both new issuance and repricing of senior debt balance.

Simultaneously, unpredictable economic scenarios, coupled with volatile markets, have additionally precipitated the lenders to be highly cautious and adopt a more risk-averse approach while tightening underwriting standards. This includes inflexible covenants, requirement for strong collateral support, lower acceptable leverage thresholds, regular cash-flow tracking to ensure future stability and increasing risk premiums to compensate for unforeseen forces.

Collectively, these challenges have disrupted senior debt usage, under traditional terms, for corporate transactions.

As deal sizes grow more complex and timelines tighten, the rigidity of senior facilities becomes a bottleneck, especially in competitive or distressed scenarios. This is where hybrid capital comes as a go-to solution for sponsors and companies.

Hybrid capital: the equilibrium approach

Hybrid capital or instruments refer to financial instruments that combine the elements of both debt and equity.

Debt traits encompass deferred or structured interest payments, while equity traits include extended or perpetual maturity dates, participation in growth, less restrictive covenants and the option/right to redeem at the discretion.

Types of hybrid instruments

A. Preferred equity: A flexible, non-dilutive form of financing that sits between senior debt and common equity.

Key features:

-

Steady dividend income, often 10.0-14.0% preferred returns, either paid-in-kind (PIK)/deferred

-

Subordinated to debt but senior to equity, thus offering downside protection

-

Less dilutive than common equity, allowing to maintain larger ownership stake

-

No fixed maturity (unless specified) and no voting rights (preserving control for sponsors)

-

Flexible features, including cumulative/non-cumulative dividends, redemption options and conversion rights.

Ideal for:

-

Recapitalisation, without diluting ownership

-

Structured solutions for continuation vehicle/secondaries fund deals

-

Situations where valuation gap exists.

Example: On 8 April 2024, Atlantic Park, along with Blackstone Tactical Opportunities and Morgan Stanley Tactical Value, extended USD 425.0m preferred equity to Buyers Edge – a digital procurement platform – enabling it to refinance the existing debt, as well as allowing the founder to retain their equity ownership under favourable terms.

B. Structured equity: A hybrid security that blends the elements of debt and equity and is tailored to a specific transaction or company need. It often includes convertibility, warrants, preferred returns and performance-linked features, among others.

Key features:

-

Combines fixed returns (like debt) with upside participation (such as equity)

-

Can include convertible preferred stock, convertible notes, redeemable shares or warrants

-

Is often used when pure equity is too dilutive and debt is too restrictive (tight covenants, etc.)

-

Includes flexible terms, depending on risk profile and sponsor negotiations.

Ideal for:

-

Restructuring financing or turnarounds

-

Complex recapitalisation

-

Fund-level solutions or NAV-based lending

-

Companies in high-growth or volatile sectors.

Example: On 4 March 2025, KKR issued USD 1.5bn of mandatory convertible preferred stock to pay dividends and convert into common shares by March 2028 unless redeemed sooner. This transaction helped the company raise additional capital for elevated deal deployment, bundled with upside potential.

C. Unitranche debt: It is a single-tranche loan structure that combines senior and subordinated debt into one facility, offering a blended interest rate, thus streamlining the capital structure. It has grown materially in popularity for middle- and upper-middle-market transactions.

Key features:

-

One agreement, one document, faster execution and fewer counterparties

-

Unified interest rate

-

One-time bullet repayment at maturity

-

Higher leverage vs pure senior deals

-

Flexible covenants, making it easier to negotiate and manage.

Ideal for:

-

Leverage buyouts and bolt-on acquisitions in fast-paced sectors such as healthcare and software as a service

-

Dividend recapitalisation, where traditional lenders are risk-averse

-

Refinancing of older, layered debt with simplified structure

-

One-stop solution for time-sensitive or sponsor-to-sponsor deals.

Example: On 9 April 2025, Carlyle’s global credit arm provided a single draw unitranche facility to refinance Dexian’s existing debt, enabling streamlined recapitalisation.

How do these hybrid tools unlock value in complex deals?

When structured thoughtfully, these instruments can combine the reliability of debt with the potential gains of equity, providing innovative solutions that traditional debt alone cannot offer. They:

-

Offer downside protection to both sponsors and investors by enabling equity-like participation by preserving ownership, combined with priority claims and guaranteed fixed returns

-

Address the valuation gap between sponsors and lenders when senior debt is adequate and mezzanine solutions are not cost-effective

-

Facilitate innovative choices for restructuring, refinancing, dividend recapitalisation or NAV-based lending and achieve targeted returns while preserving control and deferring dilution

-

Reduce the average weighted cost of capital by allowing general partners to refinance their pricier capital mix with cost-efficient hybrid financing to increase earned internal rate of returns.

-

Fast track the deal finalisation process by avoiding lengthy time-consuming documentation processes, approval process etc. vis-a-vis getting sanction of syndicated debt or issuing public equity, enabling a sponsor to secure opportunities quickly in the competitive market.

Market data

Albeit only limited data is available in the public domain, Deloitte’s 28 March 2025 report on private debt deals aids in quantifying the growing reliance on hybrid instruments, in funding the transactions. Over the last 12 months ended 31 December 2024, unitranche-backed financing accounted for 66% private debt transactions in the UK, while senior debt made up only a 12% share. Likewise, in Europe, unitranche constituted 53% of transactions and senior debt contributed only 29%.

Similarly, to reap benefits from structured equity instruments, asset managers such as Ares Management, Apollo, Blackrock, Sixth Street, Blue Owl and many more have raised exclusive separate funds, dedicated to structured equity financing.

Potential challenges and considerations

While hybrid financing offers significant advantages, it is crucial to acknowledge the associated convolutions:

-

Complexity: Structuring and negotiating hybrid solutions is inherently more intricate than traditional debt or equity, as it requires specialised legal, financial and tax expertise.

-

Higher cost: While they are flexible, hybrid instruments are generally associated with a higher cost of capital compared to pure senior debt, due to their higher complexity and subordinated position in the capital stack.

-

Intercreditor issues: Multiple tranches or lenders within the blended facility can still introduce difficulties in intercreditor agreements, although a bit less than fully bifurcated structures. These agreements require careful negotiation in the initial structuring phase to align the rights, priorities and remedies for different creditor classes. Key negotiations include waterfall payment, enforcement rights in default scenario, standstill periods and voting thresholds. Post deal closure proactive communication among stakeholders is essential to ensure aligned decision-making in the event of covenant breaches, refinancing and restructuring.

-

Exit considerations: The chosen hybrid structure can significantly impact future exit options (e.g., IPO or strategic sale). Besides, buyers and public markets may react differently to various forms of preferred or structured equity.

-

Valuation impact: The accounting and valuation treatments of different hybrid instruments can be complex and require careful consideration, influencing reported financial metrics and investor perceptions.

Conclusion

Traditionally, senior debt was less complex, but current market conditions – characterised by rising interest rates, complex transactions and slower exits – have made hybrid solutions a necessity, as they offer a balanced path – bridging risk, return and adaptability.

Thus, sponsors, embracing these instruments are better positioned to drive value via increased deal flow; enhance returns through optimised cost of capital and mitigate risk by diversifying financing resources.

Whilst conventional financing is not likely to disappear, the shift towards tailored, versatile capital strategies is accelerating – and is here to stay.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners can significantly assist companies in the private market domain by providing tailored research, analytics and tech-enabled solutions across the private equity and debt financing life cycle. This includes end-to-end support across due diligence; financial modelling; portfolio monitoring; credit analysis; market research; environmental, social and governance integration; operational support and fund administration.

Sources

-

Crystal Capital Partners | Preferred Equity: A Deep Dive into Private Markets

-

Unitranche Debt - Hybrid Loan with Senior and Subordinated Debt

-

Carlyle Provides $270 Million Unitranche Term Loan to Dexian | Carlyle

-

Buyers Edge Platform Announces $425M Preferred Equity Investment Led by General Atlantic

-

KKR aims to raise $1.5 billion in 3-year convertible stock offering | Reuters

Tags:

What's your view?

About the Author

Isha has over 14+ years of experience across credit rating, credit analysis, financial modelling, portfolio monitoring, team handling, private equity, research, valuation, report writing, fundamental analysis, industry analysis, benchmarking, comparable analysis, and competitive analysis. At Acuity Knowledge Partners, she is part of Private Markets and currently supports a US-based PE client in front and middle office. Isha is a postgraduate (MBA Finance) from GGSIPU and holds a graduation degree in B.Sc(H) from Delhi University.

Like the way we think?

Next time we post something new, we'll send it to your inbox