Published on February 1, 2024 by Mahesh Agrawal and Neelaghandan Ganeshathas

challenges amid a high-interest-rate environment

The US economy has rebounded over the past three years as consumers have returned with renewed enthusiasm, although this was not completely unexpected. However, the pace of recovery has come as a surprise, considering that uncertainties relating to the pandemic, economics and politics remain. Consumer resilience has pushed the economy to new highs, although not without its own set of challenges. Retail borrowing has spiked, with increased demand pushing inflation to levels beyond control and making the US Fed intervene with higher interest rates. Supply-side pressures have added to the troubles, making inflation sticky despite the Fed and other central banks raising interest rates to levels not seen in decades.

In this article, we discuss some of the main factors that have driven the US economic recovery since 2021 and how we see the market evolving. While consumer sentiment remains buoyant, with a tight labour market and the Fed indicating that it would pause rate hikes, higher borrowing has in the past increased the interest burden on consumers, reducing disposable income. Higher inflation is also making US exports uncompetitive in the global market, with trade unlikely to aid economic growth. We foresee significant challenges for US growth over the coming year, although the Fed has enough ammunition to provide quick relief in the event of a recession.

Credit-driven growth of the services sector

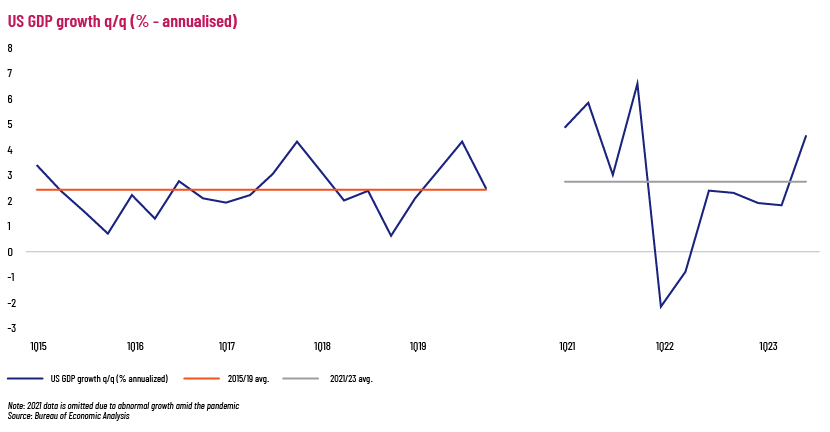

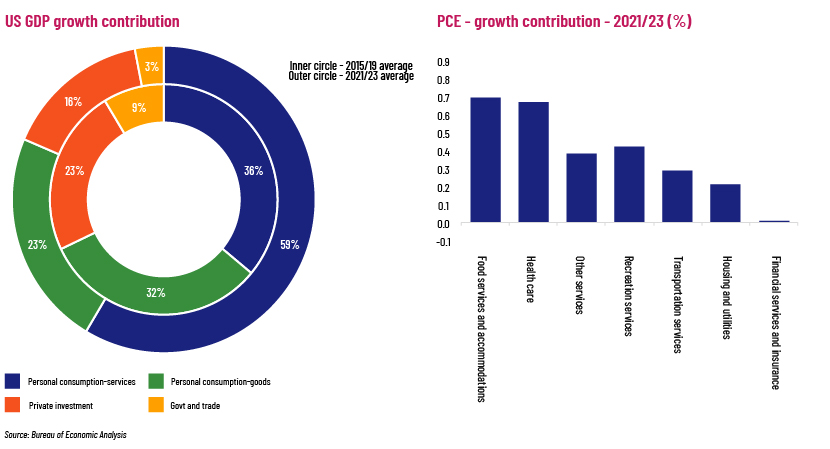

US GDP recorded high annualised growth of 3.1% q/q[1] over 2021-23 compared to its pre-pandemic (2015-19) rate of c.2.3% q/q, owing largely to robust consumer spending. The latest data from the Bureau of Economic Analysis shows that the contribution of personal consumption expenditure (PCE) to GDP growth has increased substantially, to c.90% in 2021-23 from c.72% in 2015-19. Within the PCE Index, services have accounted for c.66% of GDP growth over 2021-23, while goods have contributed only 24%. Economic growth in the past two to three years has been driven largely by higher spending on services as consumers upgraded their lifestyles. Stimulus packages, excess savings during lockdown and ultra-low interest rates with easy credit availability drove consumption despite record-high inflation levels. Data shows that US consumers have significantly increased spending on hotels, restaurants and recreation activities after the pandemic; however, this spending could drop as the economy cools and consumers are left with less disposable income.

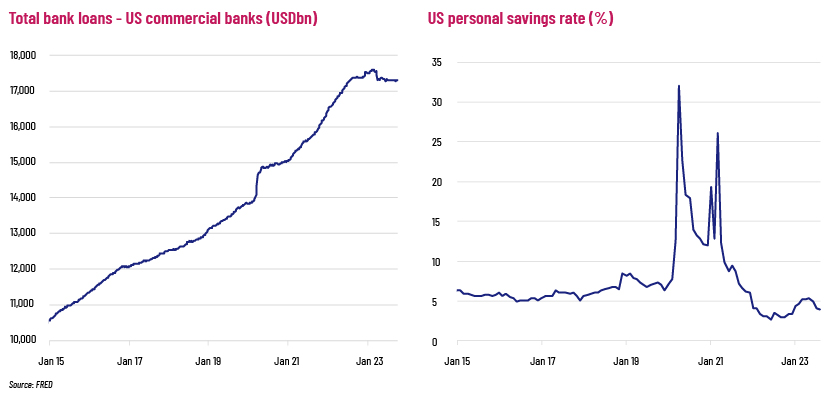

FRED data shows that lending by all commercial banks increased by c.USD2.5tn during 2021-22 compared to incremental lending of c.USD3.3tn during 2015-19. Lending has been tight since the beginning of 2023 due to restrictions, high interest costs for borrowers and pressure on banks to clean up their balance sheets due to the bank failures we have witnessed. The personal savings rate has dropped to below 4% after a jump to 20-30% during the pandemic. The current savings rate is lower than the c.6.2% in 2015-19. Smaller savings, restricted borrowings and lower disposable income could lead to a drop in personal consumption.

Challenges faced by other economic sectors:

-

PCE (goods) – The goods sector has shown modest growth to date and is likely to continue doing so. The automobile sector experienced a global shortage of semiconductors, which triggered a supply crunch and left manufacturers scrambling for parts. The subsequent rise in interest rates began to hamper demand as the average US consumer was less able to afford a vehicle. Automobile sales decreased 8.8% y/y in 2022 as rate hikes increased financing costs for new and used vehicles. Fuel prices increased substantially in 2022 in response to the Russia-Ukraine war and OPEC’s voluntary production cuts. However, the market has now stabilised, with further price hikes likely to be limited due to economic concerns and stable supply.

-

Gross private domestic investment– Unlike consumption levels, the rate of business spending and inventory buildup – as measured by gross private domestic investment – has increased at a moderate pace after the pandemic. This growth was initially fuelled by an increase in non-residential fixed investment, as evidenced by increased demand for structures, equipment and intellectual property products, such as software, owing to work-from-home and hybrid-working formats. However, the global effects of the Russia-Ukraine war and persistent supply-chain disruptions have dampened business and investor sentiment. Demand for office and retail space has shown no recovery, due to the increasing popularity of online shopping and remote working. Growth in overall business investment has been further dampened by falling profit margins and rising interest rates in response to record-high inflation levels.

-

Government spending – After a spike in FY20 to USD7.5tn, government spending retreated to USD6.3tn in FY22 and maintained this pace in FY23. Government spending as a share of US GDP dropped to c.25% in FY22[2] compared to 31% in FY20 and 30% in FY21. The slowdown in government spending has reduced its contribution to US GDP growth to 8% in 2021-23 from c.15% in 2015-19. Recent legislation, including the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act and the Inflation Reduction Act (IRA) are credited for boosting spending – with c.USD3.5tn of aggregate federal investment promised over the next decade. However, falling government revenue – an unusual occurrence following an expansionary period – has widened the fiscal deficit and raised concerns about the government's ability to service its existing debt. Coupled with the probability of further rate hikes, these factors leave us with mixed expectations on the likelihood of government spending contributing meaningfully to GDP growth.

-

Net trade – The US trade deficit widened substantially – to USD951bn in 2022 and USD528bn over the first eight months of 2023[3] from USD490bn in 2015. It has widened substantially after the pandemic due to the release of pent-up demand for imports. Higher inflation in the US and a stronger USD have helped widen the trade deficit as imports become more competitive. Meanwhile, exports have increased at a moderate pace, with energy the main contributor to growth as US crude oil and natural gas production continues to rise substantially. Exports of vehicles, parts and engines have also increased in recent years, driven by tailor-made policies to revive the nation’s auto sector.

Conclusion

Recent GDP growth is attributed to consumer spending on services after high levels of savings, credit availability and stimulus packages amid the pandemic. Savings and stimulus funds are now diminishing, while credit availability is tightening due to rising interest rates. This makes the ability of consumption to drive GDP growth uncertain. Other areas of the economy continue to witness challenges, with rising interest rates posing a threat to private domestic investment and the current legislative landscape further widening the fiscal deficit. The impact of rising interest rates on exchange rates has also widened the US trade deficit. Given that the Fed may require a considerable slowdown in inflation or a significant threat to economic stability before it changes its policy stance to accommodative, US economic growth could remain under pressure in 2024.

How Acuity Knowledge Partners can help

We provide expert market research on sectors, economies and commodities. We have a firm grasp of macroeconomic and market concepts, and expertise in technical and quantitative analysis to provide in-depth market insights on relevant topics. We help clients manage increasing demand on their teams by providing customised managed-services solutions, based on specialised skills and technology, and by delivering operational efficiency, resilience and significant cost savings.

Sources

-

[2] https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

-

[3] https://www.bea.gov/news/2023/us-international-trade-goods-and-services-august-2023

-

https://www.cpapracticeadvisor.com/2023/09/13/wages-are-rising-faster-than-inflation/94551/

Tags:

What's your view?

About the Authors

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

At Acuity Knowledge Partners, Neelan currently supports a leading Europe-based bank in analysing the macroeconomic environment for fund performance. Previously, he was a member of the Lending Services team, supporting a leading European bank specialising in real estate investments and infrastructure finance. Neelan holds a Bachelor of Science (Accounting and Finance) from the University of London and Bachelor of Business Administration (Business Economics) from the University of Colombo.

Like the way we think?

Next time we post something new, we'll send it to your inbox