Published on April 5, 2023 by Usman Ahmad

ChatGPT for Financial Analysis

ChatGPT is a large language model developed by OpenAI, based on Generative Pre-Trained Transformers (GPT) architecture. It is a powerful tool able to generate natural language responses, answer questions and even write articles. There are different versions of ChatGPT available, ranging from small to large models. The larger models can generate more complex and sophisticated responses. In addition, OpenAI continues to make improvements to ChatGPT, including increasing its ability to understand context and improve its writing capabilities.

The financial sector has been quick to adopt artificial intelligence (AI) and machine learning technologies to improve its operations. ChatGPT is one such technology that financial analysts can leverage to improve their workflow and provide valuable insights. In this blog, we explore how a financial analyst can use ChatGPT, along with API sources such as OpenAI, to increase their productivity and provide more accurate analysis. Before we do, let’s take a look at ChatGPT’s latest version.

GPT-4: A game changer in the financial sector

OpenAI recently unveiled its latest large language model, GPT-4, promising to revolutionise the financial sector with its advanced capabilities. Below, we explore the evolution of GPT and discuss how GPT-4 stands out from its predecessors such as GPT-3.5, providing unprecedented value to financial professionals.

The evolution of GPT

Before the emergence of transformer models such as Google's BERT in 2017, text generation relied on deep-learning models such as recursive neural networks (RNNs) and long short-term memory neural networks (LSTMs). These models performed well for generating single words or short phrases but struggled with longer, more realistic content.

OpenAI's GPT series has been a major breakthrough in the field of AI. Starting with GPT-1 as a proof-of-concept, the models have evolved significantly over the years. GPT-2 showcased some adoption in text generation tasks, while GPT-3 took the world by storm with its ability to generate human-like text, setting a new standard for large language models.

GPT-4: The next frontier for financial professionals

The latest iteration, GPT-4, offers substantial improvements over its predecessors, making it a powerful tool for financial professionals. GPT-4's advanced capabilities include the following:

Enhanced performance:

GPT-4 demonstrates a higher degree of factual correctness and steerability, allowing users to guide the model's output according to their needs. This is particularly useful in the finance sector, where accurate data analysis and interpretation are crucial.

Multimodal inputs:

GPT-4 can now accept both image and text inputs, enabling users to analyse complex financial charts and graphs more effectively.

Human-level performance on professional benchmarks:

GPT-4 has been evaluated on exams designed for humans, such as the Uniform Bar Examination and LSAT for lawyers, and SAT for university admission. The results showcased GPT-4's ability to perform at human level on various professional and academic benchmarks, making it a valuable resource for financial analysts and other sector professionals.

Implications for the financial sector

GPT-4 has the potential to transform the financial sector in several ways:

Enhanced data analysis:

GPT-4's improved performance and multimodal input capabilities can help financial professionals analyse complex data sets, including charts, graphs and financial statements, with greater accuracy and efficiency.

Streamlined report generation:

GPT-4's ability to generate human-like text can simplify the process of creating financial reports, analyses and summaries, saving time and resources for sector professionals.

Improved customer service:

GPT-4 can be employed in customer service applications, such as chatbots and virtual assistants, to provide customers with more accurate and comprehensive financial advice.

Customisable output:

GPT-4's steerability allows financial professionals to tailor the model's output to their specific needs, making it a versatile tool for various finance-related tasks.

GPT-4 represents a significant milestone in AI, offering substantial improvements over its predecessors. The financial sector stands to benefit immensely from its advanced capabilities, which can streamline processes, enhance data analysis and improve customer service. As GPT-4 becomes more accessible to sector professionals, it is poised to become an indispensable tool in the financial sector.

How a financial analyst can use ChatGPT

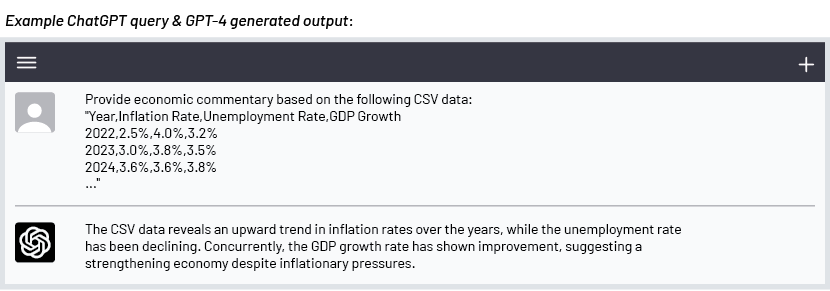

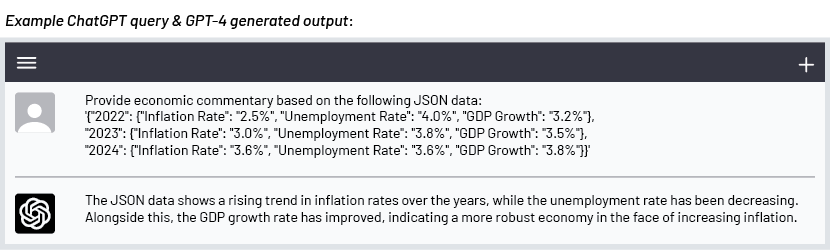

Economic commentary

One of the ways a financial analyst can use ChatGPT is to generate economic commentary. By providing ChatGPT with the latest economic data, it can generate reports on trends, forecasts and predictions. This can save a financial analyst a significant amount of time, so they can focus on analysing the data in depth.

Code generation

Another way ChatGPT can be useful for financial analysts is by generating code. Writing code can be a time-consuming and repetitive process, especially when dealing with large amounts of data. By using ChatGPT, a financial analyst can quickly generate code to perform various tasks, such as data cleaning, data processing and data visualisation.

Summarising news articles and financial reports

ChatGPT can also be used to summarise news articles and financial reports. This is particularly useful for financial analysts who need to keep up with the latest news and developments in their sector. ChatGPT can quickly analyse news articles and financial reports and provide a summary of the key points. This can save a financial analyst a significant amount of time and allow them to focus on analysing the data.

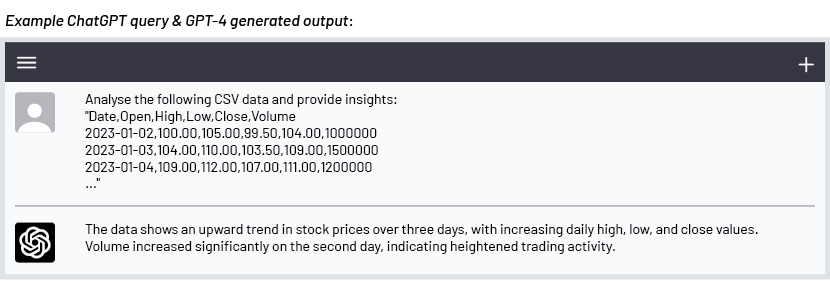

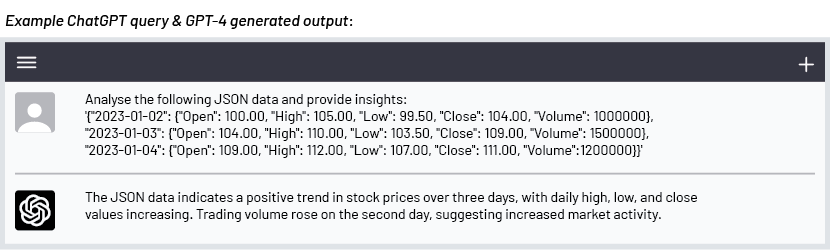

Financial data analysis and insight extraction

ChatGPT can greatly assist financial analysts in performing statistical analysis and extracting valuable insights from financial data. By inputting the most recent data into ChatGPT, the AI model can rapidly process and analyse the information, offering crucial insights for analysts. This capability not only saves a considerable amount of time for financial analysts but also allows them to concentrate on evaluating the derived insights and their implications on decision making.

Examples on how to use ChatGPT

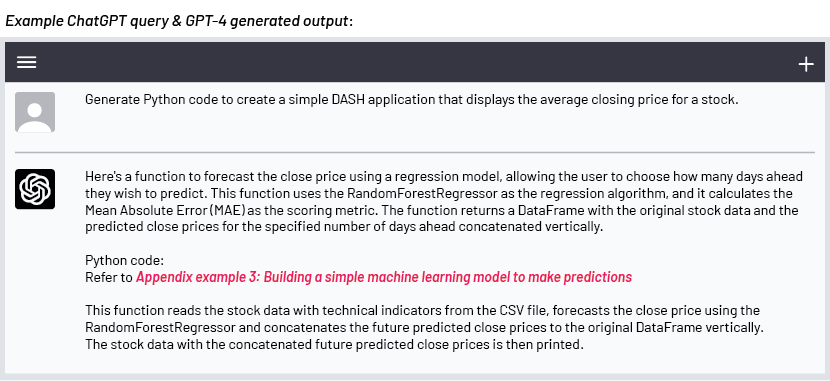

Code generation

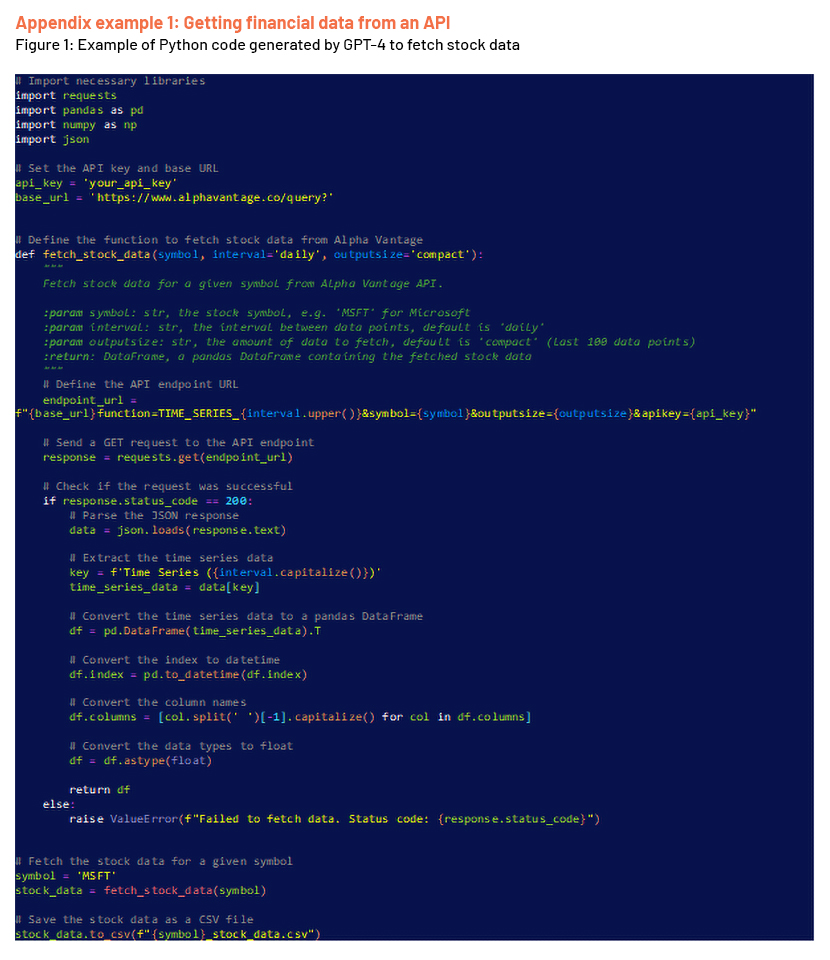

In this section, we explore how a financial analyst can use ChatGPT to code. We will provide Python examples of how an analyst can get financial data from an API, perform analysis on the data and build a simple DASH framework to report the analysis.

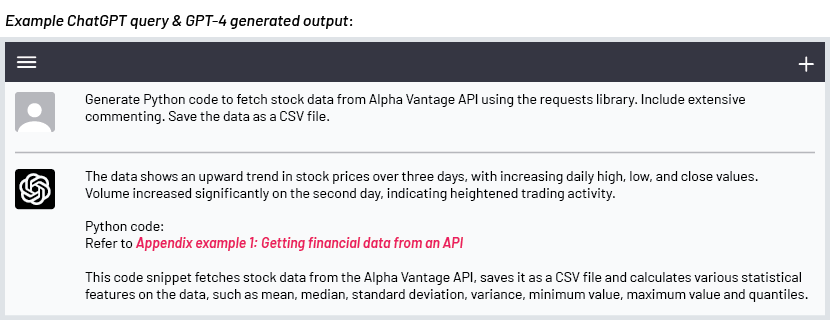

Example 1: Getting financial data from an API

To get financial data from an API, we can use the requests library in Python. The following code demonstrates how to get stock data from the Alpha Vantage API.

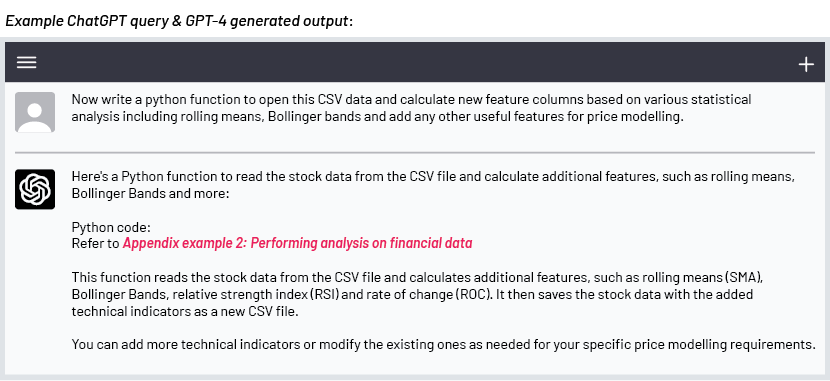

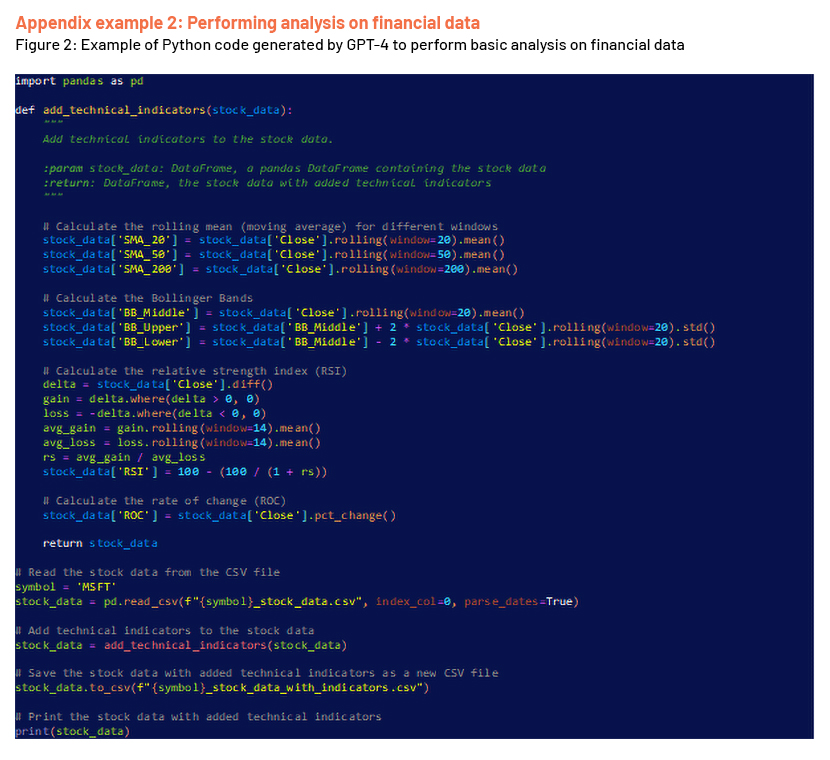

Example 2: Performing analysis on financial data

Once we have the stock pricing data, we can perform analysis on it using libraries such as NumPy and Pandas. The following code demonstrates how to calculate various features on the closing price for a stock using NumPy and Pandas.

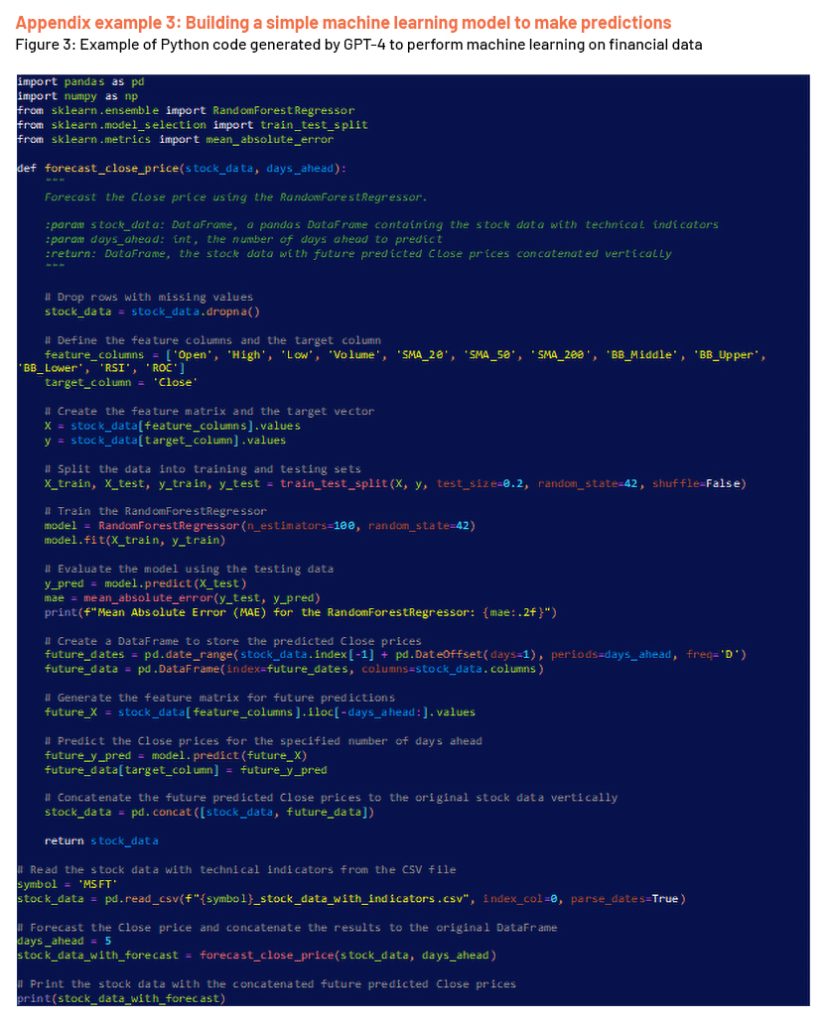

Example 3: Building a simple machine learning model to make predictions

Summarising news articles and financial reports

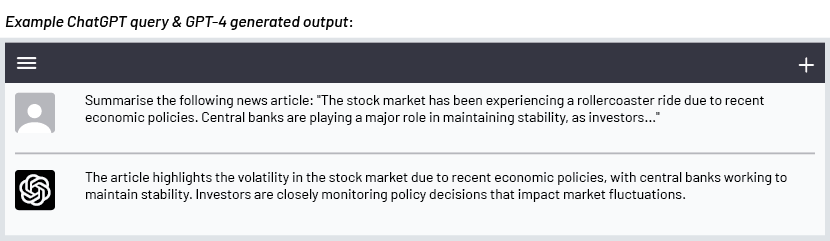

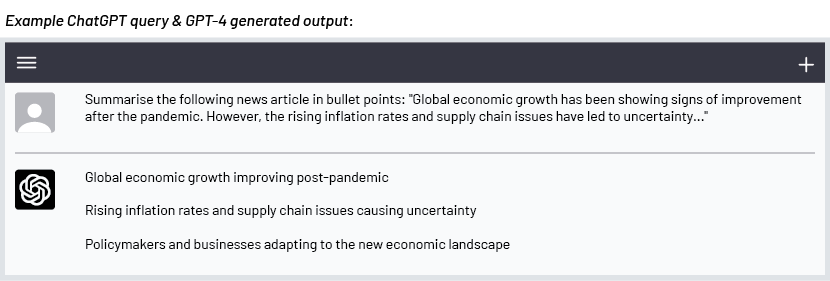

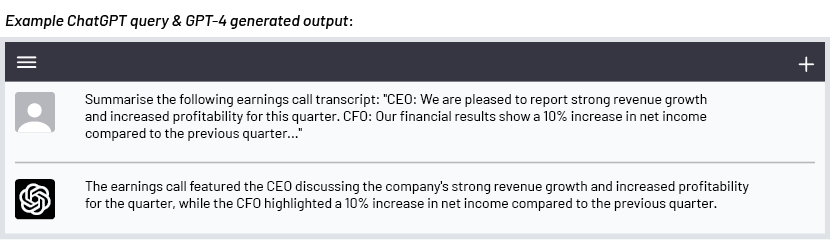

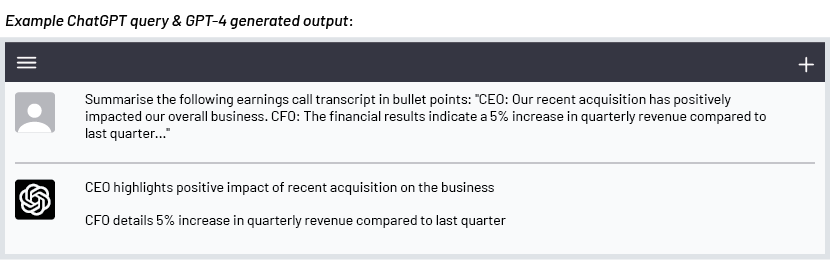

In this section, we explore how to use ChatGPT to summarise textual data such as news articles and earnings call transcripts. By providing the model with the text, ChatGPT can generate concise summaries or bullet-point overviews, saving you time and effort otherwise spent on understanding the key points.

To summarise textual data with ChatGPT, you can copy and paste the text of the article or earnings call transcript into the model's input. To illustrate this, we use a hypothetical news article and some earnings call transcripts.

Example 4: News article summary

Example 5: News article summary in bullet points

Example 6: Earnings call transcript summary

Example 7: Earnings call transcript summary in bullet points

Financial data analysis and economic commentary

In this section, we demonstrate how a financial analyst can use ChatGPT to process financial data in CSV or JSON format and perform basic analysis and generate economic commentary. ChatGPT can generate concise summaries in both paragraph and bullet-point forms, allowing analysts to quickly understand the key findings.

Example 8: Financial data analysis using CSV data

Example 9: Financial data analysis using JSON data:

Example 10: Generate economic commentary using CSV data

Example 11: Generate economic commentary using JSON data:

By leveraging ChatGPT's capabilities, financial analysts can efficiently process and analyse financial data from various sources, such as CSV and JSON files. The ability to generate concise summaries and economic commentary in both paragraph and bullet-point forms empowers analysts to quickly understand key findings and communicate them effectively to stakeholders. This reduces the time spent on manual analysis, allowing analysts to focus on higher-level strategic decision-making and other essential tasks.

Other high-level use cases to enhance financial analysis

Trading analysis

:ChatGPT can help analyse trading patterns, market sentiment and technical indicators, enabling analysts to identify potential trading opportunities and better understand market dynamics.

Holdings analysis

:With the ability to process and summarise portfolio holdings, ChatGPT can help analysts quickly identify trends, risks and opportunities within investment portfolios, assisting in the optimisation of asset allocation strategies.

ESG analysis:

ChatGPT can assist in evaluating environmental, social and governance (ESG) factors for companies by processing and analysing various data sources, such as sustainability reports, emission data, workforce diversity metrics and corporate governance structures. By feeding this data into ChatGPT, analysts can assess ESG performance more efficiently and make more informed investment decisions based on a company's commitment to sustainable practices and ethical governance.

Insider transactions:

By analysing insider transactions data, ChatGPT can help identify unusual trading activities, potential red flags or buying/selling patterns that may provide insights on a company's prospects.

Commodities analysis

:ChatGPT can process and analyse data on commodity markets, summarising trends, supply and demand dynamics, and macroeconomic factors that impact commodity prices, enabling analysts to make better-informed decisions in the commodities space.

By using ChatGPT in these additional use cases, financial analysts can save time and effort on manual analysis, allowing them to focus on higher-level strategic decision-making and other essential tasks. As ChatGPT continues to improve and the availability of financial data grows, opportunities for enhancing financial analysis processes become even more significant. This powerful combination enables analysts to derive actionable insights from their data and supports more informed decision-making in the fast-paced financial sector.

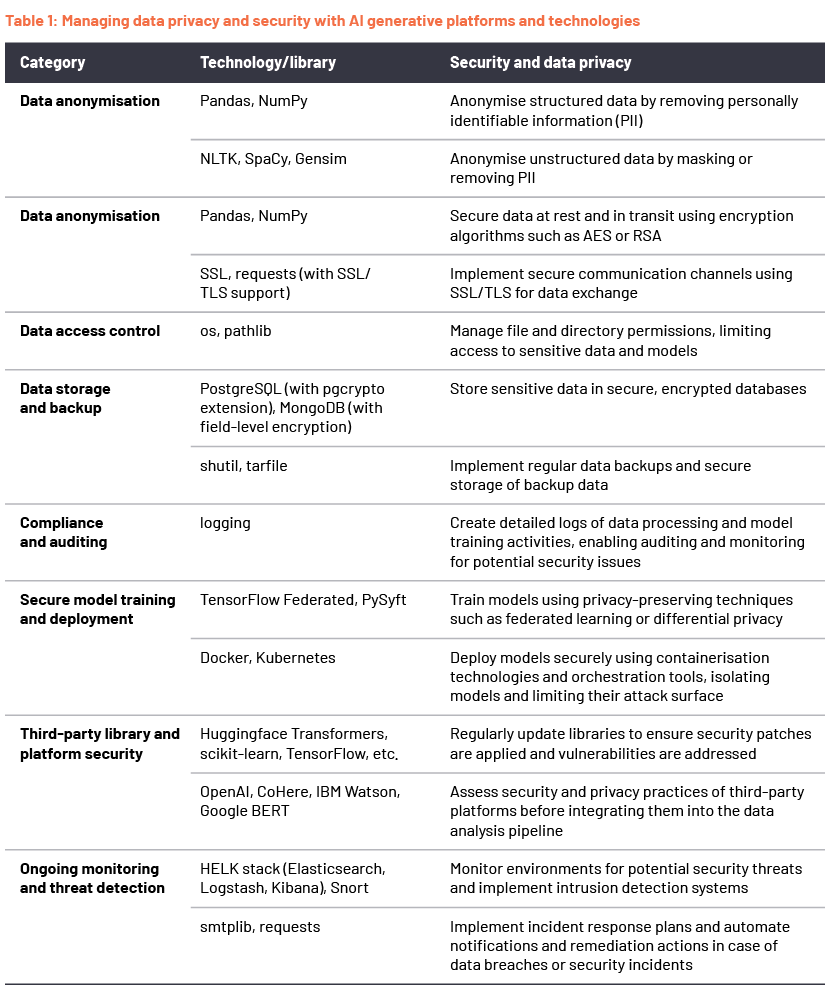

Managing data privacy and security

Data privacy and security are essential components of modern data management, especially in the era of AI and machine learning. AI generative platforms, such as GPT, OpenAI, CoHere and Huggingface, have become integral parts of the data analysis pipeline for many organisations. The table below demonstrates how firms could leverage these platforms to manage data privacy and security, using various technologies and libraries.

Conclusion

ChatGPT is a powerful tool that financial analysts, software development teams and data analytics teams can leverage to increase their productivity and provide more accurate analysis. The coding examples shown above are simple demonstrations of how these professionals can use ChatGPT to generate economic commentary, generate code, summarise news articles and reports, and perform statistical analysis. By automating tasks and streamlining workflows, ChatGPT can save valuable time and resources for these teams.

By combining ChatGPT with API sources such as OpenAI, financial analysts can access vast amounts of data and perform complex analysis, while software developers and data analysts can benefit from more efficient code generation and data processing. However, it is crucial to consider the importance of vulnerability scans and enforced code reviews when using ChatGPT-generated code in real-world applications. This will ensure the efficient and secure integration of the generated code into existing systems. As the capabilities of ChatGPT continue to improve, it would become an even more valuable tool for financial analysts, software developers and data analysts alike, enabling them to tackle more sophisticated tasks and challenges in their work, ultimately leading to enhanced productivity and effectiveness across the board, while maintaining security and code quality standards.

Appendix

* The codes listed in the examples are for demonstration purposes only.

Tags:

What's your view?

About the Author

Usman is the Chief Data Scientist at Acuity, responsible for AI/ML strategy and implementation for key client relationships. He joined Acuity in 2018 and has over 10 years of experience in delivering analytical and risk management solutions to global capital markets participants using state-of-the-art platforms. Prior to joining Acuity, Usman worked at Lloyds Bank, Goldman Sachs and UBS in front-office and middle-office functions. He holds a Master’s degree in Mathematics and Computer Science from Imperial College London

Like the way we think?

Next time we post something new, we'll send it to your inbox