Published on May 26, 2025 by Mario Gilroy Monteiro

Boeing has faced significant challenges in recent years, including the 737 MAX crashes, production disruptions due to supply-chain issues and quality issues relating to the 787. Despite these setbacks, the company is heading towards Boeing recovery under new leadership. This note examines Boeing financial performance by the impact of these crises and the commercial aerospace sector and assesses the Boeing recovery path. Boeing is on a clear path to recovery, but the success of its turnaround efforts will depend on its ability to stabilise production and improve operational performance. Investors should monitor the company's progress closely, particularly in relation to the 737 MAX production ramp.

Boeing benefits from high barriers to entry

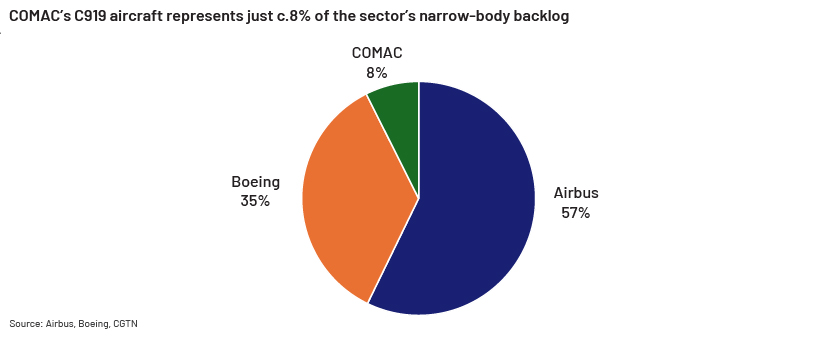

The large commercial aircraft (LCA) market is dominated by Boeing and Airbus, with high entry barriers driven by the capital-intensive nature of the sector preventing new competitors from gaining significant market share. While Airbus's narrow-body offerings include the A220 and A320 families, Boeing's flagship narrow-body product is the 737 MAX. Boeing holds a 61% share of the wide-body order books. China's COMAC launched the C919 narrow-body aircraft in 2008, aiming to compete with Airbus and Boeing. Despite over 1,000 firm orders, COMAC's production ramp remains limited compared to those of the much larger Boeing and Airbus.

Boeing plagued by operational challenges, gradually emerging to stability

1. Different product programmes facing quality issues, production delays

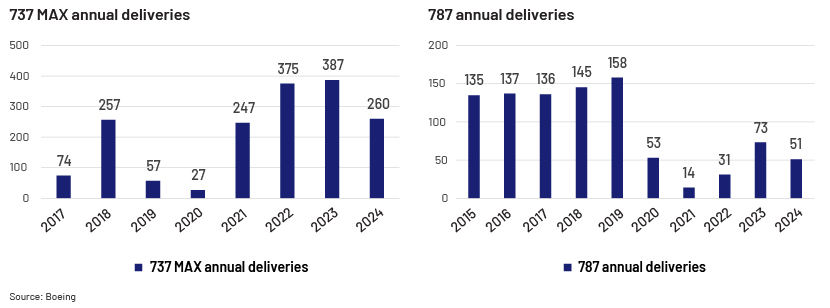

The successive crashes of the flagship 737 MAX in October 2018 and March 2019 led to a worldwide grounding and increased scrutiny by the Federal Aviation Administration (FAA). Subsequent production ramps were halted due to quality issues in early 2024, when the door panel of an Alaska Airlines aircraft blew out mid-air. This led the FAA to halt the production ramp-up of the MAX of 38 jets per month until quality was assured.

The 787 programme has faced multiple production challenges since 2020, relating to fuselage, tail fins, horizontal stabilisers and incorrect installation of fasteners. Meanwhile, whistleblowers came forward and testified to the US Congress about lapses on the production floor with potentially serious consequences for aircraft safety. The multiple challenges led to a prolonged halt in 787 output, with no aircraft being delivered from July 2021 to July 2022. As part of its Boeing recovery efforts, the company has now addressed the fuselage-joint issues and reduced its 787 inventory to 20 as of April 2025. The company plans to increase production to seven jets a month from the current five jets a month.

A series of development and testing delays have pushed the 777X’s service entry to 2026 from the previous target of 2020. These repeated delays in delivery have altered customers’ fleet plans, forcing them to look for alternative options.

2. Supply chain remains volatile and uncertain

The external operating environment has presented its own set of challenges, mainly due to severe supply-chain constraints. The downturn caused by the pandemic led to industrial production being slashed significantly, leading to severe bottlenecks along the supply chain when aircraft production picked up. While the pace of Boeing recovery gradually started to improve and raw material supply started to stabilise, the new tariff policies under President Trump have put another spanner in the works, leading to an environment of uncertainty. The sector continues to face constraints in supplies of critical components such as castings and forgings.

3. Workers’ strike in 2024

Boeing faced a worker strike from September to November 2024 that crippled commercial aircraft production, with deliveries in 4Q24 seeing a 64% decline y/y, together with losses of c.USD9.7bn. The resolution of the strike represents a victory for the company’s new CEO Kelly Ortberg, appointed in August 2024 and a key milestone in the Boeing recovery journey. Things seem to have normalised since then.

4. Financial impact considerable, but situation is improving

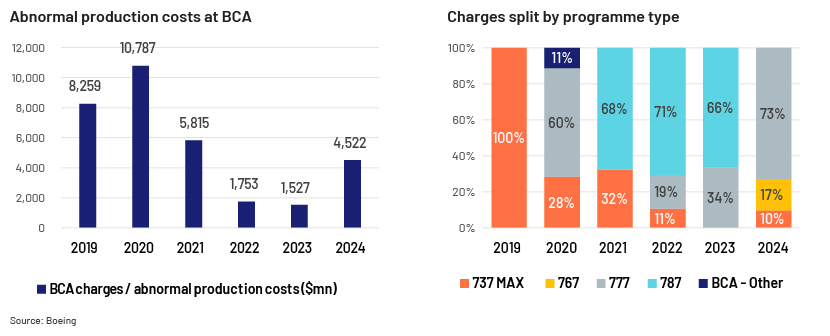

Boeing has recorded over USD32bn in charges and abnormal production costs since 2019, with the 737 MAX accounting for c.42% of these costs. The 777X programme, on which service entry has been delayed for around six years, accounted for c.33% of the costs while the 787 aircraft represented c.20% of the charges.

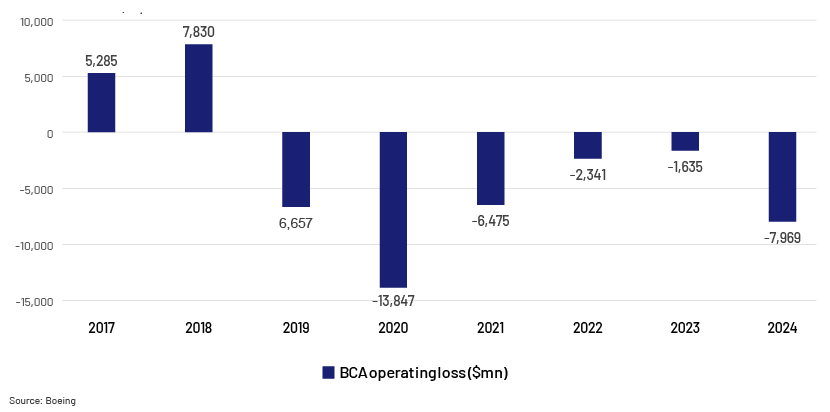

The Boeing Commercial Airplanes (BCA) division has been reporting annual losses since 2019, with a USD8bn operating loss in 2024. Although BCA was still in the red in 1Q25, with an operating loss of USD537m, this was a significant improvement from the USD1.1bn reported in 1Q24.

Annual operating profit/(loss) at the Boeing Commercial Airplanes division

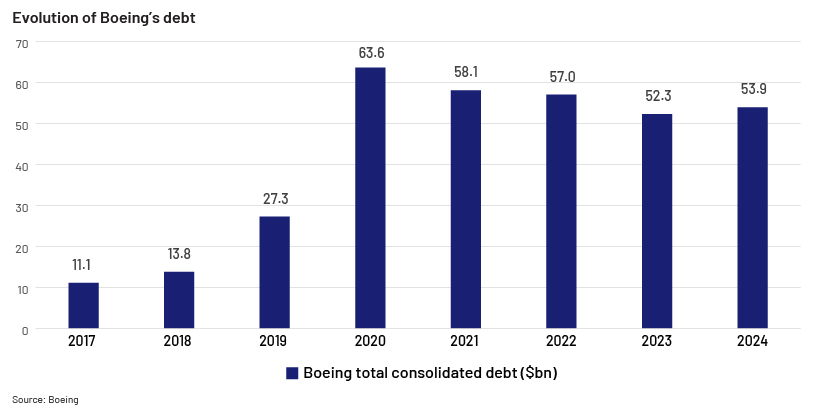

Boeing's total consolidated debt peaked at USD64bn in 2020, nearly 6x the debt level at the end of 2017, reflecting the turmoil in recent years in the aftermath of the MAX crashes coupled with the downturn amid the pandemic.

Boeing has been working on recovering gradually

1. Overhaul of the management team

The door panel blow-out incident in early 2024 led to Kelly Ortberg, an industry veteran, succeeding Dave Calhoun as CEO in August 2024, leading to several more operational improvements and cultural changes critical to Boeing recovery. We list below some of the measures taken since Ortberg’s appointment by the BCA division that have provided the market with much-needed confidence in the company’s turnaround plans.

-

Strict adherence to FAA guidelines on the MAX production ramp and quality improvements, coupled with an internal decision to seek further production rate hikes only when current levels achieve stability

-

Conclusion of the 767 commercial freighter programme in 2027

-

Reducing headcount by c.10% at the group level

2. Gradual ramp-up of the 737 MAX

This is crucial for Boeing's recovery. As discussed previously, the company announced plans to increase production run rates over the year for its 737 MAX and 787 aircraft during its 1Q25 earnings call. Boeing delivered 130 aircraft in 1Q25, indicating a gradual ramp-up of production rates following a challenging 2024, when the company delivered only 348 aircraft compared to the 528 delivered in 2023.

3. Strengthening the balance sheet

An equity raise of USD21bn and a new credit line of USD10bn, both in October, and the disposal of portions of the Digital Aviation Solutions business for USD10.55bn in April to be closed by end-2025 are proactive measures taken by management to shore up the balance sheet by providing ample liquidity.

In conclusion, Boeing's outlook for 2025 indicates a calculated recovery with anticipated gains in aircraft deliveries, supported by financing strategies, while remaining vigilant to external challenges such as tariffs.

How Acuity Knowledge Partners can help

We are a leading provider of bespoke research and analytics services, helping clients build proprietary research products across equity and credit. We also provide support in areas such as fund accounting services, investment compliance and risk management. Our in-house digital platform streamlines the overall data journey, from automated data collection to report generation.

Sources:

-

Boeing Completes 787 Rework Project and Reduces 737 and 787 Inventory

-

Ortberg: 787 Production Quality Must Improve Before Rate Increase | Aviation Week Network

-

Boeing Strike: Weekly Economic Loss Estimates – Anderson Economic Group, LLC

- Captide | Boeing Q1 2025 · Earnings

-

Boeing Company – Boeing Reports First Quarter Results (130 aircraft)

-

Boeing Delivered Only 348 Commercial Planes During Challenging 2024

-

Airbus and Boeing Report February 2025 Commercial Aircraft Orders and Deliveries – Flight Plan

-

Boeing's capital raise provides a breather through next year | Morningstar

-

Boeing Raises USD10 Billion Amid Strike and Cash Drain, Secures Credit Line | Nasdaq

What's your view?

About the Author

Mario Monteiro has over 10 years of experience covering the European Aerospace & Defense (A&D) sector in equity research. Being part of the Sell-side Research & Operations (SRO) department at Acuity Knowledge Partners, he supports sell-side clients with research assignments including initiation and thematic reports, economic updates, data research and earnings reviews. He holds a PGDM degree with a specialization in finance. His certifications include the Sustainable Investing Certificate provided by the CFA Institute and the Financial Modelling & Valuation Analyst (FMVA®) certification provided by CFI institute.

Like the way we think?

Next time we post something new, we'll send it to your inbox