Published on June 7, 2023 by Akshay Kumar Goel

1. Introduction to sustainability-linked bonds

Sustainability-linked bonds (SLBs) are a performance-based financial tool linked to the achievement of pre-established sustainability performance targets (SPTs) by a set of key performance indicators (KPIs). These targets are typically related to environmental, social or governance (ESG) issues and are designed to incentivise the issuer to achieve their sustainability goals.

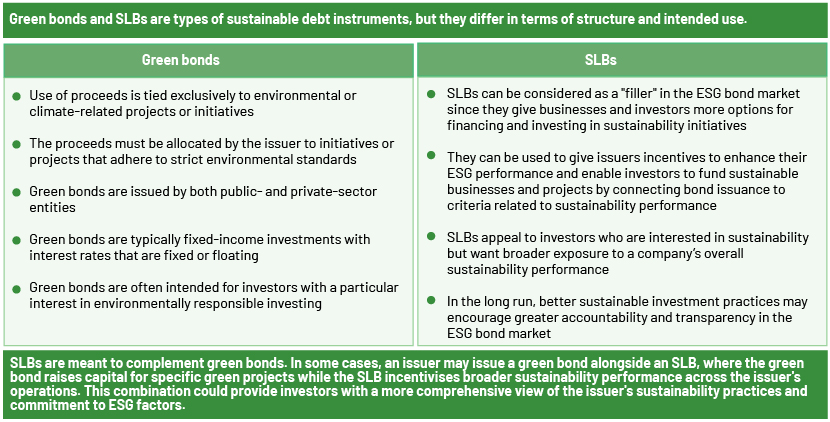

Unlike green bonds, which are used to finance specific environmentally friendly projects, SLBs are used to fund general corporate purposes. Sustainability targets for SLBs are often related to a company's overall ESG performance and may include objectives such as reducing greenhouse gas (GHG) emissions, increasing energy efficiency or improving employee diversity and inclusion.

The key feature of an SLB is SPTs – specific, measurable and ambitious objectives the issuer must achieve to obtain a financial benefit. If the issuer fails to meet the performance target, they will be required to pay a penalty or an increased interest rate. The financial benefit associated with meeting the performance target may come in the form of a lower interest rate or other financial incentives.

SLBs are a relatively new financial instrument and have gained popularity in recent years as more companies seek to demonstrate their commitment to sustainability. They provide a way for investors to support companies that are taking meaningful steps to address ESG issues while also generating financial returns.

2. SLBs and green bonds – performance review

SLB issuance has increased sharply since their inaugural issuance in 2019, and SLBs are expected to spread to more sectors and geographies. Green bonds are extremely popular, but due to their unique environment-related focus on renewable energy, sustainable resource use, conservation, clean transport and climate change adaptation, they may not be the ideal choice for all issuers.

Funds are raised using green bonds for both new and ongoing projects that help the environment and ensure a sustainable economy. However, organisations that lack the necessary capital outlay would not be able to issue a green, social or sustainability bond.

Since SLBs have no limitations on how the proceeds can be used, issuers can still access the sustainable bond market and contribute to a sustainable economy. SLBs are an alternate strategy for businesses (such as those in the consumer goods and pharmaceutical sectors) to demonstrate their responsibility and commitment to sustainability. A wider range of organisations can now enter the market for sustainable funding thanks to this flexibility.

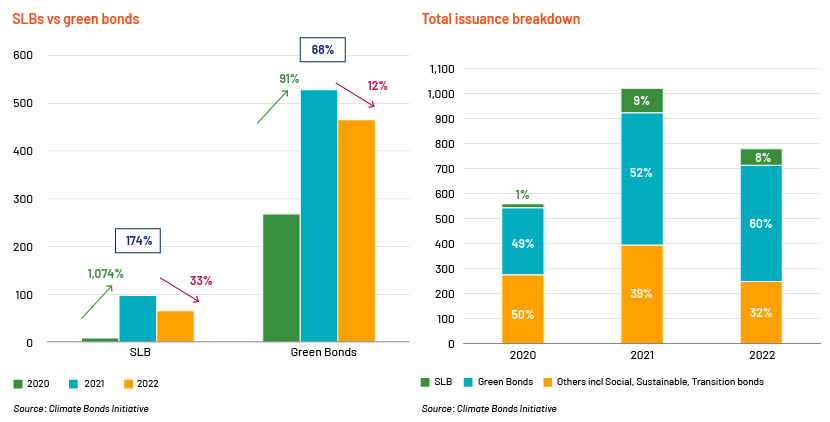

SLBs make up less than 10% of the overall ESG market (8% in 2022), while green bonds account for more than 50% of all ESG bonds issued. The dynamics of the bond market were altered by Russia’s invasion of Ukraine in February 2022 and the ensuing energy crisis in Europe, exacerbated by post-pandemic inflation. Nonetheless, SLBs are growing far more swiftly than other ESG bonds. From 2020 to 2022, SLB volume climbed by 174%, green bond volume by 68% and the ESG bond market as a whole by 62%.

In terms of performance, SLBs have generally performed well in recent years, outperforming traditional bonds in terms of price appreciation and total returns, according to a report by the Climate Bonds Initiative.

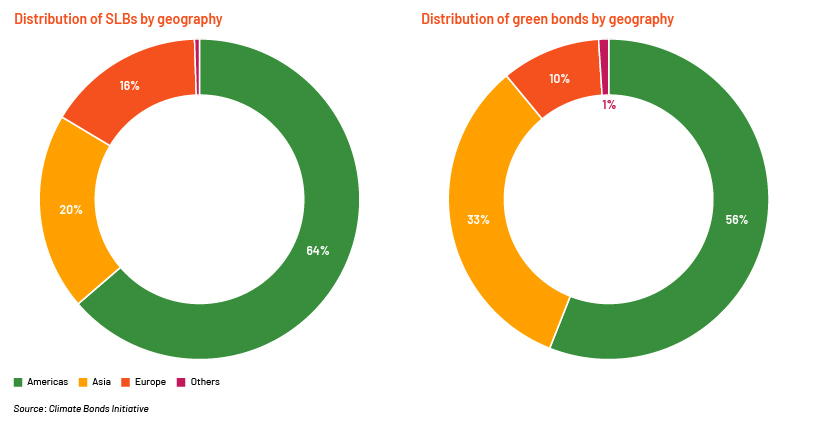

In terms of regional contribution, Europe is one of the largest markets for SLBs and green bonds, accounting for more than 50% of issuance; the next largest markets for SLBs are the Americas and the Indo-Pacific. In the case of green bonds, the next largest markets after Europe are the Indo-Pacific and the Americas. Regions such as Africa and the Middle East have issued fewer ESG bonds, but the number is gradually increasing.

Overall, the performance of SLBs has been favourable in all regions, with strong investor demand and competitive pricing and terms for issuers. However, the market is still relatively new, and greater standardisation and transparency are needed to support further growth and development of the market.

SLBs have also been found to have a positive impact on the environmental and social performance of the companies that issue them.

“Moody's reports that companies that issue SLBs tend to have better ESG ratings and are more likely to meet their sustainability targets than those that issue traditional bonds.”

3. SLBs complement green bonds

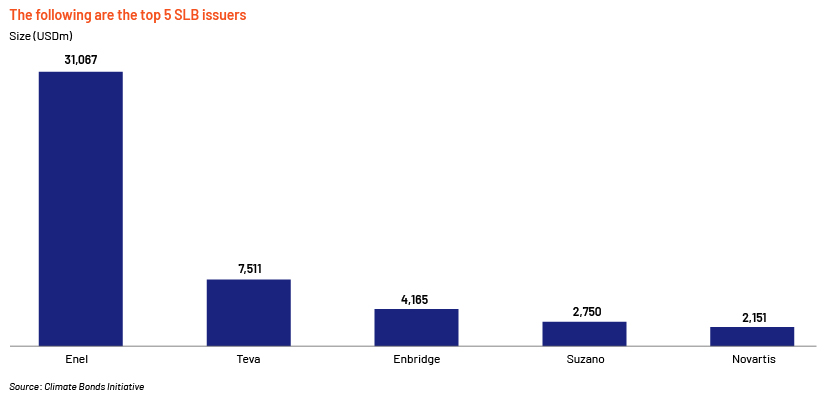

Enel SpA’s issuance illustrates how SLBs could complement green bonds

Before entering the SLB arena, Enel SpA was a pioneer corporate issuer in the green bond market. It reported total green bond issuance of USD4bn until February 2023, including its EUR1.25bn maiden green bond issued in January 2017. Enel issued green bonds to satisfy steadily increasing investor demand.

Enel decided to issue an innovative general-corporate-purpose financing product in 2019 despite its strategy and business model being sustainable. This decision helped advance the development of sustainable capital markets by providing financial incentives for the company to carry out its sustainable business.

Enel released its first SLB in September 2019 for USD1.5bn, targeting to increase installed renewable energy capacity to 55% by 2021 from 2019 levels. If the sustainability performance target (SPT) was not met by the target observation date of December 2021, the interest rate would be increased by 25 basis points (bps). Enel estimated that its bond's sustainability component saved 20bps when compared to a conventional bond.

Since its first issuance, Enel has issued a number of SLBs (around USD31bn until 2023), with a few revisions to its sustainability-linked financing framework. It has chosen five KPIs, relating to lowering GHG emissions, increasing installed renewable capacity and aligning capital expenditure with EU taxonomies.

Overall, both green bonds and SLBs are important tools for promoting sustainable finance and complement each other in terms of supporting environmentally and socially responsible investments.

4. Investor views

As a company's failure to achieve goals would result in financial gain to an investor, responsible investors still do not accept coupon step-ups.

While some investors find the broader focus of SLBs on an entity's strategy attractive, others view it as an ambiguous use of proceeds, which could prevent them from investing in the product.

Since investors are compensated for declining credit quality by increasing returns to match higher risk, a coupon step-up may not be the best mechanism.

Instead of using a coupon step-up mechanism or premium payment upon redemption for not meeting the SLB target, the penalty should be used to make up for the lost impact and should focus on donations to ESG impact funds.

5. Integrity challenge and the future

To ensure strong KPIs/SPTs and effective allocation of proceeds, market endorsement of Sustainability-Linked Bond Principles (SLBP) is essential. New disclosure frameworks, such as the EU Green Taxonomy, are also necessary to speed up standardisation of SLBs.

While SLBs can be an effective way for companies to demonstrate their commitment to sustainability, they could also be used as a form of greenwashing if sustainability targets are not meaningful or if the SLBs are not linked to the core business activities of the issuer. Greenwashing refers to the practice of making false or misleading claims about the environmental benefits of a product, service or organisation to appeal to consumers concerned about sustainability.

Investors must, therefore, conduct far more comprehensive due diligence to determine which bonds actually contribute to a company's sustainability. To prevent "ESG-washing" and promote the development of the ESG market, international norms and standards must be adhered to. Independent third-party verification could also support the validity of the issuer's sustainability claims.

Overall, both in terms of financial returns and their effect on sustainability, SLBs have performed well in recent years. SLBs are expected to become a more common option for investors seeking a favourable impact while earning returns as demand for sustainable investments increases.

The SLB market is still in a nascent stage of development. It has significant potential to attract new participants and grow the sustainable finance sector. Any growth in this sector would be advantageous since it would accelerate the transition to a more sustainable world.

6. How Acuity Knowledge Partners can help

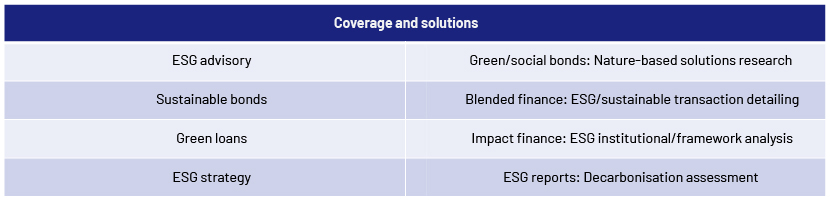

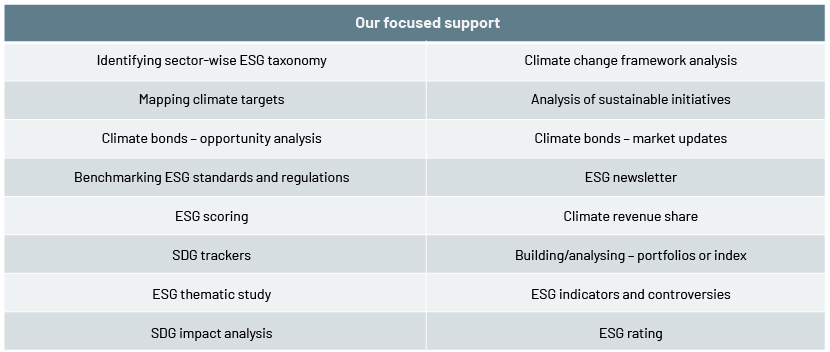

Our wide range of customised analysis and support covers the entire spectrum of financing products along the sustainable finance investment lifecycle and enables investment banks and advisory firms to establish and grow their sustainable finance practices:

We have ESG domain expertise and help banks ramp up their onshore verticals, focusing on incorporating ESG in client analysis and saving a significant amount of senior bankers’ time We standardise templates and provide coverage across APAC, EMEA, the US and Sub-Saharan Africa.

Sources

-

Sustainability-linked bonds | Global law firm | Norton Rose Fulbright

-

Sustainability-Linked Bonds (SLBs) | Climate Bonds Initiative

-

sustainable-bonds-insight-2021.pdf (environmental-finance.com)

-

What are Green Bonds and what projects do they finance? – Iberdrola

Tags:

What's your view?

About the Author

He has worked on a variety of analyses over the course of about 7.5 years, including market updates, credit research overviews, debt profiles, peer comparisons, capital structure analyses, deal case studies, covenant analyses, company profiles/industry analyses, and consensus model building. Along with these, he has contributed to various ESG-related initiatives, including SDG mapping, ESG presentations, SLB linked bonds and peer comparison, SLB Benchmarking, and ESG market updates.

Like the way we think?

Next time we post something new, we'll send it to your inbox