Published on November 27, 2024 by Sandeep Kumar

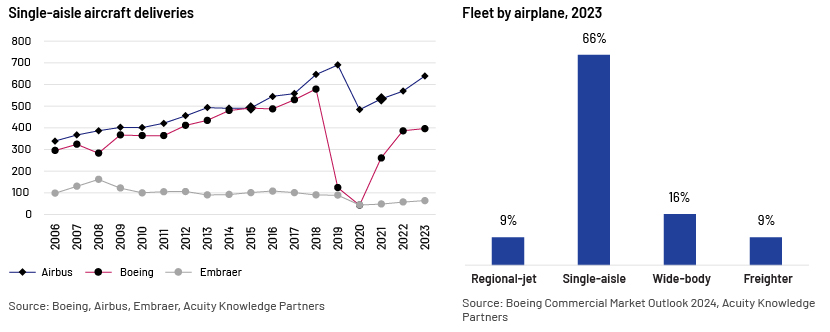

The global aircraft manufacturing market is largely a duopoly, controlled by Airbus and Boeing. Single-aisle is the largest market segment, accounting for 66% of the global aircraft fleet, and the two giants – Airbus and Boeing – have accounted for c.93% of single-aisle aircraft delivered globally over the past five years. Brazil’s Embraer has a minor presence in the narrow-body short-haul aircraft segment but does not compete head-on with the bestsellers (A320, A220 and 737 family aircraft series) offered by the incumbents. Canada’s Bombardier tried to expand its presence in the single-aisle market by developing the CSeries jet but later sold the programme to Airbus due to the financial burden; Airbus rebranded the aircraft series to A220. Embraer, however, continues to manufacture the E-series single-aisle aircraft. The latest entrant to the single-aisle aircraft segment is China’s COMAC C919 aircraft, with its 158-192 seating capacity, already in service with China Eastern Airlines since 2023.

Robust demand for aircraft over the next two decades

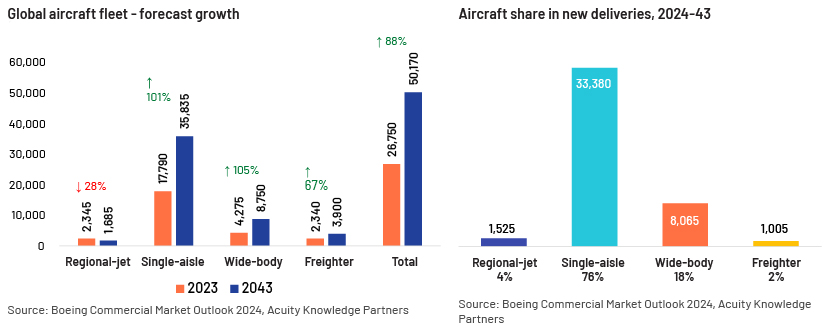

Boeing expects the global single-aisle fleet to more than double, from 17,790 aircraft in 2023 to 35,835 aircraft by 2043 (at a 4% CAGR). Actual demand, however, is likely to be much higher than the stock growth implied if replacement demand is considered. Globally, a total of 33,380 single-aisle aircraft (or 1,600 per year) are planned for delivery over the next 20 years until 2043, translating into a c.76% share of total deliveries of all types of aircraft during the period, according to Boeing’s Commercial Market Outlook (CMO).

Passenger traffic trends and outlook

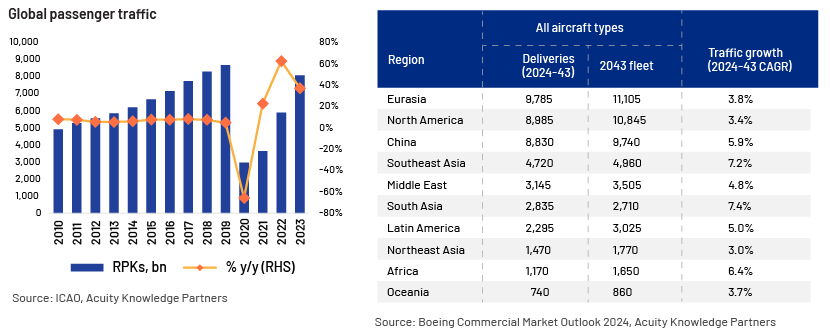

Underpinning the demand outlook for single-aisle aircraft is the expectation of moderate growth in global air traffic, at a 4.7% CAGR, over the next two decades, led by South Asia (7.4%) and followed by Southeast Asia (7.2%) and Africa (6.4%), according to Boeing’s CMO. By country, China’s growth is expected to remain healthy, at a 5.9% CAGR during the period. Past performance shows a 7% CAGR in global passenger air traffic volume in terms of revenue passenger kilometres (RPKs) over 2009-19, followed by the pandemic-induced y/y drop of 66% in 2020 (and subsequent growth of 23% yoy in 2021) and a strong recovery over 2022-24 (average annual growth of 41% over 2021-23).

China to remain a key aviation market

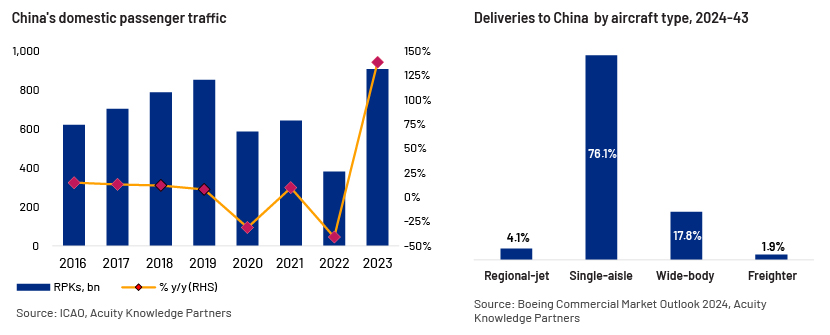

China’s domestic aviation market is the world’s third-largest market, clocking over 900bn RPKs in 2023 (surpassing the pre-pandemic level). Domestic passenger traffic grew at an annual average run rate of 12% from 2015 to 2019. Intra-China/domestic air traffic flow is likely to be the largest in the world by 2043, growing at a 5.2% CAGR over the next 20 years, according to Boeing’s 2024 CMO. Boeing also expects China's commercial fleet to grow from 4,345 aircraft to 9,740 aircraft over 2023-43, averaging an annual growth rate of 4.1%, with single-aisle aircraft accounting for 76% of deliveries during the period.

Incumbents’ capacity constraints

Airbus’s recent guidance indicates a production capacity of 75 narrow-body aircraft per month (A320 family) or 900 aircraft per year by 2027 versus an implied run rate of 53 aircraft per month in 2023 (Airbus delivered 639 single-aisle aircraft in 2023). The current backlog of 7,128 aircraft from the A320 family translates into over seven years of pipeline. Boeing’s efforts to accelerate the production of its narrow-body 737 Max aircraft are hindered by regulatory scrutiny, triggered by a series of incidents including two fatal crashes in 2018 and 2019 as well as a more recent door plug blowout incident involving an Alaska Airlines flight in January 2024. It also mentioned in its 3Q FY24 earnings call that its year-end target of reaching a production rate of 38 units per month for its 737 Max aircraft will take longer due to the IAM union workers’ strike. The backlog of 4,770 aircraft as of September 2024 was also much lower than that of Airbus. Given the mismatch between expected demand and the delivery constraints faced by the incumbents, China’s COMAC plans to make a meaningful entry into the global aviation market.

COMAC finds a space in China’s domestic market

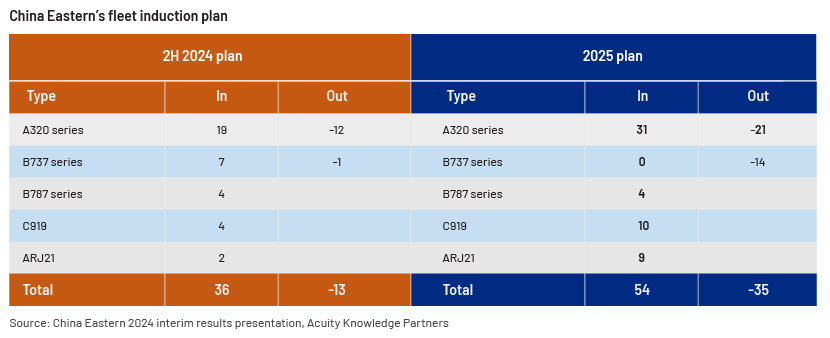

COMAC C919 aircraft has a total order book of over 1,000 units from Chinese airlines and aircraft lessors including Air China, China Southern Airlines, and China Eastern, according to media reports. This indicates that C919 aircraft has begun its journey to becoming a serious contender in China’s aircraft market – China Eastern expects to induct 4 C919 aircraft into its fleet in 2H 2024 and an additional 10 in 2025 (10% of the airline’s total new aircraft induction in 2024-25). All China airlines are likely to induct a total of 6,000 new single-aisle aircraft by 2042, according to aviation analytics firm Cirium, and COMAC is likely to capture c.25% market share of these new additions (versus Boeing’s 30% and Airbus’s 45%). To fulfil its current order book and prepare for growth, COMAC plans to increase its annual production capacity to 150 aircraft in the next five years.

COMAC’s obstacles

For COMAC C919 aircraft to establish itself as a meaningful player in the global aviation market, we believe it needs to prove its mettle, first in the domestic market. International airline companies are likely to take a wait-and-watch approach before deciding to induct the C919 aircraft into their fleets. Furthermore, obtaining approval from aviation regulators in the West would not be easy due to their scepticism about Chinese manufacturers. In addition, the C919 aircraft does not offer newer technologies or advantages over the established workhorses built by Airbus and Boeing. Lastly, COMAC would have to build a global network of maintenance, repair, and overhaul (MRO) sites and skilled technicians, which could also be challenging.

Conclusion

COMAC does not present a significant challenge to the duopolistic aircraft manufacturing market at present, but it has begun to make inroads into the domestic market, having secured sizeable orders from Chinese players. Establishing a strong foothold in the domestic market would be key before it ventures into the international market; therefore, a serious misstep could prove costly and derail its plan to become a serious contender with global giants Airbus and Boeing.

How Acuity Knowledge Partners can help

We work with asset managers as an extension of their research teams and help build their proprietary research products across equity and credit. Apart from research and advisory, we also provide services in areas such as sales and marketing, fund accounting services, investment compliance and risk management. Our integrated solutions across asset classes and functions help asset managers improve investment performance, enhance client servicing, attract new client assets and retain assets in the current complex business environment. Partnering with us, our clients have been able to achieve cost savings of 50-60% versus performing these functions in-house.

Sources:

-

https://www.airbus.com/sites/g/files/jlcbta136/files/Presentation_4DTS.pdf

-

https://www.reuters.com/business/aerospace-defense/chinas-comac-expand-shanghai-c919/

-

https://www.reuters.com/business/aerospace-defense/chinas-comac-expects-reach-annual

-

https://fortune.com/europe/2024/04/08/airbus-boeing-duopoly-commercial-aircrafts-future-china-comac/

-

https://www.reuters.com/business/aerospace-defense/two-more-chinese-airlines-start-flying-china

-

https://boeing.mediaroom.com/2024-08-26-Boeing-China-Commercial-Fleet-to-More-than

-

https://www.icao.int/sustainability/pages/air-traffic-monitor.aspx

-

https://boeing.mediaroom.com/2024-07-19-Boeing-Forecasts-Demand-for-Nearly

-

https://www.ceair.com/global/en_static/AboutChinaEasternAirlines/Airlines/Investo.pdf

-

https://www.faa.gov/newsroom/updates-boeing-737-9-max-aircraft

What's your view?

About the Author

Sandeep Kumar has around 13 years of experience in the equity research field. He has been with Acuity Knowledge Partners (Acuity) since 2011 and has supported buy-side and sell-side engagements. Currently, he provides research support to a global asset manager, covering companies in the industrials sector in the US, Europe and Asia, with a focus on the aviation and healthcare sectors

Like the way we think?

Next time we post something new, we'll send it to your inbox