Who we are

Acuity Knowledge Partners are market leaders empowering asset managers globally with cutting-edge AI/ML tools, comprehensive research, hedge fund advisory, analytics, and compliance solutions—driving significant cost savings and operational efficiency. Partner with us to leverage our decades of domain expertise and innovative technology for sustainable growth and adaptability to evolving business needs. Let’s transform your hedge fund strategy together!

Hedge Fund Solutions - Support We offer

- Equity Research Outsourcing Services

Our highly qualified and experienced equity research analysts work as an extension of the teams of global investment managers and research analysts. We support equity research firms in finding new investment opportunities, expanding coverage, and staying abreast of industry, regulatory and technology trends, and evolving company performance. Our equity research teams of fundamental research and data experts provide customised equity research services by combining alternative data, ESG and technology expertise (e.g., our BEAT suite of tools) to provide differentiated research insights across sectors. We employ one of the largest pools of research analysts with higher professional degrees in finance (such as CFA and CPA), well supported by our Training and Knowledge Management team through a CFA Institute-accredited equity research training programme.

- Fixed Income and Credit Research

We are the largest independent fixed income and credit research service provider that specialises in providing Mutually Exclusive and Collectively Exhaustive set of fixed income and credit research support services to asset managers and investment banks. We have a team of over 200 credit research analysts; they are specialists in Emerging Markets and Developed Markets and, by asset class, in Distressed Debt, Sovereign, Sub-sovereign and Corporate and Financial issuers. The team combines qualitative and quantitative fundamental credit research with technological solutions that not only improve our speed to market but also provide actionable insights.

Our fixed income and credit research team is spread across geographies and credit ratings and even the unrated spectrum, including distressed issuers and workouts. The team is well supported by several best practices documents, Acuity’s proprietary training modules (CFA accredited), and access to long-serving in-house sector and asset class experts. This helps credit analysts to continuously upgrade their subject matter expertise and move up the value chain of fixed income and credit research.

- Data Science

Global technology megatrends, regulatory developments, the competitive landscape and the rise of alternative data have been driving a paradigm shift in the capital markets ecosystem. Demand to find new avenues of alpha creation powered by data science techniques is at unprecedented levels. Acuity has been providing highly bespoke quantitative and technology-powered solutions to our buy-side and sell-side clients since 2005. To address growing demand in recent years, we launched a dedicated data science practice early in 2019 to provide unique and contextual insights based on artificial intelligence (AI) and machine learning (ML).

- Private Equity Services

We provide end-to-end support to private equity (PE) firms on the investment side as well as horizontal support across middle-office and back-office functions.

On the front-end investment side, we provide comprehensive service offerings to support our PE clients across their investment lifecycles. We assist them from deal sourcing and target evaluation to portfolio monitoring and advisory.

We also support middle-office and back-office teams of PE firms by providing bespoke fundraising, investor relations and fund operations solutions. We assist clients from level 1 responses to activities such as RFPs/RFIs/DDQs, client presentations, factsheet generation, fund monitoring and fund valuation, and investor reporting. In addition to providing dedicated support on fund valuation, investor reporting and fund administration, we are experienced in integrating data operations into CRM systems, keeping onshore teams informed and flexible to respond to queries faster.

- Portfolio Analytics and Reporting Solutions

Our ‘Portfolio Research and Operations practice provides support to a number of asset managers on activities across the portfolio management value chain, including the following:

Performance and risk analytics dashboards

Performance measurement and attribution

Risk metrics and analytics – beta, VaR, tracking error, correlation, risk attribution

Analytics using third-party platforms

Middle Office support

Portfolio Operations

Investment reporting

Portfolio analytics maintenance work on platforms such as FactSet, Barra Aegis, Axioma, Wilshire Axiom, Bloomberg and POINT

Portfolio Analytics and Reporting

We have distinguished ourselves from peers through our innovative products and client-centric and thought leadership approach in portfolio analytics and reporting and management. We enable clients to work on a "lean" model by offshoring analytical and technology requirements, increasing their bandwidth to focus on value-added strategies. We also help clients leverage our industry experience for superior portfolio risk analytics, efficient investment operations, enhanced reporting solutions, robust data integration and management, and bespoke applications, tools and dashboards. Our customers have experienced significant value from our strong capital markets knowledge coupled with data and technology capabilities to build innovative and tailored managed service solutions.

- Index Solutions

As the focus shifts towards more passive strategies and ETFs, cost pressure increases, driving the need for innovative, market-relevant products and building infrastructure to support growth. Acuity Knowledge Partners is one of the leading global third-party vendor of index support, with more than 10 years of experience in supporting four of the world’s topindex providers. We offer end-to-end index support services under one roof – we provide index development and operations across strategy and benchmark indices with multi-asset-class coverage, thematic and strategy research, index marketing and client servicing.

By leveraging our broad suite of Index services and solutions, our clients are able to move up the value chain and overcome budgetary and research bandwidth constraints. We help our clients develop and test new and monetisable research ideas. Furthermore, our research and analytics expertise and ability to take on regular maintenance work free up their time to focus on higher-priority objectives.

- EDGE in Consultant Database (CDB) Uploads

- Navigator

- Automated Financial Model Builder

- Equity and FICC Analytics and Comp Builder

- Interactive Fund Factsheet Builder

- Web Audit and Data Extractor

- Digital Marketeer Interface

- Sales and Client Newsletter Communicator

- Robo Smart Beta Quant ETF

- Portfolio Optimiser

- Fund Simulator

- Data Aggregator and Cleanser

- Research Digitisation and Report Generator

- Interactive Charting and Readership Analytics

- MIFID II Dashboards and Interactive Charting

-

Learn more about BEAT enabled Solutions

Hedge Fund Solutions - Support We offer

- EDGE in Consultant Database (CDB) Uploads

- Navigator

- Automated Financial Model Builder

- Equity and FICC Analytics and Comp Builder

- Interactive Fund Factsheet Builder

- Web Audit and Data Extractor

- Digital Marketeer Interface

- Sales and Client Newsletter Communicator

- Robo Smart Beta Quant ETF

- Portfolio Optimiser

- Fund Simulator

- Data Aggregator and Cleanser

- Research Digitisation and Report Generator

- Interactive Charting and Readership Analytics

- MIFID II Dashboards and Interactive Charting

-

Learn more about BEAT enabled Solutions

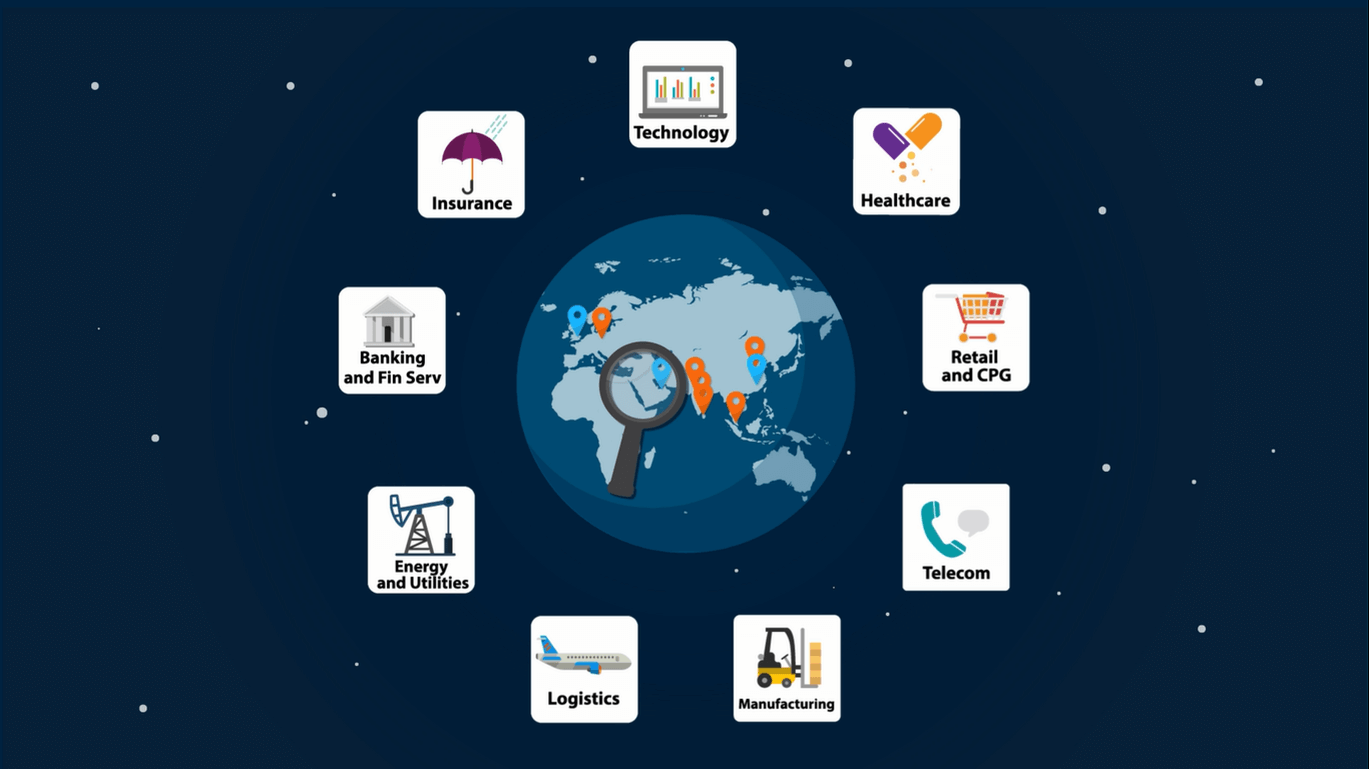

Our Hedge Fund Services Footprint at a Glance

80+

Hedge Fund Clients

USD 1.5tn+

combined AuM of hedge fund clients Technology enabled

Technology enabled

30-70%

cost savings vs. fully-loaded cost of onshore resources

How we are different

Ready access to skilled talent

Support bottom-line optimisation

Depth of delivery and industry experience

A range of cross-platform hedge fund solutions under one umbrella