Introduction

Executive summary

Given the high costs of failing to achieve a smooth transition, asset managers should formulate a comprehensive and actionable LIBOR transition strategy. This paper outlines a roadmap for asset managers. We highlight the importance of LIBOR transition impact & planning and provide a case study on the process, recommend key steps to be followed and introduce some of our proprietary solutions designed to support clients through the transition process.

Introduction/Overview

With the Financial Conduct Authority (FCA) having officially announced LIBOR cessation and loss of representativeness dates for all 35 LIBOR settings, asset managers have full clarity on end dates. Consequently, firms holding legacy fixed-income contracts with inadequate or no fallback language should have clear knowledge of their LIBOR exposure as well as a comprehensive and actionable LIBOR transition strategy.

Key Challenges

Most asset managers and research teams would find it practically impossible to allocate resources within existing teams to analyse and extract fallback language from potentially hundreds of LIBOR-linked contract documents. The process would be extremely time-consuming. Moreover, the fallback language used and the format adopted by issuers could differ significantly for issuances dated prior to the release of recommended fallback language.

Benefits

A comprehensive and actionable LIBOR transition strategy will enable firms to identify their IBOR exposure, as well as the likely impact to portfolio return and risk metrics arising from a shift to alternative reference rates. Firms can thereafter shift exposures, benchmarks and targets for funds and mandates to new reference rates.

Acuity’s Value proposition

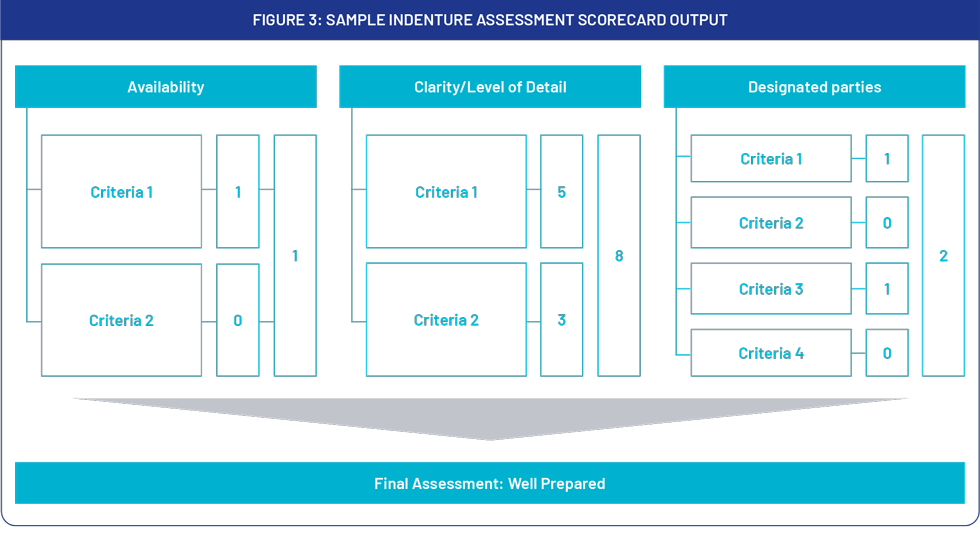

Leveraging its expertise in the analysis of fallback language, Acuity Knowledge Partners’ (Acuity’s) Fixed Income team has developed a suite of tools to assist clients, including a proprietary quantitative scoring framework that systematically ranks fixed-income issuances on a scale of “well prepared” to “worst prepared”.

Benefits delivered to clients who have utilized our LIBOR solutions include the following:

Rapidly bridging the in-house resources gap to complete the discovery/identification phase of LIBOR transition

Identifying the best and worst prepared issuances, which assisted clients’ decision making in the portfolio-recalibration phase

Sourcing master and supplemental indentures

Due diligence and extraction of fallback language across all issuances within a short period of time. Identification of country of legal jurisdiction

Issuer communication and follow-up