– Narendra Babu, Senior Director, Financial Marketing Services

Market Pulse

*All performances are in USD

Top Performing Asset Class:

US Large Cap Equities (6.2%): US Large Cap Equities surge was primarily fueled by strong performances from major tech companies like Nvidia, Microsoft, Meta, and Amazon, collectively as ‘Magnificent Seven’ along with resilient corporate earnings and investor optimism despite macroeconomic uncertainties.

Worst Performing Asset Class:

Global Bonds (-0.5%): Global Bonds experienced a downfall due to a sharp sell-off triggered by rising inflation expectations, aggressive U.S. fiscal policies, and surging government debt issuance. Investors, alarmed by mounting deficits and protectionist trade measures, demanded higher yields, leading to steep declines in bond prices across major markets.

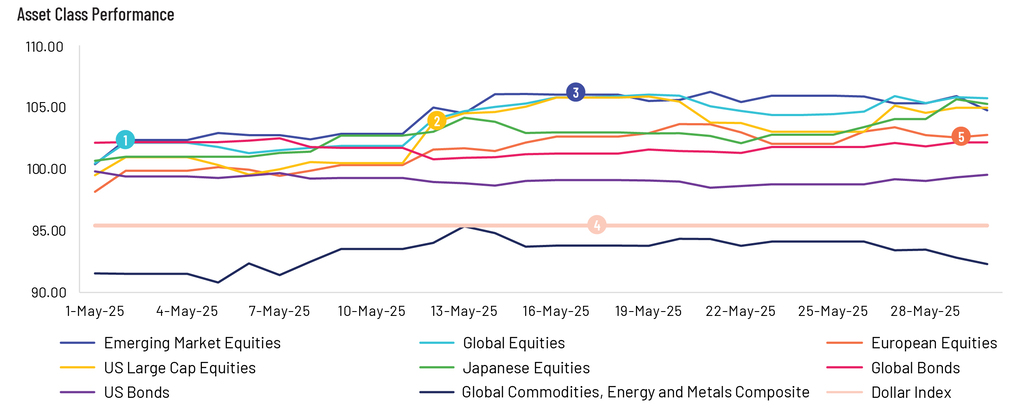

1. May 2: Global equity markets showed resilience following the April sell-off, with investors optimistic about potential stabilization in trade politics.

2. May 12: U.S. Large cap equities saw a mid-month rally on hopes of a U.S.-China mini-trade deal lifting the S&P 500 and Nasdaq. CPI data showed easing inflation, helping sentiments.

3. May 17: Emerging markets saw institutional flow shift to non-China EMs; gains seen in Southeast Asia and Latin America.

4. May 18: The US Dollar Index weakened against some currencies amid concerns over trade disruptions and their effects on economic growth.

5. May 29: European equity markets rebounded as investor sentiment improved, aided by positive economic reports and easing trade tensions.

Equities

Global equities rebounded in May as renewed optimism around US-China trade talks lifted investor sentiment after a volatile April. In the US, equities advanced steadily, buoyed by easing inflation in April, dovish reassurances from Fed Chair Powell regarding economic resilience, and upbeat corporate earnings, particularly from tech majors like Nvidia. Market sentiment was further bolstered by the rollback of Biden-era AI chip curbs and Trump-era tariffs. European markets followed suit, with equities rallying on easing US-China trade tensions, the postponement of US tariffs on EU imports, a Bank of England rate cut, and a court ruling blocking key Trump-era tariffs. The UK ended the month higher, aided by Trump’s softer stance on trade and a catch-up rally with Europe, though concerns over macro headwinds and ongoing tariff uncertainty capped further gains. Asian markets delivered strong performances across key regions. Chinese equities rose, driven by a 90-day tariff suspension with the US, a record-low policy rate, and a 10-point monetary stimulus from the People’s Bank of China (PBoC) aimed at boosting liquidity, long-term growth, and innovation. However, late-month selling emerged amid auto sector price wars and renewed tariff concerns. India’s markets saw a modest monthly gain, recovering from early losses due to cross-border tensions with Pakistan and rupee depreciation. Optimism around a potential zero-tariff trade deal with the US lifted mid-month sentiment before equities turned range-bound. Japan also posted positive returns, supported by structural reforms, trade tailwinds, and strong foreign inflows, although a stronger yen, weak insurer earnings, and concerns over a possible Bank of Japan rate hike trimmed some gains.

Fixed Income

In May, global uncertainties surged due to reciprocal tariffs between the United States and China, escalating the trade war. After negotiations, both nations agreed to a 90-day hiatus on all tariffs imposed on each other. The US Federal Reserve voted to keep the rate unchanged at 4.25%–4.50% at its May meeting, citing steady economic growth despite growing unemployment and inflation risks. The Bank of England (BoE) similarly decreased rates from 4.50% to 4.25% at its meeting, maintaining a cautious approach to further rate cuts. The European Central Bank (ECB) is also expected to cut rates by 25 basis points in its upcoming meeting, while major Asian central banks like China and India have reduced key rates to support growth and meet demand. Treasury yields rose as global indices performed negatively across treasuries and investment-grade assets, with high-yield corporates gaining momentum. In emerging market (EM) credit markets, spreads widened for corporates and sovereigns, with total returns at -0.1% and -0.4%, respectively, while EM local returned +1.4%, driven by forex performance. US Investment Grade (IG) yields returned to near pre-tariff levels after equity markets stabilized and the 90-day tariff negotiation period was announced, while Euro IG returns were outperformed by Canada and the US. The U.S. 2-year Treasury yield increased by 28 basis points, and the 10-year Treasury yield rose by 22 bps as economies recovered from the trade war shock. The US 10-2-year yield spread closed at 0.52%, below the long-term average, as US debt surged and bond yields spiked. Moody’s downgraded the US credit rating, citing the growing burden of financing the federal budget deficit and the rising cost of rolling over existing debt amid high interest rates.

Foreign Exchange

In May, the US dollar experienced significant volatility due to various factors. Below-consensus inflation data and a Moody’s downgrade of the US economy exerted downward pressure on the USD in mid-May. Trump’s announcement of a delay in the EU tariff deadline provided support to the dollar. Additionally, a recent trade-court ruling against Trump’s reciprocal tariffs boosted the dollar as traders anticipated fewer headwinds from tariff wars. However, deficit concerns remain prominent. Overall, the dollar index fell, but less sharply than in previous months. The euro surged after Trump postponed plans to impose 50% tariffs on EU imports until July 9, further supported by Germany’s unprecedented fiscal stimulus measures. Despite lower policy rates compared to the US and the UK and the likelihood of further cuts, the euro remained largely unaffected. In the UK, a hawkish stance by the BoE, a trade deal with the US, and a UK-EU reset all positively impacted the pound. The JPY rallied against the USD, with an overall gain of 0.7% during May, offsetting slight weakness after Japanese authorities announced the possibility of adjusting government bond issuance plans for the current fiscal year. Asian currencies appreciated due to USD weakness and shifting investor preferences. Elsewhere, the Russian Rouble gained significantly against the USD, reaching a two-year peak despite new sanctions on the country.

Commodities

The commodity complex performed relatively well in May. Gold prices held steady with marginal gains due to Donald Trump’s threats to impose significant tariffs on the European Union and Apple Inc. Additionally, softer-than-expected US inflation data and a weaker dollar further supported the yellow metal. Turning to industrial metals, LME copper prices rose by more than 4% month-over-month (MoM) in May, primarily due to declining copper inventories in both LME and SHFE warehouses and mine supply disruptions. As for aluminium, LME prices increased by almost 2% MoM, driven by signs of tightening supply. Meanwhile, consumption in China remains healthy, and existing caps on production capacity further supported the upward rally. In the energy complex, US natural gas prices reported gains last month, with front-month Henry Hub futures rallying over 3.6% MoM in May, primarily due to declining storage levels. As of May 23, total gas stockpiles totaled 2.476 trillion cubic feet (Tcf), down 11.3% year-over-year (YoY) but 3.9% above the five-year average. Meanwhile, crude oil prices ended with marginal gains as larger geopolitical risks and falling supply were partially offset by lower demand. Reports suggesting that Israel could be planning a strike on Iranian nuclear facilities provided some tailwinds to the oil market. Meanwhile, Chinese crude oil production stood around 14.2 million barrels per day (b/d), down 1.3% YoY, while apparent oil demand fell to 13.8 million b/d, down 5.3% YoY, the weakest since August. Lastly, in agricultural commodities, corn prices fell sharply by 6.6% MoM in May. The International Grains Council (IGC) recently raised its global corn production estimates from 1,274 million tonnes (mt) to 1,277 mt for the 2025/26 season. Additionally, favorable weather conditions and better planting data in the US pushed corn prices lower last month.

Outlook

The global economy faces a complex landscape marked by persistent trade tensions, inflationary pressures, and uneven growth across regions. Growth remains below pre-pandemic levels, hindered by escalating trade conflicts and policy uncertainties. Advanced economies, including the United States, are experiencing slower momentum due to high tariffs and reduced investment. In contrast, emerging markets and developing nations continue to grow at a faster pace, though still lagging behind historical norms. Inflation remains a key concern worldwide. While some advanced economies are seeing a gradual easing of inflation, many emerging markets continue to grapple with rising prices, complicating central banks’ strategies and policy decisions. Overall, the global economic outlook is subdued, with significant regional disparities. Continued geopolitical tensions, inflation risks, and weak investment flows call for coordinated international efforts to stabilize growth and strengthen financial resilience across markets.

Central Bank Quotes

“Inflation has eased significantly from its highs in mid-2022 but remains somewhat elevated relative to our 2 percent longer-run goal. Total PCE prices rose 2.3 percent over the 12 months ending in March; excluding the volatile food and energy categories, core PCE prices rose 2.6 percent. Near-term measures of inflation expectations have moved up, as reflected in both market- and survey-based measures. Survey respondents, including consumers, businesses, and professional forecasters, point to tariffs as the driving factor. Beyond the next year or so, however, most measures of longer-term expectations remain consistent with our 2 percent inflation goal.”

– Jerome Powell, Chairman, Federal Reserve (4 May 2025)

“In the Monetary Policy Report, we present two scenarios in addition to a baseline projection for activity and inflation to illustrate some of these risks. In one scenario, there could be weaker supply and more persistence in domestic wages and prices, including from second-round effects related to the near-term increase in headline inflation. In the other scenario, inflationary pressures could ease more quickly owing to greater or longer-lasting weakness in demand relative to supply, in part reflecting uncertainties globally and domestically. Considering all the risks, we will continue to monitor closely the accumulation of evidence on the outlook for inflation over the medium term and set Bank Rate accordingly to meet the 2% target.”

– Andrew Bailey, Governor of BOE (8 May 2025)

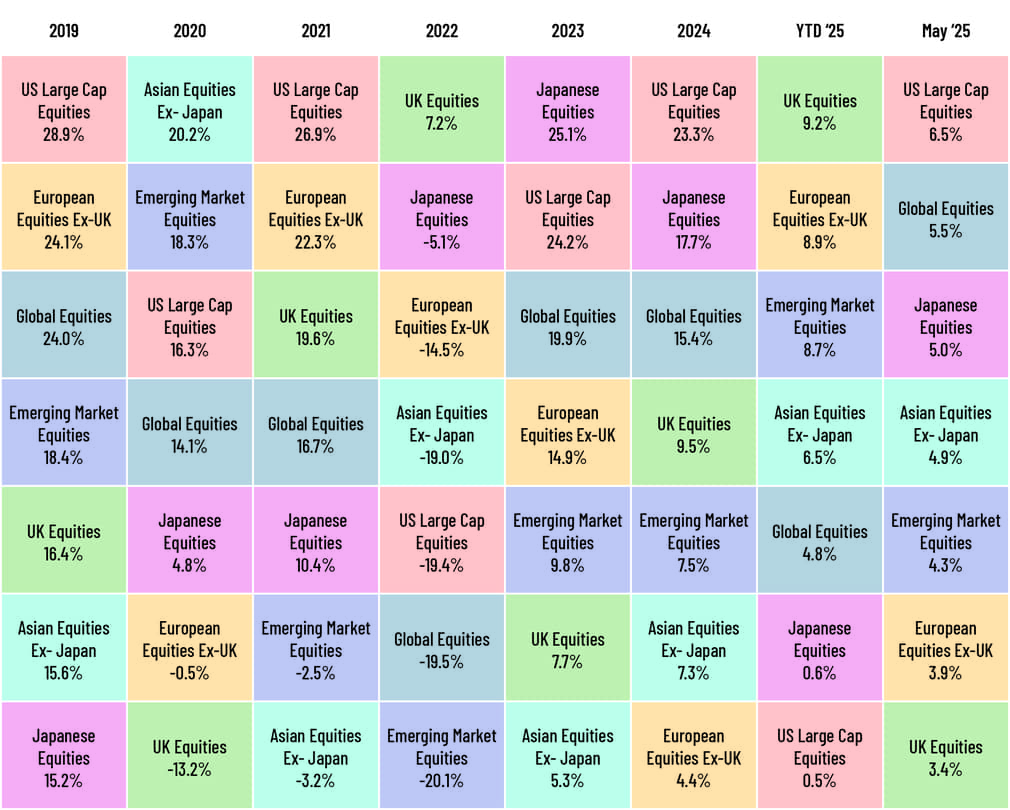

Market Indices*

*Indices are arranged in descending order based on their performance (% gains) during the period. Each colour refers to a specific index, and it remains constant for the table.

In case you missed it

1. Navigating the future: Strategic takeaways from Leading Asset Managers – May 2025

Key trends and recommendations in asset managers’ latest thought-leadership content

2. Check out the road ahead for ETF Market Outlook 2025 – March 2025

ETF Market Lens – 2025 Guide to the Evolving ETF Landscape

3. Uncover how tracking fund flows reveals investor sentiment, market trends, and hidden opportunities – March 2025

Following the money trail: understanding the importance of fund flows

4. Explore the optimisation production of Management Report of Fund Performance? – February 2025

MRFP: A case of optimizing production of a regulatory document

5. Discover how Asset Managers are leveraging global talent pool and tech augmentation – February 2025

AMs optimize costs in an increasingly disruptive environment

What’s Ahead

| Date | Country | Event |

|---|---|---|

| Jun 17 | Germany | ZEW Economic Sentiment Index |

| Jun 23 | United Kingdom | S&P Global Services PMI Flash |

| Jun 27 | France | Inflation Rate YoY |

| Jun 30 | Canada | NBS Manufacturing PMI |

| July 1 | USA | JOLTs Job Openings |

| July 8 | Australia | RBA Interest Rate Decision |

| July 12 | China | Balance of Trade |

| July 15 | Germany | ZEW Economic Sentiment Index |