Introduction

Introduction

The European Union (EU) leads the sustainable finance domain with the Sustainable Finance Action Plan, first presented in March 2018 in response to the landmark signing of the Paris Agreement 2015 and the United Nations Agenda 2030 for Sustainable Development Goals.

The Plan aims to promote sustainable investment across the economic bloc. It is also aligned with the goals of the European Green Deal that aims to make the EU carbon neutral by 2050.2 The Plan is backed by a broad set of new and enhanced regulations – the Sustainable Finance Disclosure Regulation (SFDR) and the EU taxonomy for sustainable activities – which have common but also different requirements to address the issue.

The objectives of these two regulations support the Sustainable Finance Action Plan and are as follows:

Reorienting capital flows towards sustainable investments, e.g., investments in green energy, green infrastructure and resilient communities

Managing financial risks from challenges such as global warming, climate change, extreme weather events and resource depletion

Enhancing transparency of investments and preventing greenwashing

Key similarities and differences

A major similarity is the scope of applicability: the two disclosure requirements largely apply to FMPs with operations in the EU.

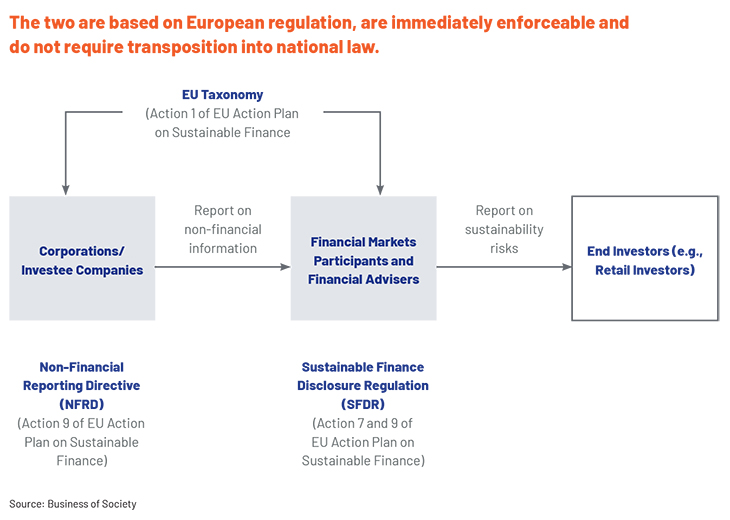

One difference between these independent regulations is that the EU taxonomy helps ascertain the sustainability of any economic activity. Figure 1 shows how Actions 7 and 9 of the EU’s Sustainable Finance Action Plan are in line with the Non-Financial Reporting Directive (NFRD) and the Sustainable Finance Disclosure Regulation (SFDR). These two disclosure requirements pertain to corporations and FMPs, respectively. The EU taxonomy provides the classification system that determines the sustainability of economic activities disclosed as part of the SFDR. Thus, the taxonomy validates the specificity of the regulations under the SFDR.

Key Benefits

The two regulations aim to increase sustainability-related disclosures. On the face it, they seem to be adding to the administrative burden, but they actually impact the real market and economy.

Companies wanting to ensure sustainability are likely to attract market interest

Their capital-raising ability will be enhanced, helping them gain a competitive advantage

They can develop better financial products with sustainability-linked features, making these products attractive to conscious customers

Disclosure requirements would necessitate companies including sustainability as a strategic priority in decision making

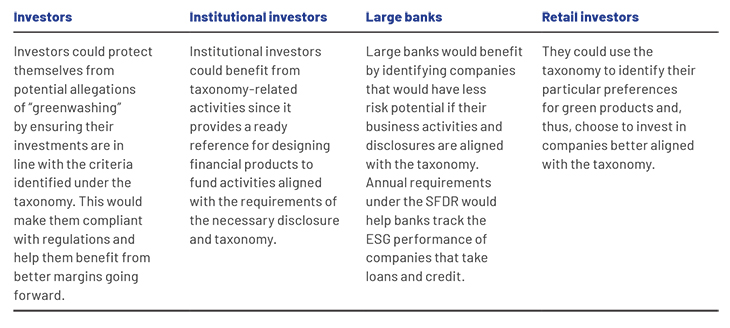

Financing entities can refer to the taxonomy to determine which factors to focus on. Enhanced focus on transparency and disclosures would generate value not only for them, but also for relevant stakeholders.

Investors would have access to detailed information on ESG risks, enhancing the quality of investments that would generate long-term financial and non-financial returns.

Green investments are expected to increase as institutional and retail investors lean towards investments that would make their entire portfolio green. The flip side would be the flow of finances towards low-margin investments with environmental and social value.

Financing entities are free to choose whether they want to follow the criteria under the taxonomy that ensures the financing products reaching customers are actually green.

The SFDR applies at the entity level as well as the product level. Simply put, this means asset managers have to report on sustainability risks both for themselves and their financial products or funds.

Future Outlook

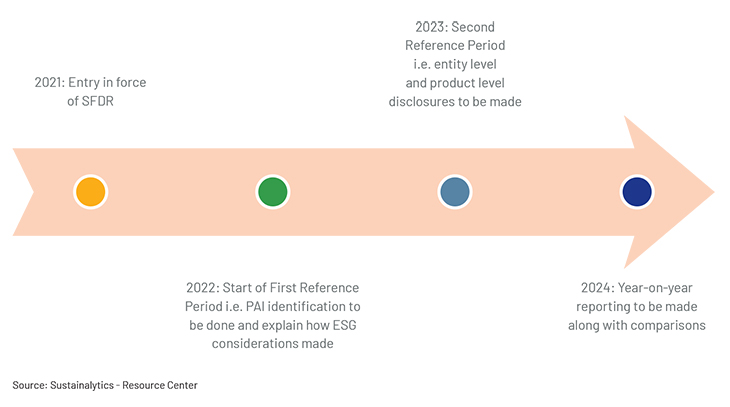

In the current scheme of things, the SFDR is expected to have been in force since March 2021. Figure 2 shows that 2022 is when the entities to which the regulation is applicable are expected to identify principal adverse impacts (PAIs) and explain how ESG factors have been considered in their investments. The usual PAIs are carbon emissions, wastewater emissions, human rights violations and board independence, broadly classified into environmental, social and governance aspects.

Obligated entities are expected to make entity-level and product-level disclosures in 2023; these refer to sustainability disclosures both for themselves and their financial products or funds, respectively. From 2024, obligated entities are expected to present their final year-on-year reports and changes in PAI values.

Acuity’s Value Proposition

We have been assisting our global clients with ESG and sustainability reporting, providing bespoke solutions to meet sustainability objectives. Our support spans the entire investment lifecycle – from deal origination, which includes initial screening and due diligence, to ESG portfolio monitoring and bespoke sustainability reporting.