Introduction

Global structured finance

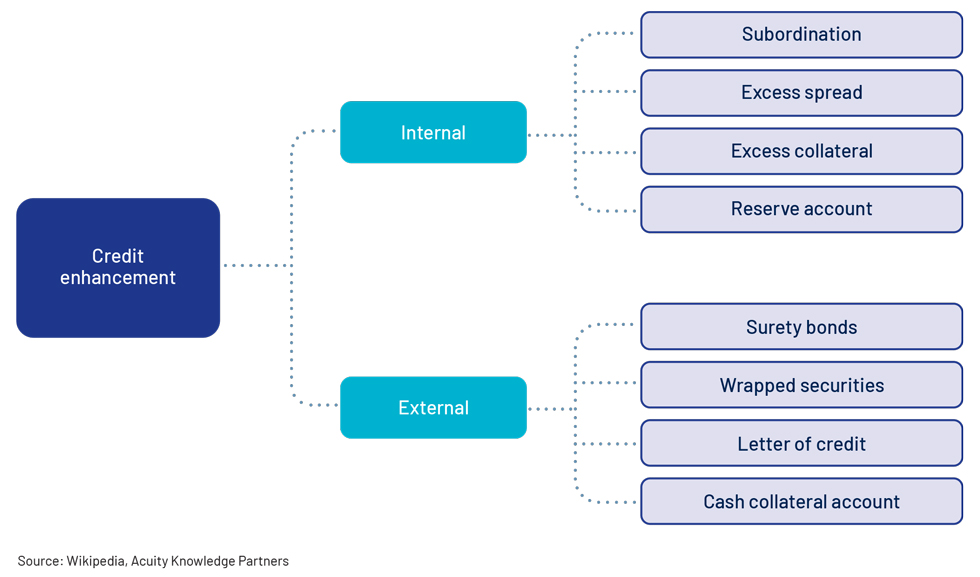

Credit enhancement is a key concept in structured finance. It involves creating a security that has a higher rating than that of the underlying collateral pool. Higher-rated securities can be sold to investors for higher prices, generating higher revenue for the special-purpose vehicle and originator.

We expect the credit environment for structured finance to remain hampered in 2023, aggravated by recession forecasts for most market participants, with major pockets of distress. Consequently, issuance volumes are expected to remain dampened, owing to the relatively high benchmark rates and high available yields.

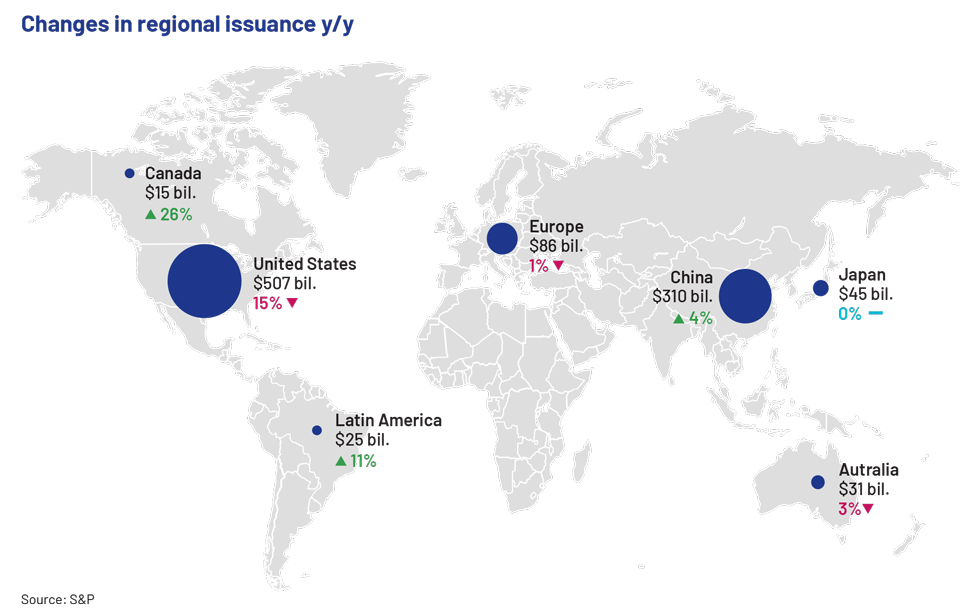

Changes in regional issuance y/y

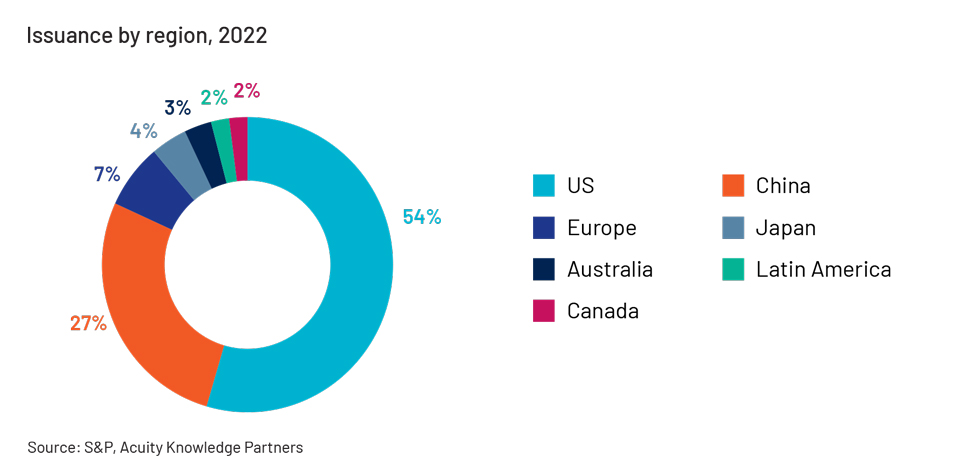

The US and China remain the largest markets for structured finance transactions: 54% of issuance in 2022 was booked in the US, followed by 27% in China, 7% in Europe, 4% in Japan and the remainder across other regions. This trend is likely to continue, with the US and China expected to be the main markets driving the sector’s recovery over the medium term.

Many consumers have favoured increased savings to stabilise their financial positions in the past three years. Conversely, most corporations have taken on more debt. Many programmes that provided pandemic-related relief such as mortgage forbearance schemes ended in 2022, leading to pockets of performance deterioration in some asset classes such as RMBS; nonetheless, this also prompted the resumption of payments in others.

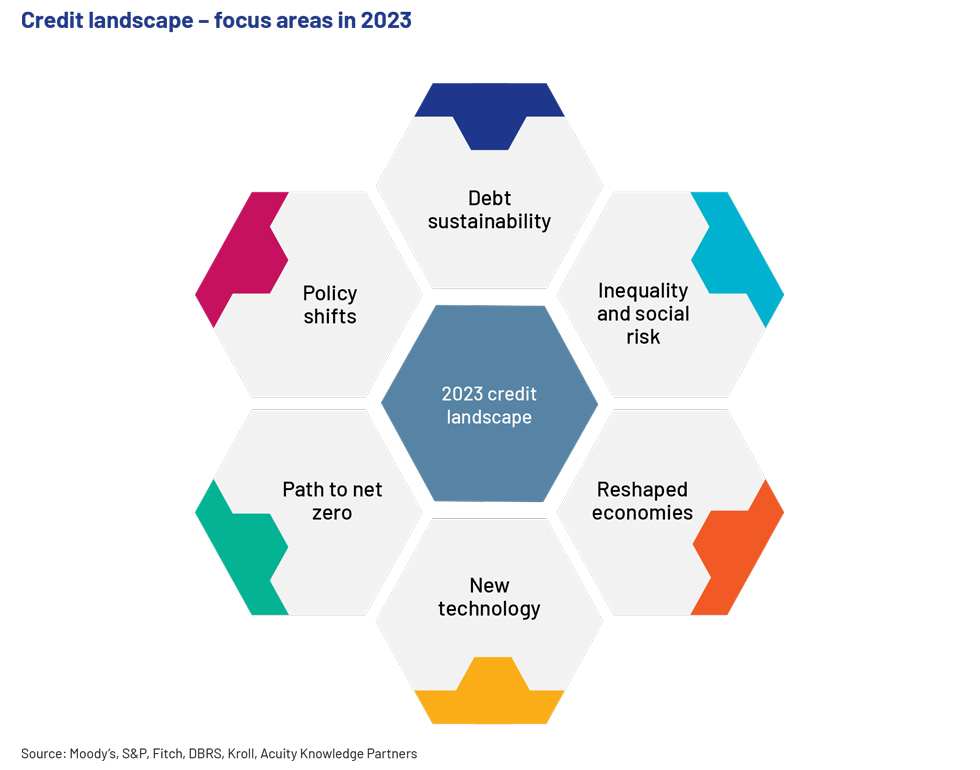

Key focus areas of the global structured finance

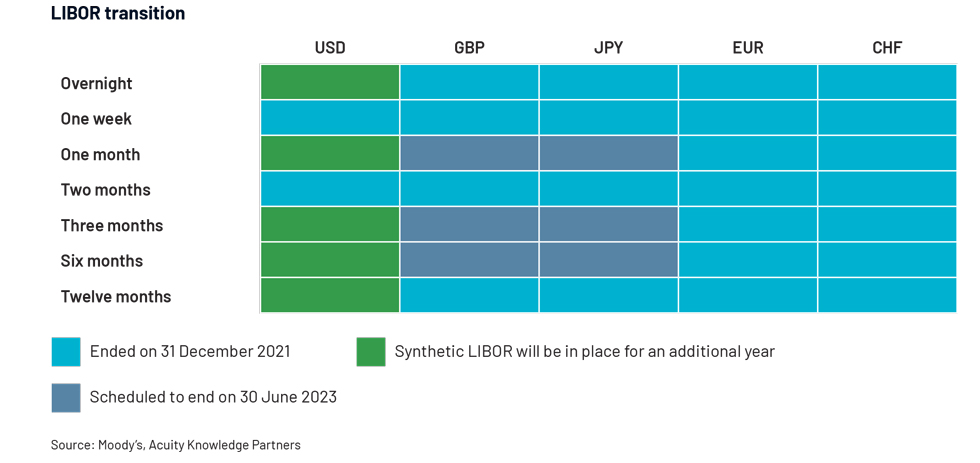

Libor Transition: The USD LIBOR phase-out will remain a major area of focus for the global structured finance market in 2023. The transition has already taken place in most other major jurisdictions, such as Japan, Switzerland, the UK and Europe. This transition will require close monitoring, owing to the relatively high volume of transactions currently pegged to the USD LIBOR standard. The new benchmark, SOFR, was rolled out in 2023, with asset-backed securities (ABS) and RMBS issuance using compounded SOFR, and CLO and single-asset single-borrower (SASB) CMBS issuance using term SOFR.

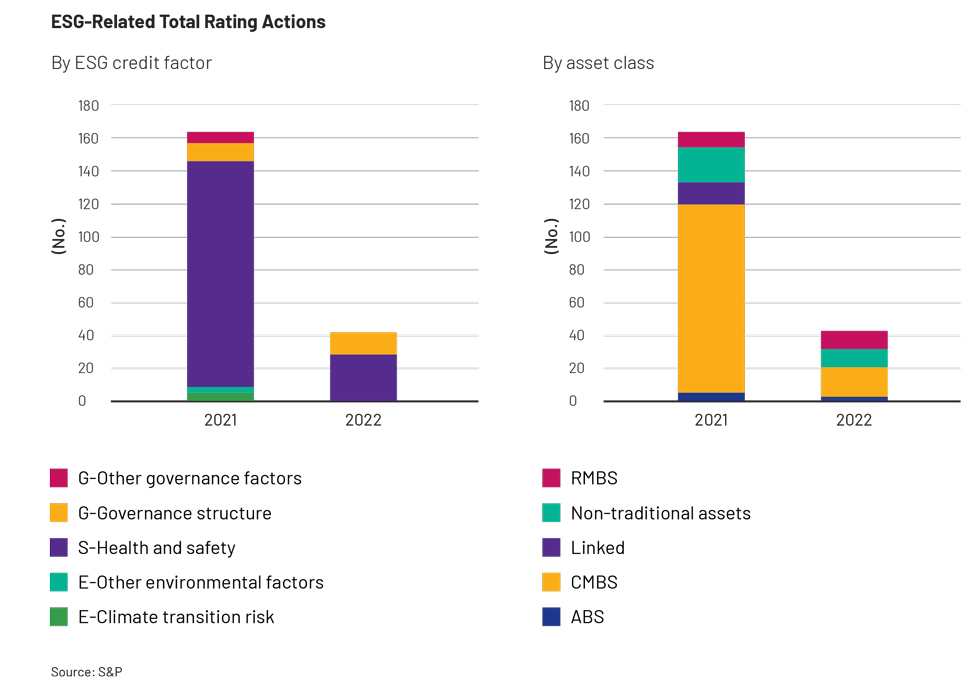

ESG: Green, social, sustainability and sustainability-linked (GSSSB) issuance is unlikely to see a major change in 2023. Issuance is expected to remain resilient on the back of (1) global decarbonisation plans, (2) the development of international initiatives such as the capital markets association and social bond principles and (3) the introduction of “use-of-proceeds” securitisations.

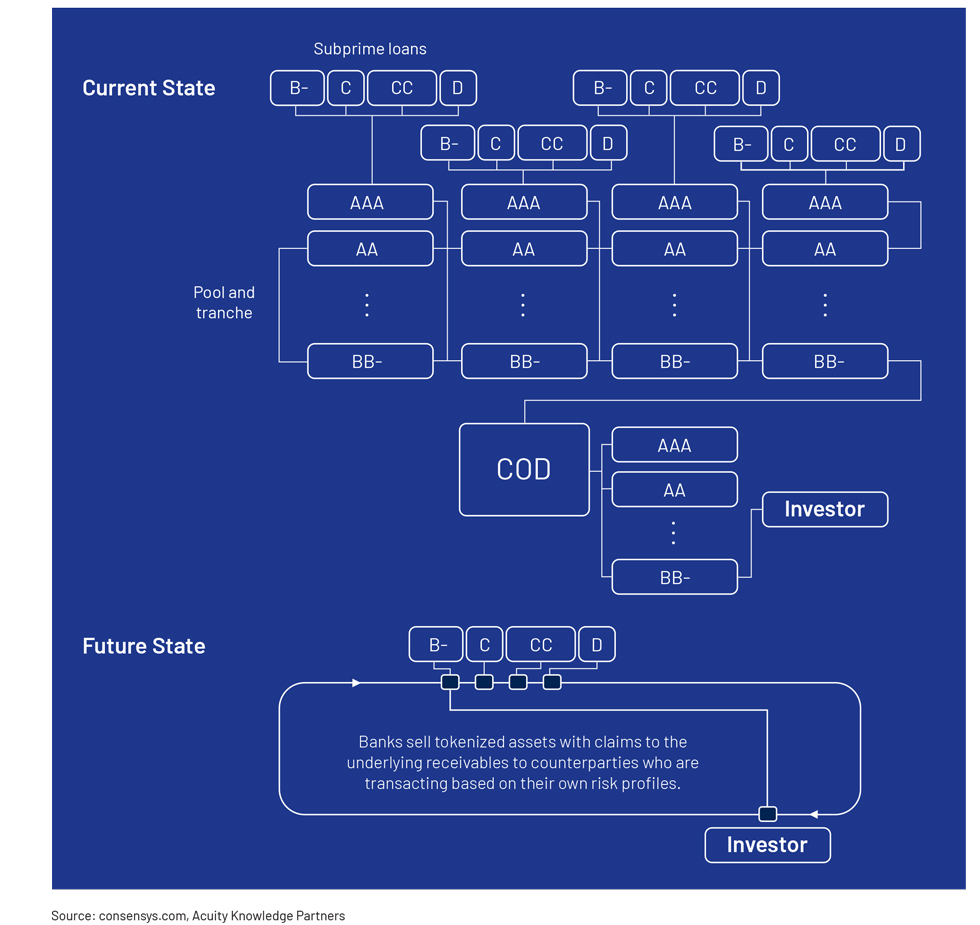

Blockchain: Due to its immutable nature, blockchain is a highly disruptive technology that has numerous applications in the finance sector. One of its latest applications is blockchain securitisation, which involves the conversion of illiquid assets into tokens that represent individual securities sold to investors on the blockchain. Blockchain securitisation would, therefore, have the potential to catapult structured finance processes to the modern digital age.

To gain a better understanding of each of the key focus areas of the global structured fiancé and the role they play, download the complete insight paper.

Outlook by region and asset class

US outlook

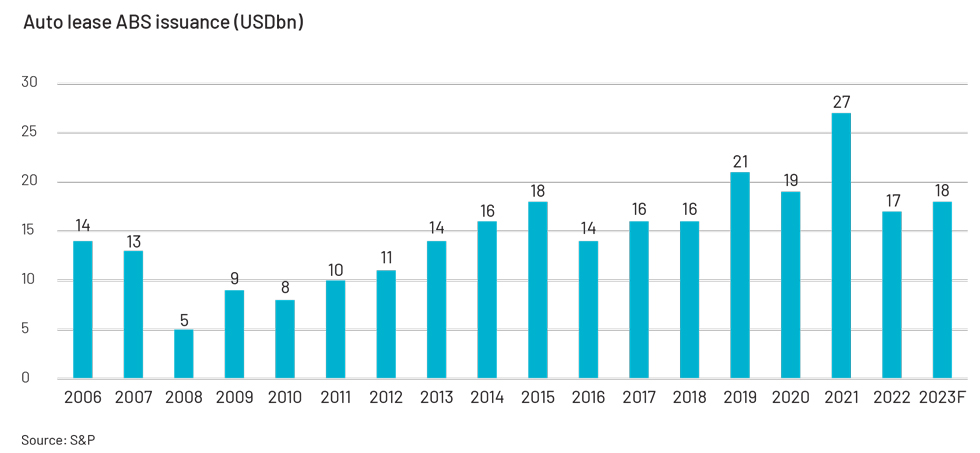

US structured finance issuance declined 24% y/y to USD595bn in 2022, with most asset classes recording a deterioration in performance. US auto lease ABS issuance declined by a significant 37% y/y to USD17.2bn in 2022 owing to production challenges stemming from chip shortages, leading to low new-vehicle inventory and a lack of incentives.

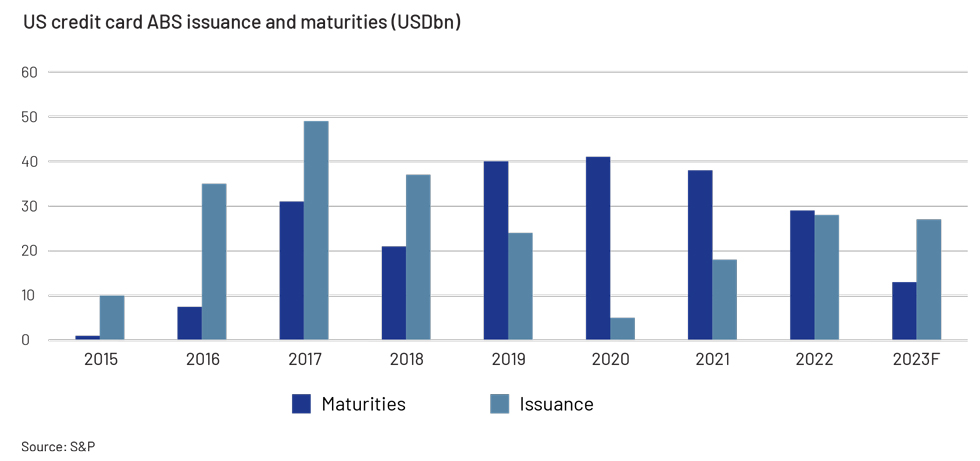

US credit card ABS issuance grew a significant 62.7% y/y to c.USD29.3bn in 2022 (in line with maturities of USD29.5bn) on the back of the relative funding advantage, driven by the prevalent high interest rate regime and high cost of deposits.

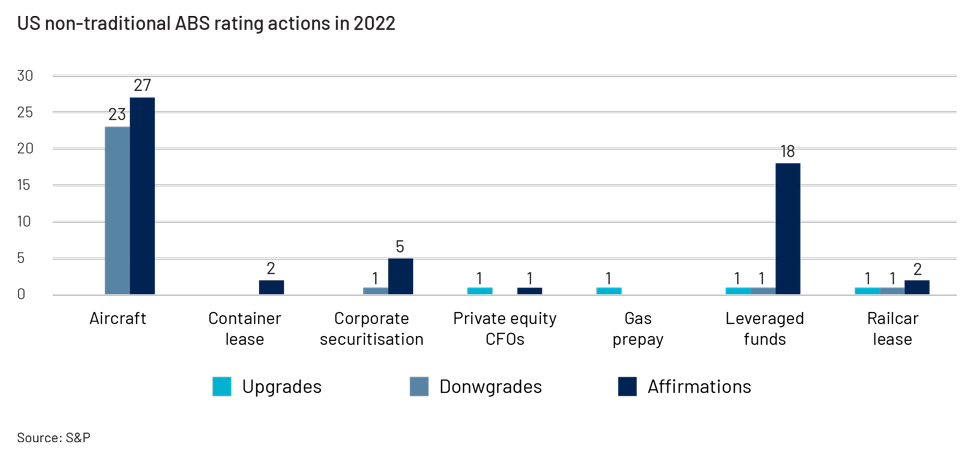

US non-traditional ABS origination volumes declined in 2022 owing to adverse market sentiment but are likely to pick up again in 2023 on the back of stable ratings, investors’ need for diversification and high yields. Rating action in 2022 remained stable across most sub-sectors.

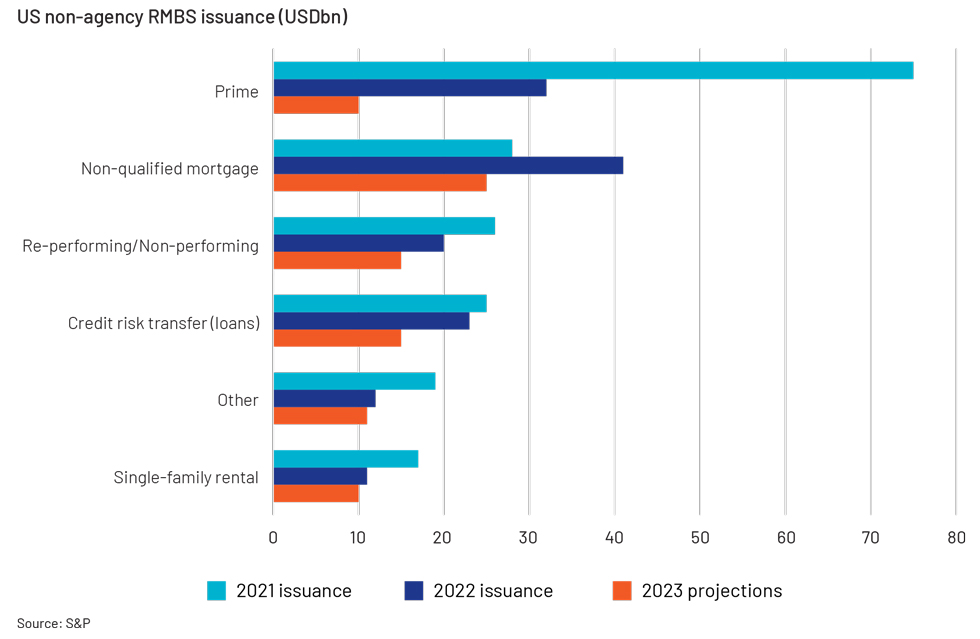

Non-agency RMBS issuance in the US stood at c.USD140bn in 2022. Strong growth in 1H22 was followed by a nose-dive in 2H22 owing to the rapid increase in rates.

To get more information of country-specific outlooks, download the complete insight paper.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is well positioned to support structured finance markets. We are a leading provider of high-value research, analytics and business intelligence to the financial services sector. Acuity’s lending services combine subject-matter and delivery expertise with domain-specific technology, offered through its proprietary suite of Business Excellence and Automation Tools (BEAT). We conduct

(1) credit reviews of relevant specialpurpose vehicles (and originators of non-ring-fenced transactions)

(2) detailed periodic analysis of covenant compliance, as laid down by the respective credit agreements

(3) financial spreading

(4) cover validations to monitor fluctuations in the asset base of the borrower

(5) borrowing base reviews to ensure client compliance with borrowing conditions

(6) collateral monitoring to analyse the composition of underlying collateral

(7) granular exposure analysis

(8) sub-portfolio reviews

(9) appropriate pricing of structured products via product-tailored risk ratings.