Published on June 7, 2022 by Rajarshi Maulik

There are c.344 banks in the UK; they include international and private banks, and 52 building societies, with the Financial Conduct Authority the regulatory body. These are slowing moving away from the brick-and-mortar form of banking, leading to steady growth in online and mobile banking in recent years. Having displayed resilience amid the pandemic-induced challenges, UK banks are now in a healthy position, witnessing an uptick in mortgage lending, in an environment where interest rates are likely to rise in the short to medium term.

Corporate credit picked up last year as corporates took advantage of government-guaranteed loans at very low rates to build up liquidity. On the other hand, retail banks are well capitalised, partly due to ring-fencing in the investment banking space.

However, from a funding perspective, effective from 1 January 2019, banks with an average of GBP25bn in core deposits for more than three years are required to place these deposits in a ring-fenced bank. This has resulted in additional transition costs and temporary operational risks for banks. Significant uncertainties still remain after Brexit and the EU-UK Trade and Cooperation Agreement, with the EU being its largest trading partner, accounting for around half of the country’s total exports. Nevertheless, the UK banks have solid capital buffers and strong liquidity to support economic growth.

Asset quality could face challenges in 2022 due to diminishing fiscal support

The UK banks have conservative risk appetite with more focus on core banking. High-street banks have completed business restructuring after spinning off non-core banking activities in recent years and now have tight control of balance sheet growth to contain risk-weighted assets (RWAs).

Although UK banks’ asset quality is strong, it is expected to deteriorate slightly in 2022 and 2023 as fiscal and policy support measures are withdrawn in 2023-25. We believe non-performing loans (NPLs) will increase due to the challenging operating environment but remain manageable, as most loans are secured. Improved pre-provision income, reduced loan loss provisioning and the excess capital buffers they have accumulated should help them overcome challenges.

Profitability is likely to benefit from an expected rise in interest rates

UK banks have a well-diversified business model, with low dependency on net interest income. In recent years, non-interest income, like fee income, has accounted for a sizeable portion of total operating income, providing a solid buffer against the interest rate cycle. Nevertheless, in light of the expected increase in interest rates, UK banks are likely to benefit from expansion in net interest margins and healthy growth in lending. UK banks charge interest rates on mortgage lending at a rate higher than the central bank base rate, allowing them to maintain margins on mortgage lending. However, spreads are expected to come under pressure from increasing competition in the market. Furthermore, the introduction of a minimum requirement for own funds and eligible liabilities would add to the challenge UK banks face in making good returns on equity.

Minimal impact from the Russia-Ukraine conflict

The UK’s direct exposure to Russia is limited, with trade between the two countries small relative to the size of their economies. The UK’s biggest exports to Russia are automobiles, machinery and appliances, whereas imports primarily comprise oil and petroleum products, and precious metals. Nevertheless, the conflict and the sanctions imposed by the UK and its allies could impact the UK economy indirectly.

An increase in the cost of living, partly due to growing energy and other import prices, is likely to test households’ flexibility across income distribution. Lower-income households, which spend mostly on energy and other essential items, would be more affected. Nonetheless, borrowers would still be able to maintain mortgage repayments, although their income resilience would be tested.

Effective fiscal management could offset downside risks

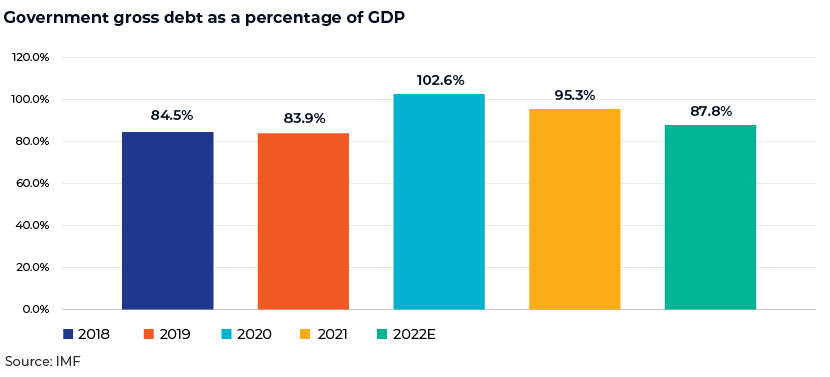

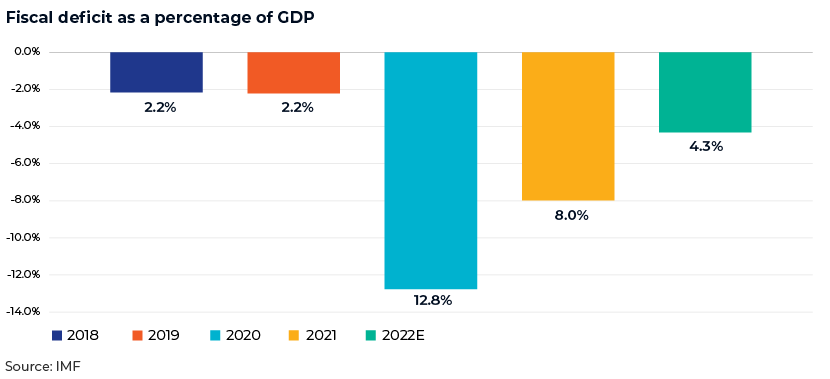

The UK is one of the major economies to implement a fiscal strategy to improve the sustainability of public finances after the pandemic. Measures to increase tax revenue, such as freezing the personal income tax allowance, introducing a new social and healthcare levy and increasing the corporate tax rate to 25% in 2023, would support the revenue-led fiscal consolidation, while facilitating higher medium-term expenditure. The fiscal deficit-to-gross domestic product (GDP) ratio declined to 8% in 2021 from 12.8% in 2020, according to the IMF, and is expected to reduce further to 4.3% in 2022. The UK’s public debt to GDP declined to 95.3% in 2021 from 102.6% in 2020 and is likely to decrease further to 87.8% in 2022, as fiscal support measures are diminishing.

A rapid economic recovery, evidenced by expected GDP growth of 7.4% in 2021 versus a contraction of 9.3% in 2020, was underpinned by the reopening of the economy after the lockdown in the first quarter of 2021, fast progress of the vaccination programme and the government’s wage and employment support mechanisms. However, challenges include uncertainties over the implementation and evolution of the Trade and Cooperation Agreement with the EU and acute labour shortages in sectors such as transportation and agriculture, exacerbated by a more rigid immigration regime.

Fiscal deficit as a percentage of GDP

How Acuity Knowledge Partners can help

Our Commercial Lending teams provide offshore support to banks by helping in the prudent underwriting of loans to large corporate, mid-corporate and SME customers. Our credit managers provide granular insight at the macro level and help banks’ credit risk teams identify potential risks in lending. Our team of experts have a good understanding of the UK banking sector, lending trends and the regulatory framework, and we currently support a number of large global banks in loan appraisal and portfolio monitoring.

Sources:

IMF – World Economic Outlook Database April 2022 – https://www.imf.org/en/Publications/WEO/weo-database/2022/April

https://www.expatica.com/uk/finance/banking/guide-to-banking-in-the-uk-291590/

https://www.bankofengland.co.uk/financial-stability-report/2021/december-2021

https://www.instituteforgovernment.org.uk/explainers/ukraine-war-uk-economy

https://www.bankofengland.co.uk/prudential-regulation/key-initiatives/ring-fencing

Tags:

What's your view?

About the Author

Rajarshi Maulik has 16 years of experience in commercial lending, investment banking and equity research. In his 9+ years at Acuity Knowledge Partners, he has worked with some of the largest banks in Europe. He is an expert in the Banking and UK housing sector and part of the commercial lending team at Bangalore delivery center.

Like the way we think?

Next time we post something new, we'll send it to your inbox