Published on February 9, 2022 by Anurag Sikder

2021 has been a year of recovery, albeit gradual, from turbulent times. With markets witnessing a certain degree of stabilisation and returning to sustained growth, asset managers have shifted their focus to capitalise on this reinvigoration. While overall performance has been promising, an underlying problem has come under scrutiny in recent years: fund distribution and costs. Traditional ways of reaching potential customers had been challenged well before the COVID-19 outbreak. The emphasis on adopting modern marketing methods as a cost-effective approach is changing the global fund distribution landscape. Even though many wealth managers had the opportunity to develop deeper relationships during the pandemic through more one-on-one interactions, bigger firms and advisors are increasingly preferring a cost-effective digitised strategy.

2022 might just see the start of a significant change in global fund distribution strategies. A 2020 study by Deloitte suggested that although private banks remained the top preference for distribution globally, US and European markets were slowly increasing their investment in direct-to-consumer efforts. Private banks are currently near the bottom of the list in these two regions. If the trend continues, the whole ecosystem of fund distribution might be set to undergo a major shift.

With that in mind, here are some of the possible trends to look out for in 2022:

-

The B2B2C model will possibly enter its twilight years

The traditional business-to-business-to-consumer (B2B2C) wholesale model—where asset managers market their funds to financial advisors, who then sell products to investors—is being challenged. Distribution has become far more complex with the rise of technology-based solutions. This threatens the multi-tiered approach to reaching the end consumer, i.e., the investor. While the relevance of financial advisors remains almost untouched, their role in decision making depends on how much value they add to the process. Given this, financial advisors must be equipped with the following:

-

Value propositions based on the individual profiles of end investors

-

Simple, on-demand access to insights and performance data

-

Demography-related data that investors would be unable to capture independently

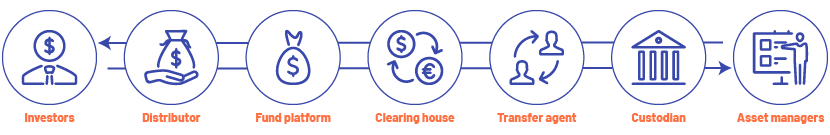

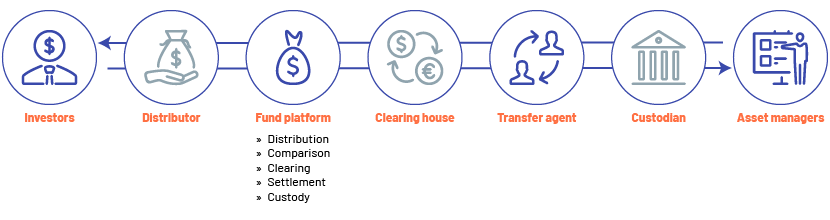

These, coupled with demand for the simplification of access to relevant information, are leading to forced attrition of stakeholders. The resultant divestment from fund managers can facilitate the investments in technology required to stay up to date with the latest developments. In addition, as a new generation of investors takes over from the previous one, they demand greater degrees of transparency and ease of access. This is hampered when there are multiple stakeholders between the asset management company and the end investor. In essence, simplification will lead to attrition, which will in turn lead to ease of access.

-

-

Intermediaries will explore new business models:

The rule of seven in marketing states that a potential customer must see a message at least seven times before they are driven to take action. For many intermediaries, this might prove to be a daunting challenge in the years to come.

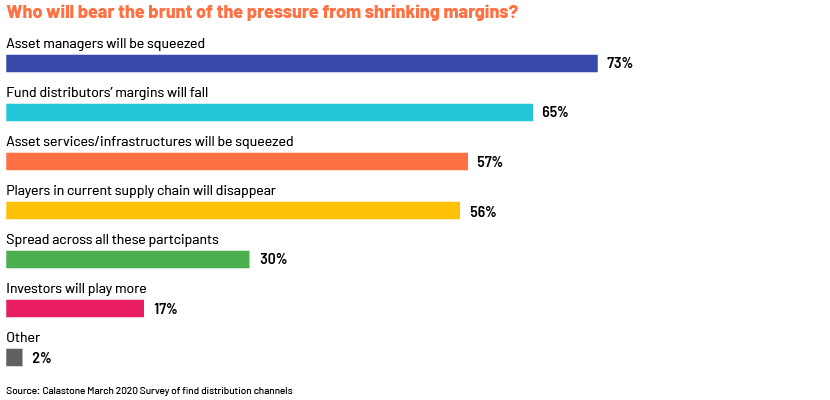

Amid digital adoption, optimisation of fund returns by managers and shrinking supply chains, intermediaries in the fading B2B2C model have been looking for innovative solutions as the market becomes tighter. A survey of fund distribution channels conducted in March 2020 by Calastone found that in five years, individual fund platforms and the direct-to-consumer distribution channel would gain the highest in popularity, with banks trailing in third place.

With the rise of distributed ledger technology and artificial intelligence, the need for sound, detailed investment advice could become the main focus area for these intermediaries. Investor education services could be another untapped area for exploration. Given the key role that social media plays in disseminating financial education to the masses, this might be an area for intermediaries to capitalise on.

-

Widespread adoption of technology for security and engagement

According to the 2021 KPMG CEO Outlook Pulse Survey of the asset management sector, 58% of the CEOs interviewed believed that, in the long run, customer engagement would be conducted predominantly through virtual platforms. As financial advisors, who collaborate with asset managers to sell their funds, demand higher pays for high-quality services provided to investors, the call to revamp the fund distribution model to one focused on digitalisation is taking centre stage.

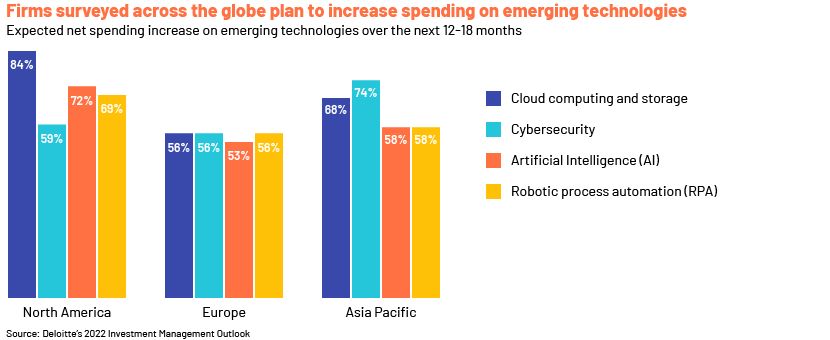

In fact, according to Deloitte’s 2022 Investment Management Outlook, one of the reasons 57% of US equity managers were not able to achieve 1-year alpha on absolute returns was the lack of digital transformation to create a credible brand story, which resulted in lags in their planned growth in assets under management.

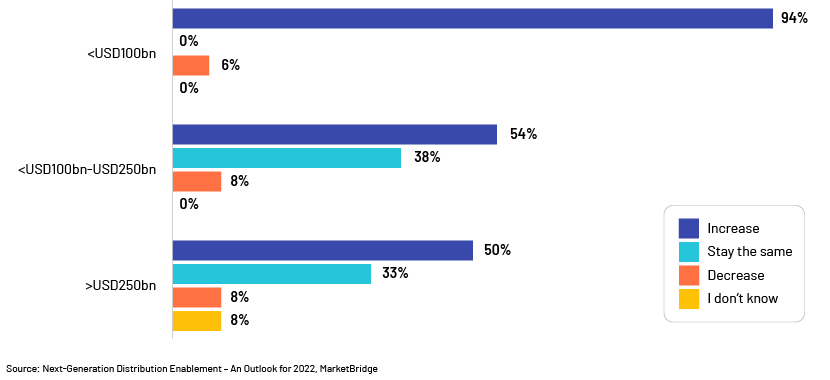

As Boomers and Generation X give way to Millennials and Generation Z, the typical investor profile has been undergoing a marked change. Asset managers around the globe are taking note of the growing influence of technology, particularly the growing preference for reduced in-person interaction and improved digital communication. This is especially true when it comes to lead conversions and client interactions and has led to a substantial increase in investments in digital distribution enablement. According to MarketBridge’s Next-Generation Distribution Enablement Outlook 2022, all firms surveyed appeared optimistic about increases in distribution enablement budgets, with 28% of the firms expected to increase spending by more than 10% over the outlook period.

-

Extensive customisation of customer experience will be key to retention and loyalty

People worldwide have become increasingly willing to share personal details on various platforms, and they do so to receive a certain degree of personalisation from those who collect that information. To capitalise on this growing trend and deliver an experience worth remembering, market segmentation and lead profiling have become more important today than ever before. Asset managers must gear up to provide on-demand content to a burgeoning customer base.

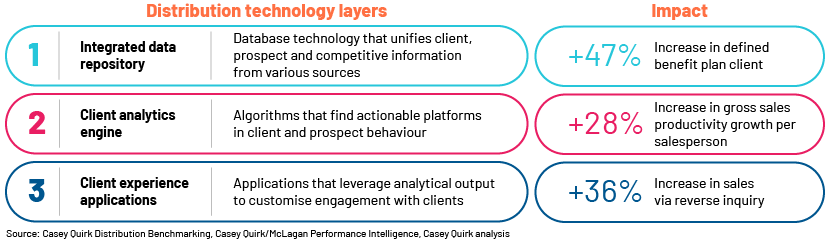

Organisations can realise increases of up to 36% in sales via reverse enquiries by leveraging technology-driven platforms such as client experience applications. By providing clients customised experiences, organisations have already been experiencing increasing sales driven by customer queries. As organisations grow their investments in digital distribution enablement, building capacity for client data and profile analysis will be essential for the success of transformational investments in fund distribution.

-

Acquisitions will focus on boosting overall agility

In MarketBridge’s Next-Generation Distribution Enablement 2022 Outlook, 55% of respondents surveyed believed that improving business agility and adapting to changes in the market remains a top challenge. Furthermore, distribution enablement for the future would rely on agile innovation and execution at scale. Only these can enable an organisation to adapt to continuing changes in customer behaviour and deliver the required improvements in productivity.

In today’s fast-moving world, asset managers have developed an appetite for acquisitions to accelerate their organisations’ ability to facilitate the digital enablement process. According to KPMG’s 2021 CEO Outlook Pulse Survey, 86% of asset management CEOs are inclined towards mergers and acquisitions, and the most common reason for this preference was to on-board new digital technologies to transform customer experience.

How Acuity Knowledge Partners can help

Our Fund Marketing Services arm offers a suite of services in the fields of marketing, reporting, competitor analysis, digital marketing, investment analysis and commentaries. We combine the knowledge of our well-qualified subject matter experts with our expertise in various third-party research and analytics tools to provide our clients the necessary insights to make the right decisions. Given our extensive experience in the reporting space, we have also been able to adapt to changes to regulations that impact distribution methods and associated marketing materials. We leverage our fund management specialists’ rich and extensive experience, built over the years through collaboration with leading global investment management firms, to help asset managers remain agile and adept.

References

https://www.funds-europe.com/calastone-march-2020/distribution-channels

https://www.ssctech.com/blog/what-is-the-future-of-distribution-for-asset-management-organizations

https://advisory.kpmg.us/content/dam/advisory/en/pdfs/2020/how-asset-manager-can-transform.pdf

https://advisory.kpmg.us/articles/2020/how-asset-managers-can-transform-distribution.html

https://assets.kpmg/content/dam/kpmg/xx/pdf/2021/06/ceo-outlook-pulse-survey-asset-management.pdf

https://www.broadridge.com/_assets/pdf/broadridge-the-retail-distribution-playbook.pdf

https://www.cross-border.lu/assets/2020-fund-distribution-industry-survey.pdf

https://www.cross-border.lu/assets/2020-fund-distribution-industry-survey.pdf

Tags:

What's your view?

About the Author

Anurag Sikder has over 13 years of experience in producing content for a wide range of industries. At Acuity, Anurag leads a range of different teams providing qualitative insight for numerous sectors in the form of market reports, white papers, thought leadership pieces, and commentaries.

Like the way we think?

Next time we post something new, we'll send it to your inbox