Published on September 5, 2025 by Dishant Maheshwari and Ayushi Jain

In a world brimming with investment options, thematic exchange traded funds (ETFs) have captured the interest of many opportunistic investors. Opportunities lie where there are chances of progress, growth and innovation. What if you could be a part of these solutions and opportunities that will be tomorrow’s problem solvers and could invest in long-term trends? Thematic ETFs are one such avenue that identifies these trends and enables you to align your portfolio with rapid advancements, evolving consumer demands and ongoing environmental changes.

Why thematic ETFs

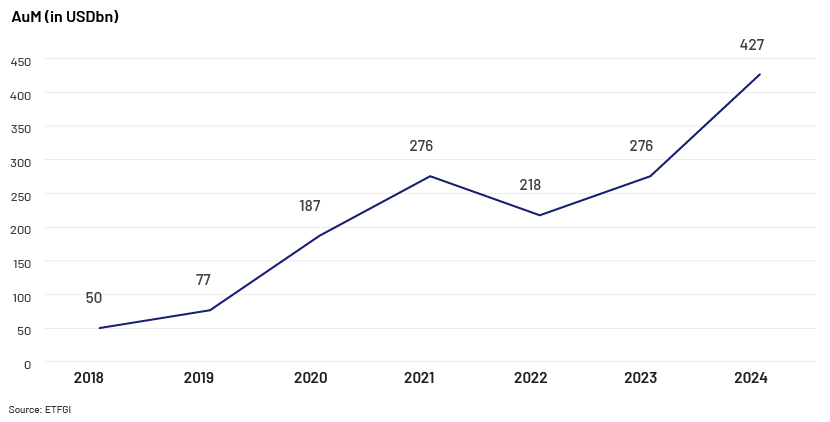

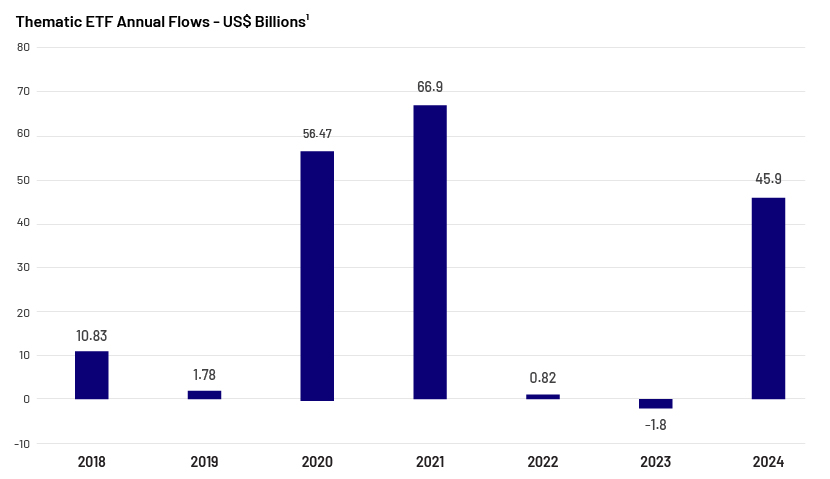

Persistent fundamental shifts in the macroeconomic environment, the need for unconventional and non-traditional return drivers and a move towards more personalised and socially-conscious investing have fuelled the rise of thematic ETFs. This is evident from the strong flows that propelled assets under management to USD427bn in 2024 from a modest USD77bn in 2019.

This growth can be attributed to several factors: the popularity of ESG investing, boosting thematic fund demand, the polarisation of growth, the growing irrelevance of traditional sectors and geographic breakdowns, improvements in data and increased access to financial markets.

Recent trends in thematic ETFs

Thematic ETFs have gained in popularity, globally tapping themes across technological innovation, environmental and social change, and demographic shifts. Their growth since the pandemic has been significant, with multiple emerging themes; “technological shifts” had the largest AuM, of USD273bn, as of February 2025.

However, different themes have dominated different regions, resulting in differing needs and advancement.

US:

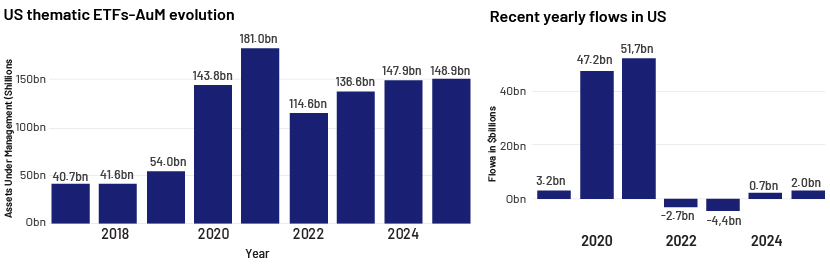

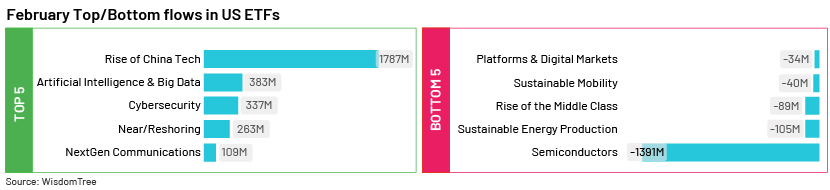

The US thematic ETF universe has grown by more than 3x since 2018, with AuM reaching USD148.9bn in 2024 from USD40.7bn in 2018. Consequently, the US witnessed strong flows of approximately USD2bn in February 2025, despite the weak market performance, compared to negative flows in 2022.

In terms of key trending themes as of February 2025, technological shifts that included “China tech” witnessed the highest inflows, followed by “AI big data” and “cybersecurity”. Semiconductors, followed by sustainable energy production, saw the most outflows during the month, signalling a gradual shift of hardware and sustainability towards the AI space.

Europe

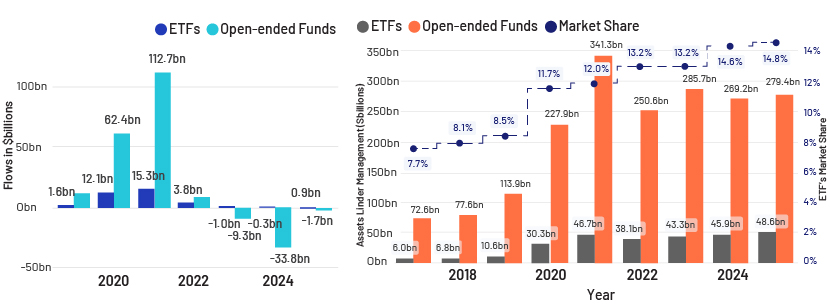

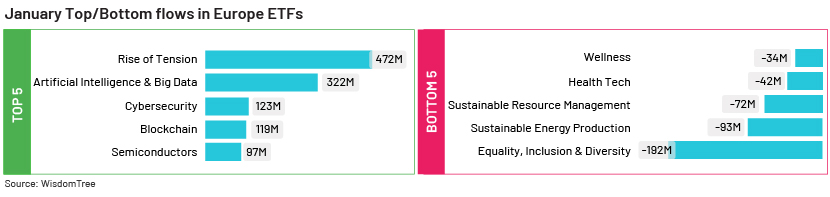

The European thematic ETF universe has grown more than 8x since 2018, with AuM reaching USD48.6bn in 2024 from USD6bn in 2018. Consequently, Europe witnessed flows of approximately USD869m in January 2025, compared to negative flows for open-ended funds.

In terms of key trending themes in Europe as of January 2025, technological shifts that included “AI” were the largest theme, surpassing the historically largest “environmental pressures” theme. However, the “increasing tensions” theme witnessed the largest inflows in January 2025 due to rising defence budgets. Conversely, “equality, inclusion and diversity” witnessed the highest outflows over the period due to changes in policies of the Trump administration.

Asia Pacific

The Asian thematic ETF universe witnessed sharp growth in flows in 2024, with inflows of USD45.9bn versus USD1.8bn in negative flow in 2023. Flows have grown significantly since 2018, indicating an increase in thematic ETFs in the region.

In terms of key trending themes in Asia, “digital future” saw the highest flows; this included AI and robotics. This was followed by master limited partnerships (MLPs), nuclear energy and banking. Conversely, biotechnology and healthcare saw the least engagement owing to a decline in vaccine use after the pandemic.

Returns/performance of ETFs

| Top five | |||

| Theme name | 1 year | 3 years | 5 years |

| Defence tech | 35.45% | ||

| E-commerce | 30.69% | 0.34% | 8.91% |

| Millennial consumer | 27.10% | 2.11% | 11.97% |

| AI and technology | 24.11% | 7.04% | 17.03% |

| Fintech | 23.37% | -7.45% | 1.92% |

| Bottom 5 | |||

| Theme name | 1 year | 3 years | 5 years |

| Cleantech | -35.85% | -26.51% | |

| Hydrogen | -32.66% | -39.18% | |

| Solar | -31.00% | -26.91% | |

| Renewable energy producers | -22.08% | -16.59% | -8.60% |

| Lithium and battery tech | -19.27% | -20.61% | 9.26% |

Number of thematic ETFs and global players

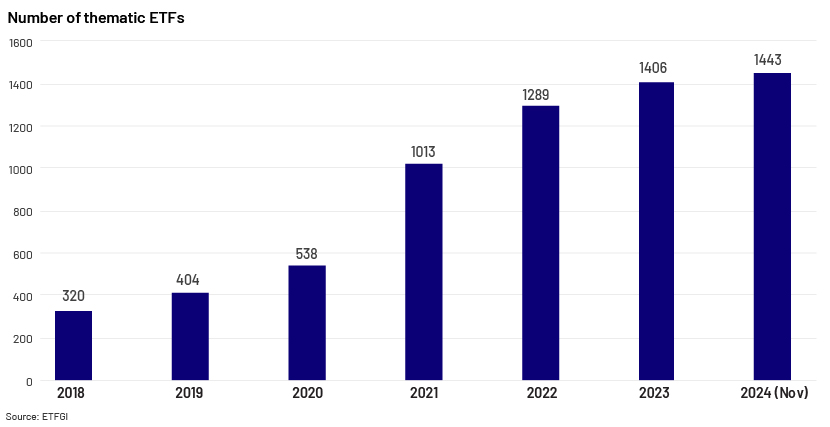

Approximately 1,400 thematic ETFs were listed globally from 271 providers in 38 countries as of November 2024. This is a 4x increase from 2018, when only 320 ETFs were listed.

Top five thematic ETFs by net new assets, November 2024

| Assets (USDm)Nov-24 | NNA (USDm)YTD-24 | NNA (USDm) Nov-24 | |

| Global X U.S. Infrastructure Development ETF | 9,715.20 | 1,885.87 | 480.95 |

| HuaAn ChiNext 50 ETF Fund | 4,209.19 | 953.39 | 366.48 |

| iShares Global Infrastructure ETF | 5,008.89 | 677.12 | 321.80 |

| Global X MLP & Energy Infrastructure ETF | 2,499.59 | 894.73 | 236.87 |

| VanEck Uranium + Nuclear Energy ETF | 750.47 | 548.06 | 236.40 |

Conclusion

Thematic ETFs offer a unique opportunity for investors to tap into emerging trends and potentially achieve high returns. These ETFs focus on specific themes, such as technology, sustainability or healthcare, enabling investors to support companies driving innovation and change. However, it is important to be aware of the risks associated with thematic ETFs, including concentration, volatility, regulatory challenges, liquidity issues and higher fees. By incorporating these investments into a diversified portfolio, investors can help mitigate some of these risks.

The concept of thematic investing is not new. Certain types of stocks have thrived historically due to major political or economic shifts. Thematic investing has evolved with the rise of thematic ETFs that track different themes and trends.

Unlike sector-based ETFs, thematic ETFs are not limited to a specific sector. They take a broader approach, tracking an index designed to capture the potential upside of a theme. For example, an electric-car ETF might heavily weight big-name electric car manufacturers and traditional car companies investing in electric technology. It could also include companies involved in lithium extraction for batteries and infrastructure firms developing car-charging points.

Predicting which theme will outperform in the future is challenging. Investors should consider the possibility that a theme may be a short-lived fad. Public interest in new technologies or themes can be fleeting, as seen with the rapid rise and fall of interest in blockchain and cryptocurrency in 2017. While thematic ETFs are less likely to experience such extreme scenarios, the fickle nature of public interest is worth considering.

How Acuity Knowledge Partners can help

We empower our clients with a comprehensive suite of services designed to enhance their marketing efforts and deepen their market understanding. We provide tailored marketing collateral, performance comparisons, newsletters and in-depth research to meet their specific needs. A key area of our expertise lies in competitor research, particularly within the ETF space. We conduct thorough analyses to identify market trends, competitor strategies and potential opportunities. We also help clients create standard templates for compelling performance comparisons, insightful commentaries and engaging blog content, ensuring consistent and effective communication with their target audiences. We understand the complexities of the ETF market and equip our clients with the knowledge and tools needed to succeed.

Sources:

What's your view?

About the Authors

Dishant Maheshwari, a Senior Associate at Acuity, has over 7 years of experience. He has worked in various roles, including commentary writing, competitor research, and fund analysis. Currently, he is a Subject Matter Expert (SME) in market research and fund analysis, with extensive knowledge of numerous databases. Dishant holds a degree in Mechanical Engineering from Gujarat Technological University, an MBA from Sardar Patel University, and has passed Level 1 of the CFA program

Ayushi Jain is an Associate at Acuity with over five years of experience in various roles, including commentary writing, competitor research, and fund analysis. Currently, she serves as a Subject Matter Expert (SME) in market research and fund analysis, leveraging her extensive knowledge of numerous databases. Ayushi holds a Bachelor of Commerce from Mumbai University, an MBA from Rustomjee Business School, and is a Chartered Wealth Manager certified by the American Academy of Financial Management®. Additionally, she has successfully passed Level 1 of the CFA program.

Like the way we think?

Next time we post something new, we'll send it to your inbox