Published on August 1, 2022 by Kanchana Attidiya

International trade has grown significantly since the start of the pandemic in March 2020 that resulted in geopolitical instability and uncertainty. It was recorded at USD28.5tn in 2021, a notable increase over previous years, and is expected to grow 5.4% in 2022.

Letters of credit (LCs) are the most reliable and safest trade tool used in international trade. Reliance on LCs has been increasing on growing trade and the underlying trade disputes. LCs offer a win-win situation for importers and exporters: reasonable payment terms to importers and security and guarantee of payment to exporters.

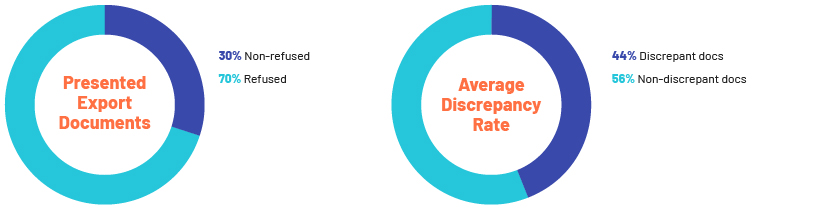

Despite these benefits, LCs have their challenges. Around 70% of the trade documents presented for payment are rejected owing to non-compliance with LC terms, according to the International Chamber of Commerce (ICC). The average discrepancy rate for export documents stands at 56%.

Challenges for banks

-

Inadequate and inappropriate information in LC applications

-

Improper or omitted details in export documents with LC terms

-

Hiring and training cost of trade experts

-

Need to improve operational efficiency in trade process

-

Need to streamline operational standards

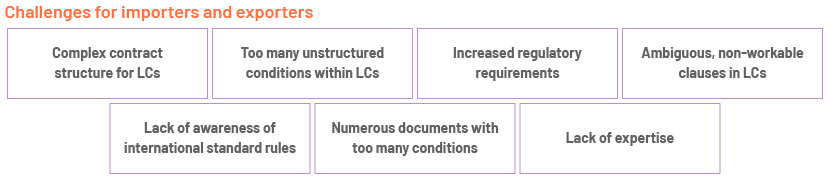

With the emergence of new trade solutions, a new platform being used to address these challenges is in-house trade advisory services. However, there is little progress in reducing discrepancy rates, improving clarity from LC advising banks and amending LC terms.

These challenges have a number of repercussions, necessitating a more thorough and careful examination of trade contracts, LC terms and export documents. A number of importers and exporters are also seeing the need to rely on expert knowledge to manage their growing global businesses. Repercussions of the challenges mentioned above include the following:

-

Misinterpretation of LC terms

-

Non-compliant presentations

-

Increased lag time

-

Delay in delivery of goods to importers

-

Delay in payment to exporters

-

Increasing bad debts in export portfolios

A number of banks have been working with Acuity Knowledge Partners to achieve the following:

-

Increase lead time in LC and export document scrutiny process

-

Increase business volume by freeing up time of costly resources to handle more-value-added tasks and deploying low-cost skilled labour

-

Maintain quality service standards amid business volume growth

-

Obtain consultancy services of a panel of technical experts

-

Optimise and save operating costs, increasing profitability

How Acuity Knowledge Partners can help:

We provide holistic solutions to importers and exporters.

Key benefits

-

Leverage our trade finance specialists’ expertise to grow and manage your clients’ trade functions smoothly

-

Reduce time and operating costs while improving efficiency of the trade workflow process

-

Ensure timely presentation of accurate documents, enhancing the efficiency of the LC issuance and document examination processes

-

Leverage our document specialists’ expertise to ensure presentations are compliant and improve cash flow

-

Leverage our MIS expertise at every step of the trade transaction

-

Improve lead time with authorities, banks and agencies

-

Reduce costly delays and non-delivery of goods to importers

References

ICC Global Survey on Trade Finance

LC Market Intelligence by DC- PRO 2005 – export document discrepancy rate

ICC reports

Tags:

What's your view?

About the Author

Kanchana Attidiya is an accomplished banker with over 17+ years of experience in International Trade Finance, Credit, and Treasury. She holds Postgraduate Diploma in Business & Finance Administration from ICASL, BSc ( Mathematics, Statistics & Computing) from the University of London ( Ext), and is certified in CDCS.

She is passionate about personal research on trade innovations, current trends, and new solutions for the challenges in trade.

Like the way we think?

Next time we post something new, we'll send it to your inbox