Published on June 22, 2023 by Jasleen Kaur

Think progress! Think a strong and effective political landscape!

A good democracy is the result of power exercised by the people rather than the representatives of a nation.

Neil deGrasse Tyson was quoted as saying, “I dream of a world where truth shapes people's politics instead of politics shaping what people believe to be true.” This qualitatively defines the notions or faith that makes a society fair, including democratic decision-making through transparent and fair elections, freedom of speech, equality before the law, social justice, economic freedom and political tolerance. A commonwealth is established only when elections are free from money, muscle power and malpractice. After all, what the common man wants is economic growth and a good standard of living.

In the gruelling race to the top of the vote bank, socialists ride political campaigns to generate large contributions.

Political contributions generally refer to any donation, subscription, loan, advance, deposit or allotment of money, or anything of value, given or transferred by one person to another, including in cash, by cheque, by bank draft, through a payroll deduction or allotment plan, by pledge or promise, with the intention of influencing the outcome of an election. This definition includes pledges and promises that are legally enforceable. Such donations are used by political parties to fund their campaigns and cover election-related expenditure, either in favour of or in opposition to the election of a candidate of a certain party, whether directly or indirectly.

Understanding political contributions, also referred to as political finance, is governed by several regulations, with all related data maintained by the International Institute for Democracy and Electoral Assistance (International IDEA). Since its creation in 2003, this database of regulations relating to political finance has grown to become the world's most comprehensive repository of data on the subject. It is an exhaustive database that covers a wide range of topics, including misuse of public resources and campaign funding. It is updated in a timely manner and provides current information on regulations for around 180 countries. The IDEA database provides answers to 43 distinct queries on matters relating to political financing, segmented as follows: regulations/sanctions on (a) income, (b) expenditure and (c) disclosures and enforcement. These divisions are explained and further divided in the database.

Allied candidates leave no stone unturned when it comes to collecting contributions, but they are restricted by directives such as the Federal Election Campaign Act (the Act) in the US and the Political Parties, Elections and Referendums Act 2000 (PPERA) in the UK. Regulations governing contribution ceilings of a candidate's campaign are examined carefully by the Election Commission. All contributions are subject to limitations, except those the candidate provides with their own finances.

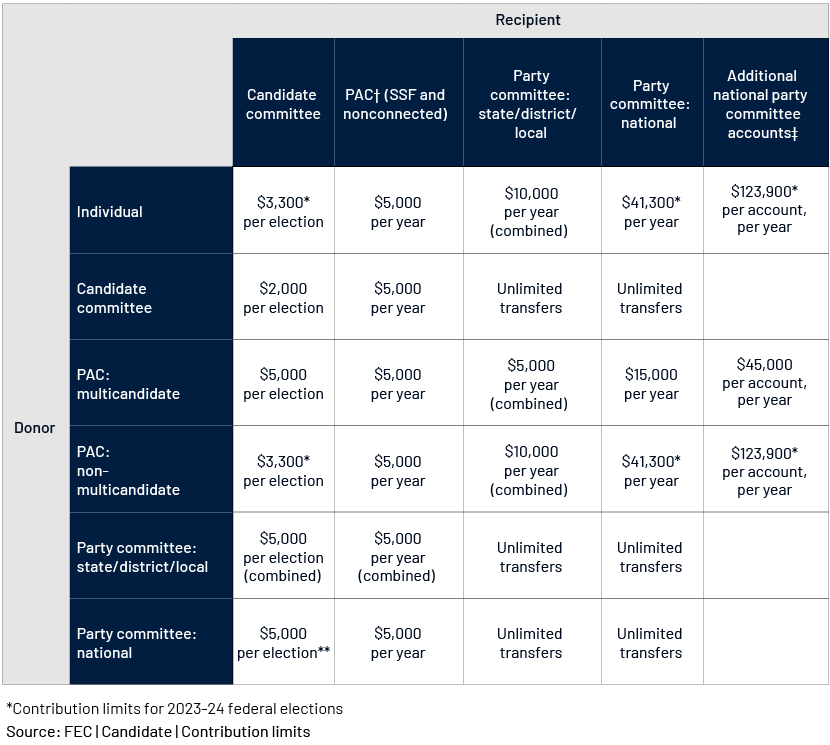

The table below provides a glimpse of political contributions to committees, according to the Federal Election Campaign Act:

It is important to remember that a campaign is prohibited from retaining contributions that exceed the limits. Special procedures for handling such funds should be followed, seeking reallocation of funds within 60 days of such disclosure.

The Political Action Committee (PAC) is a committee that makes contributions to other federal political committees. Super PACs (the modern definition of a Political Action Committee) are mavericks, independent-expenditure-only political committees that raise and disburse limitless funding from businesses, unions and individuals to influence the outcome of elections.

The advent of super PACs signalled the beginning of a new era in politics where the results of elections would be influenced by the large sums of money injected into them.

Under the PPERA, too, there are strict controls in terms of which political parties can accept donations and loans. A political party would need to appoint a registered treasurer who ensures all donation-related guidelines and rules are followed across the party – rules such as maintaining appropriate accounts and records for all donations and loan transactions and reporting them in a timely manner to the Electoral Commission. If a party accepts a donation over GBP500, it must record all relevant details, such as from where it was received, which section of the party received it and when it was received. Sources from which donations can be received include the following:

-

Individuals on the UK electoral rolls (including overseas voters and those who have left their property)

-

A UK incorporated company that conducts business in the UK

-

A political party registered in Great Britain

Third-party funding is also regulated. A third party could be an entity or individual (not a political entity or a member of the House of Representatives) who incurs/offers to incur any election expense that exceeds the disclosed/allowed limit for that year and is lower than the threshold that would require registration as a political campaigner. Regulations in certain countries include the following: Australia – provide an annual report to the Electoral Commission and comply with restrictions on foreign donations. Canada – a third party cannot make donations totalling more than CAD350,000 on partisan activity expenses. Spain – third parties are banned from campaign spending.

Additionally, third parties such as big corporates and market makers make large donations, as they provide strong brand recognition; a company that contributes more than USD100,000 in a single reporting period is referred to as a substantial donor. This also affects its position in the stock market as its elected president chooses economic advisors, fills key roles including those of the head of the Federal Reserve and influences businesses favourably through directing economic policies and interest rates (which are established by the Federal Reserve).

Indirectly, however, such political actions affect the bottom lines of corporates. Investors will take note of corporates making large political donations and are more likely to buy the stocks of such corporates. Such benefaction boosts a corporate’s brand recognition through media and advertising at the time of elections, helping it attract more investment and increasing consumers’ trust in its products.

This participation also enables them to remain informed about and active in political and regulatory processes that could have an impact on their business, sector supply chain and trade in general. This indirect effect is illustrated in bank stocks. After Donald Trump was elected president, their prices soared, because of increased investment. This was because one of the top strategies of his political regime was to support the deregulation of banks, improving their financial performance.

Large corporate lobbyists that donated to election objectors even after condemning votes against certification in 2021 were the National Beer Wholesalers Association (PAC; USD904,000*), the National Automobile Dealers Association (PAC; USD829,500*) and American Bankers Association (PAC; USD779,000).

However, in recent years, shareholder proposals to invest in a company have also depended on regulatory reports on corporate political activity; demand for such reports on political contributions grew from 25%* in 2018 to 40%* in 2020. These reports include disclosure of political contributions and whether they were above the specified thresholds. Several companies have been criticised for donating to contenders who resisted US certification laws for their benefit. Several corporates have indicated that they are suspending political handouts altogether. Board members are increasingly scrutinising such donations, as they believe these could lead to material risks for companies, including reputational risk and other risks that could arise from the intricate legal, governmental and compliance issues connected to corporate political spending and lobbying activities, whether direct or indirect (through trade associations). Companies that participate in political activities should establish sound procedures and disclose these so as to direct their activities and reduce risks. These procedures should include effective board oversight.

Companies are under pressure from shareholders, customers, employees and regulators to align their political influence with their stated values. For instance, nearly 81% of Netflix shareholders demanded at its June 2021 annual meeting that the company reveal its political donations for the sake of transparency. In such an environment, corporate political spending is receiving more attention, and issuers are advised to carefully review their political funding disclosures and policies in a timely manner.

How Acuity Knowledge Partners can help

We are proficient in providing global compliance services to various segments of the market. In terms of upcoming elections, we provide expertise in code of ethics and regulatory compliance regarding disclosure of political contributions in a timely, specified and transparent manner and assist clients to make piecemeal compilations of government or official records. We also help clients make disclosures that are easy to understand and easily accessible so investors can quickly see how a company’s political actions help strengthen its market standing.

-

We assist in compliance with regulatory policies relating to timely and quality corporate disclosure The Political Contribution Disclosure Form requires disclosing the purpose of the company's political contributions, participation in lobbying efforts and trade associations, how this activity can help the company’s strategy of encouraging public participation, the company's regulatory and legislative priorities and the board's oversight procedure for monitoring political activities. We also help establish a risk intelligence system and verify the background-check system used to conduct due diligence on annual executive political contribution data. This would also include whether the company has formed a PAC; how this committee’s decisions on such spending further the aims of the firm’s political activities; board approval or oversight required on dues exceeding pre-set thresholds on trade collaboration partnerships; whether the company has analysed the consistency between stated, material policy positions and those of its significant trade associations and if material inconsistencies existed, how those were addressed.

-

We also help conduct due diligence on exchange of gifts and entertainment (G&E) and surveillance. We assist in formulating proper reporting methodology relating to G&E logs in line with policy, specifying any pre-approval requirements and recording/reporting expectations, and in complying with regulations of the SEC, FINRA, FCA and other regulators in order to avoid large fines and reputational loss in the event of policy breach.

Sources:

-

How Is the Stock Market Impacted by Politics? – ARQ Wealth Advisors

-

https://accountable.us/projects/corporate-donations-tracker/

-

https://corpgov.law.harvard.edu/2021/02/03/corporate-political-contributions/

-

https://www.politico.com/news/2021/11/30/corporate-disclosure-political-giving-523514

What's your view?

About the Author

Jasleen has 6+ years of experience in Corporate Compliance and Asset Management. She has previously worked with BlackRock, Inc. She is an analytical and detail-oriented professional, focused on making sure proper compliance procedures for code of ethics and relevant disclosures are met as per the policies specified by SEC. At Acuity Knowledge Partners she is part of the Corporate Compliance team and specializes in compliance of Code of Ethics. Jasleen is an CFA from ICFAI, Tripura University.

Like the way we think?

Next time we post something new, we'll send it to your inbox