Published on May 28, 2018 by Chinmay Pednekar

Imagine a world where fund-raising is instantaneous and raising capital isn’t a laborious and long drawn out process that requires interacting with multiple stakeholders in the capital market value chain. Securities are credited to investors at the very instant money gets debited from their accounts. Protocols like KYC and AML are a folklore because the system can track the source of funds down to the last penny. Utopian? Not quite. In fact, it may be a lot closer into the future than you think.

The storage and validation of datasets that establish ownership and financial obligations form the core of today’s capital market operations. Currently, capital market institutions use a bewildering myriad of systems for data capture and storage, which inherently requires continuous data reconciliation. This underlying inefficiency results in duplicacy of efforts and, consequently, increased costs. While trading efficiency is measured in fractions of a second, post-trade settlement still occurs at T+3 and requires brokers, clearing houses, custodians, and exchanges to undertake overlapping business functions. It is in these contexts that Blockchain technology could revolutionize the way financial institutions generate, store, and verify data, driving a long due structural overhaul.

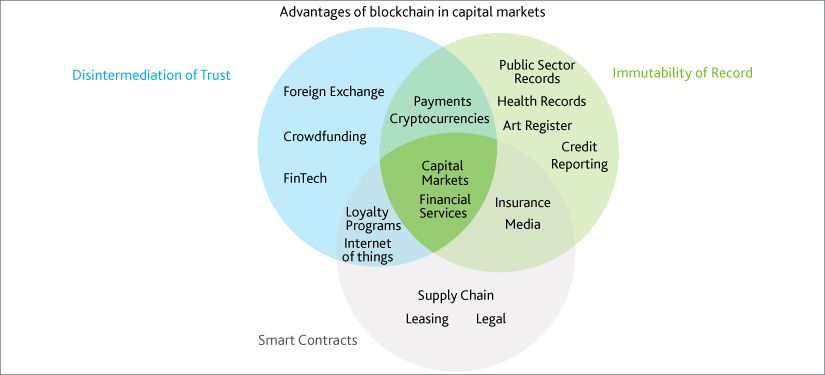

Blockchain is a digitized and decentralized public ledger that allows participants to store cryptographically encrypted data sets that form perpetual and immutable blocks of records. It can create value for all interactions of data among counterparties. Innovators around the world are scrutinizing traditional systems across industries to find processes that can be reengineered around blockchain to cut costs and derive greater value. Blockchain has a host of use cases that hold significant promise in replacing current legacy systems in various industries such as public administration, healthcare, manufacturing, supply chain, retail, infrastructure, banking & finance and, at the heart of it all, capital markets.

Source: Credit Suisse – Blockchain – The Trust Disruptor

Introducing blockchain in capital markets will allow for the disintermediation of trust, eliminating the need for clearing houses and custodians, rendering data storage and reconciliation redundant. Data would be stored in publicly accessible ledgers where nodes collaborate to help reach a consensus on the correct state of data sets. Once entered in the blockchain, all transactions would be immutable, leaving a permanent audit trail and reducing the need for reconciliatory and surveillance mechanisms. Lastly, inbuilt into the blockchain, smart contract would enable the automatic execution of transactions on the basis of predefined triggers in the datasets. Smart contracts would also drastically reduce settlement cycles and processing costs across the market.

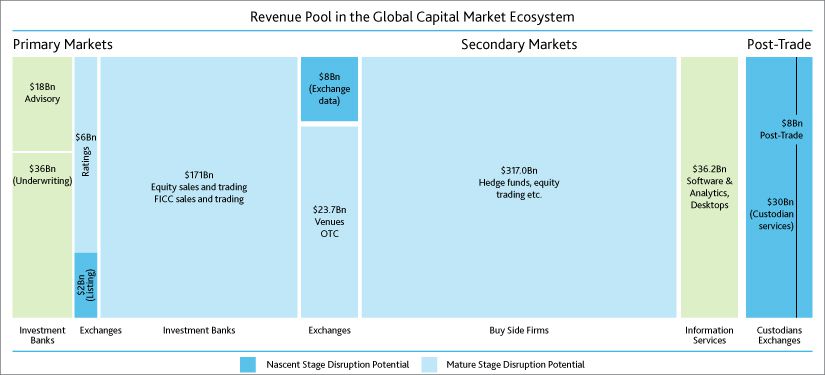

Disintermediate the traditional capital market functions of listing, custodian services, and post-trade settlement, which currently generate USD48bn in revenues annually. The harmonization of systems will also minimize the need for manual intervention by automating major functions including post-trade settlements. The immutability of records would ensure that the need for KYC and AML is eliminated. Goldman Sachs estimates that the implementation of blockchain in the US equities market alone can help save ~USD7bn annually in terms of reduced operating expenses in cash equities settlement, AML fines, and compliance costs.

The resulting reduction in cost would help democratize access to capital markets, providing small businesses with access to cheap capital. It would also help provide liquidity to the market for hard and illiquid assets via a form of securitization. The democratization of capital markets would extend to small-ticket investors, further boosting liquidity.

According to Goldman Sachs, US equities market participants deposit close to USD5bn with the DTCC towards the settlement process. The implementation of smart contracts would eliminate the need for these deposits, providing additional liquidity. In fact, if blockchain does manage to play out to its full potential, there will be no post-trade or back-office activities and the complete disintermediation of brokers, custodians, and clearing houses will be a reality. In the long run, companies implementing blockchain technology and capital market technology solutions could cannibalize the ~USD560bn in revenues generated across the capital markets’ value chain.

Source: BCG, Dealogic; Revenue pools data as of 2017

The looming threat of obsolescence is forcing conventional financial market institutions to upgrade or rather re-engineer their antiquated systems and processes and adopt ones that are more nimble, efficient and effective. With examples of participants adopting the technology becoming commonplace, what would be interesting to watch is whether this journey is a gradual evolution or a phoenix like rise from the ashes where the incumbents are burnt to ground. However the situation plays out what will be true is the fact that unyielding mammoths will walk down the road to extinction.

Tags:

What's your view?

About the Author

Chinmay Pednekar has over 5 years of experience in providing advisory and research services for PE/VC funds across Oil & Gas, Infrastructure, Healthcare verticals and in particular FinTech. He has extensive experience in working on a variety of projects covering the entire life cycle of a PE/VC fund, including fund raising, industry deep dives, target mapping, due diligence and portfolio monitoring. Prior to joining Acuity Knowledge Partners Chinmay worked with Genesis Capital Advisors, a boutique M&A advisory firm. He holds a Bachelors in Financial and Investment Analysis from University of Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox