Published on by Sachintha Wijayatunga

Executive summary

Sweeping tariffs announced by President Donald Trump in the US, dubbed ‘Liberation Day’, has reignited trade wars, threatening to disrupt global economic stability. These tariffs seek to plug the US trade deficit and incentivise US manufacturers. The baseline tariff of 10% and the reciprocal tariffs announced came into effect on 5 and 9 April 2025, respectively. However, President Trump announced a 90-day suspension of the reciprocal tariffs on all countries except for China. Financial markets and institutions worldwide are closely monitoring the fallout from the new tariffs while adjusting their strategies to navigate the broader macroeconomic risks.

Historical context to tariffs

The World Trade Organization (WTO) estimates trade finance funds 80% of global trade. It introduced the most-favoured-nation (MFN) principle as an international trade policy to eliminate tariff disparities and stymie trade wars.

However, President Trump, who threatened to withdraw from the WTO in his first term in 2018, blocked funds to the WTO in March 2025 and levied fresh tariffs. The implementation of tariffs can be traced to the president’s protectionist policy to correct the trade imbalances between the US and its trading partners.

Supply chain shifts thanks to tariffs

Countries are scurrying to prevent trade wars, formulate regional free trade agreements and grant concessions to developing in their regions as the US moves away from the MFN principle in global trade.

China, which has announced retaliatory tariffs on the US, may further diversify and engage in trade diversion tactics through the ‘Belt and Road Initiative’ and ‘China Plus One’ strategy to avoid the impact of the elevated tariffs. Meanwhile, many developing African countries no longer enjoy the tariff concessions under the ‘AGOA trade deal’ struck during the Clinton administration, which gave them preferential access to the US market.

US macroeconomic impact

In the aftermath of the tariff announcement, J.P. Morgan raised the probability of a global recession to 60% from 40 while US stock markets suffered the worst run since the onset of the COVID-19 pandemic.

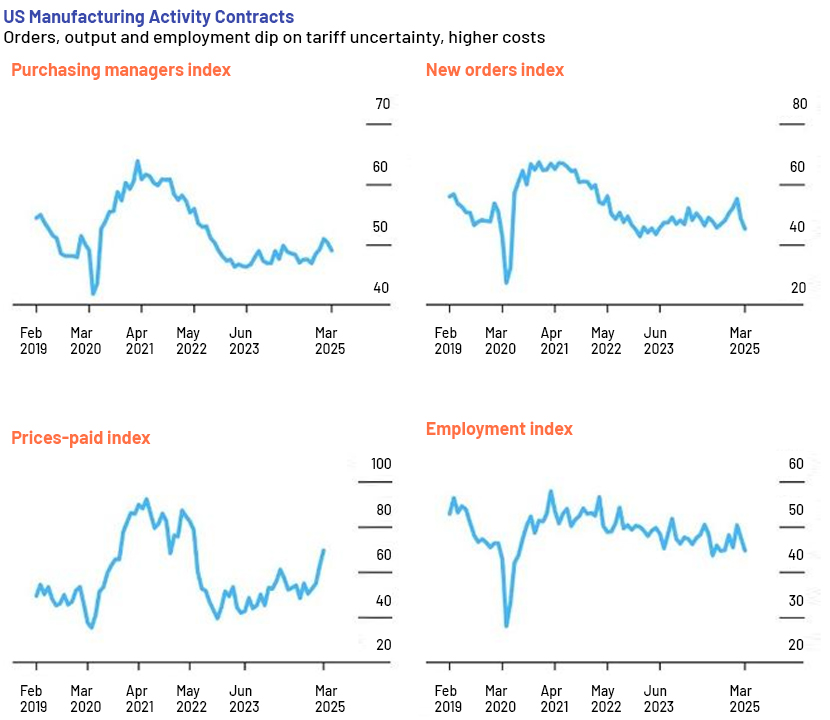

The US manufacturing Index contracted in March 2025 after advancing in the previous months, according to the Institute for Supply Management’s manufacturing PMI. Furthermore, escalating worries surrounding the tariffs pushed up the last reported composite prices-paid index – an inflation yardstick at the factory gate – to a near-three-year high. The knock-on effects of the tariffs on the global value chain will, undoubtedly, resonate with US manufacturers, as steel, aluminium, copper, gold and related products, exempt from the new reciprocal tariffs, were already subject to a 25% import duty, announced in March 2025.

Implications on banking and finance sector

Trade finance will emerge as a key risk-mitigation tool for counterparties in facilitating trade and exploring new value chains. It allows businesses to build stronger relationships with their trading partners. To address the complexities introduced by the tariffs, banks need to adopt trade finance solutions while re-evaluating product and service offerings.

A Grant Thornton article highlighted how tariffs increase the cost base and business risk for borrowers. In the short term, higher balance sheet inventory values and accounts payable will likely elevate credit risk for banks through increased leverage and deteriorating working capital of businesses, which could be linked to financial covenants in trade finance. For example, Moody’s has issued warnings on countries, such as Bangladesh, Thailand and Vietnam – the hardest hit by the tariffs – highlighting a possible drop in exports to the US, which will likely strain loan growth and erode loan quality.

Banks will also need to address trade diversion within the existing regulatory frameworks amid the heightened taxes. Businesses may import from low-tariff countries at the expense of high-tariff ones, such as China, via transshipment, while exporters may offshore their production to these low-tariff countries.

Opportunities in trade finance during tariff shifts

-

US domestic market: Import tariffs may spur domestic manufacturers to collaborate with banks for working capital requirements to meet a spike in demand as imports may be priced higher. Also, US firms may benefit from favourable trade terms during negotiations – the EU’s offer to remove all industrial tariffs on US exports is a case in point.

-

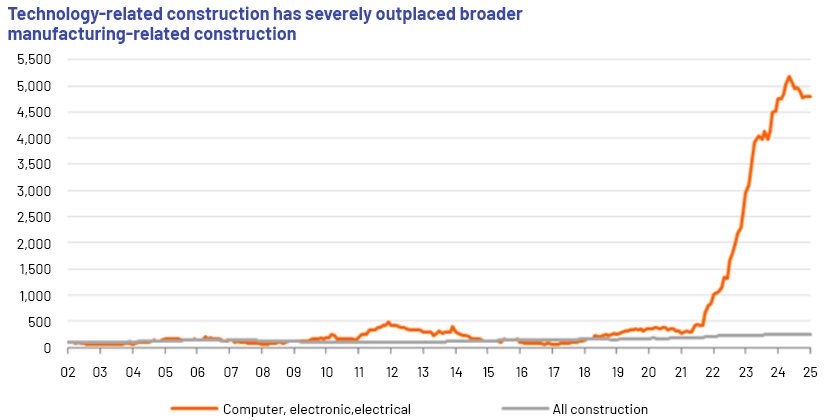

Sector-specific lending: With oil, gas, pharmaceuticals, semiconductors and other sectors exempted from the tariffs, banks can penetrate deeper in these sectors. The US has seen a recent spurt in investments in artificial intelligence and semiconductor, which ex-President Biden encouraged through incentives to reshore semiconductor manufacturing through the CHIPS Act of 2022. As seen in the chart below, post-pandemic construction spending tied to semiconductor and technology, such as data centres, has grown exponentially in recent years.

-

US automotive sector: Mixed reactions emerged from US automakers immediately after the tariff hike announcements. Ford promoted discounts for US-made vehicles by extending the prices available to its employees to all buyers in the US until June 2025. General Motors, on the other hand, is shifting the production of its full-size pick-ups to its Indiana plant to bolster US production. This should open up opportunities in trade finance in the form of supply-chain-product financing (such as factoring and invoice discounting) to help US suppliers manage cash flow and ensure smooth operations during the transition of manufacturing or ‘onshoring’ Meanwhile, Stellantis has taken immediate action, temporarily pausing production at some Canadian and Mexican locations, affecting c.900 jobs at several Stellantis US powertrain and assembly facilities. Volkswagen has announced plans to introduce pass the tariffs to vehicle purchasers.

-

Advisory services: Corporates will seek their banking partners’ expertise to leverage the brief window of opportunity presented by the likely heightened trade activity before the tariffs take effect.

-

Government stimulus packages and refinancing schemes: Pre-emptive steps were taken in March 2025 by the governments of China and South Korea to safeguard their businesses from an anticipated drop in demand from the US. China Development Bank has disbursed 14.25bn yuan (c.USD2bn) in ‘on-lending loans’ to provincial banks for foreign trade stabilisation. In South Korea, export vouchers for small and medium-sized enterprises were introduced and a 366tn won (USD249.9bn) trade finance programme – the largest to date – announced to cushion the blow from the tariffs. Banks will likely be active participants in these stabilisation programmes, envisaged to protect businesses.

How Acuity Knowledge Partners can help

Acuity provides end-to-end support for all trade finance products. Our in-house team of trade finance experts can optimise front-, middle- and back-office functionality with ease. We have been partnering with leading global banks to provide innovative solutions, efficiently setting up flexible teams and supporting project implementation.

We have robust credentials as a strategic ally of banks, with our expert credit teams offering in-depth credit analysis and continually monitoring portfolios.

Sources

-

AI Infrastructure on DOE Lands Request for Information | Department of Energy

-

Control Tariff-Related Risks in Purchase Agreements | Grant Thornton

-

China Development Bank boosts financial support for foreign trade

-

Handshake Deal for America: Ford Employee Pricing for Everyone

-

How long will the 'pharma carveout' in Trump's tariffs last?

-

Meta Plans Nearly $1 Billion Data Center Project in Wisconsin - Bloomberg

-

Korea to provide 'all-out' support to export firms amid global trade uncertainties: ministry

-

Trump's Tariffs: Steel, Aluminum, Copper, Gold Excluded From Reciprocal Duties - Bloomberg

-

US manufacturers increasingly concerned as Trump tariff optimism fades | articles | ING Think

-

US Manufacturing Activity Shrinks for First Time This Year - Bloomberg

-

US pauses financial contributions to WTO, trade sources say | Reuters

-

US manufacturers increasingly concerned as Trump tariff optimism fades | articles | ING Think

-

Volkswagen to introduce 'import fee' on tariff-hit cars, WSJ reports

-

General Motors, Nissan to boost production at US plants due to Trump tariffs

Tags:

What's your view?

About the Author

Sachintha has over 9 years of experience in Banking & Finance, Risk Management & Credit Analysis. At Acuity, he is a part of the Lending Services team servicing a large European bank on ESG work. He pursued his MBA from the Post Graduate Institute of Management (PIM), University of Sri Jayewardenepura and is an Associate Member of Chartered Institute of Management Accountants, UK

Like the way we think?

Next time we post something new, we'll send it to your inbox