Published on October 14, 2020 by Shiba Kumar Khuntia

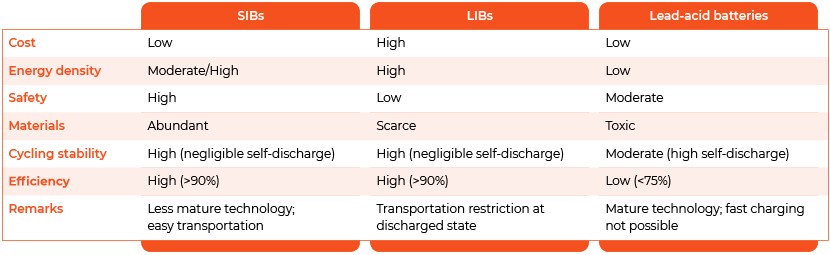

Despite the dominance of lithium-ion batteries (LIBs) in the energy storage industry over the past two decades, we believe sodium-ion batteries (SIBs) could replace them in the future, driven by their promising characteristics: (1) sodium is cheaper than lithium, (2) its chemical behaviour is similar to lithium’s, (3) the irreversible capacity of carbon anodes in SIBs is less than in LIBs, (4) sodium is abundant in the earth's crust and in seawater, and (5) it can be transported safely and at lower cost. SIB start-ups have been attracting venture capital (VC) funding in recent years. Given the potential of SIBs, coupled with the problems in the LIB supply chain, the opportunity for VC firms and other investors to be part of this sustainable and affordable energy source is substantial.

Why discuss alternatives to LIBs?

While LIBs will likely continue to drive the energy storage industry for at least the next 10 years, there are some concerns regarding them: (1) safety hazards, as they contain flammable electrolytes and explode if damaged or overcharged, (2) there is a shortage of key inputs, and (3) they are expensive.

Importantly, more than the shortage of key inputs – lithium (c.5% of LIB volume) and cobalt (c.20% of LIB volume) – mining constraints put supply-side pressure on the pricing of LIBs due to environmental concerns and domestic instability. For instance, South American countries, particularly Argentina, Bolivia and Chile, hold over 50% of the world’s lithium supply, but due to water scarcity in the region, mining activity is limited. The Democratic Republic of Congo (DRC) holds over 50% of the world's cobalt supply, followed by China (<10%), but this dependence on a single country rife with local disputes makes investment in the DRC difficult.

LIB prices fell 87% from 2010 to 2019, primarily due to the introduction of new chemistries and advanced manufacturing techniques. However, with lithium and cobalt being the key inputs, LIB prices will likely remain far higher than those of potential alternatives.

The abovementioned concerns have forced scientists to explore alternatives such as lead-acid batteries, zinc-air batteries and aluminium-ion batteries. However, SIBs have emerged as one of the most viable alternatives in recent years. The following is a comparative analysis of SIBs, LIBs and lead-acid batteries.

Source: Wikipedia

What does research on SIBs indicate?

A number of start-ups, such as Aquion Energy and Natron Energy, are already manufacturing SIBs, but these are used primarily for large-scale electricity storage, for example, for storing solar power for lighting, air conditioning and powering small electronics systems, and for other industrial uses. However, research is ongoing to assess the viability of using SIBs to provide portable electricity for mobile phones, laptops, electronic gadgets and electric vehicles.

At present, SIBs do not last as long as LIBs, primarily because of an unintended presence of hydrogen, which degrades the battery, making the life of SIBs shorter. Hydrogen is usually absorbed from the environment during the fabrication of cathode material, which affects the properties of electronic materials. Scientists are, therefore, exploring new materials that can be used as components of SIBs. Many start-ups and institutions such as the University of Texas, the University of Birmingham and the Nagoya Institute of Technology are conducting research on how to improve battery life, charging speed, and energy density.

SIB start-ups attract VC funding

While start-ups have already incurred significant amounts of debt, they have also been able to attract millions of dollars from VC firms across the globe given the promising characteristics of SIBs. The following table lists some recent deals:

Source: Company data

We understand that it may take a few years for SIBs to be commercially ready for widespread use and that LIBs will likely dominate the energy storage industry for at least the next 10 years. However, SIBs and LIBs could co-exist, with SIBs gaining an upper hand if the current challenges are resolved in the next few years. PR Newswire expects SIB demand to grow at a 24% CAGR to c.USD3.5bn by 2027, surpassing the estimated growth rate of 16% for LIBs. We believe, therefore, that given the potential of SIBs and the concerns regarding LIBs, VC firms and other investors have a significant opportunity to be part of this sustainable and affordable energy source.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners supports global investors in terms of helping them internalise more of their investment research process by building dedicated teams of research analysts at our delivery centres in South Asia, Beijing and Costa Rica. Our analysts (MBAs, chartered accountants, CFAs) work as an extension of the client team and provide support on various types of client-specified research assignments, including financial modelling and valuation, conducting background research, gathering primary and secondary data, preparing for company visits, and providing earnings-season support and a host of other value-added research. Each research output we produce is customised for the client and reflects the client’s proprietary and differentiated research process. This gives the client a unique, sustainable edge

Bibliography:

Mega Dailey, Energy and Capital, 2017, “What Makes Lithium Batteries So Expensive?”

Amit Katwala, 2018, “The spiralling environment cost of our lithium battery addiction”

List.Solar, 2020, “US sodium-ion battery programmer raises $35M as storage space financial investment surges”

AAAS and EUROAlert, Nagoya Institute of Technology, 2019, “Sodium is the new lithium: Researchers find a way to boost sodium-ion battery performance"

Lauren E. Marbella, Mathew L. Evans, Matthias F. Groh, Joseph Nelson, Kent J. Griffith, Andrew J. Morris, and Clare P. Grey J. Am. Chem. Soc., 140,7994 (2018), “Scientists at University of Birmingham develop new high-capacity rechargeable sodium-ion battery materials”

Shelly Leachman-UCSB, 2019, “Why sodium-ion batteries don’t last as long”

PRNewswire, IDTechEx, 2020, “Revolutionary Solid-state Batteries Will Create a $6 Billion Market in 2030”

PRNewswire, Reportlinker, 2020, “Lithium-Ion battery market worth $115.98 billion, globally, by 2027 at 15.6% CAGR: Verified Market Research”

Michael Schiemann and Chris Searles, 2016, “Lead-acid batteries are not going away, a technical comparison of lead-acid and lithium-ion batteries”, Wikipedia

“Lithium-ion batteries”, Brodd, Ralph J. u.a.; Prof.Em Musaki, Akiya K. Ralph J. Brodd B. Brodd (Hrsg), Springer, 2009

BloombergNEF, 2020, “Electric Vehicle Outlook 2020”

What's your view?

About the Author

Shiba Kumar Khuntia is part of the Investment Research team at Acuity Knowledge Partners. He has spent more than four years in his current role covering the U.S. Industrial Machinery at Acuity Knowledge Partners and currently supports sell-side clients with research assignments including industry research, economic research, thematic reports, and earnings reviews. He holds an MBA in Finance from Rizvi Institute of Management, Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox