Published on August 12, 2025 by Aditi Tuli

1. Introduction and meaning

As the private equity landscape evolves, the secondary market is becoming an increasingly essential component, set to attract substantial investor interest and capital in the coming years and highlighting opportunities for both experienced and new market participants.

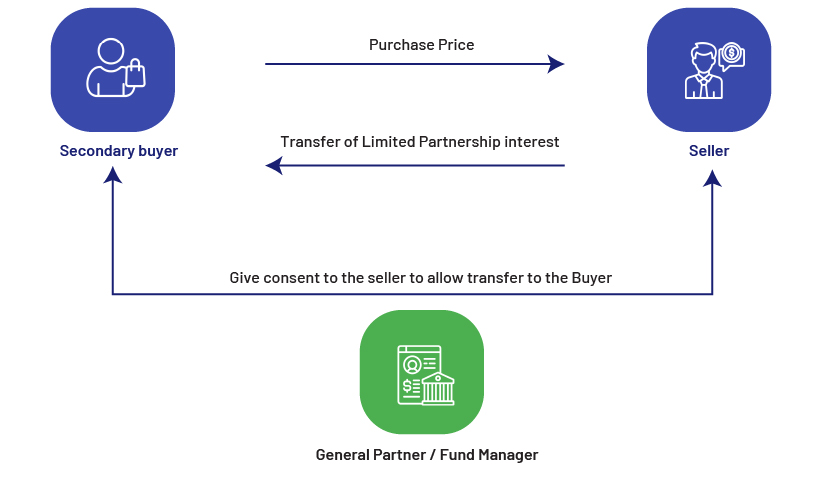

Secondaries or continuation transactions in private markets refer to the buying and selling of investments, where a private equity firm purchases an investment from another private equity firm or alternative investor. In other words, these transactions involve acquiring existing interests or assets from investors of primary private equity funds.

2. Benefits of investing in secondaries

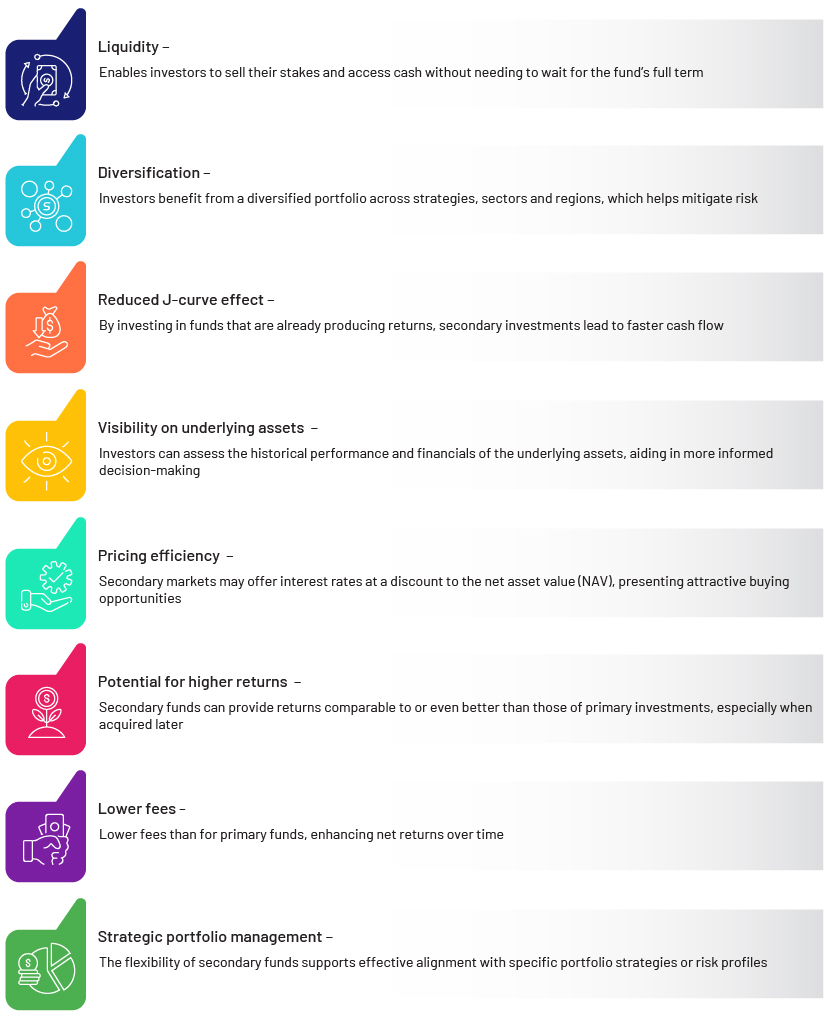

Secondaries have become an increasingly appealing segment of the private equity market owing to the benefits it offers to limited partners (LPs) as well as to the buyers (private equity firms). It provides flexibility to LPs who wish to liquidate or rebalance a portfolio; the buyers benefit from discounted access, shorter duration and faster return of capital, and enhanced transparency of the underlying portfolio or assets. Secondary funds, especially in private equity, bring several notable advantages, as covered below:

3. Different types of secondaries

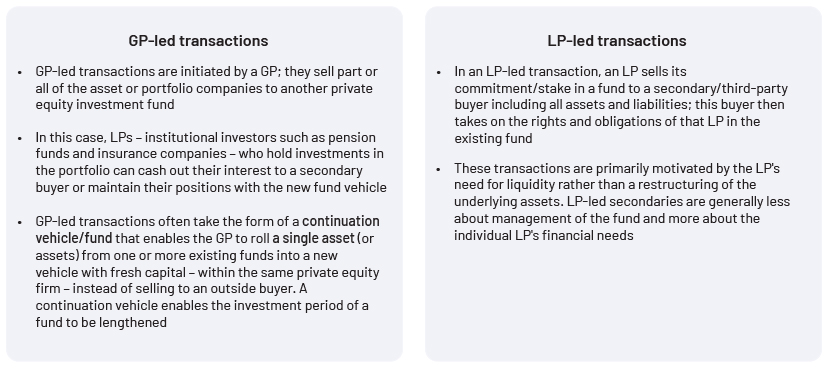

Private equity secondaries transactions can be carried out by either a private equity firm’s general partner (GP) or an LP; these take different forms.

4. Addressable size of this market

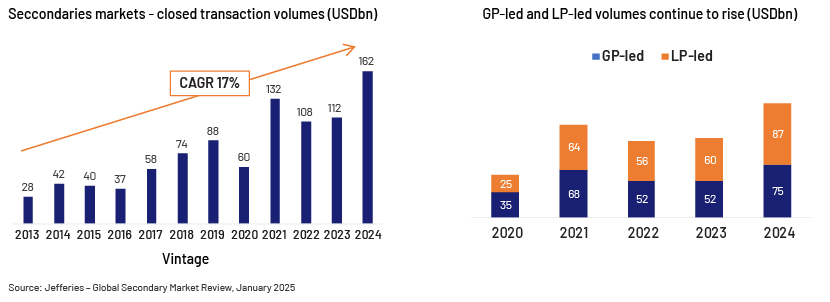

Transaction volumes in secondary markets closed at a record USD162bn as of December 2024, witnessing a rise of 45% y/y and growing at a CAGR of 17% over the last 11 years. Deal volume surpassed the previous record of USD132bn set in 2021 (amid the shock of the pandemic).

Overall volumes in 2024 were lifted by solidifying themes, including strong pricing for high-quality names, new market entrants, continued acceptance of the GP-led market and larger transactions closing in the second half of the year. LP-led deals stole the show (growing +45% y/y) as LPs capitalised on favourable market conditions by offering attractive portfolios to maximise pricing and transaction certainty, resulting in positive price movement across almost every asset-class vertical.

Volumes are projected to surpass USD220bn by the end of FY26 as the LP-led and GP-led markets continue their rapid adoption, bolstered by strong growth in adjacent categories, including growth/venture, credit and infrastructure secondary markets.

5. Key players in this space

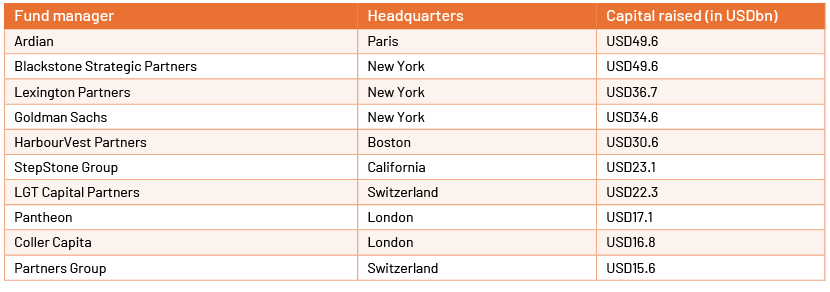

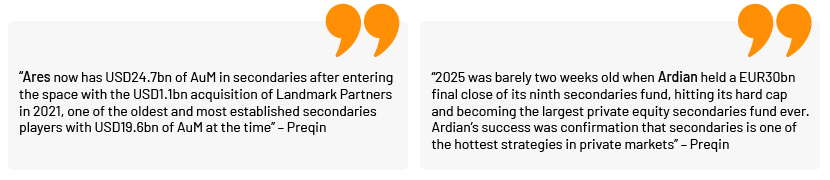

The top 50 secondaries firms raised a total of USD474bn from 2019 to 2023, 9% higher than the previous year’s record. The top 10 biggest secondaries fund managers along with their raised amounts are as follows:

Preqin, the global alternatives data aggregator, currently tracks 257 secondaries funds in markets, targeting to raise c.USD94bn in capital. Fund managers seeking more than USD3bn include Coller Capital (USD10.0bn), Intermediate Capital Group (USD6.0bn), Clipway (USD4.0bn), Lexington Partners (USD4.0bn), Partners Group (USD3.5bn), FS Investments (USD3.5bn), Hollyport Capital (USD3.0bn) and Pomona Capital (USD3.0bn). Furthermore, 13 GPs are in the market for more than USD1bn.

6. Trends and conclusion

In the secondaries market, several key trends are currently shaping the landscape:

-

Growth in direct secondary transactions: There is growing interest in direct secondary transactions, where investors buy and sell interests in private equity funds directly, bypassing intermediaries. This appeals to those seeking more control and potentially better pricing.

-

Rise of credit secondaries: Credit secondaries are becoming more popular as investors aim to diversify their portfolios and address liquidity concerns. This involves trading interests in private credit funds, which offer different risk and return profiles compared to traditional equity secondaries. For instance, Ares Capital and Mubadala (a Middle Eastern sovereign wealth fund) announced the formation of a joint venture focused on investing in global credit secondaries opportunities.

-

Market preference for LP-led transactions: LP-led transactions currently dominate the market, making up about 54% of transactions. This preference is driven by the stability and diversification benefits that LP-led deals are perceived to offer. Investors are prioritising liquidity and diversification in their strategies, leading to heightened interest in secondary-market opportunities.

-

Single-asset continuation vehicles (CVs) remain prevalent in the GP-led market:The GP-led secondaries market has seen the emergence of the single-asset model as a distinct segment, with single-asset transactions becoming the fastest-growing area within secondaries. These GP-led single-asset secondaries offer advantages in various market conditions, enabling GPs to hold on to their most promising assets longer and providing additional exit options. Accounting for c.48% of the GP-led volume in 2024, single-asset CVs continue to rise due to their asset quality, strong GP alignment and sector-specific focus.

The robust momentum from 2024 has established a strong foundation for sustained growth in secondary deal-making. As new market participants adopt proactive portfolio-management strategies, record-setting milestones are likely to continue.

How Acuity Knowledge Partners can help

Our private debt/credit support vertical offers several services to private debt/credit middle and back offices – ranging from deal origination and target screening to portfolio-monitoring services. We also help private credit managers with live deal support including due diligence, relative valuation and scenario and bond yield analysis.

Sources:

-

https://www.morganstanley.com/ideas/private-equity-secondaries-volatile-markets

-

https://www.blackrock.com/institutions/en-us/insights/market-update-h1-2025

-

https://www.preqin.com/news/secondaries-in-2025-the-outlook-for-fundraising-deals-and-performance

-

https://www.preqin.com/news/fundraising-boom-as-private-equity-secondaries-market-heats-up

What's your view?

About the Author

Aditi has over 10 years of experience in research with hands-on experience in benchmarking exercises, trading & transaction comparable analysis, discounted cash flows analysis, report writing, company profiling, and fund benchmarking & competitive analysis.

She has been associated with Acuity Knowledge Partners since April 2020 and currently supports the fund launch and product team of a private equity firm. She primarily assists them in peer performance and fee benchmarking, fund models, newsletters, LP mandates, and ad-hoc research within the private markets space.

She is an MBA with a specialization in finance from IBS, Gurugram, and completed her graduation in B.com from MCM DAV College, Panjab University

Like the way we think?

Next time we post something new, we'll send it to your inbox