Published on June 14, 2019 by Mitalee Jain

Asset managers (AMs) are constantly striving to showcase their products to prospects. Unfortunately, many still rely on conventional methods of marketing, despite high competition and heightened customer awareness. This said, there are those that understand the importance of having a strong digital presence, and how illustrating data as proof points in an impactful manner helps acquire new clients and retain existing ones. Newer avenues incorporating methods relevant to the current times are becoming more relevant. A very good example of this is that an increasing number of AMs include custom benchmark/s for performance comparison to show data based on investor requests. Through their databases, consultants today offer a platform for AMs to list their offerings with proof points for existing and prospective investors.

As most of us know, requests for proposal (RFPs) have been a widely accepted method for AM selection. Before making investment decisions, investors prefer to analyze data and indulge in quant-based comparisons. Interestingly, a detailed listing of products on consultant databases (CDBs) gives quantitative insights at a deeper level. Combining the insights gained from CDBs with RFP services for ESG and requests for information (RFIs) makes manager selection a much-informed process

AMs regularly upload and maintain product data on CDBs. The most popular investment asset classes offered by AMs, which have their data updated, are usually equity, fixed income, and multiasset strategies. Some consultants also cover real estate, private equity, and alternatives.

An RFP is a bid targeting investors who have funding available for investment. AMs compete by responding to RFPs to win a mandate and manage an investor’s assets as per the strategy discussed.

RFPs come with an opportunity. This means that following the selection process, irrespective of the result, the feedback mechanism for RFPs is simple and straight forward. However, with CDBs, the process of feedback is almost nonexistent. Even though most databases provide a brief report on the searches conducted, it is challenging to say whether there was an opportunity tied to the screen/search.

RFPs, CDBs, and Common Ground

RFPs and CDBs are interlinked at various levels. The following illustration explains the common aspects, interlinkages, and their dependence on each other.

Qualitative vs Quantitative and Overlaps

A portion of qualitative and quantitative data is common to RFPs and CDBs. Overlaps between them could be historical performance, research methodology, or basic characteristics, to name a few.

Insights and Reports

Owing to timely and regular data uploads on CDBs, consultants have developed technologies that help generate reports and insights, which are system generated. Analytical reports may include competitor analysis, market reports, investor trends, search reports, trending themes, etc. Well-known databases that provide analytics are Evestment, Morningstar, and Mercer. This said, all consultants of this age offer analytics and data reports in some form.

CDBs – Helping Initiate RFPs

Databases are more helpful at the initial stage of the manager selection process. RFPs are generally comprehensive, and collect more insights, making them suitable at any stage. However, a combination of both is ideal. Investors today use CDBs to narrow down to a few short-listed managers from available options. Once the set criterions are met, short-listed managers receive RFIs or RFPs. Doing so helps investors or consultants send questionnaires only to a select few AMs.

Lately, they are turning to invite-only RFPs. An example is an ESG (Environmental, Social, and Governance) search. Instead of sending an RFI or RFP to all managers offering ESG products, investors can screen further using minimum AuM under ESG portfolios, their performance, and minimum UNPRI (United Nations-supported Principles for Responsible Investment) scores to further narrow down the list. Short-listed managers are sent invites to participate in the next round of selection. To increase chances of receiving an invite, AMs must update CDBs accurately and have all their flagship strategies listed on the database in a timely manner.

Synergies

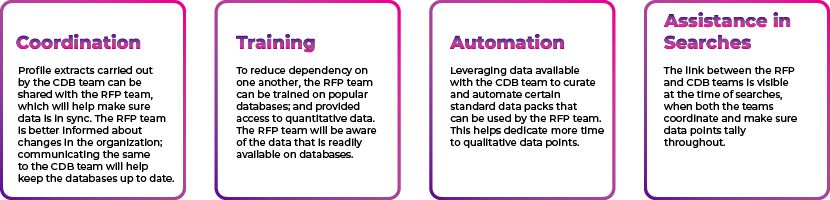

Most RFP and CDB teams operate in silos. Although they are interlinked and work toward the same goal – winning more client business – they lose out on harvesting efficiency gains if they worked in tandem.

While responding to RFPs, short-listed managers should make sure that quantitative data they submit in their responses is exactly what they had updated on CDBs. Maintaining CDBs is becoming easier and less time-consuming with automation. As a result, investing additional time in qualitative content for knowledge management rfp has become possible. This is a clear example of efficiency gains if both processes are treated as one.

Moreover, both can exploit data overlaps between them in the best possible ways, which would improve accuracy and increase alliance between themselves. By doing so, they can optimize the utilization of each team and leverage their expertise.

Key Takeaways for Head of RFPs and CDBs

Based on the common ground and synergies discussed, it is safe to say that capitalizing on overlaps and focusing on enhancing productivity will help achieve considerable efficiency gains. Time employed earlier in back and forth communication between both teams can be channelized in improving quality. Overall, it will result in improved quality, better coordination, efficient team utilization, cost reduction, improved company messaging, and process improvement, to name a few.

Bridging the Gap

Acuity Knowledge Partners has been successful in bridging the gap between RFP and CDB teams. We have years of experience in successfully managing client RFP and CDB teams and are associated with some of the biggest AMs in the world. In addition, we have rich experience of adding value through our proprietary tools and technology. The development of these in-house tools has been possible because of the talent pool, which has evolved from its experience in handling diverse AMs. EDGE, our proprietary tool, has helped clients reduce the time employed in uploading, maintaining, and checking the quality of data across databases. Furthermore, we are an established RFP solution provider. We have managed client teams with both these processes and helped them see the benefits of partnering with a firm with expertise in both the processes. Given our understanding of the commonalities between RFP and CDB experience, and proven track record, we are playing a pivotal role in changing the landscape of RFP and CDB management.

Sources

1. http://archive.constantcontact.com/fs011/1101483502228/archive/1103720701786.html

2. https://learn.g2.com/rfp-request-for-proposal

4. https://www.evestment.com/how-to-react-to-a-changing-rfp-process/

5. https://www.evestment.com/investment-database-marketing-best-practices-for-success/

What's your view?

About the Author

Mitalee Jain has experience in the consultant database space. At Acuity Knowledge Partners, she supports fund marketing services for the asset management industry. She holds a Master of Science in Finance from IESEG School of Management, Paris, and a Bachelor of Commerce from Jain University, Bangalore .

Like the way we think?

Next time we post something new, we'll send it to your inbox