Published on June 21, 2024 by Ambarish Srivastava

Interest in real assets – such as real estate, infrastructure and commodities – has been growing in recent years due to factors such as the search for yield in a low-interest-rate environment, the desire for diversification and the potential for protection against inflation. As a result, real assets’ assets under management (AuM) have grown significantly.

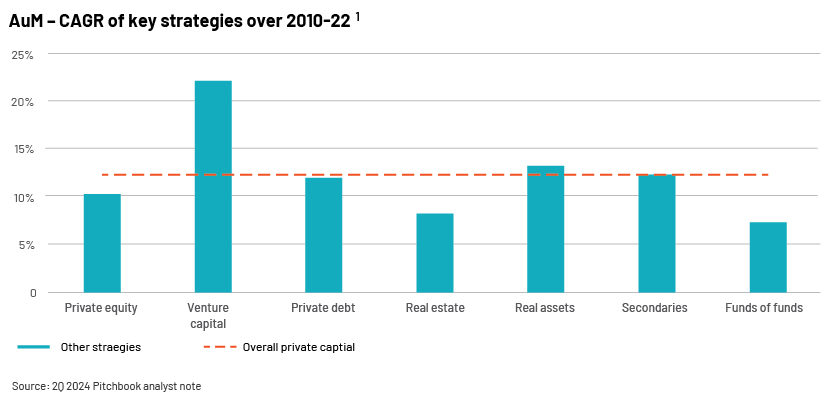

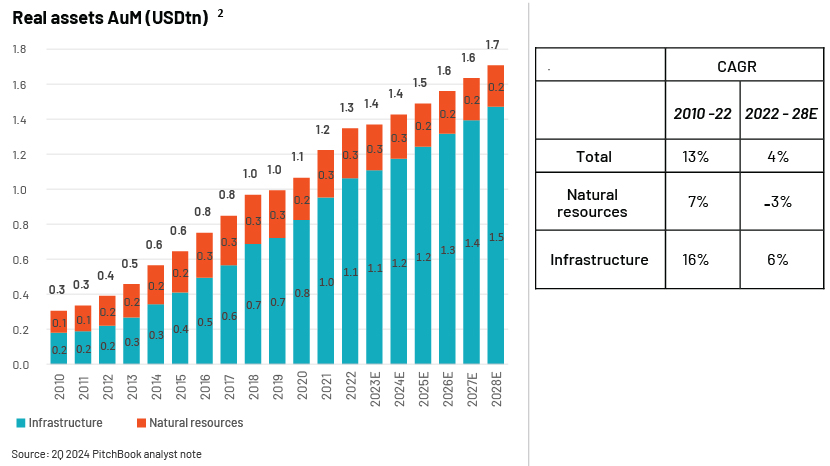

PitchBook’s analysis suggests that infrastructure is attracting substantial AuM, while natural resources within real assets seem to be falling out of investor favour. PitchBook predicts an expansion of private capital to USD20-24tn by 2028, depending on support of the macro environment. However, real assets strategy saw the second-highest growth in AuM from 2010 to 2022 (after venture capital, which saw an explosion in AuM over the period).

Infrastructure, the backbone of any modern economy, plays a pivotal role in facilitating economic growth, improving living standards and enhancing social welfare. Private investment in infrastructure has witnessed a surge in recent years, unlocking new avenues for financing and project development.

Private-capital participation in infrastructure is gaining ground, as (1) private investments reduce the burden on governments, enabling them to focus on other priority areas of social impact, (2) resource allocation becomes efficient, as private investors may have better access to capital and expertise, resulting in efficient execution of infrastructure projects, and (3) it drives innovation and risk-sharing by bringing in cutting-edge technologies and new solutions.

Reasons why infrastructure is coming into focus

Infrastructure investing is gaining focus for a number of reasons. For example, in developed regions, infrastructure is ageing, while in developing and under-developed parts of the world, new infrastructure needs to be built.

The developed world needs to replace old infrastructure

The American Society of Civil Engineers (ASCE) estimates that the US needs to spend as much as USD2tn[3] on infrastructure in the next five years. The US requires at least USD2tn to fix its ageing infrastructure; this represents approximately 0.8% of US GDP[4]. Key priorities for this investment include repairing crumbling roads, highways and bridges, which could easily cost over USD1tn. The urgency stems from the fact that some systems, such as parts of the power grid and drinking-water networks, date back to the 19th century, leaving them vulnerable to natural disasters and cyberattacks.

In Europe, the European Investment Bank's Investment Report 2022/2023 emphasises the need for substantial investment to address long-term structural challenges, including climate transition and digitalisation. It suggests that investment of EUR1tn per year is required for the EU to reduce greenhouse gas emissions by 55% by 2030; this is EUR356bn more annually than in the previous decade[5]. Furthermore, a report by Ember[6], an energy and climate think tank, indicates that grid investments across Europe must increase to support the energy transition. It points out that national transmission grid plans are based on outdated wind and solar targets, and that at least EUR5bn more is needed annually than estimated by REPowerEU for grid spending. Additionally, Euractiv has reported on water infrastructure, stating that annual investment in this sector should double from EUR45bn[7] to modernise the infrastructure and protect health and the environment.

The developing world needs to build new infrastructure as urbanisation and income increase

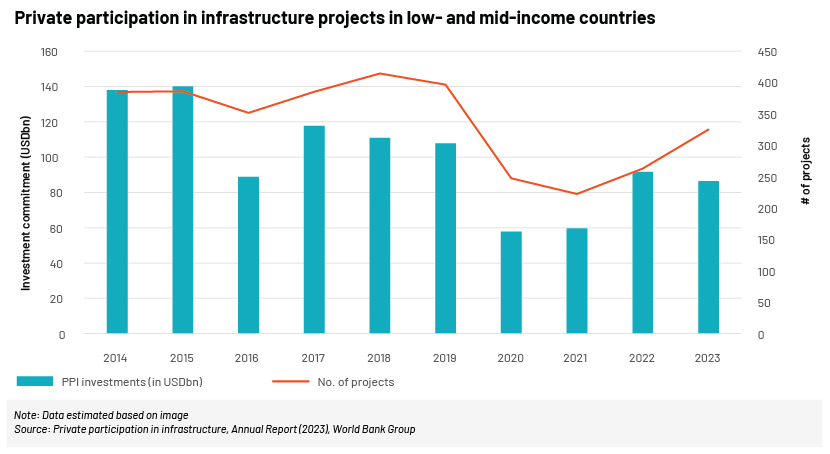

Developing countries are building infrastructure capacity in the areas of water and sanitation, renewable energies, transport and municipal solid waste. Infrastructure investment registered a decline in 2023 over 2022, but this was likely due to a revival of investment in 2022, after two subdued years greatly impacted by the pandemic. The World Bank classifies low- and mid-income countries in terms of global regions. Three regions – East Asia and the Pacific, Europe and Central Asia, and the Middle East and North Africa – registered an increase in 2023. However, Latin America and the Caribbean, South Asia and Sub-Saharan Africa witnessed a decline.

Other drivers of infrastructure investment

Besides the need to build new infrastructure and replace ageing infrastructure, investment in infrastructure is driven by factors such as increasing dependence on and evolution of digital ecosystems, leading to an increase in data centres, and increasing awareness of the need for renewable energy and other environmentally-friendly technologies such as electric vehicle-charging stations.

Private capital aimed at investment in infrastructure faces challenges

Despite benefits such as protection from inflation, opportunity to diversify and low volatility, infrastructure investment faces regulatory challenges, as navigating complex regulations and approval processes can delay or even derail projects. In addition, a fine balance is required in risk-sharing arrangements between the public and private sectors. Infrastructure projects can be vulnerable to public issues – such as India’s Kudankulam nuclear power plant that saw significant protests in 2012[8]. Ensuring public support and understanding of infrastructure projects is also essential for minimising social and environmental concerns and ensuring environmental sustainability.

How Acuity Knowledge Partners can help

We are experienced in supporting infrastructure strategies of global private equity firms in all key infrastructure sectors – core and core+, providing assistance on deal sourcing, due diligence, portfolio management, CRM and back- and middle-office operations.

Sources

-

[1] Q2 2024 PitchBook Analyst Note: Private Capital’s Path to $20 Trillion | PitchBook

-

[2] Q2 2024 PitchBook Analyst Note: Private Capital’s Path to $20 Trillion | PitchBook

-

[3] https://www.procore.com/jobsite/rebuilding-americas-aging-infrastructure

-

[4] https://www.cbsnews.com/news/infrastructure-what-will-2-trillion-buy-and-how-will-america-pay/

-

[6] Grids for Europe’s energy transition | Ember (ember-climate.org)

-

[7] Time to invest in Europe’s water infrastructure – Euractiv

-

[8] https://www.hindustantimes.com/india-news/a-decade-on-kudankulam-nuclear-plant-protesters-say-still-face-ordeal-101654455406226.html

Tags:

What's your view?

About the Author

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox