Published on June 23, 2025 by Ankur Jain

Introduction

Private credit refers to privately negotiated loans between a borrower and a non-bank lender, and forms a key part of the evolving private credit market outlook enabling the borrower to access capital with customised financing details that may not be available from traditional lenders such as banks. It also provides investors with another avenue to access income-generating investments within the fixed income portion of their portfolios.

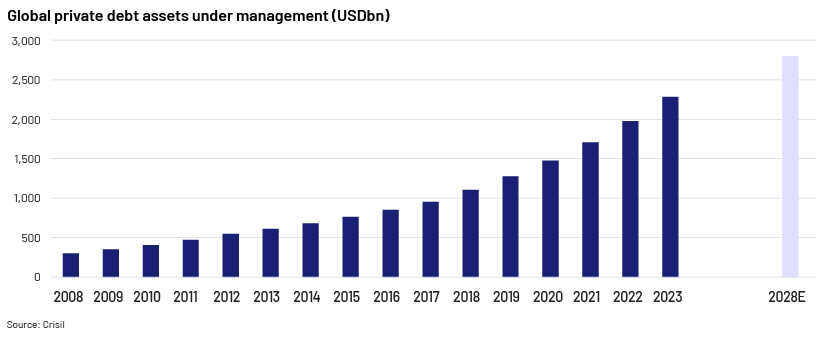

Following the 2008 financial crisis, banks became stricter with lending due to new regulations and increased risk aversion, making it difficult for many businesses to secure loans. Private credit emerged as an alternative, offering flexible and customised financing. Since then, it has become a crucial part of the global financial system and the private credit market outlook has grown rapidly in the past decade and a half. Assets under management grew from USD200bn in 2008 to c.USD2.1tn in 2023 and are projected to reach c.USD2.8tn by 2028. The US currently holds a c.70% market share, followed by Europe, according to a Crisil report. Asia Pacific is also showing strong growth potential contributing to private credit market outlook amid promising economic prospects.

Given the current volatile and uncertain economic and geopolitical landscape (including recent uncertainty relating to continued changes in policies on tariffs), investments in private credit can be influenced by multiple factors. Identifying and understanding these factors become crucial in navigating the current volatile market environment. Key private credit market trends impacting private credit markets include the following:

1. Focus on retail/HNI investors

Global wealth has grown to more than USD300tn, with more than half held by individuals. Only a small portion (c.USD4tn) of individual wealth is currently invested in alternative assets such as private equity, private credit and real estate. The increasing prevalence of intermittent liquidity structures such as interval funds (closed-end funds that offer periodic, limited liquidity to investors, allowing them to sell a portion of their shares at set intervals, usually quarterly or semi-annually), business development companies (publicly traded investment firms that provide capital to small and mid-size private companies) and tender offer funds (closed-end funds that allow investors to sell shares back to the fund at specific times through tender offers) provides access to private markets to a broad group of high-net-worth individuals (HNWIs). This fragmented group holds more than USD80tn in wealth globally, making them a key target for asset managers. Asset managers clearly have this cohort in their crosshairs, seeing them as a key driver of industry growth. To access this wealth, managers are coming to the market with evergreen funds while some are rolling out first-ever private credit exchange traded funds (ETFs). Individual allocation to alternatives is forecast to more than triple to USD13tn over the next decade. The largest untapped opportunity lies with high-net-worth (HNW) and very-high-net worth families (with USD1-30m in assets).

2. Evolving role of banks

Banks have started to show interest in the private credit market by actively increasing lending to the broadly syndicated loan market. Major banks in North America and Europe have recently formed new partnerships with private credit firms. These agreements allow banks access to private credit capital and give private credit firms access to bank relationships. This has led many banks to adopt an “intermediary” role, where they earn a fee for originating loans and bringing in outside investors via syndications and securitisations. This enables banks to earn fees without adding much risk. Additionally, some banks are cooperating with private credit firms by offering wealth management and advisory services. They are also deploying their own capital to develop their private credit capabilities, by ramping up their involvement in broadly syndicated loans, offering competitive rates to attract borrowers.

As banks seize the burgeoning opportunities within the private lending space, their strategic adaptability and innovative approaches will be key not only for enhancing their competitive edge but also for reshaping the future of financing in this dynamic market.

3. Evolving role of insurance companies in private credit

Insurers are continuing to shift their investment portfolios from public investment-grade assets to investment-grade private asset-based finance assets to enhance portfolio returns. Many insurers are achieving this through partnerships with private credit managers who have greater expertise in this area. US life insurance companies, traditionally active in the private credit market, are increasing their exposure through a combination of new business flows, investment portfolio repositioning and growing affiliation with alternative asset managers. Alternative asset managers are pouring capital into the insurance sector, acquiring minority or controlling stakes in insurance companies. These evolving partnerships have enabled US life insurers to leverage the managers' direct access to asset-originator platforms, lowering costs and improving yield generation for the insurance companies. With the growing use of asset-origination platforms to generate assets, synergies between insurance companies and alternative asset managers are expected to strengthen further.

4. Growing allocation to specialty finance

Specialty finance and opportunistic credit strategies are gaining momentum as direct lending matures. Limited partners (LPs) are diversifying their private credit portfolios, showing increasing interest in niche strategies such as asset-based lending, litigation finance, NAV lending and royalty financing. While direct lending remains the largest subset of the private credit market, specialty finance is growing rapidly. Allocations in this subset increased from 10% of mandates in 2023 to 18% in 2024. This trend is expected to continue, with investment consultants including AON, bfinance, Callan, Cambridge Associates, Mercer and StepStone recommending specialty finance and opportunistic credit to clients for diversification.

5. Private credit spending on AI

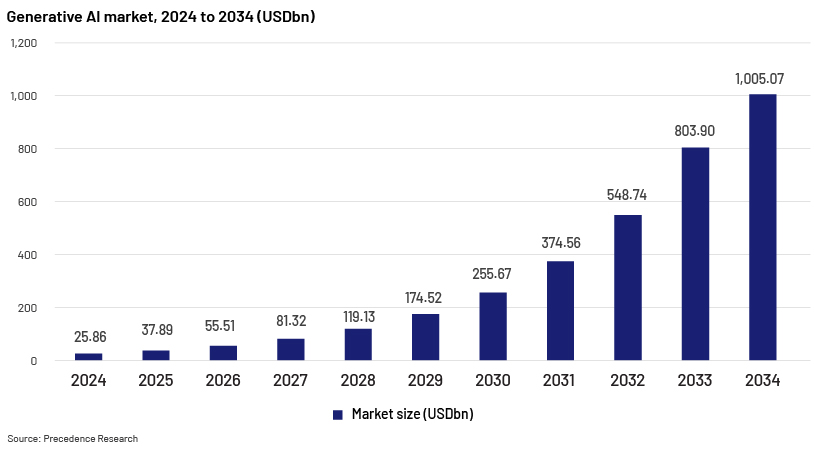

Precedence Research expects the global generative AI market to grow from USD37.89bn in 2025 to c.USD1,005.07bn by 2034, registering an impressive CAGR of 43.9%.

As demand for AI grows, the need for substantial data storage and infrastructure will increase, driving significant capital investment. Private debt can play a crucial role by funding innovative AI companies and financing the development of datacentres, electric grids and new energy capacities. This support extends to diverse sectors such as infrastructure, real estate, venture/growth lending and investment-grade debt. This multifaceted approach not only supports technological advancements in AI but also stimulates growth in various areas of private credit market outlook, making it an exciting time for both AI and financial markets as they evolve together.

A PwC report dated 28 January 2025 highlights some of the major investments in datacentres and digital infrastructure, including DigitalBridge and Silver Lake’s USD9.2bn equity investment in Vantage Data Centers, completed in June 2024; the AI partnership between BlackRock, Global Infrastructure Partners, Microsoft and a leading AI investor from the Middle East, announced in September 2024, to fund up to USD100bn; Blackstone’s USD16bn acquisition of AirTrunk, completed in December 2024; and the “Stargate” joint venture between OpenAI, SoftBank and Oracle, announced in January 2025, to fund up to USD500bn.

6. Expanding role of technology

Technology is expected to play an important role in supporting multiple operational areas across the private credit ecosystem. Machine learning and AI have the potential to improve underwriting decisions and support more effective portfolio monitoring. Alternative data sources can complement traditional data in pricing and risk algorithms, while automation can standardise and streamline credit processes, reducing the time required to make lending decisions. There are multiple platforms already in use to support these advancements. For instance, Acuity Knowledge Partners provides tools such as FolioSure, used to support portfolio monitoring, while CreditPulse supports AI-based credit report writing.

7. Regulatory changes – Basel III Endgame

In July 2023, the US Federal Reserve and the FDIC published their Notice of Proposed Rulemaking for Basel III Endgame, with implementation starting on 1 July 2025, and a three-year phase-in period through 30 June 2028. Once implemented, these changes are expected to raise capital requirements for banks. As banks face higher capital requirements, they may reduce their lending activities, shifting lending to private credit funds and other non-bank financial institutions. This shift could increase the role of private credit in the financial system. Private credit funds are likely to see significant growth as they step in to fill the gap left by banks. These funds would benefit from increased demand for alternative financing.

Conclusion

The potential addressable market for private credit exceeds USD30tn across diverse asset classes. A significant portion of this market lies outside traditional leveraged corporate debt, presenting substantial opportunities for investors who can broaden their perspective and navigate near- and long-term trends to drive consistent value for clients. The private credit market is expected to continue its upward trajectory, reaching around USD3tn by 2028. Despite the positive private credit market outlook, the market will face challenges such as regulatory hurdles, market volatility and the need for continuous innovation to stay competitive. As the private credit market evolves, it is crucial that investors stay informed and adaptable, understanding the dynamics and trends shaping the market to navigate opportunities and risks.

How Acuity Knowledge Partners can help

We have over two decades of experience in supporting global clients in the private credit domain, ideally positioned to help clients navigate the changing private credit market outlook through robust, tech-enabled solutions. with our expertise spanning several sectors and credit investment strategies. Our private credit team offers end-to-end support across the research cycle, including due diligence, portfolio monitoring, credit analysis, market research, ESG integration, operational support and fund administration.

The following are two of our main platforms via which we provide services:

FolioSure is a comprehensive portfolio monitoring and reporting solution for private markets. It features a unique blend of cutting-edge technology and human intelligence to streamline the overall data journey, from collection to report generation for private equity and venture capital funds and funds of funds. It can be fully integrated into current technology stacks and processes and can be configured in line with client requirements to take full control of a portfolio’s lifecycle.

CreditPulse is an LLM-based tool that helps create summarised commentary for fact-based analysis for credit risk report writing. Based on user-defined prompts, the tool generates commentary for report sections such as business description, management bios, financial performance, ownership structure and industry analysis. CreditPulse benefits from the combination of generative AI and our deep domain expertise to deliver highly analytical credit reviews for effective risk governance.

References:

-

https://www.mckinsey.com/industries/private-capital/our-insights/the-next-era-of-private-credit

-

https://www.moodys.com/web/en/us/insights/credit-risk/outlooks/private-credit-2025.html

-

https://fsinvestments.com/fs-insights/private-wealth-in-private-markets/

-

https://fsinvestments.com/fs-insights/private-credit-the-changing-role-of-banks/

-

https://www.apollo.com/insights-news/insights/2025/01/2025-credit-outlook-defying-gravity

-

https://www.wellington.com/en-axj/institutional/insights/2025-private-credit-outlook-5-key-trends

-

https://www.moodys.com/research/Private-Credit-Global-2025-Outlook-Primed-for-growth-as-Outlook-

-

https://www.pwc.com/gx/en/services/deals/trends.html#interest-rates

What's your view?

About the Author

Ankur has over 9 years of experience in financial analysis and writing credit research reports for different clients. He has rich experience in financial spreading, capital structure analysis, credit analysis, identifying key financial and operating risks of the company, identifying and analyzing industry trend and writing detailed credit report.

Like the way we think?

Next time we post something new, we'll send it to your inbox