Published on July 21, 2020 by Ganesh Hebbar

The Office of Foreign Assets Control (OFAC), a division under the Department of Treasury (DoT) is the prime agency for enforcing unilateral sanctions based on powers of the US presidency. The OFAC has a long history of sanctions enforcement – from its inception during the Korean War of 1950 to date. It has evolved over time; this blog summarises its recent sanctions and key takeaways for companies to comply with them.

Types of sanctions imposed by the OFAC:

-

Primary/comprehensive sanctions: Prohibits citizens and companies of the sanctioning country from engaging with their counterparts in the sanctioned country

-

Secondary/supplementary sanctions: Halts activity with the sanctioned country by threatening to sever its access to the US market

-

Sectoral/targeted sanctions: Prohibits citizens and companies of the sanctioning country from engaging with people and companies in sector-specific transactions

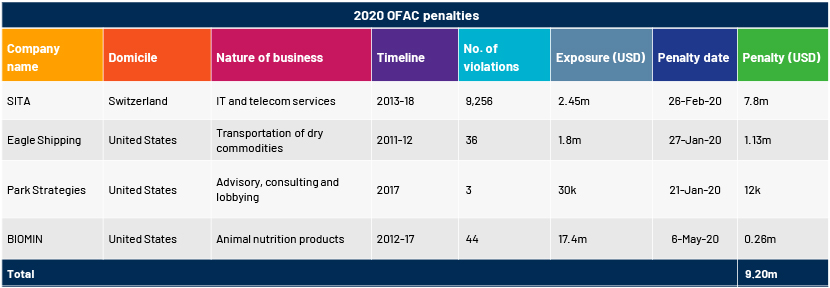

The OFAC has accrued c.USD9.20m through civil penalties for violations from four companies so far in 2020. Trends are changing, and its focus is now on non-financial sectors, due to their lack of understanding of sanctions.

Emerging trends from 2020 OFAC settlements:

Summary of settlements:

-

Settlement 1: Société Internationale de Télécommunications Aéronautiques SCRL (SITA)

-

Provided multiple communication software services to Iranian, Iraqi and Syrian private airlines, violating Global Terrorism Sanctions Regulations (GTSR)

-

Took a reactive approach and knowingly violated sanctions by curtailing access only to selected software related to fields such as ticketing, airfare, and e-commerce, and continuing to provide software related to areas such as baggage management and messaging services after sanctions designations

-

The OFAC identified violations as the sanction-designated entities were identified as SITA’s member owners and services were offered from, or transited through, the group’s US companies

-

-

Settlement 2: Eagle Shipping International USA LLC (Eagle Shipping)

-

Involved in shipping sea sand from Burma between the consignee and the consignor, where the consignor was sanctioned under Burmese sanctions regime

-

Applied for an OFAC licence for the first time and shipped goods before the OFAC’s response and continued to engage with the seller after the OFAC denied the licence

-

The OFAC identified violations through the company’s self-disclosure after it was taken over by the new owners

-

-

Settlement 3: Park Strategies, LLC (Park Strategies)

-

Entered into a contract with a Somalian company to engage in lobbying activity in relation to real estate deals with various divisions of the US government, violating GTSR

-

The OFAC identified violations through the company’s self-disclosure, and the company blocked the first payment of the contract as soon as it had realised the breach

-

-

Settlement 4: BIOMIN America, Inc. (BIOMIN)

-

Was engaged in the sale of agricultural commodities produced outside the US to a Cuban company without authorisation from the OFAC, violating Cuban Assets Control Regulations (CACR)

-

Developed a transaction structure that it incorrectly determined would be consistent with US sanctions

-

During the time when the apparent violations occurred, BIOMIN did not have an OFAC-compliant programme in place; it later made a self-disclosure of the violation

-

Takeaways:

-

Secondary sanctions are applicable not only to companies in the home country but also to companies that leverage a global network of offices to deliver their services

-

To transact under sanctions regimes, a company could obtain a general licence or a specific one from the OFAC

-

Sanctions could be enforced even though the original executive order is no longer effective

-

Sanctions regimes cover vast areas and could relate to transactions where a company acts as a third party to buy/sell goods or services

-

It is important to conduct a fool-proof due diligence review and audit, both before and after an acquisition

-

Self-disclosure is a good thing and leads only to nominal fines, with minimal business impact. Companies should also constantly and closely watch for the following:

-

Changes to the sanctions programme and their applicability over time

-

Exemptions available under each sanction designation

-

History of case-by-case approval of licences by sanctioning bodies to deal with sanctioned parties

-

How Acuity Knowledge Partners can help:

We are equipped to assist companies to identify and deal with an offense/sanction nexus in their customer bases, supplier lists, projects, or transactions through the following:

-

Extensive sanctions due diligence, remedial proposals and accurate sanction reporting on companies/groups of companies

-

Expert advice from a team of sanction compliance specialists on deals, projects, mergers and other such activity

-

Training and development programmes to up-skill compliance teams to deal with real-time sanction risks

Source

Tags:

What's your view?

About the Author

Ganesh Hebbar has over 9 years of experience in compliance, having worked for various firms including Goldman Sachs and Societe Generale. His expertise spans across the risk and compliance sector, focusing on know your customer (KYC) and risk management. Ganesh has done his MBA from Ramaiah Institute of Technology Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox