Published on February 8, 2018 by Ambarish Srivastava

Akin to any financial crisis, the 2008 global financial meltdown led to reshaping the financial industry’s practices and procedures. The private equity (PE) sector also faced increased regulatory scrutiny after implementation of the Dodd Frank Act in 2010, particularly in the form of new regulations in key regions, e.g., the Alternative Investment Fund Managers Directive (AIFMD) in the EU and the Volcker Rule in the US.

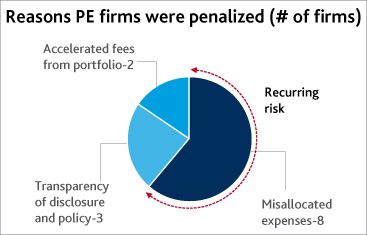

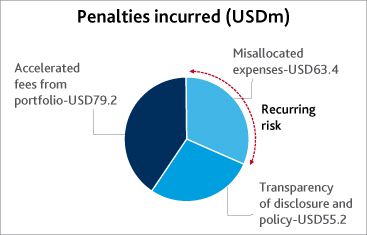

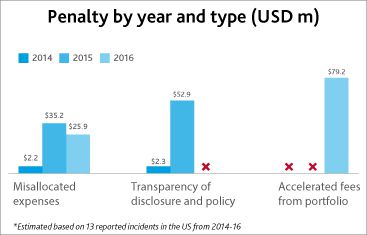

Regulators also hounded the sector to identify clear or perceived violations of the Investment Advisers Act. The US SEC’s Office of Compliance Inspections and Examinations (OCIE) became more active and charged 13 firms for ethics- and fraud-related offences in 2014-16.

Regulator actions

Based on observations in the US, regulators examined PE firms’ books, investigated fraud and fined those they found to be acting fraudulently. Such avoidable developments, when publicly exposed, embarrassed this publicity-shy sector. The regulators exposed two types of risks in the firms’ books:

(1) Situational risks: These arise from a defined category of regulatory observations, e.g., ‘accelerated fees from portfolio’ and ‘transparency and disclosure’. These risks could be expensive to incur but can be mitigated by strengthening internal policies and controls, to ensure a low level of occurrence.

(2) Recurring risks: PE firms were exposed to a large number of such risks, as these occur not only due to a lack of definition but also due to errors in commission or omission, e.g., ‘misallocated expenses’.

PE firms did not face similar incidents of situational risk once a specific risk was addressed, although they could face new risks, leading to penal action. However, the seemingly low-risk ‘recurring risks’ category, i.e., ‘misallocated expenses’, posed a higher risk, with violations observed for all three years examined.

Regulators could also check historical records, for example, the way they examined a firm’s misallocated fees since 2001.

Risk mitigation by PE firms and the cost conundrum

With regulatory vigilance here to stay, and likely to increase, firms are adopting stringent processes and sanitizing books to carefully allocate costs of their investment activities, and are implementing business policies and organizational procedures to mitigate risks.

However, since most of these changes are carried out internally, a firm ends up consuming precious internal bandwidth on non-productive work. This work could be outsourced to external vendors, but classifying costs of activities performed by such vendors also becomes a daunting task. Even after defining watertight policies, such engagements are exposed to ‘recurring risks’. To mitigate these risks, firms would either need to (a) invest in additional administrative bandwidth internally or (b) align vendors’ processes with their internal processes, to streamline cost allocations.

The second option could be a viable long-term solution if external vendors are tightly integrated to share responsibilities, reduce risks, and save administrative time. However, most vendors are bound by their own structures and lack the flexibility to exactly mirror a client’s set-up. Hence, PE firms find it challenging to identify a partner that can understand their organizational structures, cost allocations, regulatory reporting, and business requirements and associated flexibility. However, if such a partner is identified, synchronizing processes and reducing risks, especially recurring risks, become much easier.

MA Knowledge Services is experienced in working with PE firms of differing sizes across strategies and spaces, and understands the characteristics of the PE world in terms of structure, funding and costing. Accordingly, we adopt processes that mirror a client’s internal processes and that mitigate compliance risk. Our integrated and seamless work approach helps to classify activities efficiently and in real time, and to classify deliverables by type, geography and funds. Our internal processes not only proactively mirror industry-focused regulatory updates (e.g., on insider trading) but are also vetted by external agencies (e.g., ISO certifications).

What's your view?

About the Author

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox