Published on November 17, 2023 by Gunjan Lahoty

The US Labor Department announced the consumer price index had advanced 3.0% y/y in June 2023. The increase indicated a global trend of higher inflation driven by ultra-expansionary monetary policies implemented by central banks worldwide to counter COVID-19-induced supply chain disruptions, exacerbated by higher energy prices on geopolitical issues. In order to counter the escalating consumer prices, the US Federal Reserve resorted to several hikes in interest rate in 2022 and 2023, which climbed sharply to 5.25%-5.50% in July 2023 after sustaining at 0% for more than a year amid the pandemic. With that said, it is about time we discuss the elephant in the room – low-investment-grade loans in a rising interest rate scenario:

-

Lenders adopt better underwriting standards to lower the credit risk, shifting their portfolios to operationally efficient and higher-profit-margin-generating businesses. This makes it challenging for low-investment-grade companies to access credit for their operational and capital investments.

-

As inflation drives higher interest rates, a direct impact is reflected in the deterioration of interest coverage ratio of companies that lack significant pricing power to maintain EBITDA and free cash flow.

-

Expensive borrowing rate increases discount rates and lowers the present value of future cash flow, putting high-growth businesses at most risk, as they require high cash burn amid falling valuations and investor confidence.

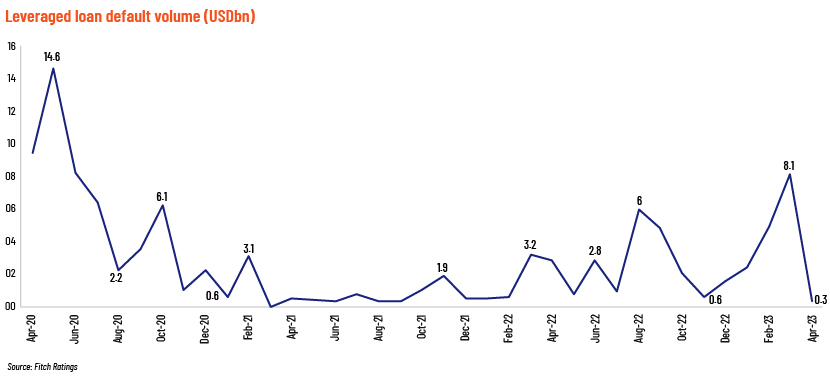

However, as we observe below, the US leveraged loan default volume has declined from its peak in April 2020 – a result of sudden movement restrictions imposed during the COVID-19 .

Despite the aforementioned challenges faced by leveraged lending transactions during such recessionary tendencies, what has caused loan default levels to cool off? The answer lies in the evolution of the leverage lending market following the global financial crisis era:

-

Syndicated loans: Credit risk is diversified, with a group of lenders (syndicate) pooling their funds to provide credit to a single borrower, providing a particularly fertile ground for financial innovation.

-

Covenant monitoring: In order to protect lenders from potential credit risk, credit agreements explicitly state debt covenants, as restrictions placed on borrowers as a control mechanism for maintaining the lender-borrower relationship after loan origination. Signs of financial deterioration or an overdue covenant attestation is alerted timely to the credit officers. Companies usually comply with their qualitative and quantitative covenants in order to maintain their creditworthiness.

-

Interest rate hedge: A credit agreement often mentions a cap on interest rate, limiting how high the interest rate can rise on variable debt, thereby protecting a borrower from significant rate hikes.

The adoption of lending terms and associated regulatory compliance policies based on current market conditions has eliminated potential risks to a considerable degree and the associated regulatory compliance policies, allowing banks to continue their lending activity and companies to remain afloat during economic difficulties through wider and deeper access to capital.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners offers bespoke leveraged finance services tailored to the current needs of investment banks and specialist advisory firms. Solutions include extensive support across acquisition financing, loans, high-yield bonds, project finance and debt refinancing/restructuring. Our sector experts continually track sector dynamics and factor them in the customised solutions we provide in each sector.

Sources

Tags:

What's your view?

About the Author

Gunjan Lahoty is a qualified Chartered Accountant and Company Secretary with more than five years of experience in financial analysis and credit underwriting. Currently , part of the Leveraged Lending team at Acuity Knowledge Partners handling US Corporate Clients. Prior to joining Acuity, she was part of Commercial Banking Credit Stewardship team of leading UK bank handling portfolio of Corporate and Commercial Clients.

Like the way we think?

Next time we post something new, we'll send it to your inbox