Published on May 3, 2021 by Namrata Deka

Highlights:

Latin American (LatAm) cross-border corporate issuance has been strong since 4Q20 as investors have sought higher yields due to the US benchmark interest rate remaining at sub-zero levels amid the pandemic

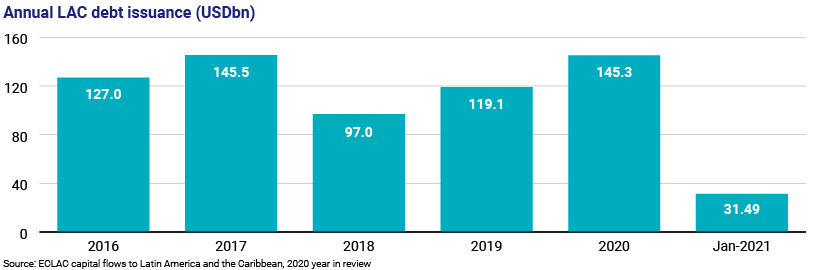

Total LatAm and Caribbean (LAC) issuance grew by 23% y/y in FY20; issuance in January 2021 alone represented c.22% of total FY20 issuance

Rising US Treasury yields have made investors wary of investing in emerging-market (EM) credits, but higher yields and ample market liquidity are likely to keep demand for LatAm corporate issuance afloat

Hunt for yield drives investment in riskier LatAm markets

Demand for EM debt markets has remained high as the US Fed continues to keep the benchmark interest rate near zero. This, coupled with high liquidity backed by significant fiscal spending, has made investors look beyond safe havens and hunt for yield.

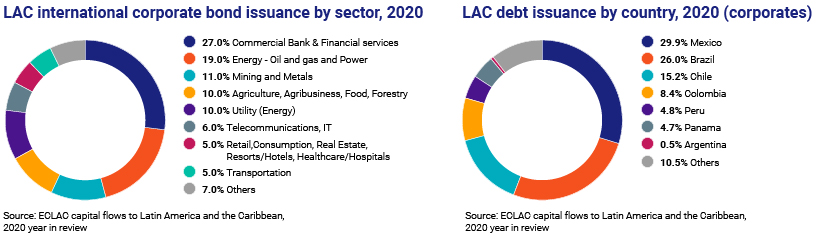

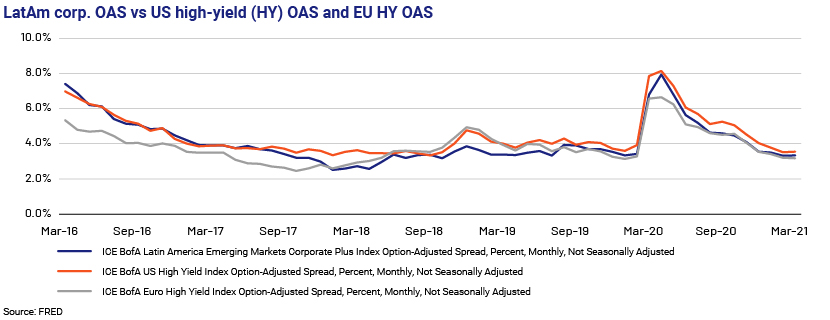

LatAm corporates have benefitted from this capital flow: LAC issued USD145.3bn in the international market (+23% y/y) in 2020, with 55% of the issuance coming from corporate issuers and >90% being denominated in USD. Data from Dealogic suggests that November and December 2020 were the busiest months on record for LatAm issuers, with international bond issuance (from corporates, sovereigns, and supranational and financial institutions) of c.USD23bn. The market gained momentum as the Fed decided to keep rates near zero in November, prompting the hunt for yield as the average option-adjusted spread (OAS) on LatAm corporate bonds remained one of the widest at 380-450bps from October to November 2020 (vs US investment-grade OAS at 100-140bps).

LAC cross-border issuance started at a record high USD38bn in January 2020, but pandemic stress in mid-March 2020 widened corporate spreads to c.700bps as volatility and risk aversion reached historic peaks. However, by 2Q20, spreads started to tighten and volatility subsided as the Fed and the European Central Bank (ECB) resorted to liquidity taps to revive their respective economies. This presented LatAm corporates an opportunity to increase their debt maturity (to 16 years vs 15 years in 2019) and reduce their cost of debt. Average annual coupons on LAC bonds issued in 2020 were c.4.4% vs 5.3% in 2019.

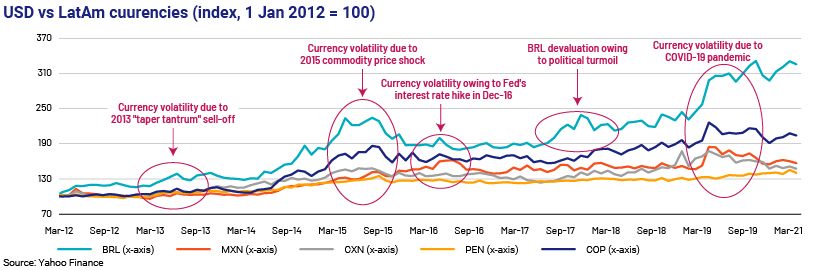

Foreign exchange rates, and social and political unrest remain the overhang on LatAm bonds

Although the spreads on LatAm issuers remain attractive, they introduce idiosyncratic risks ranging from social and political upheaval to foreign exchange volatility. Foreign exchange volatility has historically been a drag on LatAm issuers, with rising interest rates in the US and a strengthening USD weakening LatAm currencies (for example, the Brazilian real depreciated by about 20% from January to December 2013 during the “taper tantrum” that year). Foreign exchange volatility in LatAm economies is broadly driven by the following:

Wide current account deficits, with LAC’s current account deficit at an average of 2.3% of GDP over 2010-19, coupled with low foreign exchange reserves. Foreign exchange reserves of Brazil, Chile, Colombia, Mexico and Peru (the LA5 economies) stood at c.23% of GDP as of December 2020 and at 18% as of December 2019.

High proportion of foreign-currency debt – LAC’s external debt as a percentage of exports of goods and services stood at 226.7% in 2020 and 192.6% in 2019 vs 95.7% and 85.9% in EM Asia and 141.9% and 120.9% in EM Europe, respectively. LAC’s foreign reserves in months of imports stood at 8.9 in 2019 vs 11.5 for EM Europe and Central Asia and 7.9 for South Asia.

Political instability, coupled with low productivity. LAC’s real GDP grew at an average of 2.0% over 2010-19 vs 7.0% in EM Asia and 3.1% in EM Europe.

LatAm economies are leading exporters of commodities, including natural minerals (oil, copper, and iron ore) and agricultural products (coffee and soybean); therefore, they remain dependent on commodity cycles that are priced and traded in USD.

However, despite substantial foreign exchange risks, investments in LatAm markets remain highly sensitive to idiosyncratic risks. Thus, understanding corporate fundamentals and financial strategies and, more importantly, the respective government’s ability to support plays a crucial role. As such, commodity-oriented sectors – such as mining, oil and gas and agriculture – may provide a natural hedge against their USD-denominated debt during periods of commodity upturn.

What’s in store for 2021?

Fitch expects USD12.4bn and USD19.1bn worth of bond maturities in 2021 and 2022, respectively (as of September 2020), for its LatAm rated issuers; this should result in high refinancing activity through the year. Furthermore, the outlook for LatAm economies is likely to be supported by rising commodity prices. Expectations of strong GDP growth from the US and China – the LatAm markets’ key commodity-importing partners – are also likely to support growth (US 2021 real GDP is forecast to grow 6.4%, China’s 8.4% vs LAC’s 4.6%). Expected commodity price increases include those of copper, iron ore, and crude oil.

Even though increased optimism about global growth and the recent USD1.9tn US fiscal stimulus are leading to rising US bond yields, US real bond yields are at a historic low of about -80bps. Rising yields and high inflation expectations have forced LatAm central banks to consider rate hikes despite economic uncertainty, which should provide currency protection in the near term. Brazil increased its benchmark interest rate by 75bps to 2.75% in March 2021 and has flagged another 75bps hike in May 2021; other LatAm economies are likely to follow suit.

Thus, with the Fed expected to keep interest rates at sub-zero at least until 2023 and global liquidity at an all-time high, we expect LatAm offshore corporate bond issuance and demand for such issuance to remain elevated through 2021.

How Acuity Knowledge Partners can help

Increased issuance activity in LatAm debt markets, coupled with widening yields, presents attractive investment opportunities for foreign participants seeking higher returns. Asset managers globally have leveraged our credit research expertise over the years given our experience in covering EM issuers and our deep understanding of the nuances involved in analysing EM issuers and the idiosyncratic risks and opportunities they bring to investment. Our subject-matter expertise and on-the-ground presence in San José, Costa Rica, further strengthen our service offering. Our time-bound scalable solutions have helped asset managers of all sizes not only to develop proprietary solutions but also to track local sector and regulatory developments by analysing reporting in Spanish and Portuguese.

Tags:

What's your view?

About the Author

Namrata has five years of experience in investment research and has been associated with Acuity Knowledge Partners (Acuity) since September 2018. In her current role, she covers distressed issuers in LatAm. Prior to joining Acuity, she worked as a financial analyst at Trefis and JP Morgan Chase. Namrata holds an MBA (Finance) from the ICFAI Business School, Hyderabad, and a B.Com (Hons) from the University of Delhi. She has also passed the CFA Level III examinations.

Like the way we think?

Next time we post something new, we'll send it to your inbox