Published on April 4, 2024 by Yaran Li

What is the jeonse system?

South Korea’s real estate market has two rental systems: one is similar to that in other countries – pay a deposit and monthly rent. If there is no deposit, the rent will be more expensive. The other system is unique to South Korea and is called jeonse.

In the jeonse (Korean: 전세; Hanja: 傳貰) system, instead of a monthly rent, tenants pay a one-time deposit of 50-80% of the market value of the premises, which is returned at the end of the lease. Instead of collecting monthly rent, the landlord can reinvest this full amount. The system was originally established amid high interest rates in the 20th century, when South Korea’s housing finance was weak.

South Korea, Spain, France, Argentina, Bolivia and other countries have a jeonse system, but only South Korea and Bolivia actually use it in their housing markets (source: A Comparison of the History of Jeonse and Bolivia's Jeonse System, Kim Jin-yu, Korea Research Institute, 2015).

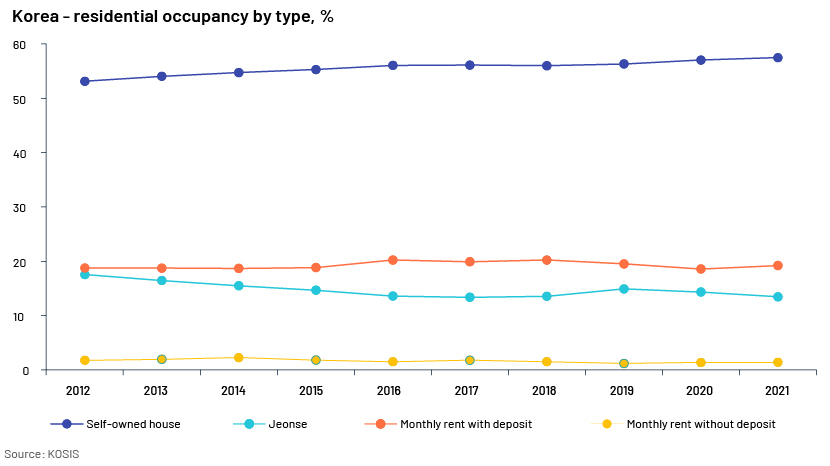

The security deposit in South Korea's real estate rental market is KRW900-1,000tn. The number of those paying monthly rents in addition to a security deposit continues to increase, but jeonse remains a primary lease system. Pure jeonse households have dropped by 50% since 2014 and are fewer than those that pay monthly rents in addition to a security deposit, but jeonse remains the dominant form of rental payments: about 48% of the households in Seoul are pure jeonse residents.

Real estate prices fell in the early 2010s, and jeonse declined sharply, but the proportion of jeonse households has risen again since 2016 amid the real estate market boom. However, with the recent spike in lease fraud, the number of monthly rent contracts has increased.

Figure 1: Jeonse accounts for a large portion of Korea’s housing market

Why jeonse is popular in Korea

South Korea's jeonse system developed when the financial system was fragile and as part of private finance. Adoption has spread amid rapid urbanisation, mainly due to the constraints of the housing finance market. Amid high interest rates and weak housing finance, landlords use the jeonse system to quickly access large amounts of cash. From the perspective of a renter, the cost of living using the jeonse system is lower than if rent was paid monthly; the system is often used before transitioning to owning property.

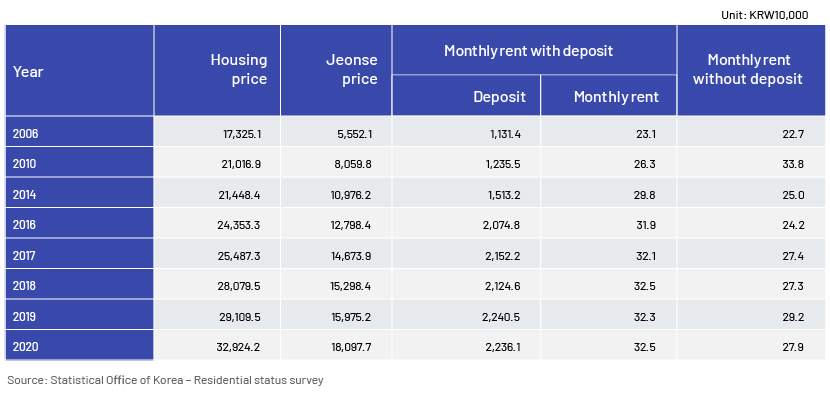

Table 1: A comparison of jeonse and monthly rent in Korea – jeonse is still the cheapest way to rent

Challenges – jeonse fraud

Problems arise when landlords squander the large sums of money tenants pay and have no money to return when tenants request to terminate contracts. The houses are auctioned, and the losses borne by tenants. This is known as jeonse fraud.

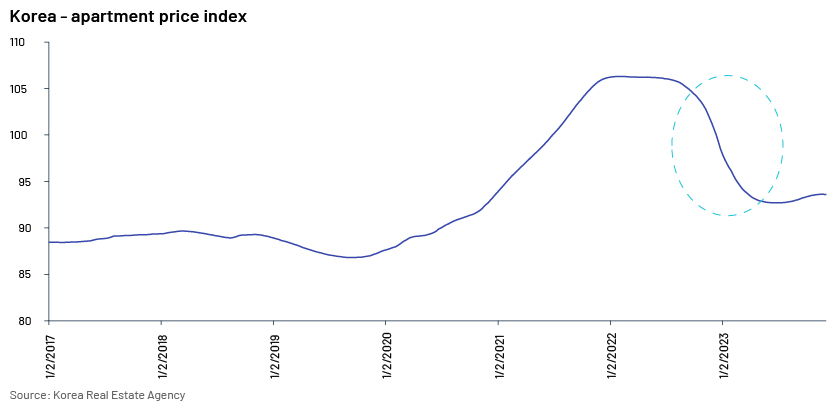

During the real estate boom, investment demand surged, and the jeonse model increased market volatility. However, the risk of landlords being unable to return tenants' security deposits is inevitable amid an economic downturn. When the housing price falls below the security deposit, the landlord will choose to breach the contract, relinquish home ownership and take the deposit. With the recent contraction of the real estate market, the problem of landlords not returning security deposits has increased. Tenants often borrow from banks to pay these deposits, and landlords not returning them leads to a series of ripple effects.

Figure 2: Korea's real estate market suffered a severe contraction in the second half of 2022

As the jeonse market continues to raise concerns, the South Korean government is formulating measures to prevent jeonse fraud and support victims, with increased focus on supporting victims. The Ministry of Justice has ordered the prosecution to respond quickly and strictly to lease fraud, according to a government announcement, and the prosecution plans to form a "council to respond to lease fraud" with the National Police Agency and the Ministry of Land, Infrastructure and Transport, and establish a "Prosecution and Police Regional Hotline" in seven major areas*. In particular, the prosecution, the police and the Ministry of Land, Infrastructure and Transport jointly extended the "special crackdown on pan-government lease fraud" to end-2023 to strictly punish lease fraud. Policy for 2024 has yet to be announced.

*Metropolitan areas (Seoul, Incheon, Suwon)/regional areas (Daejeon, Daegu, Busan, Gwangju)

Considering the structural problems of the jeonse system, each time the real estate market shrinks, jeonse-related risks would become more prominent, and fundamental improvement plans would need to be formulated.

Outlook for jeonse

Although the jeonse system has structural problems, it is likely to continue as the main rental system in South Korea. It contributes to the stability of housing supply and residential housing and enables tenants to raise investment funds. In addition, the lessee’s burden of rent is lighter than when paying rent monthly, increasing disposable income.

From the government's point of view, although jeonse is a private finance system, the government is trying to prevent a spike in non-performing loans. This is because South Korea does not have enough cheap public housing for rent and the government cannot maintain political stability unless it uses the jeonse system to ensure the stability of civilian housing. The stable supply of jeonse is one of the government’s main achievements in the real estate sector.

The jeonse system will likely remain, although policy measures such as increasing the number of market participants are needed to improve the transparency of jeonse transactions and improve policies.

How Acuity Knowledge Partners can help

Our research experience in South Korea helps us understand the evolution of its real estate market. We have in-depth knowledge of this market, its policies and regulations, news and market trends.

Sources:

-

Statistical Office of Korea – Residential status survey https://www.kostat.go.kr/board.es?mid=a10409070000&bid=12030&act=view&list_no=422671

-

Korea Real Estate Agency https://www.reb.or.kr/r-one/main.do

-

kr<정부, 전세사기 근절·피해회복 위해 기한 없이 단속한다>, 2023.11.01 정부, 전세사기 근절·피해회복 위해 기한 없이 단속한다 - 정책뉴스 | 뉴스 | 대한민국 정책브리핑 (korea.kr)

-

A Comparison of the History of Jeonse and Bolivia's Jeonse System, Kim Jin-yu, Korea Research Institute, 2015

Tags:

What's your view?

About the Author

Yaran Li joined Acuity as an Investment Research Analyst in November 2018 and presently supports the China consulting team as a consultant since September 2023. Prior to Acuity China consulting team, she supported Macro-economy team of top-tier global Investment bank, focusing on the Korea and Taiwan market. Her key responsibilities include data collecting and analyzing, news tracking, policy research and translating. Prior to Acuity, she worked as an Equity Data Research Analyst in Morningstar with a focus on Korea market company research.

Like the way we think?

Next time we post something new, we'll send it to your inbox