Published on June 29, 2022 by Sohan Choudhuri

The Chilean government is mulling a new royalty scheme for the mining industry, which can materially influence mineral inventory crucial to leading industries globally. It is estimated that the enforcement of the new tax regime could hike the tax rate of copper mining businesses up to c.80%, shrinking gross profit by 50% or more at existing copper prices. Chile will then likely have the peak tax liability on copper mining, potentially prompting companies to revisit the feasibility of their existing and future investments.

Mining industry overview in Chile

Mining is one of the key economic sectors in Chile. Copper throughput in the nation held a c.28% global share in 2020. Chile also produces 22% of world lithium output (second-largest share). The mining sector accounted for 12.5% of overall GDP in Chile in 2020. Additionally, it holds the fourth position in exploration budget. From 2019 through 2026, an estimated USD22bn in mining project execution and USD31bn in evaluation were expended in Chile.

Existing tax structure in mining sector

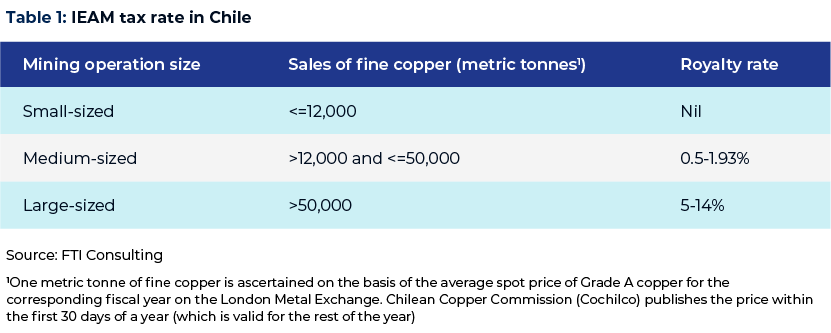

Chilean Income Tax Law, through Articles 64-bis and 64-ter, regulates Chile’s specific mining tax, Impuesto Específico a la Actividad Minera (IEAM). It was enforced on 1 January 2006 through Law No. 20026. The tax was amended in 2010, through Law No. 20469, to ratchet up the tax liability of large miners. IEAM levies staggered taxes on the operating margin of mining operators (see the table below).

Proposed royalty in mining sector

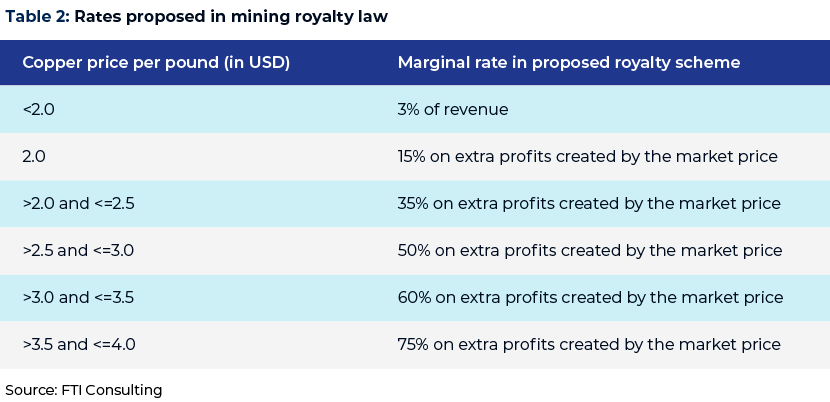

In March 2021, advanced discussions on planned mining legislation within the National Congress of Chile explored the introduction of novel tax rates on the sale of lithium and copper. While the Lower House approved the bill on 6 May 2021, voting in the Upper House was pending. A two-thirds majority in the Senate is essential to approve the bill. Two proposals are being evaluated, but nothing concrete has emerged. The first one proposes a basic tax of 3% on gross sales of companies with annual copper production of over 12,000 tonnes, plus a rate hike based on the yearly average price of copper established on the London Metal Exchange. The second proposal stipulates a 5% royalty on mining margin. The bill also suggests discounts on marginal rates based on the proportion of mined products processed. For copper smelting and refining in Chile, rebates will likely move northwards on marginal rates.

Impact of planned royalty rate on project economics

We consider Minera Salar Blanco (MSB) SA’s project to ascertain the sensitivity of projects to royalty rate. MSB SA – a stage I lithium project – is owned by three entities – Bearing Lithium Corp (17.14%), MSB SpA (31.31%) and Lithium Power International (51.55%). The project is located 170km northeast of Copiapo province in III Region of Atacama in northern Chile. Highlights include the following:

-

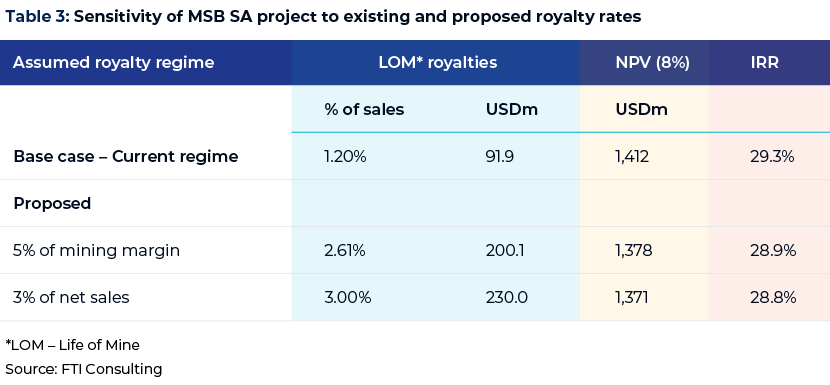

The project is registered under IEAM. Production from the project would be subject to Law 20026 of Specific Tax on mining activities. Royalties would amount to c.USD4.6m per year, or c.1.2% of yearly sales.

-

In the new royalty scheme, two proposals have been floated. The first one proposes a 3% royalty on net sales, while the second one has set a 5% royalty on mining margin, equivalent to 2.7% royalty on net sales.

-

Overall project economics is unaffected, as the project is largely immune to royalty rate. Advancing royalty from 1.20% to 3.0% of sales diminishes the project’s net present value (NPV; currently 8%) by 2.9ppt and the IRR (Internal Rate of Return) by less than 0.5ppt.

Near- and long-term ramifications of proposed royalties

a) Tax burden:

-

The imposition of the suggested law would raise mining companies’ gross tax burden. Tax liability is estimated to ramp up from c.14% to over c.80% for large copper miners. Furthermore, the average payback allowance for copper miners in Chile will likely shrink c.55% at copper price of USD4 per pound.

-

Additional royalty can downsize production or force a number of mines in Chile to fold operations.

-

Chile will likely become less competitive than countries such as Australia, Peru, Canada and Mexico. For example, the average tax for mining companies is c.44% of net sales in Australia, c.41% of net sales in Mexico, c.40% of net sales in Peru and c.40% of net sales in British Columbia, while the new tax in Chile envisages a royalty of 75-80% of net sales.

b) Uncertainties shrouding FDI flow:

-

Prospective investors may be affected by the suggested royalty regime starting in 2024. Consequently, international mining operators could flock to other nations.

Risk management of investors against proposed royalties

-

Contract assessment. Mining investors are encouraged to assess their position if the new royalty scheme comes into force. They should meticulously evaluate the contractual terms under which projects are being implemented to uncover hidden risks in projects.

-

Fiscal stability agreements. They are likely to be critical to investors. These deals are invoked through local tribunals or international arbitration and lend an edge in negotiations with fiscal authorities. Projects that benefit from stability agreements are more attractive in non-uniform tax scenarios.

-

Project ownership structure. Investors should evaluate project holdings to guarantee most suitable investment treaty coverage for their foreign assets.

How Acuity Knowledge Partners can help

The Research team within our Private Equity and Consulting Group offers a slew of strategic advisory and support services to metal and mining companies. We work with metal and mining bellwethers, offering insights on areas such as project profiling, M&A and deals, and regulatory landscape. Moreover, our subject-matter experts provide customised, time-bound solutions to swiftly map strategic objectives and execution plans.

Sources

https://investchile.gob.cl/key-industries/mining/

https://lithiumpowerinternational.com/wp-content/uploads/2022/01/NI43-101_DFS2022_LR.pdf

What's your view?

About the Author

Sohan has over 6 years of experience in the field of Infrastructure, Energy and Steel sector. Sohan is a Delivery Lead and currently supports Energy and Utilities clients across various geographies.

Sohan has diverse work experience with Government authorities, steel companies, project developers, power producers, utilities, cement players with focus on strategy formulation, pitch document preparation, investment advisory, market entry, financial advisory.

Sohan holds a MBA degree in operations from Narsee Monjee Institute of Management Studies (NMIMS Mumbai) and B.Tech degree from NIT Rourkela, Sohan has previously worked for one of the Big 4 consulting firms.

Like the way we think?

Next time we post something new, we'll send it to your inbox