Published on June 23, 2025 by Kirti Agarwal and Rajat Gupta

Introduction

Once characterised by traditional practices and personal interactions, the global wealth management industry is now experiencing dynamic digital transformation. Wealthtech is harnessing cutting-edge wealth management technology, including artificial intelligence (AI), big data analytics, blockchain, and machine learning, to revolutionize how wealth is managed, accessed, and grown. This shift is not only boosting efficiency but also democratising investment opportunities on a global scale.

The majority of the research institutes estimate that the wealthtech market, valued at USD5.4bn in 2024, will reach USD9.4bn by 2028 at a CAGR of 14.9%. This rapid expansion is expected to be fuelled by the drive to digitise the investment process, deliver tailored client experiences and introduce new and improved services, such as access to alternative assets.

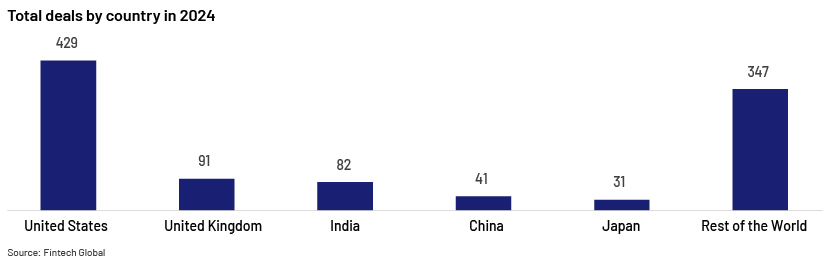

Global wealthtech deal activity plunged by 67% YoY to 1,021 deals in 2024 from the 3,105 deals recorded in 2023 and a 74% drop from 2020’s peak of 3,947 deals. US firms dominated the market with 42% of the deals in 2024. However, Asian countries are becoming important players in the global wealth management arena, boosted by their growing wealth and economies.

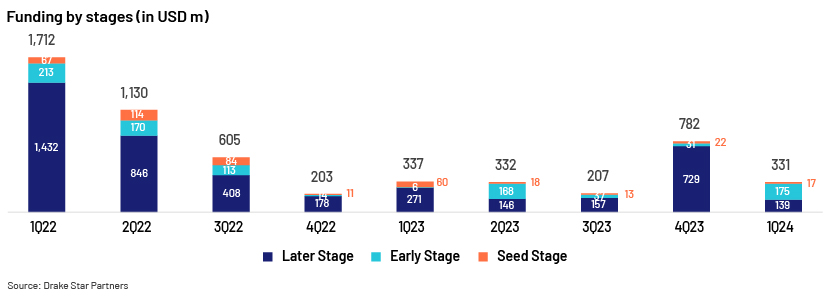

Investments in funding activities are slowly rising after a sharp decline, with investors’ focus shifting towards early-stage companies as investor optimism boosted due to a fear of recession and a decrease in inflation.

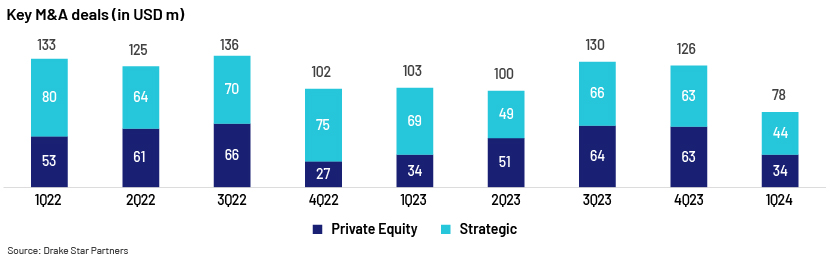

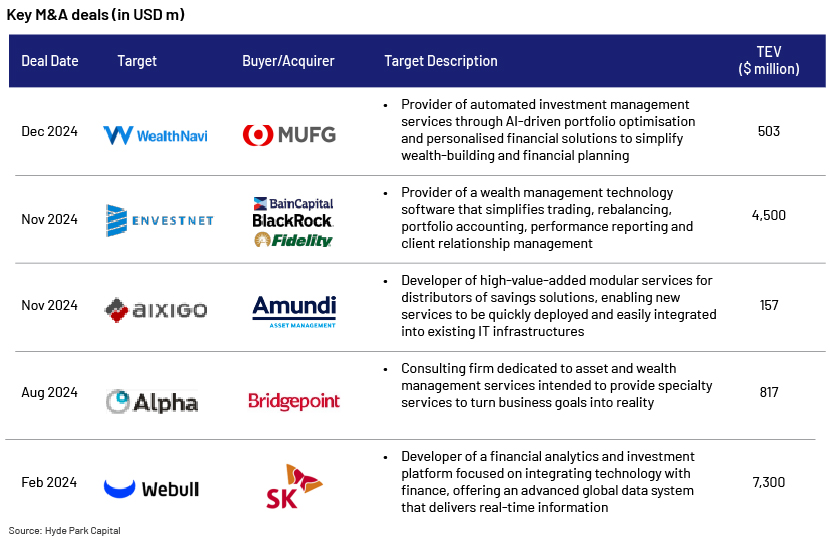

M&A deal volume declined by 38.1% in 1Q24 compared with 4Q23; however, the average deal value increased by 45% to USD145m in 1Q24 from USD98m in 2023, driven by strong activity of strategic buyers.

Industry growth drivers

Technological advancements

-

The use of AI in wealth management is driving smarter, more efficient processes, enabling firms to offer advanced portfolio strategies and real-time personalization. Robo-advisors, for example, use algorithms to create diversified portfolios tailored to individual risk appetites and goals.

-

Blockchain technology is ensuring secure and transparent transactions, while tokenisation is opening previously inaccessible asset classes, such as fractional ownership in real estate and fine art.

Regulatory requirements

-

In addition to technological advancements, regulatory changes have also contributed to the growth of the wealthtech Governments and regulatory bodies worldwide are recognising the potential of digital financial services and are implementing policies to support their development.

-

For instance, the European Union's Revised Payment Services Directive (PSD2) has been a game changer for the growth and revolution of open banking. It allows third-party providers to access financial data, paving ways to offer innovative services. Such regulatory frameworks are creating a conducive environment for wealthtech companies to thrive.

Growing demand for personalised financial services

-

Modern digital-native generations prefer seamless, mobile solutions that integrate automation with personalisation. Wealthtech platforms leverage AI and machine learning to analyse and process extensive datasets to deliver customised ae, aiding clients in making informed investment choices. This degree of customisation was previously unachievable with conventional wealth management approaches.

Emerging industry trends

ESG investments

-

Wealthtech platforms are helping to boost environmental, social and governance investments. AI-driven tools help clients identify sustainable investment opportunities aligned with their values. In the Europe, Middle East and Africa region, many as investment opportunities.

Blockchain for transparency

-

Wealthtech platforms are leveraging blockchain to streamline processes such as identity verification, asset tokenisation and cross-border payments. This not only improves efficiency but also builds trust among clients.

AI-driven analytics

-

Firms such as Morgan Stanley, BlackRock, and Openbank are using AI to increase manager productivity, forecast market trends, optimise asset allocation and enhance risk management strategies, giving them a competitive edge in dynamic markets.

The future of wealthtech

Wealthtech is poised to play an even larger role in the global wealth management industry. The market’s growth trajectory indicates that collaboration between traditional financial institutions and fintech startups will intensify, driving innovation.

Embedded finance, such as generative AI, is positioned to influence the future of wealthtech by democratising access to financial tools and granting consumers the ability to utilise capital markets and affordable portfolio management solutions.

How Acuity Knowledge Partners can help

The Wealthtech industry is continuously evolving, driven by advancements in technology, changing investor preferences, and the rise of digital-first solutions highlighting how Wealthtech trends are shaping the future of financial services. However, this growth comes with challenges, particularly around navigating complex regulatory landscapes, maintaining robust operational models and staying competitive in a rapidly innovating market.

Acuity Knowledge Partners will assist by providing in-depth research on market dynamics, emerging technologies, and customer behaviour to help firms identify growth opportunities. We also offer monitoring and analysis of global regulatory updates, competitive landscape and positioning, competitive benchmarking, competitor tracking and market-entry strategy. We can also support fundraising efforts with investor presentations, business valuations, due diligence services and providing strategic guidance on mergers, acquisitions and partnerships to drive scalability and innovation.

Sources

-

https://fintech.global/2025/01/31/what-are-the-wealthtech-markets-to-watch-in-2025/

-

https://blog.tbrc.info/2024/08/global-wealthtech-solutions-market-analysis/

-

https://www.marketresearchfuture.com/reports/wealthtech-solutions-market-24442

-

https://www.linkedin.com/pulse/which-nation-led-wealthtech-deals-2024-how-financial-advice-wmgfc/

-

https://www.mckinsey.com/featured-insights/future-of-asia/a-wake-up-call-to-tap-into-digital-wealth

-

https://8573936.fs1.hubspotusercontent-na1.net/hubfs/8573936/Research/Ft_Q1_2024.pdf

-

https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2025/02/pulse-of-fintech-h2-2024.pdf

-

https://www.morningstar.com/views/blog/data/wealth-tech-trends

-

https://www.eliftech.com/insights/wealth-management-trends-driving-the-wealthtech-market-and-beyond/

-

https://hydeparkcapital.com/wp-content/uploads/2025/01/HPC-FinTech-Outlook-BankTech-Winter-2024.pdf

-

https://hydeparkcapital.com/wp-content/uploads/2024/12/HPC-FinTech-Outlook-Winter-2024.pdf

-

https://hydeparkcapital.com/wp-content/uploads/2024/08/HPC-FinTech-Outlook-Summer-2024-08.29.24.pdf

-

https://hydeparkcapital.com/wp-content/uploads/2024/03/HPC-FinTech-Outlook-Winter-2023.pdf

What's your view?

About the Authors

Kirti has over 8 years of experience in providing quantitative and qualitative research services to top strategy consulting firms. She has previously worked with the retail sector and provided specialized support on proposals, client cases, and business, and internal development initiatives. She is currently supporting strategic consulting assignments involving investment opportunity analysis, due diligence, market sizing, and business model evaluation.

Rajat has over 5+ years of experience in Investment Banking, Consulting and Financial Advisory with extensive experience in financial modelling, valuations, restructuring, company profiles, advanced excel, credit benchmarking analysis and pitch decks for raising debt and ad-hoc industry research using secondary sources and reports.

Like the way we think?

Next time we post something new, we'll send it to your inbox