Published on April 1, 2024 by Bhavya P

In a world grappling with climate change, social inequalities and corporate scandals, traditional finance no longer feels sufficient. We yearn for a system that rewards not just financial prowess, but also responsibility towards the planet and society. Enter environmental, social and governance (ESG) lending, a revolutionary approach that integrates ESG factors into lending decisions, creating a win-win scenario for both borrowers and the planet.

Beyond the balance sheet: demystifying ESG lending

What is ESG lending?

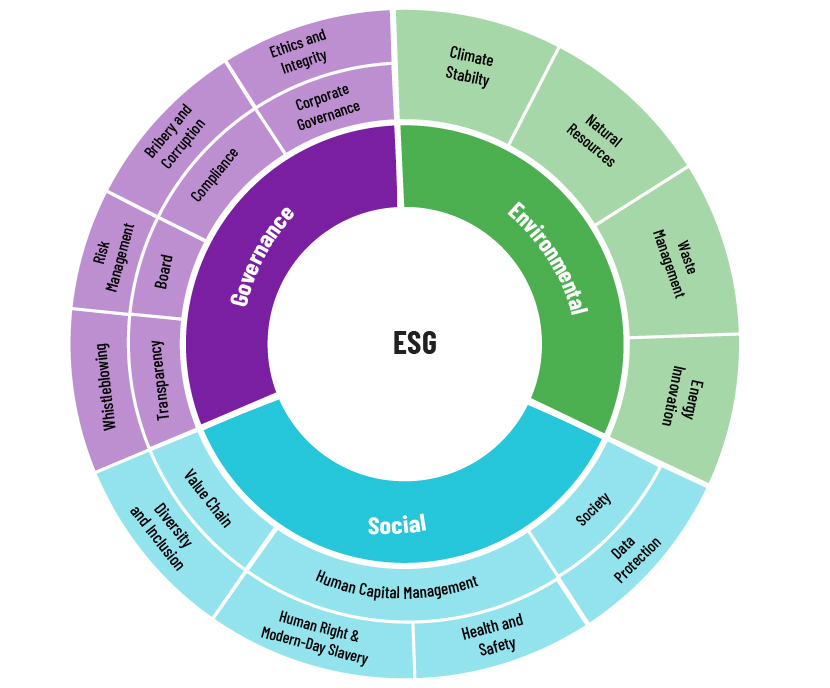

ESG lending goes beyond traditional creditworthiness assessments. It incorporates a borrower's commitment to environmental sustainability, social responsibility and good governance into the lending decision. This means that lenders consider factors such as the following:

-

Environmental:Energy efficiency, carbon footprint, waste management, pollution control

-

Social: Diversity and inclusion practices, employee wellbeing, community engagement, responsible supply-chain practices

-

Governance:Ethics, transparency, board composition, anti-corruption policies

By considering these factors, lenders can identify borrowers who are not only financially sound but also responsible stewards of the environment and society.

By analysing these aspects, lenders gain a more holistic understanding of a borrower's risk profile. Companies prioritising ESG principles tend to

-

Face fewer operational risks:Strong environmental practices mitigate the risk of environmental liability issues, while ethical governance structures minimise the likelihood of fraud or mismanagement.

-

Exhibit greater resilience:Companies investing in employee wellbeing and community engagement foster loyalty and build stronger relationships, creating a more resilient workforce and market presence.

-

Attract and retain talent:Conscious consumers and employees increasingly seek to align with companies making a positive impact, giving ESG-focused businesses a competitive edge.

The power of facts: quantifying the ESG advantage

The financial benefits of ESG lending are not mere theoretical predictions; they are backed by compelling data:

-

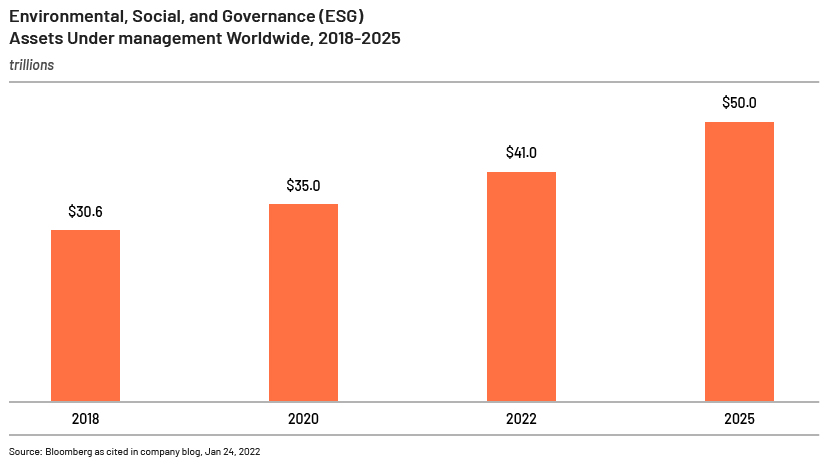

Global market boom:The global ESG lending market is projected to reach a staggering USD37tn by 2025, showcasing its rapid acceleration and growing investor interest.

-

Outperformance:A 2022 report by the Business Roundtable found that S&P 500 companies prioritising ESG outperform their peers by 5 points in total shareholder return over five years.

-

Investor appetite: ESG assets reached a stunning USD53tn by end-2022, representing more than 40% of professionally managed assets globally, according to the Global Sustainable Investment Alliance. This explosive growth underscores the fact that ESG is not just a fad, but a dominant force reshaping the future of finance.

Unlocking benefits for all – borrowers and lenders

ESG lending isn't just good for the environment and society; it's a win-win for both borrowers and lenders:

For borrowers:

-

Reduced borrowing costs:Studies show that ESG-compliant companies have lower borrowing costs due to perceived lower risk profiles. This translates into significant financial savings, freeing up resources for further investment and growth.

-

Improved access to capital:A wider pool of investors seeking sustainable investments opens doors for ESG-focused borrowers. This expands financing options and increases the likelihood of securing favourable loan terms, including through asset based lending services.

-

Enhanced brand reputation:Demonstrating a commitment to ESG principles attracts conscious consumers and investors, potentially boosting revenue and brand loyalty. A strong ESG profile also enhances a company's competitive edge in today's sustainability-conscious marketplace.

-

Improved risk management:Proactive management through strong ESG practices leads to fewer operational risks and defaults, benefiting borrowers in the long run. This not only enhances financial stability, but also builds trust with stakeholders.

For lenders:

-

Reduced default risk:Lenders have greater confidence in the long-term sustainability of ESG-compliant borrowers, mitigating the risk of default. This translates into greater stability and security for loan portfolios.

-

Attracting new investors:Offering ESG-focused financial products caters to a growing market of investors seeking sustainable investments, expanding and diversifying lender portfolios. This opens doors to new revenue streams and market opportunities.

-

Long-term profitability:Investing in borrowers committed to sustainable practices fosters a more resilient financial ecosystem, leading to greater returns for lenders. By contributing to a healthy planet and society, lenders also build goodwill and enhance their own brand reputation.

The Paris Agreement – a landmark treaty in the fight against climate change

The adoption of the Paris Agreement at the 21st Conference of the Parties (COP21) to the United Nations Framework Convention on Climate Change (UNFCCC) in 2015 was a pivotal moment in the international community's response to climate change. This legally binding international treaty brings together 195 parties (194 states and the European Union) under a common goal: limiting global warming and mitigating its devastating impacts.

Objectives

-

The central objective of the Paris Agreement is to restrict the increase in global average temperature to well below 2°C above pre-industrial levels, aiming to limit it to 1.5°C. This ambitious target signifies a significant shift from the previous 2°C limit and reflects the scientific consensus on the urgency of reducing greenhouse gas (GHG) emissions to avert catastrophic climate consequences.

-

Nationally Determined Contributions (NDCs): Instead of imposing a uniform target, the agreement operates on a bottom-up approach, where each country submits its own NDC, outlining plans to reduce GHG emissions and adapt to climate impacts.

Regulations encouraging ESG lending

-

Transparency framework: A robust, transparent system ensures that countries regularly report their emissions and progress, fostering accountability and trust.

-

Climate finance: Developed countries commit to providing financial support to developing countries, enabling them to transition to low-carbon economies and build resilience to climate impacts.

-

Technology framework: The agreement fosters international cooperation on technology development and transfer, facilitating the spread of clean and efficient technologies.

-

European Union: The EU's Sustainable Finance Disclosure Regulation (SFDR) and Taxonomy Regulation require financial institutions to incorporate sustainability risks and opportunities into their investment and lending decisions. They also need to disclose their ESG considerations to investors and clients.

-

China: China's Green Finance Guidelines encourage banks to increase green lending and integrate ESG factors into their risk management processes.

-

Singapore: The Monetary Authority of Singapore (MAS) launched the Green Finance Industry Taskforce to develop recommendations for promoting green lending practices in the country.

Legislation addressing specific areas of ESG

-

France: The "Energy Transition for Green Growth" law requires banks to offer specific sustainable investment products and report on their green lending activities.

-

Netherlands: The Dutch Sustainable Finance Action Plan includes measures to encourage banks to consider climate risks in their lending decisions.

Countries exploring mandatory ESG lending

-

Malaysia: The Central Bank of Malaysia is exploring the possibility of making ESG disclosure mandatory for banks.

-

India: The Reserve Bank of India has issued guidelines encouraging banks to incorporate ESG factors into their credit assessments.

The Paris Agreement represents a critical step forward in global climate action. Its goals are ambitious yet achievable through continued collective effort, strengthened commitments and innovative solutions. The future of our planet and its inhabitants hinges on our ability to collectively rise to this challenge.

Impact beyond balance sheets

ESG lending offers a broader lens for assessing a company's true value. By factoring in ESG factors, lenders gain insights into a company's

-

Resilience:Companies with strong ESG practices are better equipped to adapt to environmental challenges, social change and evolving regulations, mitigating risks and fostering long-term stability.

-

Innovation:Embracing sustainability often leads to innovative solutions and new business models, enhancing competitiveness and unlocking untapped market opportunities.

-

Attractiveness:Consumers and investors increasingly prioritise companies with strong ESG profiles, leading to increased brand loyalty, talent acquisition and access to capital.

Challenges and opportunities

While ESG lending holds immense promise, challenges remain:

-

Standardisation:Defining and measuring ESG performance remains complex, with the various rating systems and methodologies resulting in inconsistencies.

-

Data availability:Accurate and transparent ESG data is crucial for informed lending decisions, but gaps and inconsistencies still exist.

-

Greenwashing: Some companies may engage in "greenwashing" to falsely portray their ESG commitment, necessitating robust due diligence on the part of lenders.

However, these challenges are being addressed through collaborative efforts of investors, regulators and industry experts. Initiatives such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) are developing standardised reporting frameworks to enhance transparency and comparability. Moreover, growing investor pressure and regulatory scrutiny are pushing companies to genuinely embrace ESG principles.

A future built on values

ESG lending has the potential to fundamentally reshape the financial landscape. By aligning financial decisions with environmental and social responsibility, we can build a more sustainable and equitable future. Imagine a world where

-

Companies compete not just on price, but also on their positive impact on the planet and society

-

Investments flow towards businesses demonstrably committed to responsible practices

-

Financial markets create wealth not just for shareholders, but for all stakeholders, including future generations

Conclusion

This is the future that ESG lending promises. It's a future were borrowing smarter and growing greener are not just slogans, but a way of life, a path towards a healthier planet, a more just society and a more prosperous future for all.

How Acuity Knowledge Partners can help

-

Expert ESG analysis:We decipher complex ESG data, providing deep insights on potential borrowers' environmental, social and governance practices.

-

Customised risk assessments:Our tailored reports equip lenders with a comprehensive understanding of ESG-related risks and opportunities, mitigating greenwashing and maximising impact.

-

Benchmarking and best practices:We benchmark borrower performance against industry leaders, guiding companies towards sustainable growth strategies.

-

ESG communication and reporting:We help craft compelling disclosures and communications, transparently showcasing your commitment to responsible borrowing and lending.

Sources:

-

The Global Alliance for Sustainable Banking: https://www.gabv.org/

-

The Climate Bonds Initiative: https://www.climatebonds.net/

-

What Is ESG Investing and Why Is it Worth Trillions? | Nasdaq

-

https://www.longfinance.net/programmes/financial-centre-futures/global-green-finance-index/

Tags:

What's your view?

About the Author

Bhavya P is associated with Acuity Knowledge Partners with a year of work experience in the Financial Spreading domain as a part of Lending Services.

Bhavya is a dedicated and enthusiastic learner with strong passion for finance. Graduated MBA in Finance and Marketing at Presidency College, She have honed skills in the financial sector and awarded as the best student in the field of finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox