Published on July 25, 2025 by Surangi Liyanage

Debt restructuring plays a vital role in economies when businesses face financial stress and require debt modification for their credit facilities. When a borrower faces a sharp decline in their income, impacting ability to repay debt as planned, renegotiating repayment terms (tenure of the facility, interest rate, interim moratoriums, etc.) to suit the revised scenario is beneficial for both the borrower and the bank.

The borrower will benefit from an improved cashflow position to operate their business, preventing future credit downgrades, legal action or bankruptcy. The hope is that if one hits rock bottom, they can reconsider their repayment terms to make them bearable and sustainable.

The bank will be taking proactive steps to avoid a loan being classified as non-performing and the resultant ramifications. Furthermore, such actions will ensure customer loyalty and continued relationship.

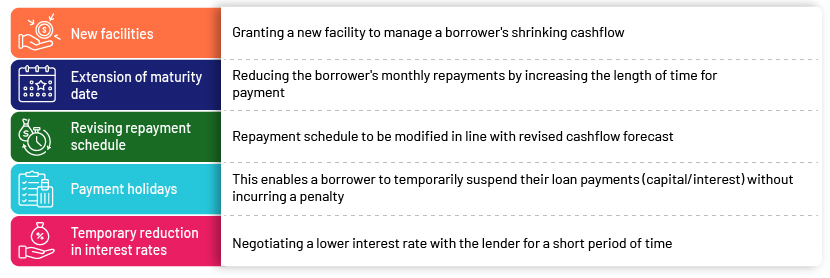

Amid the economic hardship caused by the pandemic, governments across the world extended concessionary schemes that were rolled out by their respective banks (for example, stimulus packages and bailout funds). Concessions ranged from new facilities to manage shrinking cashflow, payment holidays, extension of maturity dates and revising repayment schedules to temporary reductions in interest rates, providing borrowers with much-needed respite.

Overview of loan restructuring

Loan restructuring refers to modifying existing loan terms to align them with the revised business circumstances faced by the borrower. The mix of concessions granted will vary depending on the circumstances and financial conditions of each borrower.

Loan-restructuring procedure

A loan-restructuring process would be triggered for a number of reasons. The bank may identify certain events that result in a significant increase in credit risk (SICR) of the borrower and approach the borrower to enter negotiations to understand the circumstances. Another scenario could be broad economic shifts requiring renegotiation, similar to the experience in the aftermath of the pandemic.

When a bank undertakes a restructuring process, the credit is usually looked at afresh; the loan underwriter will thoroughly analyse the revised cashflow position of the borrower and offer new repayment terms to match this revised position. Depending on the revised circumstances of the borrower, the loan underwriter may need to negotiate new collateral to strengthen the credit proposal. Fresh covenants may also need to be incorporated to keep the credit facility on a tighter leash.

Upon obtaining the necessary approvals, an amended facility agreement will be executed with the new collateral arrangements as well. Thereafter, the loan operations team will do the needful on the loan management system to effect the restructuring and revise the repayment plan of the borrower.

Loan operations support for loan restructuring

Based on the restructuring proposal approved by the bank, it is the responsibility of the loan operations team to make the appropriate changes in the loan management system (LMS). First, the team would need to review the approval documents and ensure the changes approved are in line with the bank’s credit policy. Thereafter, the team will check whether the required legal documentation has been prepared and executed accurately.

As detailed above, there are multiple methods to execute a restructuring – from amending existing loan structures to granting new loans and even creating new collateral. If an amendment to the repayment plan is underway, the loan operations team will re-enter the loan amortisation schedules. Temporary reductions in interest rates would need to be made carefully, with proper alerts set up to revise the interest rate back to market rates after a given time.

If new collateral is being taken, due diligence of the insurance, valuations, etc. and proper lien perfection should be conducted to protect the bank from the enhanced risk undertaken.

The timing of these tasks is critical; therefore, if a large amount of restructuring needs to be implemented, the loan operations team needs to be adequately staffed to avoid delays that could result in the underlying loans crossing to non-performing status. Loans crossing to non-performing status have a number of consequences for a bank, ranging from increased impairment charges to a downgrade of investor ratings.

Impact of loan restructuring on the lender’s impairment loss

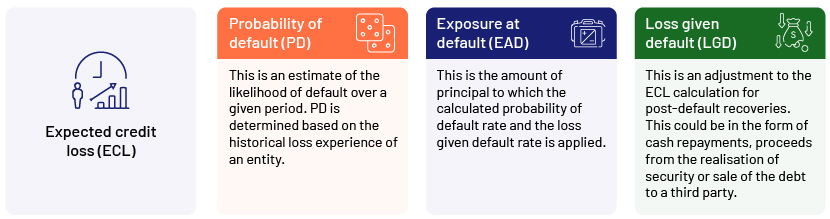

Banks incur impairment losses due to loan restructuring impacting net operating income. IFRS 9 introduces a forward-looking expected credit loss (ECL) model for impairment, replacing the incurred-loss model under IAS 39. When restructuring loans, banks need to exercise sound judgement in applying IFRS 9 by assessing whether there is a significant increase in credit risk.

ECL is the difference between contractual cashflow due to an entity and cashflow the entity expects to receive. ECL is recognised as a provision for impairment loss; this helps understand the potential risk associated with credit exposure. It requires companies to assess how current and future economic conditions may impact potential losses on their financial assets. This ECL model requires banks to recognise credit losses based on expected credit losses over the life of a financial asset, rather than waiting for evidence of a loss event.

According to IFRS 9, the first-time restructuring of a loan will classify the credit facility under Stage 2. IFRS 9 has identified three stages of credit facilities based on credit risk.

| Stage 1 | Stage 3 | Stage 3 |

|---|---|---|

| Assets that are performing/no significant credit risk | Assets that face a significant increase in default risk | Credit impaired |

| 12-month ECL | Lifetime ECL |

IFRS 9 permits two approaches: the general approach and a simplified approach, whereas banks and financial institutions use the general approach, as detailed below.

In the US, banks recognise ECL under the current expected credit loss (CECL) model, which is mandated by the Financial Accounting Standards Board (FASB). CECL requires recognition of lifetime expected credit losses at the time of asset origination or purchase. Unlike in IFRS 9, there is no staging. Lifetime ECL is recognised from the beginning.

How Acuity Knowledge Partners can help

We provide end-to-end expertise for all loan operations, including loan administration and in-life servicing, and have nearly 20 years of experience in supporting global banks across the loan lifecycle, providing tailormade solutions to 90+ banking clients in the retail, business, middle-market, real estate and leveraged finance segments.

In a restructuring event, we assist in preparing the amended facility agreement, incorporating all the revised clauses. Thereafter, on completion of the facility agreement and the collateral, we effect the adjustments in the loan management system and collateral management-related tasks such as a lien perfection. We have domain expertise in these areas of work spanning multiple loan management systems, enabling us to take on bulk project-type work from clients. We also support with accounting for loan impairments and loan restructuring via a bank’s internal accounting platform.

Sources:

-

https://assets.kpmg.com/content/dam/kpmg/na/pdf/IFRS9-for-Banks

-

Restructuring of Loans Explained With Loan Restructure Meaning, Benefits & How It Works

-

What Is Loan Restructuring? Understand the Process, Pros and Cons | Arthavya Markinn

-

Understanding Debt Restructuring and Loan Refinancing: Key Insights

-

Implementing IFRS 9 and CECL: Practical Insights | Deloitte US

What's your view?

About the Author

Surangi has over 9 years professional experience in internal and external audit, which includes 3.5 years at one of the Big 4 Audit Firms and covering many industries including banking & finance, insurance, trading & manufacturing, healthcare and agriculture & plantations. At Acuity Knowledge Partners, she has been operating as a Team Lead for the Financial Institutions portfolio in the US of a large European Bank, where she performed financial spreading, risk ratings, analytical credit review writing and periodic covenant monitoring tasks. She holds a Bachelor of Science in Finance with a 1st Class from the University of Sri Jayewardenepura, Sri Lanka and is also a qualified accountant, having..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox