Published on August 2, 2024 by Chitrang Chaudhary

The story so far

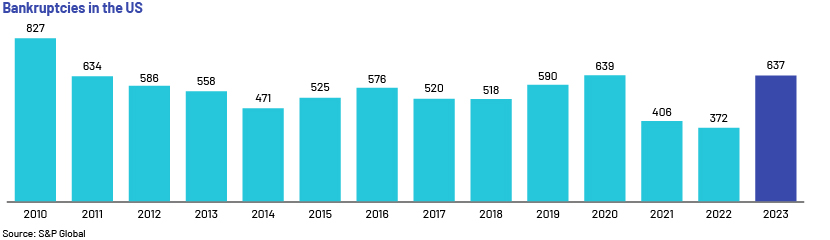

Corporate bankruptcies in the US are surging, with no signs of a slowdown. A total of 637 companies filed for bankruptcy in 2023, the most so far in this decade. Despite this spike, the level is still far from the peak during the Great Recession or for that manner, at any time before.

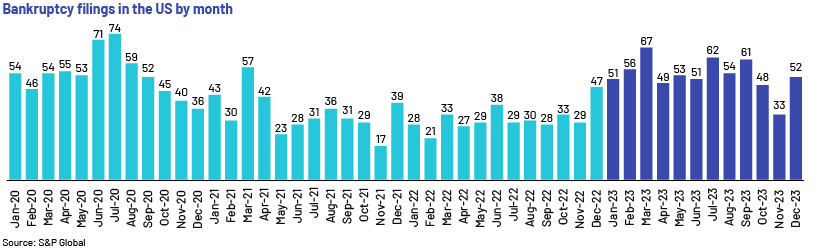

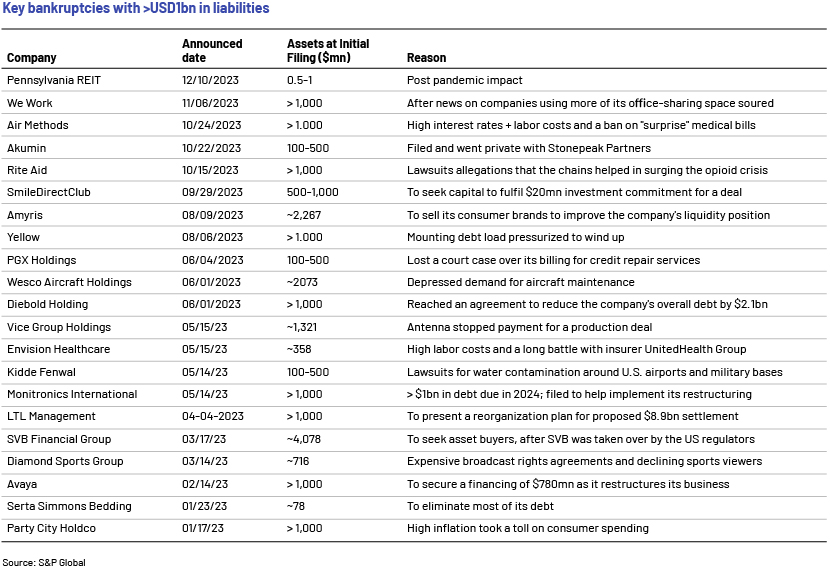

Economic headwinds such as high interest rates, tight labour markets and pressure from the “back to normal” trend have exerted additional pressure on cash-strapped companies that were floating on pandemic-related funds. 3Q saw the most bankruptcies in 2023, although there was some relief in October and November. A number of large corporates with large liabilities are likely to cave in because of high interest rates, creating uncertainty in the market and could result in loss of tens of thousands of jobs.

Chapter 11 filings gained pace in 2023, especially those by companies with more than USD1bn in assets. In 2022, only 16 companies with more than USD1bn in assets filed for bankruptcy; Pennsylvania REIT is the latest to join the list of famous corporations filing for bankruptcy, including WeWork, SVB Financial, Bed Bath & Beyond and Rite Aid.

-

Companies in the consumer discretionary and industrial sectors top the list, with 82 filings each, followed by companies in the healthcare sector, with 81 filings

-

The big retailers buckled due to high operating costs and interest rates, and pandemic-induced challenges such as a drop in consumer demand and disruptions to the value chain

What the future holds

Increased borrowing costs resulted in c.346 corporate defaults as of end-June 2024, and the list seems to be growing. Cash-strapped companies looking to refinance may have to reissue bonds at the current elevated rates and not at fixed coupons, with such floating-rate debt affecting earnings and profit margins. According to Fitch’s latest report, defaults by high-yield bonds reached 2.8% by end-2023, c.4x the 2021 default rate (0.7%). Defaults are seen across sectors, but companies in the consumer products, healthcare and industrial sectors are defaulting the most, driven primarily by high leverage, strained cashflow, elevated capex and reduced access to capital markets.

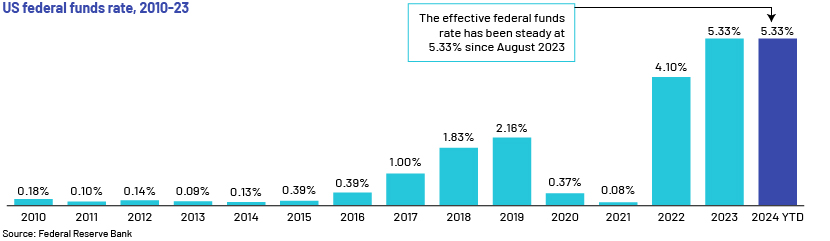

The federal funds rate, on the other hand, has been stagnant at 5.33% after a steep hike, with the US Federal Reserve waiting until September 2024 to cut its key interest rate due to strong resilience of the US labour market and a series of stronger-than-expected inflation data. Despite the cut, high borrowing costs are likely to remain a burden, causing defaults to increase in 2024 to 5-5.5%, before declining in 2025. Higher-for-longer interest rates would put downward pressure on free cashflow and limit financial flexibility and borrowing capacity for issuers seeking to address near-term maturities and other liquidity-related challenges.

How Acuity Knowledge Partners can help

We have two decades of experience in partnering with leading market players across market cycles. We combine analytical rigor with process expertise, helping corporate and investment banks improve operational efficiency and grow revenue. We have been collaborating with clients’ restructuring teams to implement customised front-office solutions by leveraging industry-best practices, technology automation and our global pool of subject-matter experts.

Sources:

-

S. business bankruptcies rose 30%, court stats show | Reuters

-

Corporate Bankruptcies Are Set to Reach a Decade-Long High – The New York Times (nytimes.com)

-

S. HY Default Rates Grinding Higher as High Rates Challenge Refis (fitchratings.com)

-

Wave of Bankruptcies, Corporate Debt Defaults Could Spark a Downturn (businessinsider.com)

-

Bankruptcy Filings Rise 13 Percent | United States Courts (uscourts.gov)

-

Fed May Be Done With Rates Hikes, but Get Ready for More Defaults in 2024 (businessinsider.com)

-

US Advisory Firms to Benefit from Rising Bankruptcies, Restructuring Volumes (fitchratings.com)

-

https://www.visualcapitalist.com/comparing-the-speed-of-u-s-interest-rate-hikes/

-

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

-

Federal Funds Effective Rate (FEDFUNDS) | FRED | St. Louis Fed (stlouisfed.org)

-

Leveraged Loan, High Yield Default Rates to Rise in 2024, Fall in 2025 (fitchratings.com)

-

Effective Federal Funds Rate – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

What's your view?

About the Author

Chitrang has been with Acuity since 2014 and has experience working with investment bankers globally from various products and sector coverage teams. Currently, he collaborates with senior bankers of various investment banks on live deals involving M&A and capital raising activities.

Like the way we think?

Next time we post something new, we'll send it to your inbox