Published on August 18, 2025 by Venkatarao Bodapati and Sunil Kumar Agarwal

The global trading landscape is evolving rapidly, with shorter trade-settlement cycles, increasing regulatory requirements and rising low-touch/no-touch trades posing operational challenges and necessitating enhanced risk management. Shorter settlement cycles demand significant investment in upgrading trading, clearing and settlement systems, while intensifying regulatory scrutiny in the US and Europe has led to the use of sophisticated tools to detect market misconduct. Additionally, the rise of low-touch and no-touch trading is reshaping broker-dealers’ margins, driven by the need for faster, cheaper and more efficient trading.

For firms managing these rapid changes, working with Acuity Knowledge Partners (Acuity) effectively addresses both operational challenges and regulatory compliance requirements. By collaborating with Acuity, broker-dealers can leverage advanced technological capabilities and experienced resources dedicated to efficiently managing trade operations, alleviating the full burden of in-house transformations.

The shorter trade-settlement cycle requires significant investment to upgrade or realign existing systems

The transition to shorter trade-settlement cycles to T+1 in key markets such as the US, Canada and Mexico on 28 May 2024 marks a significant milestone in global financial operations. The move towards a T+0 settlement cycle in certain markets such as China (where securities are settled on the same day) and India (which introduced an optional T+0 settlement for the top 500 stocks in January 20251) underscores the ongoing evolution and greater urgency for firms across regions to keep pace.

To comply with shorter trade-settlement cycles, broker-dealers are required to invest significant resources in upgrading technology capabilities and automating their trading, clearing and settlement systems. The costs related to these technological enhancements/automation initiatives can strain budgets, particularly for smaller firms lacking robust financial resources.

Additionally, the real-time nature and accuracy of trade data are paramount in achieving successful settlements within the shorter timeframes. Increased demand for swift decision-making may compel firms to expand their workforce, leading to overtime costs and increasing operational expenditure.

Commentary from industry leaders and companies

“Automation is a key enabler of operational efficiency and enhanced client experience. As the industry continues to prepare for T+1, we are focused on further increasing our automation of allocations in the US market.”2 – Risa Lederhandler, Global Head of Equities and Securities Services Operations at Goldman Sachs

T+1 impacts collateral management and securities lending, as recall and collateral movement windows are now shorter. JP Morgan notes the potential need for greater automation and risk mitigation through solutions such as tri-party agents, especially where workflows are fragmented.16

“The long-term strategic advantages of T+1 are compelling...it will encourage the industry to invest more in technology and in achieving better straight-through-processing (STP)...Not only will this help the industry shift away from manual processing, but it will also boost resiliency and accuracy.”17 – Kamalita Abdool, Head of Securities Services, Americas, Deutsche Bank

Increasing regulatory scrutiny of trade operations in the US and Europe

Regulatory scrutiny of market conduct has increased since the 2008 crisis, emphasising data transparency and traceability of trades from origination to settlement. Over time, the focus has evolved due to factors such as market liquidity swings, product complexity, market-wide events and technological advancements. Regulators globally have invested in sophisticated tools to spot potential market misconduct.

Algorithmic trading strategies are under the microscope to prevent risky and manipulative practices linked to market volatility and flash crashes. In addition, the shift to remote work, accelerated by the pandemic, has introduced new compliance challenges such as record-keeping, communication and supervision. The US Financial Industry Regulatory Authority (FINRA) has issued guidance on maintaining compliance in remote work settings7, emphasising robust supervisory systems.

Key penalties and enforcement mechanisms

In 2025, the UK’s FCA fined Mako Financial Markets Partnership LLP GBP1.66m for serious financial crime control failures related to cum-ex trading, marking the eighth enforcement action in this area. The FCA’s total fines in this area now exceed GBP30m.20

In early 2025, FINRA fined Robinhood Financial and Robinhood Securities USD26m for multiple failures, including not having adequate anti-money-laundering (AML) controls or reasonable procedures to detect/manipulate suspicious transactions.22

Bank of America was fined USD24m by FINRA for 717 instances of spoofing in US Treasuries.23

In 2023, the US SEC charged Matthew Melton with securities fraud for false representations in an algorithm-based trading platform, highlighting ongoing regulatory efforts to protect investors.3

From January 2023 to March 2025, Jane Street Group allegedly manipulated India's derivatives markets, earning INR48.4m from unlawful trades. The SEBI found that Jane Street's FPIs executed synchronised trades to stabilise prices, highlighting the need for stringent oversight.6

Barclays Bank UK PLC and Barclays Bank PLC were fined a total of GBP42m by the UK's FCA in July 2025 for poor handling of financial crime risks in two high-profile cases. Although primarily related to AML/KYC failures rather than pure market manipulation, the failings involved inadequate controls that could enable market abuse.18

Federal jurors in New York convicted Avraham Eisenberg of fraud and manipulation in the US’s first cryptocurrency trial. His trading inflated futures prices by 1,300% in 20 minutes, stealing USD110m.4

The former FTX CEO was convicted of wire fraud, conspiracy and securities fraud after misappropriating customer funds to benefit another firm he owned, causing billions in losses. Investigators used forensic analysis and expert testimony to establish fraudulent and manipulative practices.5

The impact of automation: how low-touch/no-touch trading is impacting broker-dealers’ margins

The rise of low-touch and no-touch trading is not just about new technology; it is a major shift that is putting a lot of pressure on broker-dealers' profits. Low-touch trading has very little human involvement, and everything is focused on being efficient, while no-touch trading goes even further, removing human involvement completely.

Goldman Sachs indicated in its FY24 annual report that the increasing volume of trades being executed electronically has increased the pressure on trading commissions, as electronic trading commissions are generally lower than those for non-electronic trading. It also estimates that this trend towards low-commission trading will continue.9

A study by Greenwich Associates highlighted that 44% of US equity trading volume was executed electronically in 2024, with expectations for it to reach nearly 50% within the next three years10, driven by institutional investors seeking faster execution and lower costs. The rise of electronic trading platforms has intensified competition, leading to lower commissions and squeezing broker-dealers’ margins. Hence, we believe the path forward for broker-dealers is clear: they would need to embrace the change, innovate relentlessly and find new ways to thrive in a world where technological innovations reign supreme.

Commentary from industry leaders

"The continued rise of low-touch and algorithmic, no-touch trading channels is heavily compressing per-trade margins for broker-dealers, particularly in the most liquid markets. Technology has driven incremental market share to only the most efficient firms, and those lacking economies of scale or proprietary execution technology are seeing their margins eroded."19 – Joseph Mecane – Head of Execution Services, Citadel Securities

“Margins on vanilla, flow-driven business are thinner than ever. Smart order routing, liquidity aggregation, and technological scale now determine margin pools. High-touch desks must focus on complex, illiquid, or high-impact trades, where relationship and discretion still command a premium. The dual approach – max tech in standardized markets and tactical human value-add in complex scenarios – is the only way to preserve brokerage profitability.”19 – Matthew McDermott – Managing Director, Goldman Sachs Global Markets (Digital Asset and Market Structure Lead)

“No-touch trading commoditizes order flow. As execution becomes fully automated and transparent, commission rates and bid-ask spreads both collapse. Margin pressure is the direct result; only firms with significant scale, internalization, and differentiated analytics or order routing can sustainably grow profits. Brokers who are slow to innovate essentially see their economics evaporate.”19 – Roman Ginis – CEO, Imperative Execution (and former Morgan Stanley Managing Director, Electronic Trading)

Acuity’s global markets solutions enhance efficiency and cost-effectiveness for broker-dealers

Our global markets solutions offer broker-dealers a significant advantage in navigating operational challenges such as shorter settlement cycles, increasing regulatory scrutiny and low-touch/no-touch trading, as we provide the necessary bandwidth to ensure trades are executed efficiently, risks are managed and regulatory requirements are met.

By leveraging our markets operations support, broker-dealers can enhance efficiency and flexibility, lower operational risk, reduce costs and streamline processes.

We support global markets teams across trade lifecycle management including prime brokerage and custodian operations, collateral management, securities lending and borrowing, client servicing, corporate actions, asset inventory, reconciliations and fund admin support. Our expertise covers pre-trade and post-trade processes such as trade capture, matching, settlement and reconciliation. In compliance, we offer KYC, remediation, periodic reviews and trade surveillance. Additionally, we assist with regulatory reporting, credit reviews, treasury and cash management and product control functions, providing customised technology support, process automation, platform implementation and upgrades tailored to clients' needs.

How we help our clients with global markets operations support

We have teamed up with several investment banks in the US and Europe to support their global markets operations teams. We follow a collaborative and phased transition process, working closely with our clients to ensure the building blocks of success are in place. Instead of a “cookie-cutter” approach, we follow a phased approach that includes a whiteboarding process where we have detailed sessions with our clients to provide bespoke solutions.

Given the complexity and criticality of processes, we will ensure that there is no impact on client businesses by identifying and mitigating any transition risks. A dedicated transformation manager will be appointed to liaise between client stakeholders and the Acuity team and to introduce best practices for a smooth transition.

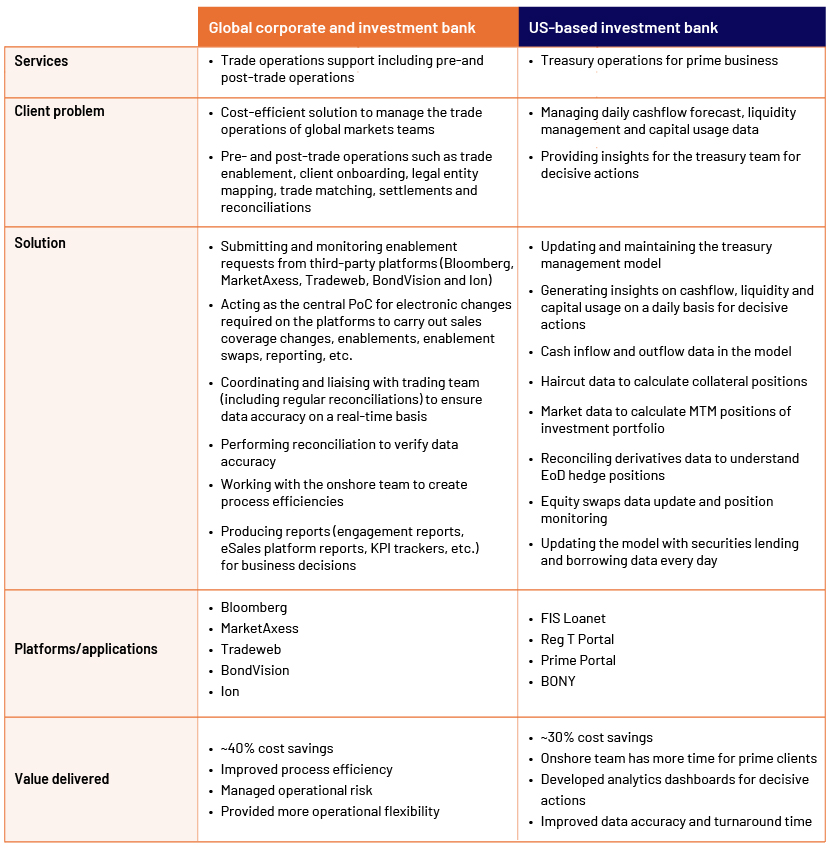

Selected global markets operations support success stories:

About Acuity Knowledge Partners

Acuity Knowledge Partners is globally recognised as the leading provider of tailored research and analytics support to the financial services sector, serving 660 clients with 6,500 domain experts stationed in offshore locations worldwide. We currently work with over 225 banks and corporate advisory firms to provide services across M&A, ECM/DCM, leveraged finance, lending origination, underwriting and monitoring, sell-side research and operations, publishing, private banking and wealth management, and global markets operations.

We set up dedicated teams for our clients in line with their needs in our delivery centres in India, Sri Lanka, China and Costa Rica. Our associates enable the smooth functioning of client teams by taking ownership of tasks of medium to high complexity so onshore resources can dedicate more time to high-value and revenue-generating activities.

Sources:

-

CCP Global – The Global Shortening of the Settlement Cycle.pdf

-

Algorithm Trading Program | David Chase, P.A. | 800-760-0912

-

The ₹4,843 crore trick: How trading giant Jane Street gamed India's market and got caught

-

Implementing FINRA’s Best Practices for Remote Work in a Pandemic | Corporate Compliance Insights

-

2024 Form 10-K – Goldman Sachs

-

T+1 settlement: All you need to know

-

FCA fines Barclays £42 million for poor handling of financial crime risks

-

BUY-SIDE PERSPECTIVE: High Touch or Low Touch? – GlobalTrading/Markets Media Europe

-

FINRA fines Robinhood: Many themes will be relevant for Neo-Brokers (Ashurst)

What's your view?

About the Authors

Venkat is a distinguished leader in Sell-side Research Operations, and project management. With over 20 years of experience in these fields, he has established himself as a key leader in the financial services sector. His extensive tenure of 16 years at Acuity has been marked by pivotal contributions in establishing enterprise-level accounts and leading large research and operations teams across multiple locations. Venkat's profound understanding of client needs has facilitated successful collaborations on transformative projects, ensuring governance and quality assurance excellence.

Throughout his career, Venkat has developed long-term partnerships with a diverse range of clients, including broker-dealers, investment banks, independent research firms, and boutique investment banks. His significant contributions..Show More

Sunil Kumar Agarwal is a distinguished professional with over 17 years of experience in equity research and project management. Since joining Acuity in 2008, he has played a crucial role in supporting sell-side equity research firms. Currently, Sunil leads teams that deliver research support to sell-side equity research clients. His academic credentials are noteworthy, including a Master of Business Administration from the Indian Institute of Planning and Management (IIPM), New Delhi, and a Bachelor of Commerce from Osmania University, Hyderabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox