Published on October 17, 2018 by Richa Gambhir

The business ecosystem has long relied on a defined set of data – economical, financial, and standard operational KPIs – to gauge efficiency and opportunities. With the revolution in information technology, businesses have realized that alternative data (Alt Data) is a very potent competitive tool.

As the name suggests, Alt Data is gathered from nonconventional data sources such as social media, flight and shipping trackers, credit card transactions, and email receipts. The analysis of this data yields additional insights for businesses, which complement the information they receive from conventional sources. Alt Data provides a significant competitive advantage to firms compared with those that rely on traditional data to run their business.

The hedge fund industry is at the forefront of Alt Data adoption

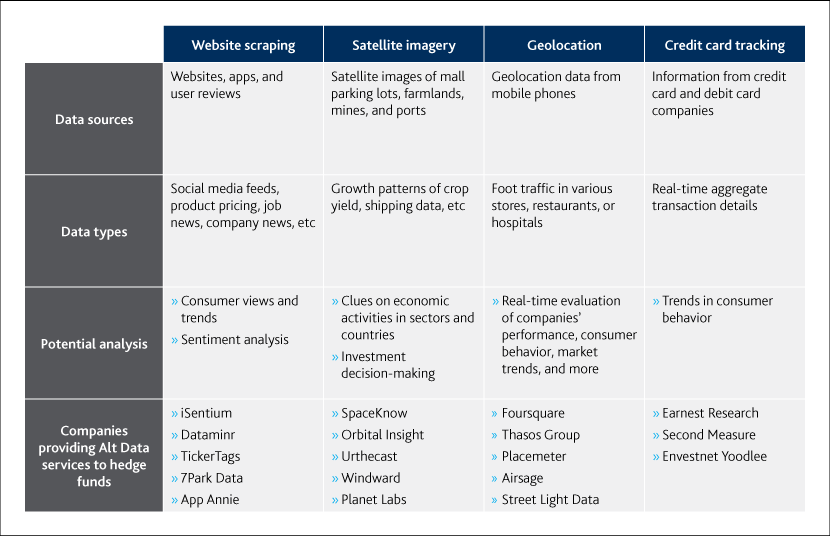

The ever-competitive hedge fund managers are always trying to find ways to gain an upper hand in the information market – and hence it isn’t surprising that they are gathering digital data from disparate sources (such as shopping mall traffic, liquor license applications, oil storage tanks, and FCC radio permits) to research new investment ideas and generate alpha. According to EY’s 2017 Global Hedge Fund and Investor Survey, around half (46%) the hedge fund managers surveyed used nontraditional data to support their investment process compared with 31% in 2016. Moreover, 32% of hedge fund managers are expected to use it in the near future, up 21% from last year.

Hedge funds leveraging Alt Data in analysis and investment decisions

Source: Various websites and articles

Alt Data is essential to gain an edge in the market

Over the next few years, Alt Data is expected to transform investment management systems of hedge funds. Firms that do not update their investment processes within this time span could face strategic risks, and may very well be outmaneuvered by players that efficiently incorporate Alt data into their trading processes. The focus on Alt Data is so strong that experts and veterans are considering it the data of the future. Leveraging hedge fund research services can help firms in interpreting Alt Data effectively and staying ahead of the competition.

According to BlackRock, “In order to generate sustained [returns], investors must embrace the task of acquiring, analyzing and understanding the ever-growing data universe. Those that fail to do so run the risk of falling behind in a rapidly changing investment landscape.”

Echoing BlackRock’s sentiment, Deloitte Center for Financial Services opined, “The lure of alternative data sets is largely the potential for an information advantage over the market with regard to investment decisions. True information advantage has occurred at various times in the history of securities markets, and alternative data seem to be just its most recent manifestation…Speed and knowledge are advancing with the use of advanced analytics, and there will be no waiting for laggards, no turning back.”

Man Group’s fund quintupled in three years on the back of Alt Data Man Group, a UK-based hedge fund, began utilizing artificial intelligence (AI) algorithms for one of its funds in 2014, along with the analysis of alternative data sets including container ship movements and weather forecasts. From 2014 to 2017, the AHL Dimension fund has quintupled its AUM due in part to its strong performance, driven by AI and Alt Data. This has led Man Group to deploy AI and data techniques for an additional four funds managing USD12.3bn (as of September 2017).

Alt Data won’t stay alternative for a long time

For Alt Data, the same report from Deloitte says that “today’s innovation could be tomorrow’s requirement.” Consider the following:

-

In 2017, Greenwich Associates revealed that more than one-fifth asset managers and hedge funds had geolocation data on their wish list.

-

Bloomberg and Thomson Reuters have included Alt Data in their offerings.

-

75% of hedge funds already use news and feeds from social media as part of their investment process.

-

80% of investors (including hedge funds) want greater access to Alt Data sources in general, with private-company data, logistics data, and evaluated pricing topping the list. To effectively manage and leverage this increasing volume of data, hedge fund solutions play a crucial role in streamlining data acquisition, analysis, and decision-making.

-

Opimas, a consultancy, said hedge fund’s spending on Alt Data was increasing by around one-fifth each year and was expected to hit USD7bn by 2020.

Going beyond wish list, players are striving hard to get hold of Alt Data. On one hand, top hedge funds (e.g., Two Sigma, Point72, Winton, and BlackRock) have already set up data units and are hiring data experts to remain at the top of the game. On the other hand, niche players with limited assets have mushroomed in the hedge fund industry, with unique investment strategies and innovative capabilities to leverage Alt Data to generate alpha.

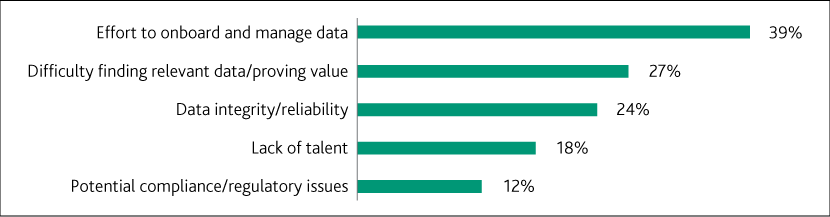

Hurdles faced in implementing Alt Data

Source: EY’s 2017 Global Hedge Fund and Investor Survey

Funds need to acquire right data sets from reliable sources so that they can quickly interpret and run a hypothesis to detect promising opportunities. Further, the prevalence of same data sets in the market and potential legal issues surrounding data ownership are cause of concern for managers.

However, the biggest challenge for hedge funds using Alt Data lies in adding talent and technology to support data management and governance.

Acuity Knowledge Partners extensively supports hedge funds, banks, and other financial firms in their research and analysis. We specialize in providing periodic updates, sector analysis, opportunity evaluation, and related services on a global scale. Our team of fundamental research experts and data experts can provide optimal solutions combining hedge fund data management and technology expertise and design differentiated data research insights.

Bibliography

-

https://www.dnb.com/content/dam/english/dnb-solutions/alternative-data-for-alpha-final.pdf

-

http://mattturck.com/the-new-gold-rush-wall-street-wants-your-data/

-

https://www.ft.com/content/d86ad460-8802-11e7-bf50-e1c239b45787

What's your view?

About the Author

Richa Gambhir has over 5 years of experience in the research and consulting industry. As part of Acuity Knowledge Partners’ Corporate and Consulting practice, she is currently handling a media monitoring project for a US-based hedge fund. Richa’s expertise is in secondary research, and she is experienced in preparing company- and industry focused-reports, event updates, newsletters, and other related tasks. She holds a Bachelor’s degree in Economics from Delhi University and a Master’s degree in Business Economics.

Comments

03-Feb-2019 08:49:09 am

Is there any way for retail investors and low volume traders to use the alternative data? What are the sources? Data reliability? Need someone who can walk me through the process. Regards, Ujwal Chaudhari

Like the way we think?

Next time we post something new, we'll send it to your inbox